J. Michael Jones/iStock Editorial via Getty Images

Introduction

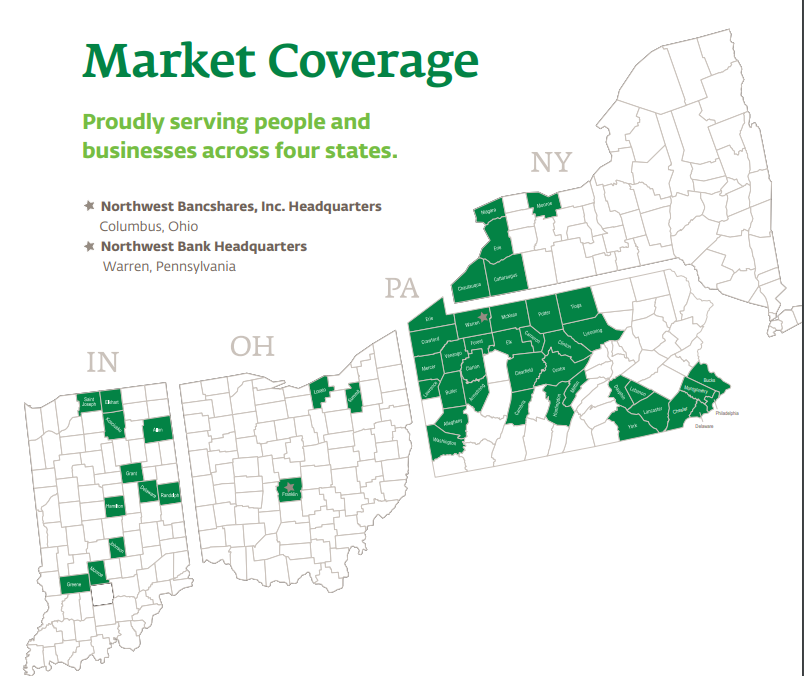

Northwest Bancshares (NASDAQ:NWBI) is a Pennsylvania-headquartered bank (the holding company is headquartered in Ohio) with activities in Pennsylvania as well as the western portion of New York State and some areas of Indiana and Ohio.

NWBI Investor Relations

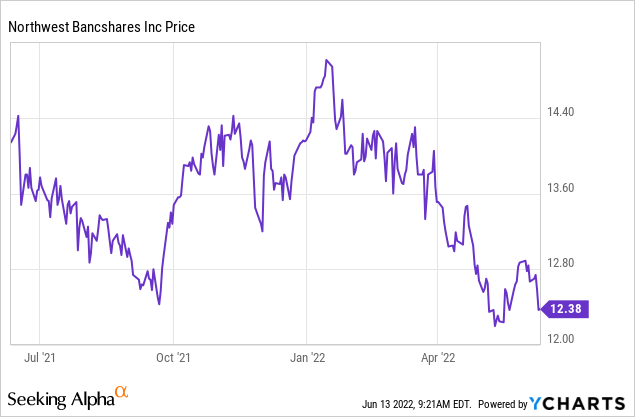

I am attracted by the bank’s exposure to residential real estate, while the balance sheet appears to be run in a relatively conservative way with plenty of focus on liquidity. Meanwhile, the current dividend yield of in excess of 6% adds to the appeal, so I wanted to dig a bit deeper into the bank’s Q1 results.

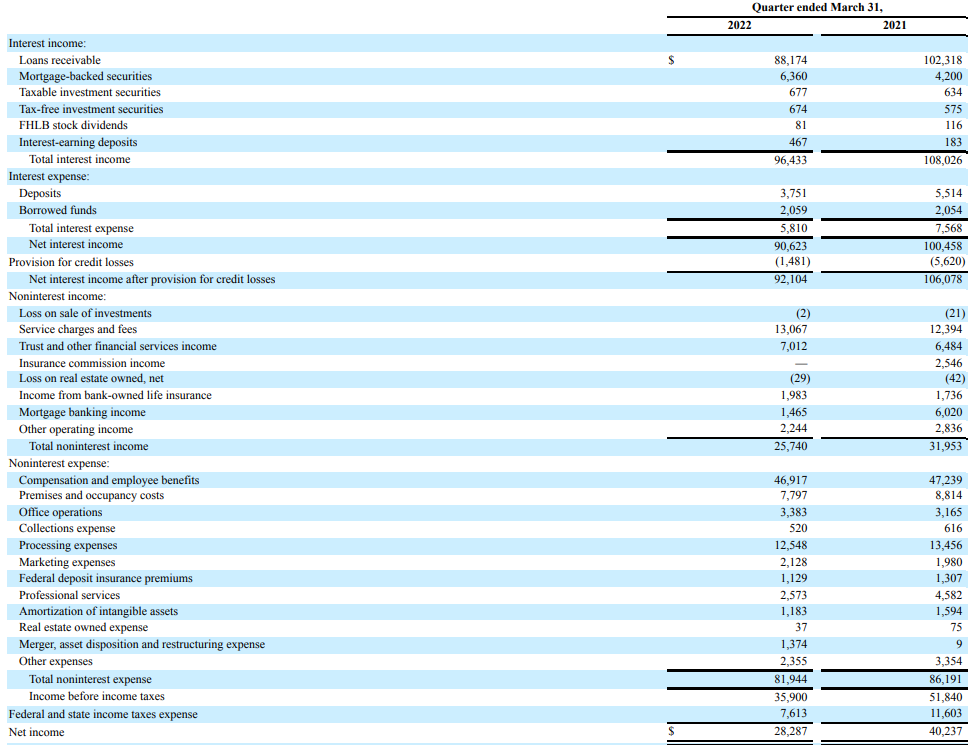

NWBI’s Net Interest Income Was Slightly Disappointing In Q1

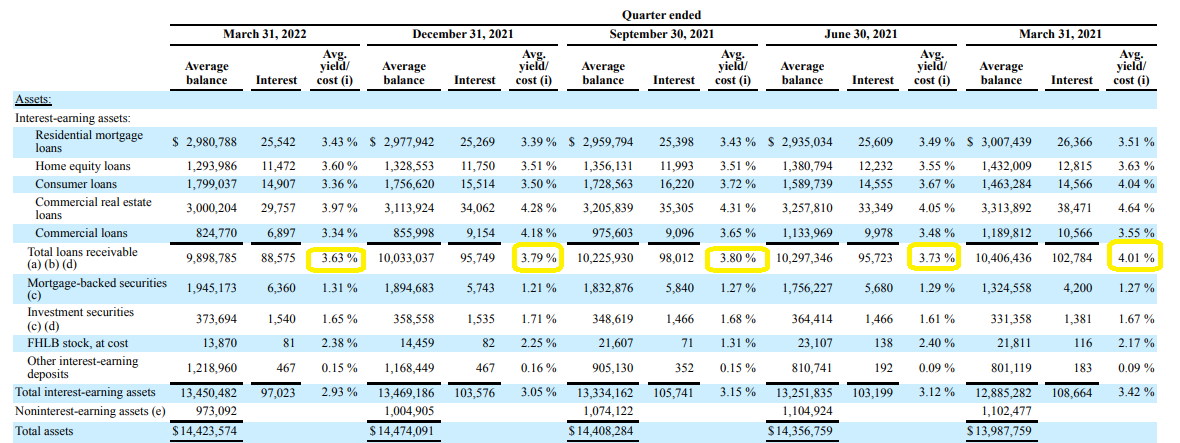

Northwest Bancshares is one of the few banks that actually saw its net interest income decrease in the first quarter of the year. This was caused by a lower average loan balance during the first quarter, while the average yield on the loans decreased from 4.01% in Q1 2021 to just 3.63% in Q1 2022. As interest rates increase, we can reasonably expect the interest income to increase as well.

The total interest income decreased to just $96.4M and although the interest expenses decreased as well, it wasn’t nearly enough to compensate for the interest income decrease. The verdict? A net interest income of $90.6M, down almost 10% compared to the $100.5M generated in the first quarter of last year.

NWBI Investor Relations

Fortunately, Northwest was able to keep the net non-interest expenses relatively stable, and it was able to reduce the loan loss provision by about 75% to just $1.5M. Those elements somewhat helped to keep the reduction of the pre-tax income ‘limited’ as Northwest Bancshares reported a pre-tax income of $35.9M and a net income of $28.3M (representing an EPS of $0.22/share). That’s much lower than the net income of $40.2M in Q1 last year (the EPS back then was $0.32) despite recording lower loan loss provisions.

The culprit is the net interest income and the yield on the loans. And in an increasing interest rate environment, Northwest should be able to increase the returns on its loan book.

NWBI Investor Relations

Northwest Bancshares is paying a quarterly dividend of $0.20. On an annualized basis, the $0.80 dividend represents a yield of just under 6.5%. That’s great for income investors, but although the dividend is still fully covered based on the Q1 results, investors should be aware the stock is currently trading at about 14 times earnings.

Balance Sheet Appears To Be Well-Structured And Loan Book Is Geared Towards Residential Assets

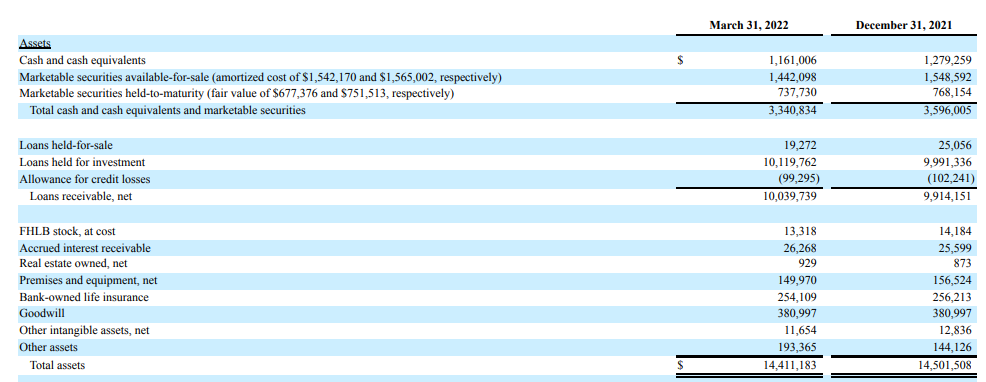

That’s a relatively high earnings multiple for a bank, but the reason for that is Northwest’s focus on trying to keep its loan book and cash deployment safe. As you can see in the image below, the total size of the balance sheet is $14.4B and of that amount, $3.34B is invested in cash and securities. That’s a ratio of approximately 23.2% and confirms access to liquidity is important for Northwest.

NWBI Investor Relations

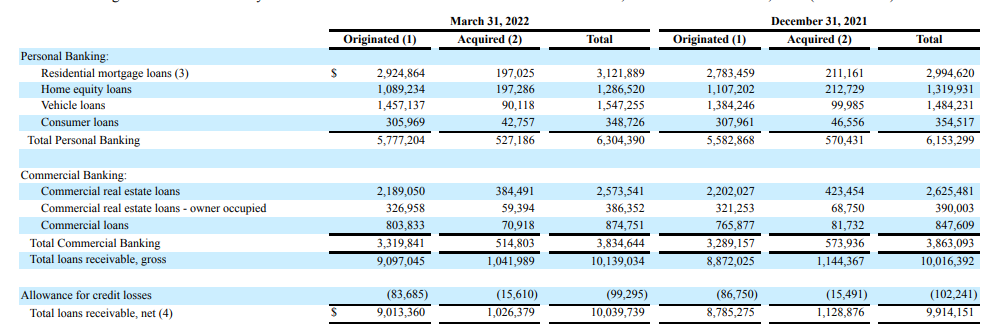

I’m mainly interested in the $10B loan book owned by Northwest Bancshares. Looking at the breakdown, we see about $4.4B is invested in residential mortgages and home equity loans, with an additional $1.55B invested in vehicle loans.

NWBI Investor Relations

The commercial real estate loans total just $2.95B, while the amount of commercial loans is $875M, or less than 9% of the loan book.

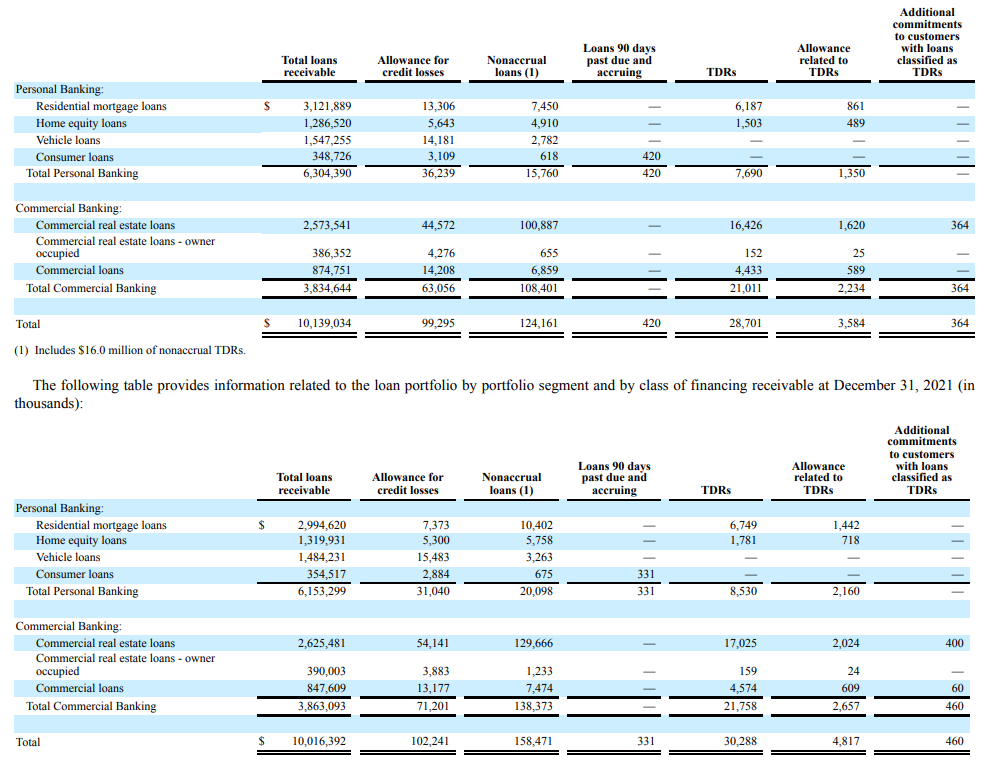

As of the end of March, only $15.8M of the personal banking loans were placed on a non-accrual status. That’s less than 0.25% of the total loan book. The image below shows the situation is worse in the commercial banking division, where in excess of $100M in CRE loans are no longer accruing. That represents almost 4% of the total amount of CRE loans outstanding. That being said, the total amount of non-accrual loans has been trending down from YE 2021 when the total amount of non-accrual loans was $158.5M versus the $124.2M as of the end of Q1 2022.

NWBI Investor Relations

Thanks to the reduction in the total amount of non-accrual loans, the coverage ratio has improved, but as of the end of Q1, the allowance for credit losses still didn’t fully cover the total amount of non-accrual loans. That’s understandable, as the bank obviously does not expect those loans to be a total write-off. Even if it would have to write off 50% of the loans, the current amount of loan loss allowances should be sufficient to cover the shortfall (although the bank would then have to start building up its provisions again).

Investment Thesis

Northwest Bancshares is an interesting bank. It offers a very generous dividend yield which is still fully covered by the earnings, although the EPS was somewhat disappointing in the first quarter of the year. The bank is taking action to improve its financial performance, and its recent closing of a few branches earlier this quarter will allow it to save about $8M per year on an annual basis. This should add about 5 cents per share per year to the earnings profile and will improve the dividend coverage ratio.

But the key element to further increase the earnings (and dividend coverage ratio) is improving the net interest margin, and the higher rate environment should help. Despite this and despite the very attractive dividend yield, I’m not really inclined to pay 14 times earnings and 1.4 times the tangible book value for NWBI. I will keep an eye on the stock, but there doesn’t seem to be an urgency to go long immediately.

Be the first to comment