AsiaVision/E+ via Getty Images

The Digital Payments industry is exploding as consumers demand fast, frictionless and secure payments both in-store and online. According to a study by Nilson, the total volume for payment cards is forecasted to reach an eye watering $79 trillion, by 2030, nearly doubling from “just” $42 trillion in 2020. Adyen N.V. (AMS:ADYEN) (OTCPK:ADYEY, OTCPK:ADYYF) is a leading Fintech company, which provides modern end to end payment infrastructure for some of the biggest companies globally.

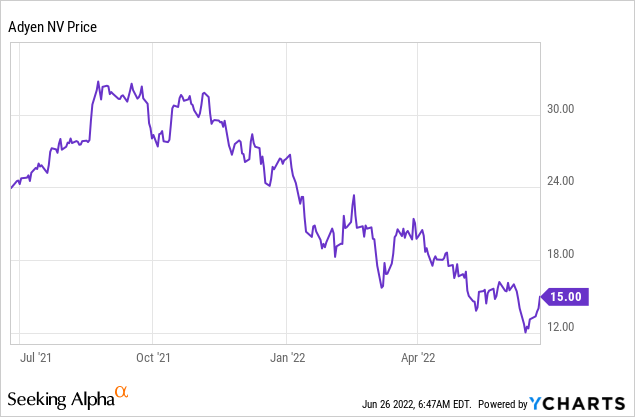

Founded in the Netherlands in 2006, the company processed a staggering €516 Billion ($544B) in payment volume in 2021, up a rapid 70% year over year. While the stock price has nosedived by 48% since the highs in November 2021, this decline was mainly due to the high inflation numbers released and rising interest rate environment, which has compressed the multiples of many “growth stocks.” Given these factors, the technical charts showed support at €1240/share and the stock is now undervalued relative to historic multiples. Let’s dive into the Business Model, Financials and Valuation for the juicy details.

Innovative Business Model

The name “Adyen” means to “Start Again” or “New Beginnings” in the Surinamese language. This name perfectly sums up the company’s founding strategy and rise to become a $46 Billion company in just 16 years. Adyen has disrupted traditional financial infrastructure, by providing a modern End to End payment infrastructure, which offers data insights and financial management in one unified solution. Historically, Merchants were held back by Legacy payments infrastructure, which was designed to use minimal data (as it was expensive). However, Adyen’s platform allows these data insights to be captured by merchants and used to optimize experiences and improve payment confirmation.

Adyen flipped the traditional business model of starting with small businesses before moving upmarket on its head. Adyen’s original platform started with the needs of Enterprises, and then they discovered their platform appealed to mid-market merchants also. Today, Enterprises still make up the lion’s share (97%) of payment volume and include leading players such as Uber, Microsoft (MSFT), Booking.com (BKNG), Spotify (SPOT), Facebook (META), McDonald’s (MCD), KLM (OTCPK:KLMR), LinkedIn, Mango, Domino’s (DPZ), Zara, Dropbox (DBX) and many more. Even eBay (EBAY) abandoned PayPal (PYPL) and signed an agreement with Adyen to give them greater control over the end to end payments experience. Amazon Japan (AMZN) partnered with Adyen in 2022 to process payments for Japanese customers. Buy Now Pay Later (BNPL) Provider Afterpay also expanded their partnership with Adyen in 2022.

Adyen Platform (Investor Presentation)

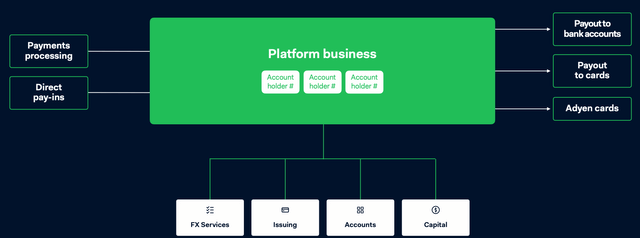

The company offers a variety of products which can be segmented into three main sections.

1. Payments

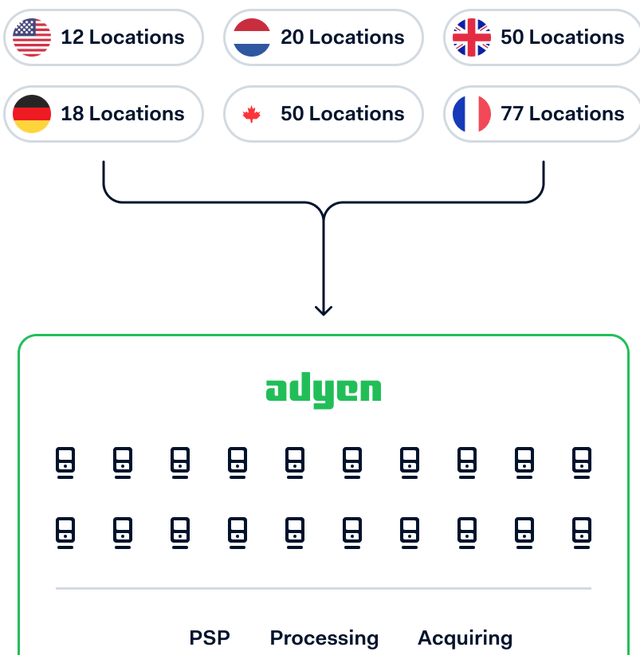

This segment includes; Online, In Person (Point of Sale) and Cross Channel payments. The company’s Point of Sale Terminals is one of the fastest growing parts of the business, POS accounted for 13% of total payment volume in 2021 ($65 Billion) which was double the prior year. These devices are used by customers such as Subway to enable a single technology platform to capture data from multiple locations on a single dashboard, which truly is a game-changer.

“Unified Commerce” is also very interesting offering, which enables the connection of both in-store and online payments.

Adyen Point of Sale (Adyen Website)

2. Enhancements

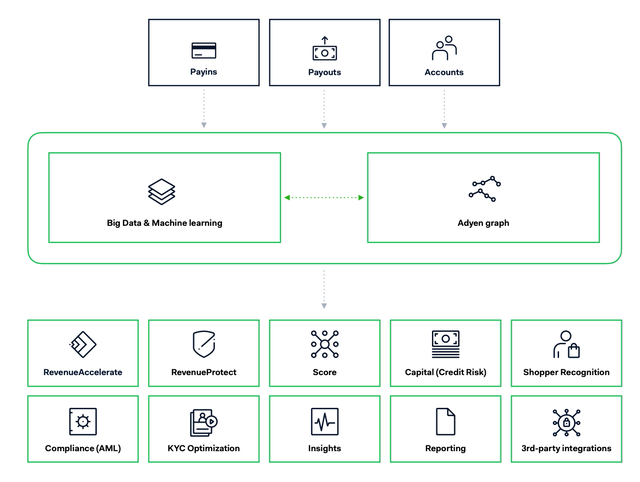

This segment includes; Risk Management, Revenue Optimization, Insights and Authentication. Adyen’s Revenue Accelerate tool uses machine learning and AI to inform merchants when the is best day and time is to retry failed payments. This is a game changer for businesses which transact billions of dollars in payments, as even a 2% reduction in failed payments can offer millions in savings.

3. Financial Products (Card Issuing)

Card Issuing is still a very small section of the business, but offer significant runway ahead. As the company noted at their Capital Markets Day, they measure issuing volumes in in the “tens of millions” vs. acquiring volumes measured in the “hundreds of billions.” “Capital” is also in the early stages of the pilot phase and has no historical financial contribution yet, but offers major potential for the future, as they aim to compete with the likes of Square, now Block (SQ), which offers “Square Capital” to businesses.

Adyen makes the majority of their revenue from “Settlement Fees” which are fees paid by merchants (percentage of transaction value). The company also charges “Processing fees” which is a Fixed fee per transaction paid by merchants for the use of Adyen’s platform, this is captured when a transaction is initiated.

Competitive Moat

Adyen has a few competitive advantages which should ensure secure free cash flow for investors for years to come. The first is the platforms inherent “stickiness,” with low churn for enterprise customers. Payments is arguably the most important part of any business and if a technology is working well with flexibility, security, innovation and low costs then changing providers would be unlikely. This is one reason why traditional payments infrastructure has been so embedded and hard to change, there is an element of “Don’t touch what is working.” Adyen’s partnerships with leading brands also offer strong network effects as the company’s Artificial intelligence systems learn and optimize from the half a trillion dollar in payment volume passed through its systems in 2021.

Adyen AI (Investor Presentation)

Adyen’s “modular” approach allows multiple Financial services to be layered on the platform, which increases “stickiness” and retention. Their single unified platform offers direct processing and acquiring which means the company doesn’t have to rely on legacy infrastructure for card payments. For example, peers in the industry such as PayPal rely on legacy banks as Merchant acquirers such as JPMorgan Chase (JPM) and Wells Fargo (WFC).

Employee Efficiency

In 2021, Adyen added 433 full time employees to the team which totaled 2,180 by the end of 2021. This is a much lower employee count than competitor, Stripe which has over 7,000 employees and a similar gross payment volume of $640 Billion vs $540 Billion for Adyen. One reason for this seems to be from the company’s developer culture, which allows them to build more in-house and means acquisitions are unlikely. Adyen’s CEO (Pieter van der) even ruled out acquisitions in 2022 and stated

“We have the ambition to build a global company ourselves without acquisitions.” – Adyen CEO

Given multiple studies show the majority of acquisitions don’t create shareholder value, this is a positive sign for investors.

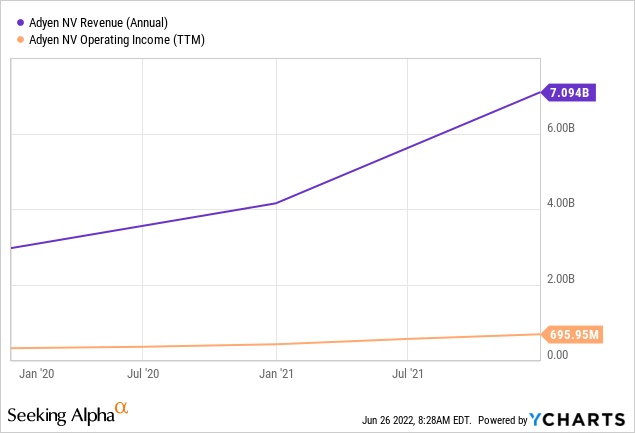

Growing Financials

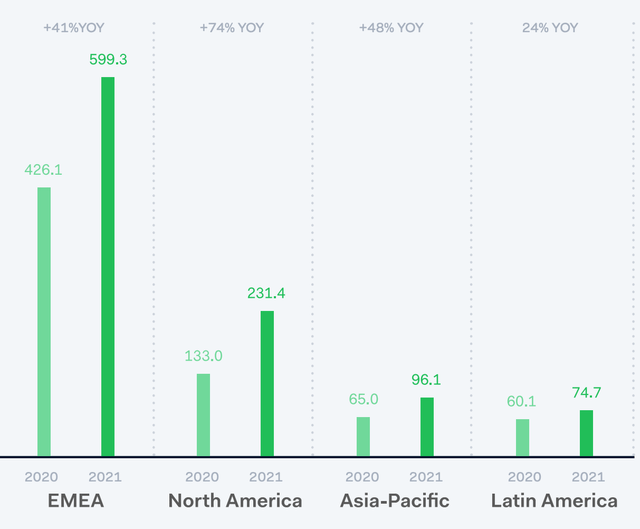

Adyen had a tremendous 2021, with processing volume reaching a ginormous €516 Billion ($544B) in 2021, up a rapid 70% year over year. They generated Revenue of $5.9 Billion for FY 2021, up a rapid 64% year over year. While what the company calls “Net revenue” (similar to Gross Profit) jumped to €1 Billion ($1.06B) in 2021, up 46% year over year. Approximately 60% of their Net revenue is generated from the EMEA region, followed by North America, Asia Pacific and Latin America, as you can see on the below chart.

Adyen Net Revenue by Region (Capital Markets Day Presentation)

Adjusted EBITDA rose to €630 million ($655m) up a rapid 57% year over year. Operating expenses rose by 31% year over year to €406.8 million and 41% of net revenue. The main driving factor for this was employee benefits which grew to €241 million, up 34% year over year. Overall I don’t deem this to be a negative sign as securing the best talent is becoming harder than ever, especially in the Fintech industry.

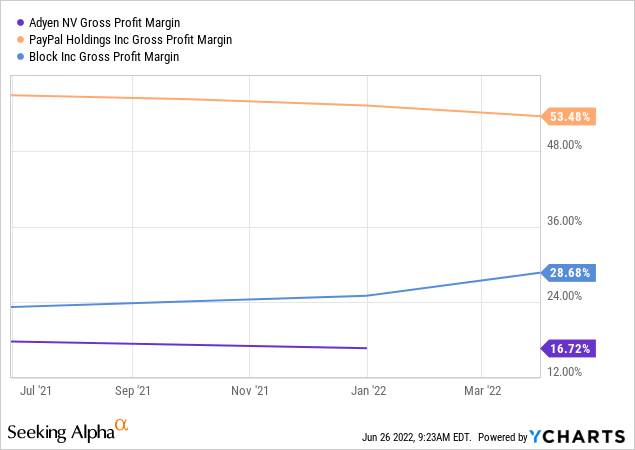

Adyen’s Gross Margin is fairly low at 16.7%, when compared to industry peer’s such as PayPal and Block.

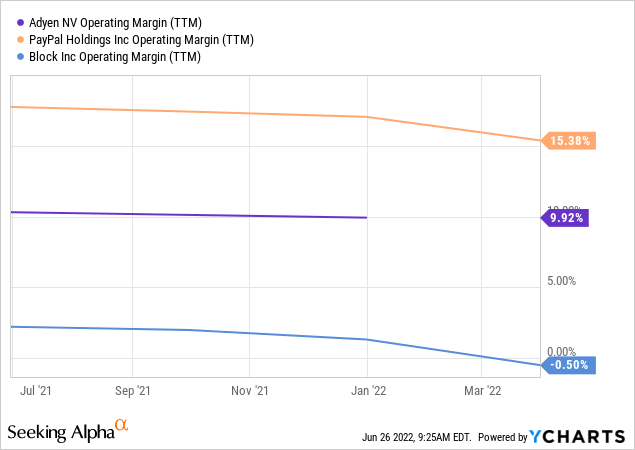

The good news is their Net Income margin 7.83% is higher than the sector median of 5.34%. While their Operating margin is 9.9%, which is higher than peers such as Block, but lower than PayPal. They generated strong Free cash flow of €567 million, up a rapid 53% year over year.

Adyen has a robust balance sheet with €4.6 Billion ($4.86B) in cash and cash equivalents, up a substantial 70% year over year. They have just $107 million in lease liabilities and very low debt of $163 million.

The company has issued strong guidance for 2022 and beyond, with a net revenue CAGR between the mid-twenties and low-thirties range. While they expect their EBITDA margin to increase above 65% long term, as the company benefits from increased operating leverage as it scales. They also aim to keep capital expenditure low at up to 5% of their net revenue.

Advanced Valuation

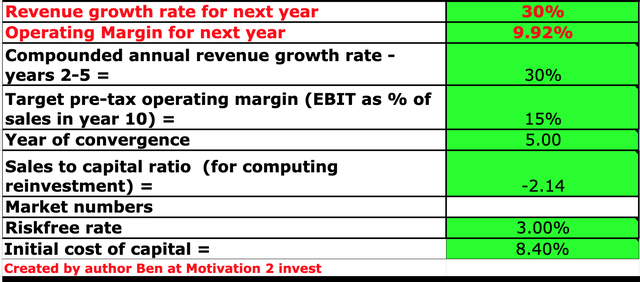

In order to value Adyen, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 30% revenue growth for the next 2 to 5 years, which is in line with the company’s own estimates.

Adyen Valuation model (Created by author Ben )

I have also forecasted the operating margin to expand to 15% in the next five years, as the company scales and benefits from increased operating leverage.

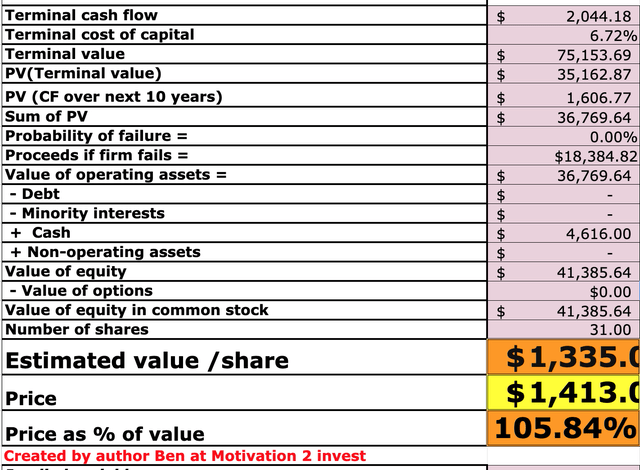

Adyen Stock valuation 2 (created by author Ben)

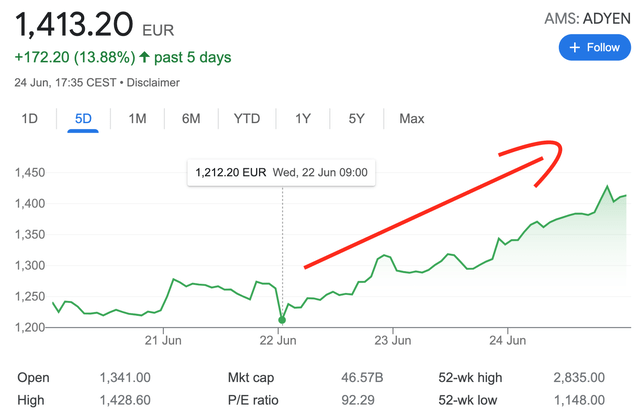

Given these factors, I get a fair value of €1,335 (ignore the dollar signs, all details are in euros) which is close to where the stock trades today. As an extra data point it is also interesting to see that the stock dropped to lows of 1,212 euros per share, just a few days ago (22nd June) before increasing by 16%. This leads me to have faith in my valuation model and believe the market is seeing value at those levels.

Adyen Stock Price Chart (June 22nd to 26th)

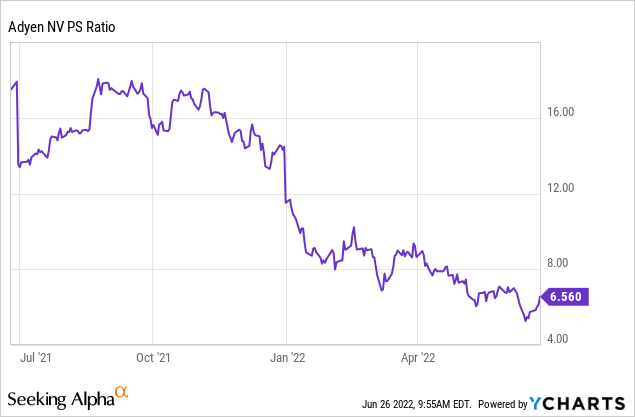

The stock also trades at a Price to Sales ratio = 6, which is substantially cheaper than historic levels of above 16.

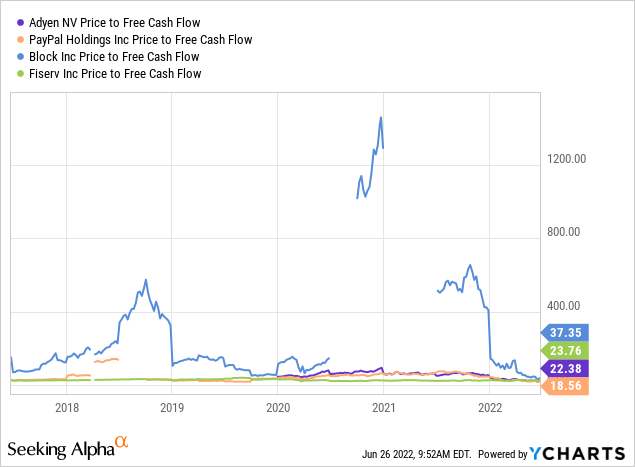

For a relative valuation, I have compared the Price to Free cash flow ratio across multiple Fintech stocks. Adyen trades at a mid-range valuation with a Price to Free Cash flow = 22.38, which is cheaper than Block, which trades at a P/FCF = 37, but more expensive than PayPal, which has a P/FCF = 18.5.

Risks

Competition

The Fintech industry has many competitors all seemingly offering a commodity product (fast, secure payments). Industry competitors include: PayPal, Block, Stripe (Private and recently valued at $95 billion), Marqeta (MQ) (for card issuing), FIS, and many more. High competition means a “land grab” strategy has ensued with those who can capture the biggest customers benefiting long term. So far, Adyen has captured some of the largest companies globally and thus is in a strong position.

Consumer Spending may slow down

The annual inflation rate in the U.S. accelerated to 8.6% in May 2022 and has consistently been much higher than the Fed’s 2% target since early 2021. Inflation squeezes the consumer with higher food, Gas and electricity costs. The Ukraine-Russian War has only exasperated rising energy costs and higher interest rates will make mortgage payments more expense for households and reduce surplus income for consumers.

Economics 101 states higher costs equals lower demand. As many of these Fintech companies make their revenue based on transaction volume, less volume equals less revenue. Although I believe this is only a temporary issue (until inflation subdues), it is a still a risk for all businesses.

Final Thoughts

Adyen is a tremendous company which has disrupted the traditional financial system and has an elite customer base to show for it. Their technology is best in class and the single platform makes it easy for businesses to setup their secure payments. The data collection and machine learning add an extra benefit to customers, which will act as a “Data Moat” as the company processes more volume. The stock price has pulled back significantly and the stock is now fairly valued intrinsically.

Be the first to comment