Scott Olson/Getty Images News

Weber Inc. (NYSE:WEBR) is headquartered in Chicago and manufactures its leading brand of grills in Huntley, IL. Weber has a longstanding tradition in the manufacturing of grills since 1952.

Weber Grills have a rich tradition. (Weber.com company website.)

Weber’s public debut was on 8/5/21 priced at $14 per share. I covered the IPO trade with a short term buy for short term traders in this article. Please excuse the title of that article, as well as the title for this article also. I am just a stock jockey, you were expecting Shakespearean prose?

Much of my work is short term swing trading, and the Weber IPO provided some short term volatility. The IPO day low was $15, four days later Weber’s stock traded to nearly $21 in the pre-market. Fairly muted volatility by 2021’s standards, but the short term trade worked out okay. That was then, this is now.

The daily chart below illustrates that volatility has returned to the Weber trade recently. The better than 10M share volume day on 6/23/22 accompanied the two-day, 60%, price spike from $7.72 to $12.25 per share. The chart shows the roughly 50% retrace from the peak of $12.25 back down to about $9.70 on the 6/23/22 chart, which is fairly common price action.

Interestingly, while volume declined by about 80% on 6/24/22, the stock’s decline during that session was very small at just .34 cents, or about 3.4%. Yes, 6/24/22 was a monster green day for the markets, and that may account for some of the relative strength of Weber on such low volume after a 60% price spike higher. It should also be noted that the intraday price action on 6/24/22 did not retest the previous day’s high of $12.25. The very narrow trading range during this session in part corresponds with the sharp decrease in volume as the market seemed to lack conviction for a move in either direction, higher or lower.

Let’s crank the rotisserie 1/2 turn and see who is about to get roasted on this trade. Are bull ribs on the menu, or are bear burgers the specialty of the grill master for this swing trade?

A closer look behind the mechanics for this trade and this story gets a lot more interesting. There may be more at work behind the Weber chart pattern than meets the eye for the Weber trade currently. Bulls subscribe to the analysis from S3 Partners that Weber is one of the most overcrowded shorts on the entire street currently. Additionally, there may be very little stock left to borrow on the street, and the current borrow rate is expensive at about 50%. The elevated price of the shares now means that shorts are paying a hefty borrow fee for the privilege of bag holding their underwater short positions.

This may be an untenable position for a growing number of shorts who cannot average up to increase their short position either, due to a lack of availability for shares to sell short. Bottom line, if bulls can muster the volume to continue pressuring the bears into covering their shorts, then the short squeeze that bulls have been orchestrating could continue to move Weber shares higher in the short term. In this case, shorts will be forced to cover, or else face the prospect of becoming bear burgers on the Weber grill.

“Every Picture Tells A Story, Don’t It?”

A bullish flag pattern may be forming on the Weber chart. (IBKR chart data.)

Stock charts are very much pictures that are telling a story of price action, and corresponding events off of the charts as well. The daily chart pattern above appears to be forming a bullish flag pattern. However, the very steep decline in volume could be a headwind for further bullish price action. Still, in what is likely to be a lower volume, pre-holiday, trading week ahead this trade could defy the general rules of low volume price action.

The weekly chart below actually presents a better look at what may be an oversold chart pattern. This longer term picture of Weber’s price action may be giving bulls optimism that a continuation pattern higher may occur on the chart:

Weekly chart suggests further upside possible on the Weber trade. (IBKR chart data.)

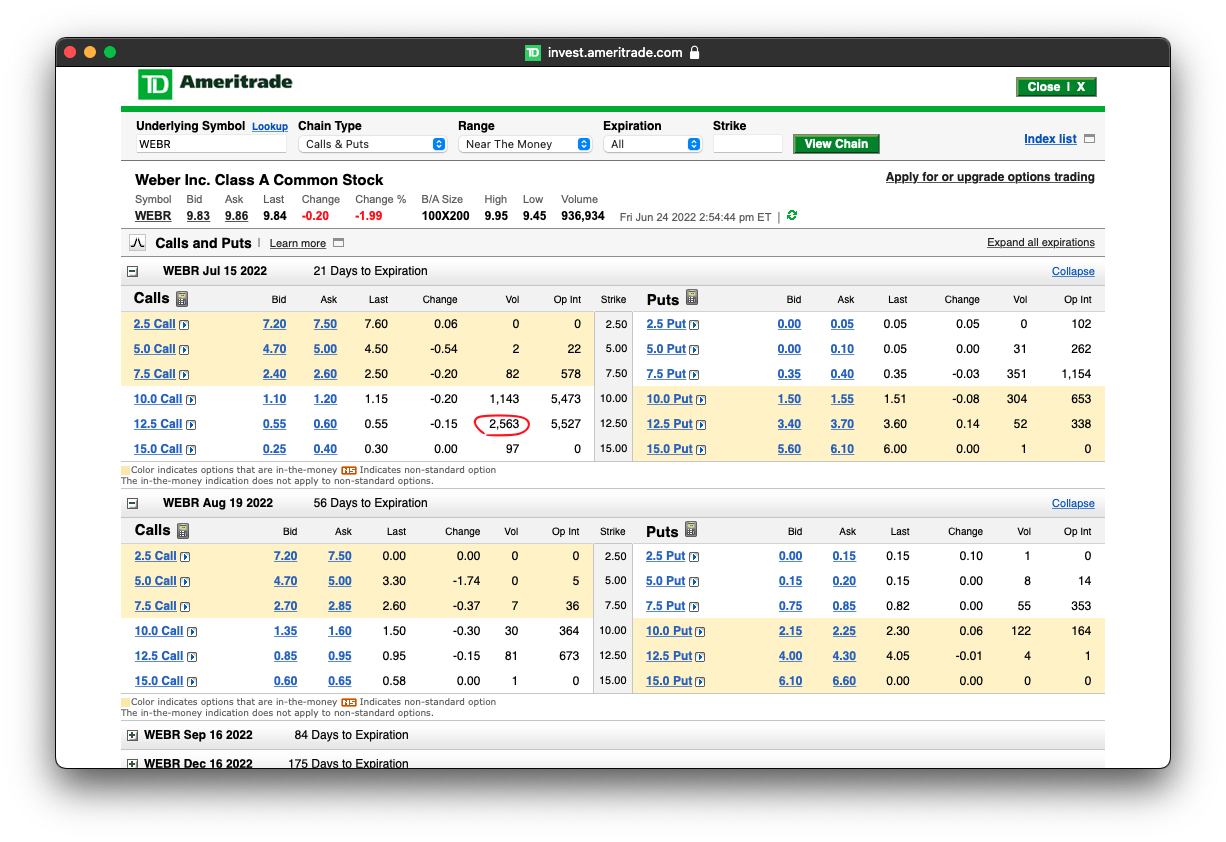

Bullish sentiment for this trade is evident in the call option volume and open interest in the July 15 $10 and $12.50 strike prices, as indicated in the graphic below:

Call option volume and open interest suggest bullish sentiment. (TD Ameritrade)

The open question remains as to whether bulls can muster the necessary volume to continue marching the stock price up the chart. In the absence of volume, bulls would have to rely upon hopes for a continuance of the bear market rally to help lift the price of the stock. In a lower volume and less volatile market for Weber shares, bulls might hope to win the war of attrition as bears feel the pain of a 50% borrow fee. This could contribute to a significant amount of short covering in the near term.

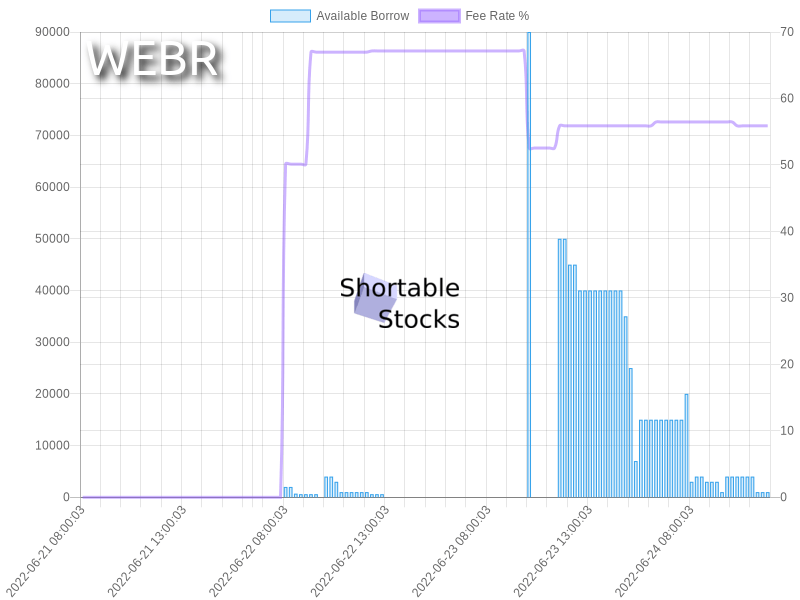

The graphic below illustrate the high borrow rate, which closed 6/24/22 at about 49.5%. The descending blue histogram on the graphic below illustrates the decreasing availability of shares to borrow for shorting. Knowing that this is an overcrowded short, courtesy of S3 Partner’s data, the management of Weber should consider that if ever there was an opportune time to drop some type of impactful PR, then now would be that time. Even if I had to announce that my new Weber smart grill had learned to grill pickles and okra, then I would roll that PR out on the newswire with great hyperbole. Weber can worry about the negligible TAM for grilled pickles and okra later.

High borrow fees, and higher short utilization rates are bullish factors. (ShortableStocks.com)

The Bear Case Is Also Very Compelling For This Trade

There is a reason why stocks become overcrowded short trades. When a trade becomes overcrowded to the short side, it can often indicate fundamental problems. This link to the Weber Q2 2022 quarterly press release reveals under-performance that surprised the street to the downside. The excerpt from the PR below presents the top and bottom line misses, followed by revised guidance lower. This is the trifecta of bad news that only a bear could love in an earnings report:

FOR THE THREE MONTHS ENDED MARCH 31, 2022

Net sales decreased 7%, to $607 million, from $654 million in the prior-year quarter. On a two-year stack basis, net sales increased 46% above 2020. Foreign exchange accounted for $20 million of the sales reduction, and, excluding the impact of foreign exchange, net sales declined 4% year-on-year. Net sales were adversely impacted by product and component part availability resulting from global supply chain disruptions. In addition, retail traffic, both in-store and online, slowed broadly in comparison to last year, driving lower category point-of-sale performance. The decrease in sales volume was partially offset by certain pricing actions.

Net sales decreased 18% in the Americas, to $306 million, from $373 million in the prior-year quarter, however on a two-year stack basis, net sales increased 41%. EMEA net sales increased 9%, to $268 million, from $246 million in the prior-year quarter, and increased 47% on a two-year stack basis. APAC net sales decreased 6% to $34 million, from $36 million in the prior-year quarter, yet increased 157% on a two-year stack basis.

Gross profit decreased 27% to $209 million, or 34.3% of net sales, compared to $286 million or 43.7% of net sales in the prior year. We made significant progress on our recovery plan as we improved gross margins by 1,170 basis points from the first to second quarter. The year-over-year decrease in gross profit was primarily due to higher inbound freight costs, higher commodity costs and elevated costs related to the startup of a new production line.

Net loss of $51 million compared to net income of $69 million in the prior-year quarter. Adjusted net loss was $34 million compared to adjusted net income of $98 million in the prior-year quarter.

Adjusted EBITDA of $86 million compared to Adjusted EBITDA of $149 million in the prior-year quarter, driven by lower net sales and higher cost of goods sold in the quarter as compared to the prior-year period.

As of March 31, 2022, Weber had cash and cash equivalents of $46 million and $266 million of available borrowing capacity under the revolving credit facility.

As announced on May 11, 2022, the Weber Board of Directors declared a cash dividend of $0.04 per share, payable in cash, on June 17, 2022, to holders of its Class A Common Stock as of the close of business on June 7, 2022.

UPDATED FISCAL YEAR 2022 GUIDANCE

For the fiscal year ending September 30, 2022, the Company has revised guidance to reflect the anticipated industry impact of reduced retail sell-out related to retail traffic and consumer purchase trends over the balance of 2022, as well as foreign currency devaluation.

As a result:

Net sales are expected to be in the range of $1.65 billion to $1.80 billion, and

Adjusted EBITDA is expected to be between $140 million and $180 million in view of the cost and volume challenges.

End of excerpt from Q2 2022 PR statement.

In response to this disappointing quarter, Moody’s issued a downgrade for Weber’s outlook from Stable to Negative.

Notably, in the midst of a period where the company is being challenged by lower profitability results, inflationary pressures, higher capital expenditures for growth, a looming recession, and a disappointing quarter that shocked the street, management chose to issue a .04 cent dividend that will pressure cash flows further to the tune of $47M annually. Perhaps the company was trying to cushion the blow for such a weak Q2 report, but the timing of this dividend issuance may come into question as the company will likely need to keep cash on the balance sheet in the coming quarters.

In my experience, a company’s first downward revision in guidance can be followed by a second downward revision. This can be especially true for a retail-facing manufacturer of high end discretionary items, as much of the world contemplates the start of a recession. I understand the bear case for Weber. The reasons for the overcrowded short side of the trade are cogent and rational. Seeking Alpha lists the average analyst price target for Weber at $7.79 per share, about $2 below the current price. Maybe it won’t be bear burgers on the grill after all, maybe it will be bull ribs getting grilled?

Inflation, Recession, and Counter-Intuitive Price Action

While Weber’s chart pattern and technicals have improved for the short term, bears want to talk about the difficult Q2 2022 results, seemingly stubborn inflationary input costs for this manufacturer, and the likelihood of a weakening consumer. It is likely that the inflationary pressures that plagued the Q2 2022 quarterly report will repeat again here in Weber’s fiscal Q3 2022 report as well.

Inflation may have recently peaked in some areas of the economy, we hope. Still coming down off of a peak does not mean returning to the Fed’s target of 2% inflation by any means. We must continue to endure painfully high food and energy costs, which seem to filter out into almost every other area of the economy.

Inflation may subside to some degree, but it is likely that prices are going to stay elevated. Certainly the inflationary costs of higher labor wages and costs are with us for quite a long time, maybe permanently. Weber will need to learn to adjust and price its already high end products still higher. We can expect this action to be deleterious to sales during this approaching recession.

A looming recession seems to be on everyone’s mind as well, which may not be helpful for Weber’s more expensive line of grills. Unless Jerome Powell can engineer the elusive soft landing that even he discusses as nothing more than a tenuous goal, then a recessionary cycle is upon us. I am not banking on the soft landing scenario as a very likely outcome from the current Fed activity.

Would a recession benefit the chances for the Weber bears to put the bulls on the grill? You know, this is where the concept of a recession relative to the stock market’s price direction can become counter-intuitive. We all have felt the recent, sharp pain of a steep decline in market prices. The market is a forward-looking discounting mechanism, so the market has been pricing in the likelihood of higher rates and a recession. The much maligned term of stagflation has become a frequent topic of discussion lately also. Not good.

With so much bad news having been priced into the market, there is actually room for an upside surprise along the way. We are already starting to see many commodity prices backing off of their recent highs. The market has also taken interest rates down a bit last week as the idea of a recession with the accompanying demand destruction is starting to price into the markets. This concept of lower inflation, lower interest rates, and a weaker economy provided the catalyst for last week’s 5%-8% rallies in the major indexes last week.

When we consider whether stock prices should continue trading lower into any upcoming recession, the answer may be, “It depends.” It depends upon how deep of a recession the Fed’s actions cause for the economy. What economic policy might we experience from Biden and team? What duration might we expect for this recession? How vibrant will the economic recovery be on the other side of the recession? Will inflation remain persistent, or be tamed back down to the Fed’s 2% target? Many questions and numerous variables are ahead for the market. Weber’s upcoming quarterly reports could be hurt a little by a moderate recession, or the quarterly reports could be impacted more negatively by a deeper recession. The market is watching the weekly data closely to determine the gauges for inflation relative to the depth of any upcoming recession.

Summary

If we believe that this oncoming recession is likely to be deeper and longer in duration than markets are currently considering, then we might believe that Weber will also trade lower along with the overall market.

If your view on the market is for a short and shallow recession, and I hope that you are correct, then stocks may have already seen their bear market bottom.

In either case, whether you believe that a moderate/short recession is pending, or if you believe that a more severe/longer recession is incoming, here is where the Weber trade stands currently:

- The bulls have just succeeded in moving the price of Weber shares up significantly from $6 per share to a peak gain of $12.25. This has been a gain of about 105%. Weber now trades at about $9.70;

- For this trade to continue higher, increased volume is likely needed. The upcoming low volume, pre-holiday week ahead could be an exception where Weber could be moved higher by lesser volume. But without a sharp increase in volume, it is difficult to see Weber trading above the recent, short-term high of $12.25.

- The current trade setup with high borrow fees and almost zero short availability may be the best chance that Weber bulls will get to squeeze the bears in this stock.

- The rally in stock prices for the major indexes may continue into this coming week. This could be very helpful to the bulls efforts to retest the technically important $12.25 recent high on the chart;

- Bulls may have a limited window of favorable opportunity currently open to take the price of Weber shares beyond the recent high;

- If bulls cannot capitalize upon the current window of opportunity to continue the squeeze of Weber bears at this time, then the window likely narrows.

- The lower volume in this trade may combine with the weakening fundamentals for Weber. This will likely result in the share price of Weber trading back lower. It is possible that Weber could give back most, or even all, of its recent gains as the weakening fundamentals are impacted by recession.

Conclusion

I believe the trade setup for bulls to take Weber shares higher in the near term exists. The major caveat is that we will likely need to see volume re-enter this Weber trade before we can believe that the squeeze is in effect. Corporate PR or some external catalyst would likely need to be experienced for the type of volume that we recently saw in driving this stock price higher.

Absent this essential volume for the Weber Trade, it is possible that bears may survive the recent squeeze higher. All of Weber’s price targets are lower than the current price of Weber’s stock. Importantly, we should note that these price targets were issued at various points in the past. Worsening economic conditions may result in a further lowering of price targets, and even further downgrades from Moody’s and Wall Street analysts.

Be the first to comment