Getty Images/Getty Images News

Apple’s (NASDAQ:AAPL) over-reliance on cheap Chinese labor has served it well in the last couple of decades since thanks to it the Cupertino tech giant managed to become one of the most valuable companies on Earth. However, the Covid-19 pandemic, the current energy crisis, and the war in Europe signal the end of a globalized era that will lead to further fragmentation of supply chains across the world. Major western companies are already in the process of bringing their supply chains closer to home in order to protect themselves against future geopolitical shocks.

This is not the case with Apple, which except for some minor efforts to outsource some of its production to third countries, continues to be too dependent on China. As a result, there’s a risk that Apple won’t be able to show the same outstanding performance as it did in the past due to the internal and external challenges that China as a whole is already facing or is about to face in the future. This article highlights three main Chinese-related risks that investors can no longer ignore when deciding whether to invest in the company.

The Importance of China to Apple

China is an important country for Apple. If we go through the company’s Q2 results, which were released in April, we’ll see that revenues from the Greater China region accounted for ~19% of the overall revenues, while the operating income in the region accounts for ~27% of the overall operating income during the period. This makes Apple more exposed to the Chinese market than a great number of other western tech companies that also operate in the region.

On top of that, over the last few decades, Apple has also outsourced a large portion of production to the region. While the company manufactures its devices in 30 countries, 42% of all production is in China, and only 16% and 9% are in Japan and the United States, respectively. Thanks to the abundance of cheap labor, established assembly hubs, and governmental support, Apple has greatly benefited from close relationships with China in the past. However, such an over-exposure to one country also has its downsides that have already started to materialize.

3 Risks To AAPL That Investors Can’t Ignore Anymore

Apple’s overreliance on China is also one of its major downsides. The latest geopolitical shocks along with the internal and external challenges that the country is facing are already starting to negatively affect Apple’s financials and disrupt its operations there. Going forward, three major risks could negatively affect Apple’s ability to continue to grow at an outstanding rate in the future and in my opinion are already making its stock a less attractive investment.

Beijing’s Interference Is A More Serious Threat Now

In my articles on Alibaba (BABA) I have been describing how Jack Ma’s critique of the political establishment of China prompted the government to crack down on his company, impose severe regulations on the business and destroy billions of dollars in shareholder value to send a message to everyone not to go against the Chinese Communist Party.

Apple’s CEO Tim Cook got the message and in recent years has been vocally praising China and going as far as to give an interview to China Daily last month, which has been accused of spreading misinformation, in order to remain in the good graces of Beijing. By doing so, Apple has been able to continue to benefit from the Chinese cheap labor environment, while at the same time it has managed to successfully establish a strong presence in the expanding Chinese consumer market without any troubles. Considering the exceptional growth of the company’s top and bottom line in recent years, it’s safe to say that such an approach to China worked well for the company and its shareholders. However, several developments have been occurring behind the scenes that no longer can’t be ignored, as they could disrupt Apple’s global operations and prevent the business from growing at the same growth rates in the future.

Last year, New York Times ran two stories that covered how exposed Apple is to China and how it could hurt the business in the future. The first story highlights how Apple has been making compromises with Beijing in order to be able to operate in the country. In recent years, Apple started to store the data of its Chinese customers in servers within China and let the state employees manage those servers, which could put the data security of Chinese customers at risk. At the same time, in addition to production, Apple has also been setting up its R&D center in the region, which has led to stories of IP theft by its Chinese counterparts.

On top of that, Apple has been aggressively censoring apps that criticize the Chinese government within the Chinese app market. It went as far as to fire its own employee for approving an app that angered Beijing. In late 2020, when China started to crack down on the tech sector, there has been an uptick in the number of apps that were taken off from Apple’s app store by the company.

The second story published a month later described Apple’s decision to hire a Chinese expert Doug Guthrie to study the company’s supply chains in China. Mr. Guthrie has been finding out how the Chinese government has been building assembly lines for Apple, hiring workers, and helping it to set up production to ensure that the company increases its exposure to the country. A few years ago, he started to sound the alarms about China’s transformation to a more authoritarian state under Xi Jinping, who became the General Secretary of the CCP a decade ago and has been strengthening his grip over the country ever since. In response, Apple started to outsource some of its production to other countries to minimize its downside, but the story states that despite all the risks Tim Cook has been standing by his decision that Apple’s supply chain will continue to be centered in China anyway despite all the risks.

Those stories clearly show that Beijing has too much leverage against Apple, which leaves the latter with no ability to counter the Chinese risks that arise from Beijing’s more aggressive rhetoric. In addition to interfering in the affairs of its domestic tech companies, which cost international investors billions of dollars, Beijing has also begun to pass legislation such as new data laws or algorithm rules that give it the ability to strengthen its grip over the private sector. If the Chinese Communist Party didn’t hesitate to get more power at the expense of its own companies, it’s likely that it won’t hesitate to do the same with international businesses such as Apple, which have no ability to hedge themselves against such risks. It was not a problem for Apple to leave Russia after the latter invaded Ukraine earlier this year, but in my opinion it won’t be able to do the same thing if, for example, Beijing decides to invade Taiwan in the future.

Additional Supply Disruptions Are Likely

Unlike the majority of other countries, China continues to stick with a zero-Covid policy. As a result, during a resurgence of Covid-19, such as the one that happened earlier this year, it will continue to close whole cities and regions on lockdown to fight the disease. The latest lockdowns, which occurred a few months ago, forced Apple to suspend the production of millions of devices in some of its factories, which could cost the business $4 billion to $8 billion in the June quarter alone. The street already expects Apple to report EPS of only $1.15 this Thursday, down 11.31% Y/Y, while its revenues are expected to increase only by 1.83% Y/Y to $82.93 billion.

What’s worse is that while the movement restrictions were eased recently, there’s no guarantee that they won’t return in the future, as it appears that China will be sticking with the zero-Covid policy for as long as it takes. In June, reports started to surface in which the Chinese officials were saying that travel restrictions will become a new norm in the following years, while Xi Jinping himself last month confirmed that the country won’t back off from the zero-Covid policy.

Considering this, it’s likely that we’ll see additional supply disruptions in the foreseeable future since new Covid-19 variants continue to emerge from time to time. Just two weeks ago, there were still 31 Chinese cities that had full of partial lockdowns, which were affecting around 250 million people. As a result, due to its over-reliance on China, Apple’s supply chains and global sales are constantly going to be at risk of further disruption due to the zero-Covid policy.

The Chinese Economy Is Not What It Used To Be

It appears that years of the rapid growth of the Chinese economy are long gone. Lockdowns have already negatively affected the economic growth rate, as two weeks ago the Chinese Q2 numbers came out and showed that the economy grew only by 0.4% Y/Y, below the forecasts of 1% Y/Y, also below a 4.8% Y/Y growth in Q1.

Considering that China is currently facing mortgage strikes, as its real estate developers face boycotts, while its banks face a confidence crisis that has led to protests and prompted Beijing to use violence, it’s hard to see how the country will be able to reach its official 2022 GDP growth target of 5.5%, the lowest in decades. The country’s industrial activity still hasn’t recovered to this day, its domestic companies face record low growth levels, while the World Bank expects only a 4.3% growth in 2022, below the official target by over a percentage. As a result, if the zero-Covid policy remains, while the crackdown against the private sector intensifies, it’s hard to see how the Chinese economy will be able to rapidly expand, making it hard for Apple to show outstanding results in the region as well.

What’s The Real Value Of The Business?

On Thursday, Apple will report its Q3 results for the June quarter. Given the economic challenges that China is currently facing, the street has been more bearish about Apple’s ability to outperform in the current environment and has made 25 down revisions in recent weeks.

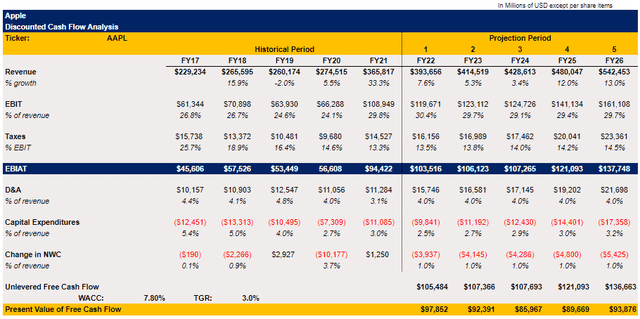

Considering this, I decided to make my own DCF model to find out what’s the real value of Apple’s business in the current environment. In my model, the revenue and EBIT estimates for the next three years are in-line with the street estimates. In years 4 and 5, I modeled an improvement of the business and return to a greater top-line growth, which could be attributed to the company’s potential improved performance in the consumer electronics business thanks to its innovations in chip design, which could help it to gain more market share. All the other metrics in the model are mostly averages of previous years.

Apple’s DCF Model (Apple’s Earnings Reports, Own Assumptions)

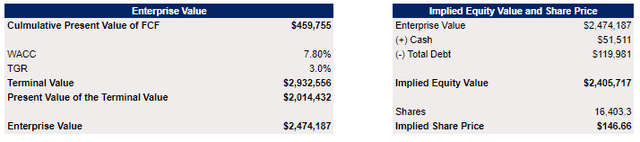

The WACC in the model stands at 7.8%, while the terminal growth rate is 3%. The model shows Apple’s equity value to be $2.4 trillion, which translates to a fair value of $146.66 per share, below the current market price of ~$153 per share.

Apple’s DCF Model (Apple’s Earnings Reports, Own Assumptions)

The target price in my model is below the consensus street price of $181.08 per share, but it’s also above the lowest target of $130 per share. In addition, while it might seem that the downside is minimal and Apple’s strong position in the consumer electronics market could help it to improve its financials which would lead to the reevaluation of the model to the upside, there are several things that we shouldn’t forget about.

First of all, the model assumes Apple’s growth rates in a stable environment with limited disruptions. In a current less globalized and more fragmented world where supply chains are at constant risk of disruptions, Apple is at continuous risk of generating lower revenues due to such disruptions. In addition, any additional interferences by Beijing could undermine Apple’s operations in the region which could lead to fewer profits there. Considering the crackdown against Alibaba and its peers in the last two years, there’s no guarantee that Apple will stay in Beijing’s good graces forever. Therefore, my double-digit growth rate assumptions in years 4 and 5 could become unrealistic in such a scenario. As a result, when we add all of those risks, my model could be considered not as conservative as some might suggest given our new reality.

The Bottom Line

Apple’s decision to outsource a large portion of its production to China in recent decades has helped it to thrive and become one of the most valuable companies in the world. However, such a decision also has its downsides. As China starts to become a more authoritarian state under Xi Jinping with Beijing strengthening its grip over the private sector, it will become harder for the company to have good relationships with the government without giving up more control over its business in the future, due to its overreliance on the country. Add to this various geopolitical shocks, possible new lockdowns, and slower growth of China’s economy, and in my view Apple’s stock becomes not as an attractive investment as it was before in the current environment.

Be the first to comment