LordHenriVoton/E+ via Getty Images

Generally speaking, I do not like to invest in the retail space. The industry is plagued by low margins, high competition, and is subject to downward pressure in difficult markets. But there are some players in the retail space that make sense. One such prospect is Village Super Market (NASDAQ:VLGEA). This small player, with a market capitalization of just $331.7 million as of this writing, has held up surprisingly well over the past several months as the broader market has dropped. This serves as a testament to the company’s robust fundamentals and continued growth. On top of this, it also helps that shares of the company are trading at very cheap levels at this time. In all, I would call Village Super Market one of the best prospects in the retail space and certainly a great prospect for investors to consider.

A solid firm at a great price

2022 has been rather difficult for most companies across most industries. Unless you are heavily invested in the energy sector, odds are your portfolio is down. But there are some companies that have experienced a modest amount of upside that are not in the energy space. When I last wrote about Village Super Market in an article published in December of last year, I applauded the company’s history of topline revenue growth. I also said that cash flows were mostly stable, and I was impressed by the fact that it had cash in excess of debt. On top of this, I acknowledged that shares of the company were trading at fundamentally low levels that could indicate strong upside potential. As a result of this, I decided to rate the business a ‘buy’, indicating my belief that it should outperform the broader market over an extended timeframe. So far, the business has fared better than I could even have anticipated. While the S&P 500 has dropped by 19.2%, shares of Village Super Market have generated a return for investors of 1.8%.

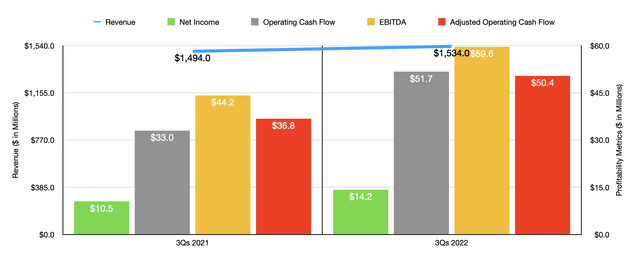

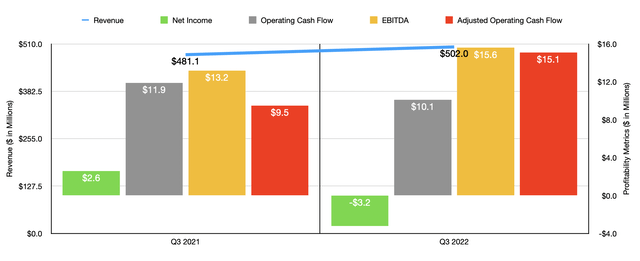

This share price performance is not without cause. When I last wrote about the firm, we had data covering through the entirety of the company’s 2021 fiscal year. Today, our data covers through the first three quarters of 2022. For the most part, the results are impressive. Despite concerns regarding inflation and the supply chain, the company has managed to increase both its revenue and profitability. Revenue in the first three quarters of 2022 totaled $1.53 billion. This represents an increase of 2.7% compared to the $1.49 billion generated at the same time one year earlier. According to management, this increase in sales was driven in large part by a 3.7% rise in same-store sales, with some of that being offset by the closure of one of its locations. For those worried that the economy is getting progressively worse, it’s worth pointing out that revenue growth in the latest quarter was particularly strong, with sales rising from $481.1 million last year to $502 million this year. That translates to a year-over-year growth rate of 4.3%. In this case, the company benefited from a 4.3% rise in same-store sales.

Profitability has been a bit mixed but still positive for the most part. Revenue in the first nine months of the company’s 2022 fiscal year came in at $14.2 million. This is 35.2% above the $10.5 million generated just one year earlier. Meanwhile, other profitability metrics fared even better. Operating cash flow jumped 56.7% from $33 million to $51.7 million. Even if we adjust for changes in working capital, it would have risen by 37% from $36.8 million to $50.4 million. Meanwhile, EBITDA was also on the rise, climbing by 34.8% from $44.2 million to $59.6 million. Using data from the latest quarter, results were a bit more mixed. For instance, the company’s bottom line did worsen year over year, with net income dropping from $2.6 million to negative $3.2 million. Operating cash flow also fell, declining from $11.9 million to $10.1 million. If we adjust for changes in working capital, however, this metric would have jumped from $9.5 million to $15.1 million while EBITDA increased from $13.2 million to $15.6 million.

It’s worth discussing what caused some of these changes on the bottom line even as revenue increased. For the first nine months of 2022, the company’s gross profit margin increased by 0.47%. Though this may not seem like much, it would add $7.2 million in pre-tax profit to the company’s bottom line. Management attributed this to improvements in departmental gross margins and a favorable change in product mix. Unfortunately, the departmental gross margin discussion is rather vague. Regardless, the improvement in gross margin was even greater in the latest quarter. However, this was offset by higher operating and administrative costs, driven by a $12.3 million settlement charge that came from the company’s decision to terminate its employees’ retirement plan. Excluding this change, margins here would have actually increased.

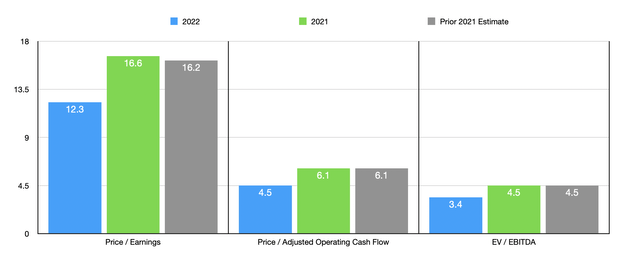

Because management has not provided any real guidance for the current fiscal year, we don’t know how 2022 will look as a whole. But given how late we are in the year, it’s not a stretch to forecast financial performance. Annualizing financial results seen in the first three quarters of the year, we get net income of $27 million. Adjusted operating cash flow would be $74.3 million, and EBITDA would come out to $92.7 million. Using this data, we can easily value the business. On a price-to-earnings basis, the firm is trading at a multiple of 12.3. The price to adjusted operating cash flow multiple is even lower at 4.5 while the EV to EBITDA multiple should be 3.4. If we want to be more conservative and use 2021 figures, these multiples would increase slightly to 16.6, 6.1, and 4.5, respectively. For the 2021 figures, the latter two match perfectly with what the company was trading for when I last wrote about it. And using the price-to-earnings multiple approach, we saw a modest increase from the 16.2 of my prior article.

To put the pricing of the company into perspective, I decided to compare those results to the results of five similar companies. On a price-to-earnings basis, these companies ranged from a low of 11.4 to a high of 71.7. Three of the five companies were cheaper than Village Super Market on this basis. Using the price to operating cash flow approach, the range was from 5.5 to 22.7. In this case, two of the five were cheaper. And finally, we get the EV to EBITDA approach. In this case, the range is from 4.6 to 25.9. Our prospect is the cheapest of the group here.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| Village Super Market | 12.3 | 4.5 | 3.4 |

| Natural Grocers by Vitamin Cottage (NGVC) | 12.9 | 5.5 | 5.2 |

| The Kroger Co. (KR) | 21.2 | 5.6 | 7.0 |

| Grocery Outlet Holding Corp. (GO) | 71.7 | 22.7 | 25.9 |

| Sprouts Farmers Market (SFM) | 11.4 | 6.9 | 4.6 |

| Casey’s General Stores (CASY) | 20.0 | 8.6 | 10.3 |

Takeaway: VLGEA stock remains a buy

At this point in time, Village Super Market seems to be doing a really great job considering the broader economic uncertainty. Shares have actually generated a slight profit for investors at a time when the market is down significantly. The stock remains cheap, and even if financial performance were to worsen, I have a difficult time believing that the company could actually look expensive in any way, shape, or form. As a result of this, I’ve decided to retain my ‘buy’ rating on the company at this time.

Be the first to comment