yusnizam/iStock via Getty Images

I do fully realize that the word “trust” has more than one meaning. According to the ever-helpful Dictionary.com, it’s a noun, an adjective, and a verb.

Definitions include:

- to have trust or confidence in; rely or depend on

- confident expectation of something; hope

- confidence in the certainty of future payment for property or goods received; credit…

- the obligation or responsibility imposed on a person in whom confidence or authority is placed

- charge, custody, or care

- something committed or entrusted to one’s care for use or safekeeping, as an office, duty, or the like; responsibility; charge

- A fiduciary relationship in which one person (the trustee) holds the title to property (the trust estate or trust property) for the benefit of another (the beneficiary) [or] the property or funds so held.

And the list goes on from there, with 23 entries altogether, including several that actually include their own bullet points.

Some of them don’t fit in with my idea of “trust.”

But I’m pretty sure I can make more than one work when it comes to describing real estate investment trusts (“REITs”).

Let me know what you think in the comments.

“An Uncomplicated Way to Buy and Own Real Estate”

Real estate investment trusts are a category all unto themselves. As I write in my latest (but not last) book, The Intelligent REIT Investor Guide, they are:

“… an uncomplicated way to buy and own real estate run by experienced professionals who give you some of the profits anyway. REITs offer access to reaping income from major office buildings, shopping malls, hotels, and apartment buildings. In fact, they work with just about any kind of commercial real property you can think of. Better yet, this all comes in an easily traded common stock like Apple or Amazon.

“Perhaps best yet, they do all this while giving you the steady and predictable cash flows that come from owning and leasing real estate – and on a much larger scale than a mere individual can handle. Essentially, REITs put their corporate-strength access to public equity and debt capital into acquiring and building additional properties to grow their businesses.

“Combined, these features can add stability to their investors’ portfolios.”

They also must:

- … distribute at least 90% of its annual taxable income, except for capital gains, as dividends to its shareholders (most pay out 100%).

- … have at least 75% of its assets invested in real estate, mortgage loans, shares in other REITs, cash, or government securities.

- … derive at least 75% of its gross income from rents, mortgage interest, or gains from the sale of real property. And at least 95% must come from these sources, together with dividends, interest, and gains from securities sales.

- … have at least 100 shareholders with less than 50%… of the outstanding shares concentrated in the hands of five or less shareholders.

With that said, there’s more to the name than that.

Why I Really Trust REITs

I probably should have said this in the beginning, but…

If you’re already a REIT expert, you might want to just skip ahead to the recommendations section. These three introductory segments are meant to inform those less aware of these amazing investments.

If you do know a thing or two about REITs already, then you already know how much “trust [and] confidence” in them you can have.

They make up a very safe sector overall. It’s difficult (though hardly impossible) for them not to be conservative with their money when so much of it must – by law – go directly to their shareholders in regular payouts (i.e., dividends).

That’s why I have such a “confident expectation of” and in them. I sleep well at night (“SWAN”) “in the certainty of future payment” coming out of the money I invest in them.

I’ll stop here to stress again that this hardly means I randomly select REITs to buy into. I carefully research each one.

But there are so many excellent examples I’m happy to own at the right prices. That’s all because I know they take growing my “confidence” as not just an “obligation” but a “responsibility.”

In short, they take the “charge, custody, or care” of my money seriously.

I’ll stop there again, only because I think you get the point. I can trust (the right) real estate investment trusts. They’ve made me a lot of money over the past 10+ years.

And they’ve made my readers a whole lot of money as well.

That shows in the fact that I have over 104,000 followers. Seeking Alpha readers recognize what I’m selling here is “real.”

Real estate investment trusts, that is. With the emphasis on “trust.”

Trusted REIT #1 – National Retail Properties (NNN)

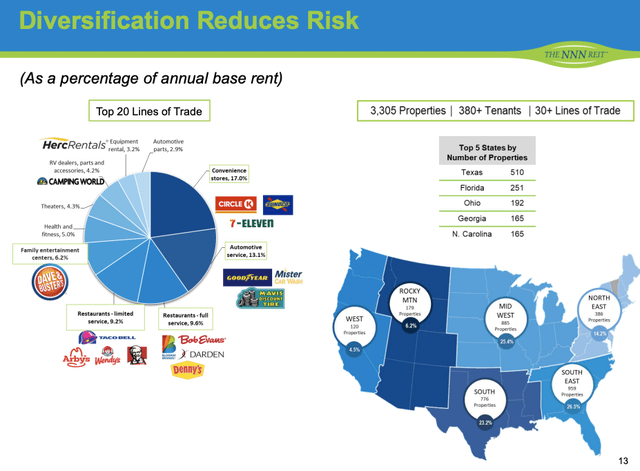

National Retail Properties, Inc. is a fully-integrated REIT that acquires, owns, and invests in real estate property that’s leased to retail tenants. They have a very strong portfolio that is diversified geographically and across business lines.

These leases they enter into with tenants are called sales-leaseback transactions, which is when the landlord purchases real estate, which is occupied by the seller, and then the asset is turned around and leased back to the tenant/seller.

This type of transaction allows the seller to not only free up capital, but it also allows them to continue using the property without owning it, so no disruption should take place within the operations of the business.

National Retail Properties owns a very diversified portfolio with over 3,300 properties within 48 states, and those properties are leased out to more than 380 different tenants.

NNN has prided itself on maintaining a strong balance sheet over the years, which they have been able to fall back on during slower economic times. The REIT’s strong management team has guided the company and has maintained a focus on quality over quantity.

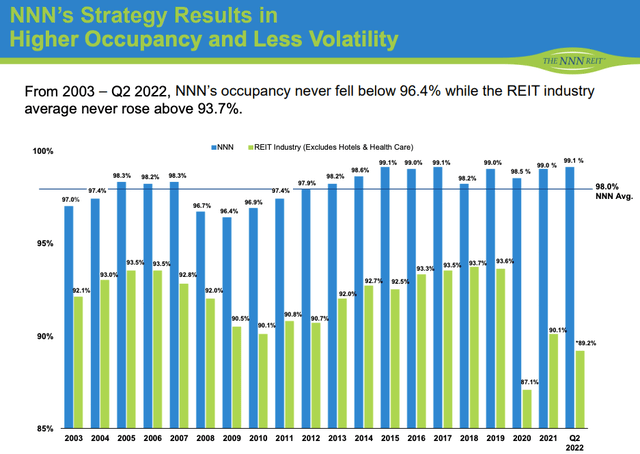

This shows through in the tenants they choose to do business with. NNN has never seen their occupancy levels fall below 96.4%.

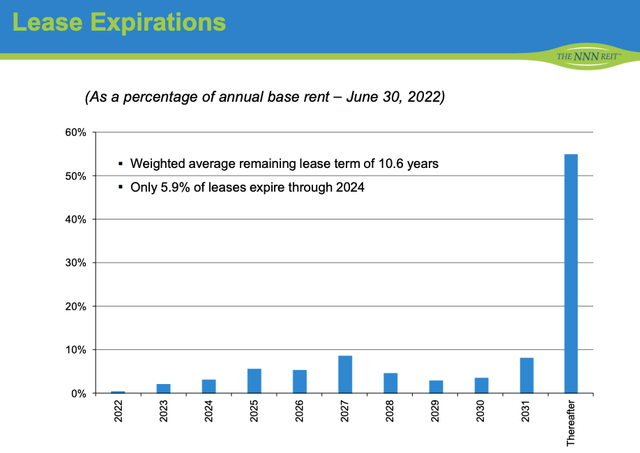

Many of the lease agreements they enter into are long-term leases, which is one reason investors love net-lease REITs. They provide consistent reliable returns due to these long-term agreements. NNN has a weighted average remaining lease term of 10.6 years.

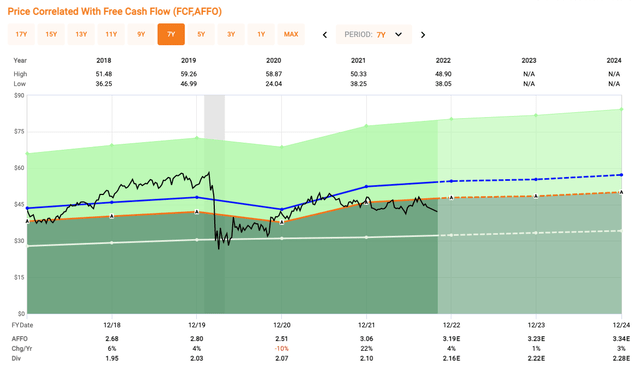

Over the course of the past five years, National Retail Properties has seen their revenue grow at an average annual rate of ~6%, which has trickled down to AFFO growth as well.

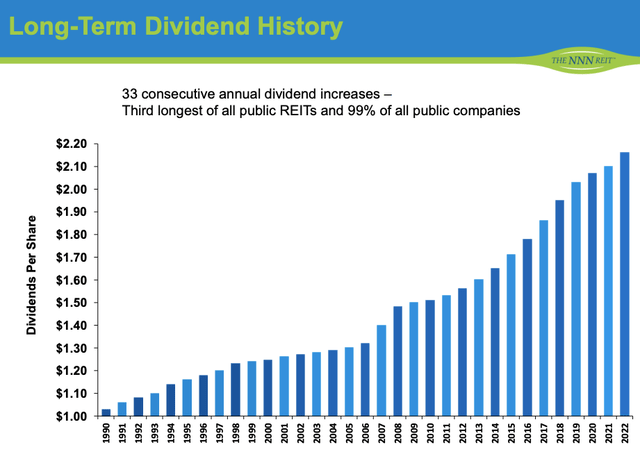

AFFO growth is what has fueled the growing dividend, a dividend that has been increasing for 33 consecutive years now and counting, making it one of the few REITs on the Dividend Aristocrats list.

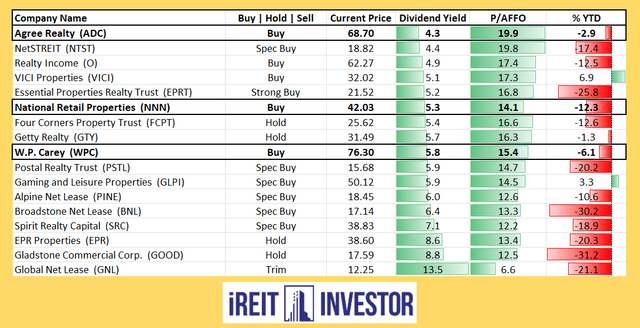

The current valuation of NNN shows that the stock price is undervalued when compared to their recent history. Shares of NNN currently trade at a P/AFFO of 13.3x, which is well below their five-year average of 17.1x, as well as below the sector median.

National Retail Properties is a very well-run company with a BBB+ rated balance sheet that has a strong track record of success and total returns. This appears to be a great opportunity to pick up shares of NNN for long-term investors.

Trusted REIT #2 – Agree Realty Corporation (ADC)

Agree Realty is a blue-chip REIT, similar in many ways to National Retail Properties that we just looked at as well as Realty Income Corporation (O). The business model is the same, and rather boring at that, but sometimes boring is what makes you consistent cash flow.

This is why, especially when it comes to REITs, focusing on blue-chip/high-quality companies is sometimes all you need.

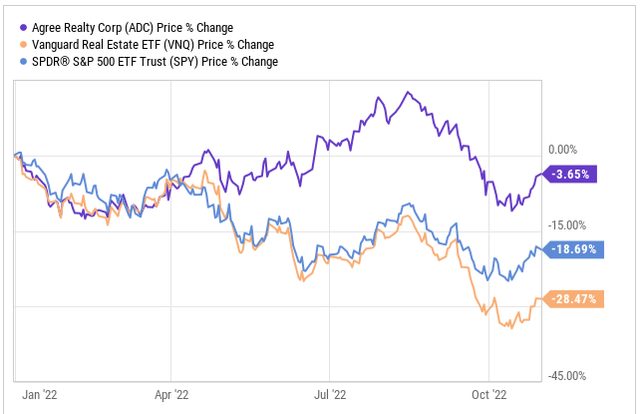

On the year, the S&P 500 (SPY) is down 18%, the Vanguard Real Estate ETF (VNQ) is down nearly 30%, and yet, Agree Realty is down only 3%.

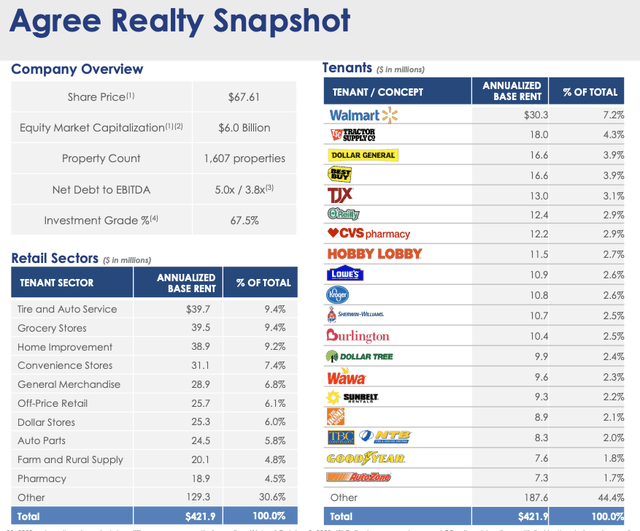

Agree Realty currently has a portfolio of over 1,600 properties that make up 34 million square feet of leasable space. The company focuses a lot of attention on high-quality tenants, which is why nearly 70% of their tenants are investment grade.

Speaking of tenants, here is a look at ADC’s top tenants based on annualized base rent and top sectors by ABR.

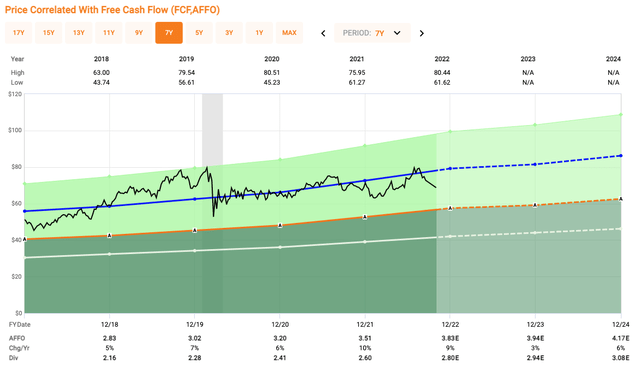

Working with these strong tenants, who enter into long-term leases, ADC has maintained a very high occupancy ratio and generated strong cash flows. During the pandemic in 2020, ADC was one of the few retail REITs to generate positive AFFO (adjusted funds from operations) growth, which is a testament to the quality of not only their properties, but their tenant base as well.

Here are some stats on returns as they relate to ADC:

- Over the past five years, shareholders have enjoyed over 90% total return

- 12.7% compound average annual return since going IPO in 1994

- 5.5% compound annualized dividend growth over the past 10 years.

The current valuation of ADC shows that the stock price is undervalued when compared to their recent history. Shares of ADC currently trade at a P/AFFO of 18.2x, which is below their five-year average of 20.7x.

If you are looking for a company you can trust to put your hard-earned money to work, ADC is a great place to look. At iREIT on Alpha, we currently rate shares of ADC a BUY.

Trusted REIT #3 – W. P. Carey Inc. (WPC)

The final trusted REIT we will discuss today is W.P. Carey, which is a blue-chip REIT within the warehouse sector. The company is not only trustworthy, but they are also inflation resistant.

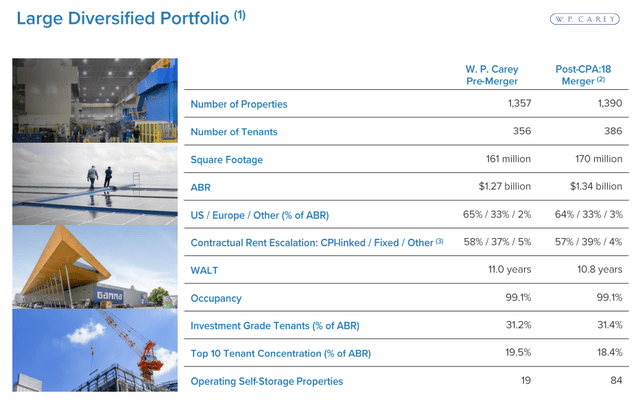

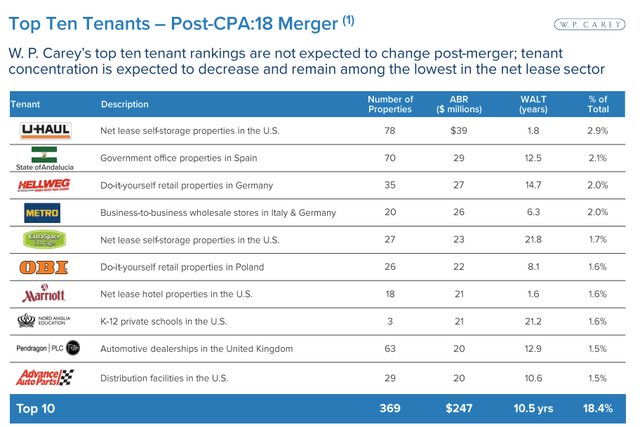

WPC currently owns 1,390 net lease properties that are made up of 170 million square feet of leasable space. The company is geographically diversified as well, as 64% of company revenue is from the United States, 33% from Europe, and the remaining 3% is scattered throughout the globe.

The company, similar to the other trustworthy REITs we have looked at today, maintains a very high occupancy rate at 99.1%.

WPC is not as focused on investment grade tenants as other REITs, as just 31.4% of their annual base rent comes from IG tenants.

Here is a look at the company’s top 10 tenants.

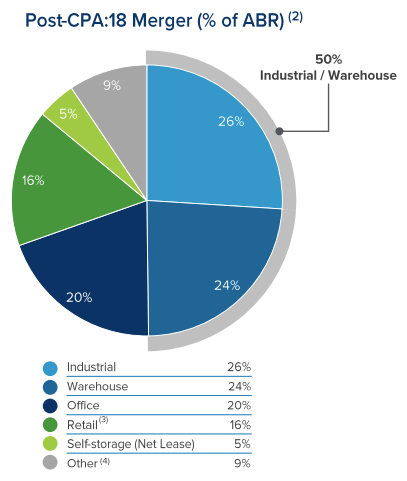

We already touched on how the REIT is geographically diversified, but they are also diversified when it comes to property types. Looking at the chart below, you can see that Industrial and Warehouse properties make up 26% and 24% of ABR (annualized base rent), respectively, but also have properties in Office, Retail, and Self-Storage.

WPC Investor Presentation

As of the company’s most recent quarterly report, WPC has a weighted average remaining lease term of 10.8 years, but here is where things get unique.

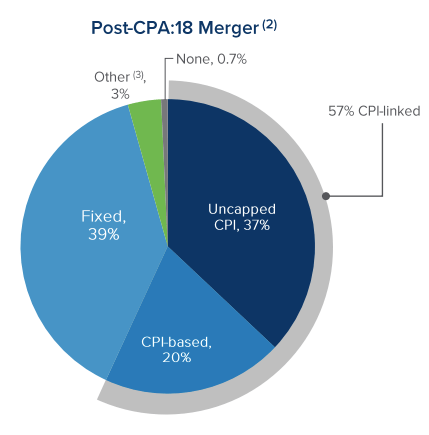

In terms of inflation, looking at the chart below, you can see that 99% of all the company’s leases have contractual rent escalators and 57% of those are tied to CPI. And unless you have been living under a rock of late, CPI has been burning hot. Of those leases that are tied to CPI, 37% are uncapped.

WPC Investor Presentation

This provides great safety to investors of WPC, especially during higher inflationary times like those we are currently going through.

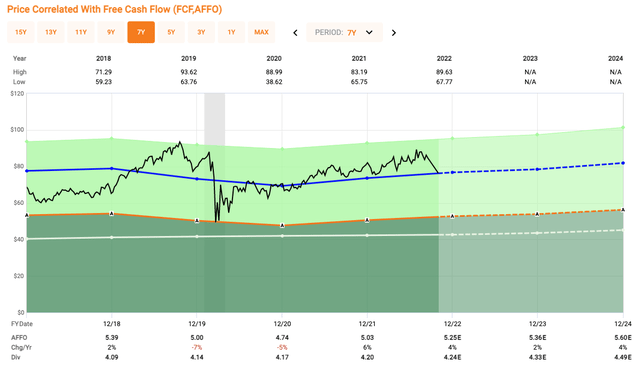

In terms of valuation, WPC currently has a P/AFFO of 14.6x. WPC has a five-year average P/AFFO of 14.6x, suggesting shares are trading in-line with recent history. However, the REIT is much different than what it was in the past.

WPC of the past was not focused as much on industrial and warehouse as it is today, and when you look at similar REITs like Prologis, Inc. (PLD), you can see their shares trading around 26x, with a five-year average of 28x. Now, WPC is not fully comparable, but their valuation should be less in-line with an office REIT and more in-line with, at the very least, a net lease REIT.

Based on the multiple expansion opportunity combined with the high-yield dividend of 5.6%, W. P. Carey makes for a solid total return investment. At iREIT on Alpha, we currently rate shares of WPC a BUY with a buy below $80 threshold.

Trust But Verify

As I explained in a recent article:

“A few days ago, I heard Jim Cramer literally crying on CNBC when asked about his Meta Platforms (META) bet. He said (emphasis added): “Let me say this: I made a mistake here. I was wrong. I trusted this management team. That was ill-advised. The hubris here is extraordinary, and I apologize.”

“OK,” replied his cohost, awkwardly.

While I can certainly sympathize with my friend, Jim Cramer, I’ll end this article with just three words from President Ronald Reagan:

“Trust but Verify.”

At iREIT on Alpha, we spend countless hours screening for the best REITs to buy and sell. Our methods aren’t 100% guaranteed, but we have a good track record for success because of our tedious due diligence practices.

Over the years, we have found that some of the best opportunities are found by screening the broad REIT landscape, not just focusing on yield, but on both quality and value.

All three above referenced REITs meet our screening criteria and are terrific candidates for including in an intelligent REIT portfolio.

Be the first to comment