Marco_Bonfanti/iStock Editorial via Getty Images

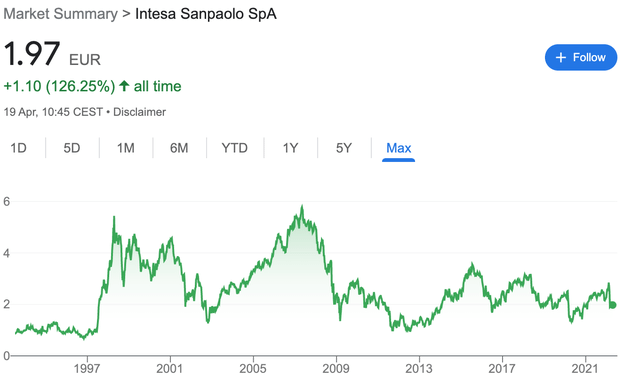

It perhaps tells you what you need to know about the Italian banking sector that the share price chart below represents the best-in-class player, Intesa Sanpaolo (OTCPK:ISNPY). Intesa really hasn’t done well this past decade-plus, but nor has it delivered the kind of permanent capital destruction that many of its peers in the Italian and wider Eurozone banking space have. Of a pretty bad bunch, it is one of the better names.

At the root of the company’s woes is the domestic banking landscape. Credit quality has, put simply, been catastrophic, while yields on interest-earning assets like loans have been painfully low. Sure, the bank has a nice core deposit franchise, and it does have significant non-interest sources of income too, but that hasn’t been enough to offset the wider problems in the domestic retail/commercial banking business.

While the above means that Intesa doesn’t look pretty, it is quite cheap right now, having fallen over 30% since hitting a multi-year high back in February. There’s also a nice capital returns story on offer, and management’s 2022-2025 strategy goals further add to what looks like an interesting medium-term investment case. Buy.

A Horrid Environment

Intesa doesn’t get much coverage here, but with total assets in excess of a trillion euro, it is actually a huge bank.

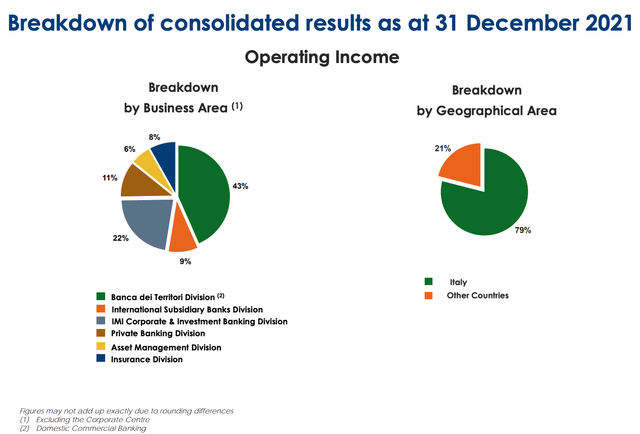

The company reports across six segments: Banca dei Territori; Corporate & Investment Banking; International Subsidiary Banks; Private Banking; Asset Management; and Insurance. Banca dei Territori encompasses the bread-and-butter Italian retail/commercial banking activities, while International Subsidiary Banks represents its non-Italian retail/commercial banking subsidiary businesses (11 Central & Eastern Europe markets plus Egypt). The others are probably self-explanatory.

Intesa Sanpaolo April 2022 Investor Presentation

As you can see, the domestic banking business is the biggest part of the group. It has also been dogged by severe issues over the past ten-plus years, reflecting the horrid environment in the wider Italian banking market. For one, credit quality has been horrendous. In 2014, for instance, Intesa sported group-wide gross loans of around €370B, of which over €60B were classed as non-performing (“NPL”)! Understandably, provisioning for bad debt has been a significant expense here, and over 40% of Banca dei Territori’s net interest income has been consumed by provisions in that time.

On its own, a relatively higher level of NPLs isn’t necessarily all that instructive (although the ratio above is obviously very high), as a bank can also earn higher yields on riskier loans to offset things. This hasn’t been the case here. Indeed, yields have been chronically low, with the bank reporting net interest income of around €7.9B last year on approximately €800B in interest-earning assets.

The bank does have a nice core deposit franchise and low funding costs, with circa €430B in current accounts and other retail deposits, while it also has significant non-interest sources of income (~54% of the 2021 top line, not including insurance income). Even so, that hasn’t been enough to offset the headwinds outlined above, and Intesa has ultimately reported fairly lackluster profitability metrics.

Righting The Ship

The good news is that things have improved significantly in recent years. Yields are still very low, of course, but asset quality has improved enormously, with gross NPL exposure amounting to around €15B last year (circa 3-4% of total loans), down from €21B at the end of 2020 and over €60B in 2014/15.

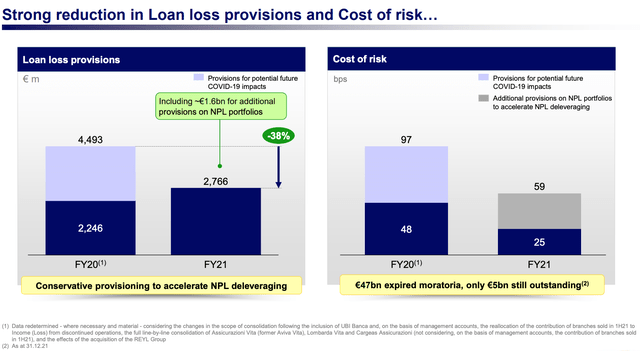

Loan loss provisions fell to €2.77B in FY21 (~0.59% of loans to customers), down from €4.49B in 2020 (~0.97%), and that helped boost net income to €4.2B for the year, up from €3.3B in 2020. Management expects provisioning to be a further boon to net income this year.

Intesa Sanpaolo 2021 Results Presentation

I would like to see higher coverage – a circa 54% NPL coverage ratio looks very light to me, certainly compared to continental peers like BBVA (BBVA) (~75% NPL coverage ratio), but the situation is definitely a lot better than it was in the not-too-distant past.

The bank is also well-capitalized, with a fully loaded CET1 of around 14% at the end of last year. Subtracting 2022 buyback cash (see below) reduces that to around 12.9%, which is still solid.

Reasonably Cheap And Returning Cash

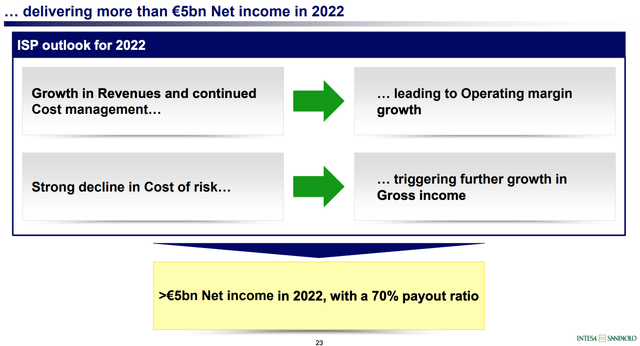

Although the bank has certainly had its issues, I do think the shares are reasonably cheap right now. Looking ahead, lower levels of provisioning were seen boosting 2022 net income to over €5B, nudging the bank toward a double-digit return on tangible equity. Intesa does have a small amount of direct exposure to Ukraine and Russia – around 1% of total loans – though it’s the potential knock-on effect in terms of increased recession risk that is the main worry.

Intesa Sanpaolo 2021 Results Presentation

As a result, these shares have sold off a fair bit, losing around a third of their value since hitting a multi-year high in Q1. At around the €1.97 mark in Milan trading, Intesa stock trades for around 0.7x tangible book value (“TBV”) and 9x 2021 EPS. The dividend yield is 7.7%, with that based on the FY21 payout of 15.1¢ per share.

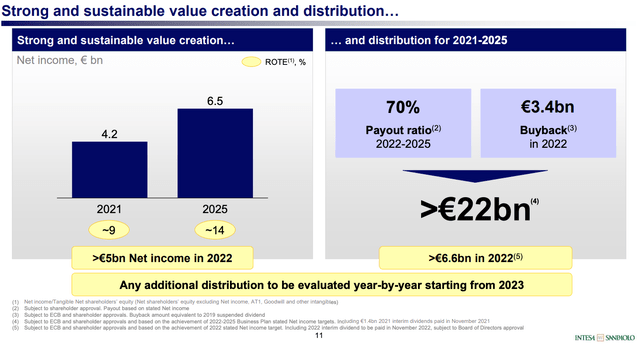

Over the medium-term, management sees its strategic efforts – cost control, operating income growth and lower levels of provisioning – leading to circa €6.5B in annual net income by 2025, which would be good for a solid double-digit return on tangible equity (“ROTE”).

Intesa Sanpaolo 2022-2025 Business Plan Presentation

Of course, there is a large element of “jam tomorrow” in that. After all, 2025 is still quite a long way ahead of us, and there’s no guarantee the bank will actually hit its targets. I mean, let’s face it, although the story has improved a lot here in recent years a European bank failing to reach its profitability goals wouldn’t exactly be new.

Still, based on its current ROTE profile and P/TBV, there is little downside to the stock right now. In a bad-case scenario, Intesa plods along earning a high single-digit ROTE and investors don’t get much of a boost from an expanding valuation. If it does hit its strategic goals, these shares trade closer to TBV and investors get 30%-plus from multiple expansion.

At the same time, the bank is shipping off large amounts of cash to shareholders. Buybacks earmarked for 2022 are worth €3.4B, which alone is equal to around 9% of the current market cap. Assuming net income rises in line with the bank’s goals, shareholders could be looking at €22B in capital returns from dividends and the ’22 buyback through 2025, which would be worth double-digit annualized returns in its own right.

Worst case, shareholders get high single-digits annualized from the current yield without much growth. Best case, they get circa 11-12% annualized from dividends and the current buyback, plus a boost from multiple expansion. Buy.

Be the first to comment