courtneyk/E+ via Getty Images

Meridian Corporation (NASDAQ:MRBK) relies heavily on mortgage banking income; therefore, the normalization of mortgage refinancing activity this year will significantly hurt earnings. On the other hand, loan growth, excluding paycheck protection program loans, will support the bottom line. Overall, I’m expecting Meridian Corporation to report earnings of $3.94 per share for 2022, down 31% year-over-year. Compared to my estimates given in my last report on Meridian Corporation, I have increased my earnings estimate due to an upward revision in the loan growth estimate. The year-end target price is close to the current market price. As a result, I’m maintaining a hold rating on Meridian Corporation.

Earnings to Depend on Mortgage Refinance Activity

Meridian Corporation’s earnings surged in the last two years because of heightened mortgage banking income. Non-interest income from the mortgage banking business made up 50.3% of total revenues in 2021 and 56.3% of total revenues in 2020. In comparison, mortgage banking income made up 40% of total revenues in 2018, before the impact of the latest monetary policy easing cycle (the Federal Reserve started cutting its federal funds rate in late 2019).

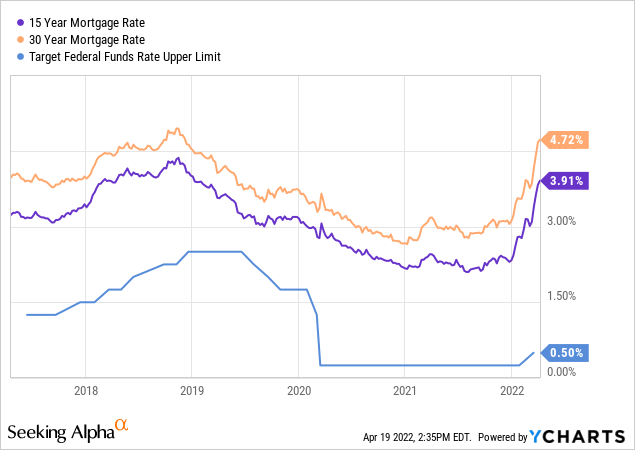

The anticipated increase in the federal funds rate, and consequently mortgage rates, will lead to a normalization of mortgage refinancing activity this year. As shown below, mortgage rates have already increased sharply so far this year.

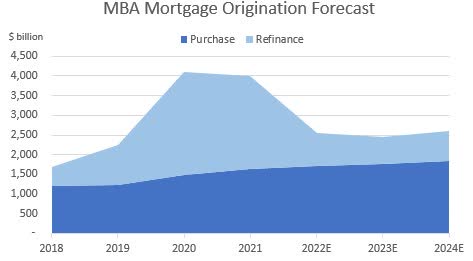

The Mortgage Bankers Association (“MBA”) expects a sharp plunge in mortgage refinancing activity this year to almost the 2019 level. However, MBA expects purchase activity to likely be much higher than in 2019.

Mortgage Bankers Association

Considering these factors, I’m expecting the non-interest income to plunge by 32% year-over-year in 2022. Despite the yearly dip, the non-interest income will likely remain much higher than the 2019 level.

Loan Growth to Counter Slowdown in Mortgage Refinancing Market

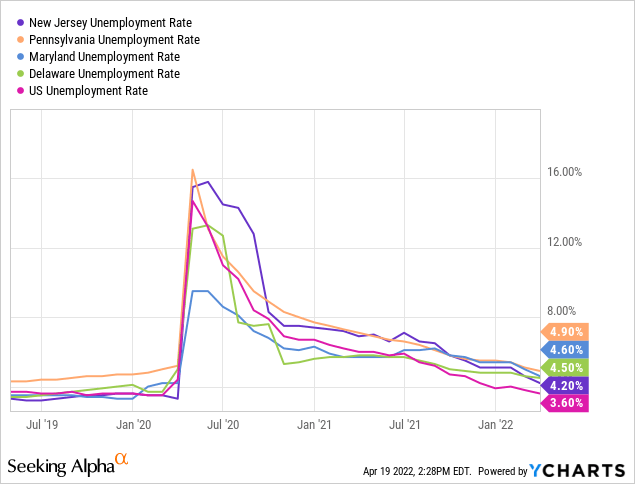

Excluding the Paycheck Protection Program (“PPP”) loans, the loan portfolio increased by a sizable 2.8% in the last quarter of 2021, as mentioned in the earnings presentation. Going forward, growth in commercial segments will likely remain robust thanks to the economic recovery in Meridian Corporation’s markets. Meridian operates in New Jersey, Delaware, Maryland, and Pennsylvania, all of which are currently lagging behind the rest of the country in terms of the unemployment rate but have still recovered well from the beginning of the pandemic.

However, the upcoming forgiveness of PPP loans will likely constrain the loan growth this year. Meridian Corporation has a sizable chunk of its PPP portfolio still outstanding. According to details given in the earnings presentation, PPP loans outstanding totaled $70 million at the end of January 2022, representing 5% of total loans. The forgiveness in the year ahead will likely have a sizable impact on the total loan portfolio size.

Considering these factors, I’m expecting the loan portfolio to increase by 6% by the end of 2022 from the end of 2021. In my last report on Meridian Corporation, I estimated loan growth of only 4% for 2022. I have revised upwards my growth estimate because the economy now appears better than I previously anticipated.

Meanwhile, deposits and other balance sheet items will likely grow in line with loans. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | |

| Financial Position | |||||

| Net Loans | 830 | 955 | 1,266 | 1,368 | 1,452 |

| Growth of Net Loans | 20.7% | 15.1% | 32.6% | 8.0% | 6.1% |

| Other Earning Assets | 102 | 123 | 360 | 249 | 254 |

| Deposits | 752 | 851 | 1,241 | 1,446 | 1,535 |

| Borrowings and Sub-Debt | 130 | 168 | 313 | 82 | 82 |

| Common equity | 110 | 121 | 142 | 165 | 179 |

| Book Value Per Share ($) | 17.0 | 18.7 | 22.9 | 26.6 | 28.8 |

| Tangible BVPS ($) | 16.3 | 18.0 | 22.2 | 26.0 | 28.1 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Loan growth will likely be the chief contributor to net interest income growth this year, as I’m expecting the rising interest rate environment to barely have any impact on the net interest margin. More liabilities than assets will re-price this year. As mentioned in the 10-K filing, the gap between the repricing liabilities and assets is $173.7 million, representing 10.1% of total assets. Further, the management’s interest rate sensitivity analysis given in the 10-K filing shows that a 200-basis points increase in interest rates can decrease the net interest income by 0.18%.

However, Meridian has an opportunity to improve its asset mix going forward, which can lift the net interest margin. Cash and investments made up a sizable 11% of total assets at the end of December 2021, as mentioned in the earnings presentation. Meridian can shift some of the excess cash into higher-yielding securities as interest rates increase.

Overall, I’m expecting the net interest margin to remain mostly unchanged this year from 3.83% in the fourth quarter of 2021.

Expecting Earnings to Dip by 31% Year-Over-Year

The sharp plunge in mortgage banking income will likely be a major contributor to an earnings decline this year. Further, the provision expense will likely return to a normal level in 2022 after a year of subdued provisioning. I’m not expecting big provision reversals this year because the current reserve level is quite close to the level of non-accrual loans in the loan portfolio. According to details given in the earnings presentation, reserves made up 1.46% of total loans, while non-accrual loans made up 1.34% of total loans at the end of December 2021. Loan growth will likely be the chief driver of provisioning in 2022. Overall, I’m expecting the provision expense to make up around 0.25% of total loans in 2022, which is the same as the average provision-expense-to-total-loan ratio for the last four years.

On the other hand, loan growth will likely support the bottom line. Meanwhile, I’m expecting the efficiency ratio to barely change this year. Despite a ‘branch-lite’ model, Meridian Corporation’s efficiency ratio is quite high which presents opportunities for cost savings. Nevertheless, I’m not expecting any improvement in the efficiency ratio as the company has not announced any significant initiatives in that area.

Overall, I’m expecting Meridian Corporation to report earnings of $3.94 per share in 2022, down 31% year-over-year. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | |||

| Income Statement | |||||||

| Net interest income | 33 | 36 | 49 | 63 | 67 | ||

| Provision for loan losses | 2 | 1 | 8 | 1 | 4 | ||

| Non-interest income | 32 | 33 | 87 | 88 | 60 | ||

| Non-interest expense | 53 | 55 | 93 | 104 | 92 | ||

| Net income – Common Sh. | 8 | 10 | 26 | 36 | 24 | ||

| EPS – Diluted ($) | 1.27 | 1.63 | 4.27 | 5.73 | 3.94 | ||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

In my last report on Meridian Corporation, I anticipated earnings of $3.66 per share for this year. I have revised upward my earnings estimate because I have raised my loan growth estimate for this year.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to the COVID-19 pandemic and the timing and magnitude of interest rate hikes.

Current Market Price Close to the Year-Ahead Target Price

Meridian corporation is offering a remarkable dividend yield of 5.8%, including the special dividend of $1.00 per share and quarterly dividend of $0.20 per share. Excluding the special dividend, the dividend yield is only 2.6% for the year.

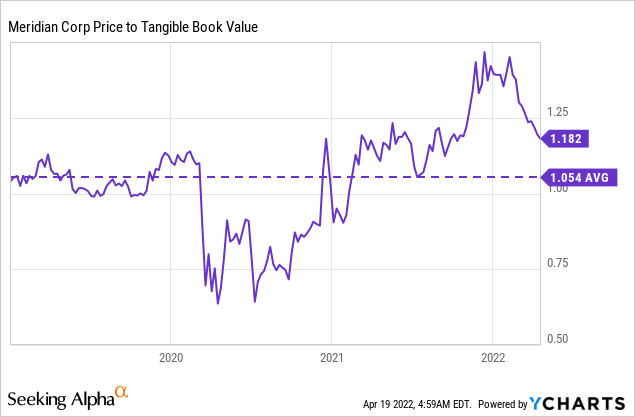

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Meridian Corporation. The stock has traded at an average P/TB ratio of 1.054 in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $28.10 gives a target price of $29.60 for the end of 2022. This price target implies a 4.7% downside from the April 18 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.85x | 0.95x | 1.05x | 1.15x | 1.25x |

| TBVPS – Dec 2022 ($) | 28.1 | 28.1 | 28.1 | 28.1 | 28.1 |

| Target Price ($) | 24.0 | 26.8 | 29.6 | 32.4 | 35.2 |

| Market Price ($) | 31.1 | 31.1 | 31.1 | 31.1 | 31.1 |

| Upside/(Downside) | (22.7)% | (13.7)% | (4.7)% | 4.4% | 13.4% |

| Source: Author’s Estimates |

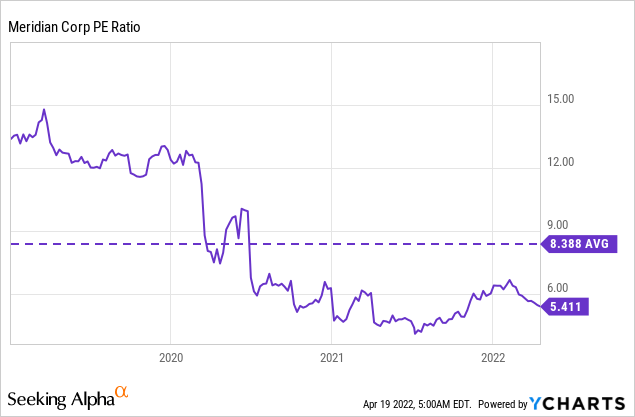

The stock has traded at an average P/E ratio of around 8.388x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $3.94 gives a target price of $33.10 for the end of 2022. This price target implies a 6.5% upside from the April 18 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 6.4x | 7.4x | 8.39x | 9.4x | 10.4x |

| EPS – 2022 ($) | 3.94 | 3.94 | 3.94 | 3.94 | 3.94 |

| Target Price ($) | 25.2 | 29.1 | 33.1 | 37.0 | 41.0 |

| Market Price ($) | 31.1 | 31.1 | 31.1 | 31.1 | 31.1 |

| Upside/(Downside) | (18.9)% | (6.2)% | 6.5% | 19.2% | 31.8% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $31.30, which implies a 0.9% upside from the current market price. Adding the forward dividend yield gives a total expected return of 3.5%. Hence, I’m adopting a hold rating on Meridian Corporation.

Be the first to comment