piranka

The value of the U.S. dollar remains strong.

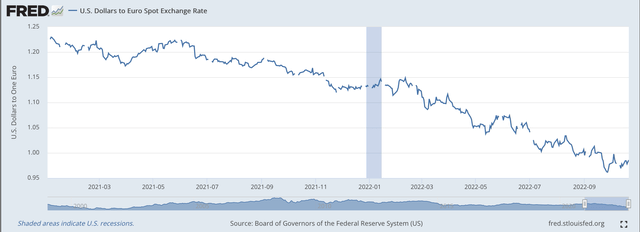

In terms of the euro, the dollar is still maintaining a price below parity. As of 10:30 am on Monday, October 31, 2020, it took only $0.9899 to purchase one euro.

The dollar has risen in value against the euro since the start of the Biden Administration. On January 2, 2021, a euro cost $1.2328.

The path since January 2 has been almost steadily downward.

U.S. Dollars To Euro Spot Exchange Rate (Federal Reserve)

As I have written before, I believe that there are two basic reasons for the continuing strength of the U.S. dollar.

First, with the advent of the Biden Administration, the world re-asserted its belief that the United States is, economically, the strongest nation in the world. Thus, funds began to flow to the United States because of the belief that the U.S. was the “go-to” country in terms of safety for risk-averse investing.

Second, the United States transformed into the world leader in terms of facing the rising inflation in the world, and then moved faster than other central banks in an attempt to combat these rising prices.

The question was not so much that the Federal Reserve “did” a lot of things, especially early in the game, but the Federal Reserve talked about moving and then did move earlier than most of the other major countries in the world facing inflationary threats.

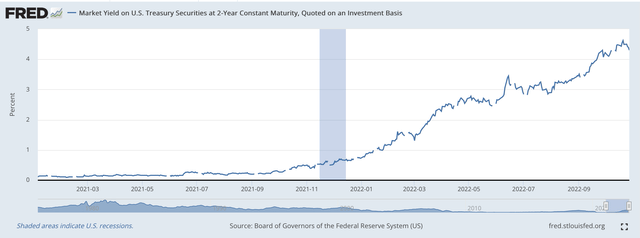

To pick up the Federal Reserve’s influence on world currency markets, I present the chart on the movement of the yield on the 2-year U.S. Treasury note. The correlation between the two charts is quite remarkable.

Market Yield–2-year U.S. Treasury Note (Federal Reserve)

It should be noted that this relationship was not a part of the economic policy plan of the Biden Administration. In a sense, it just happened.

The Federal Reserve has made no mention of the value of the U.S. Dollar being a part of the monetary policy it is facing.

The Fed’s policy just pushed interest rates to rise, and the rise in interest rates changed the “relative” position of U.S. rates against interest rates in other parts of the world.

And, this relative position of interest rates continued to dominate the financial markets.

Of course, there have been other things happening in the international space that have further contributed to the strength of the U.S. dollar. For example, the Russian invasion of Ukraine contributed to foreign monies coming into the United States. And, the Chinese economy is apparently performing at a lower level than it has for many years.

So, events around the world have helped to further strengthen the U.S. dollar.

Looking Forward

The future?

Right now I see very little in the world to indicate that the current relationships are going to end. Thus, it appears to me that the value of the U.S. dollar is going to remain strong in foreign exchange markets.

The Federal Reserve System is still on record for further increases in its policy rate of interest. Furthermore, Federal Reserve leaders seem intent upon continuing to shrink the Fed’s securities portfolio through the process of “quantitative tightening.”

The plan is for the quantitative tightening program to go on into 2024.

But, there is plenty of debate going on in the investment community about whether the Fed leaders will “keep on, keeping on” with the quantitative tightening program, or will they lose their nerve and “pivot” out of the effort.

Not only is there the cry of pain coming from the stock markets as stock prices fall because the Fed is keeping money “tight,” but there is the increasing call of agony as many U.S. businesses dealing in foreign markets find their profits hurt by the rising value of the dollar around the world.

Strong Dollar

To me, I am in favor of a strong U.S. dollar, but as a policy choice, not a residual result.

Businesses in countries that have strong currencies are forced to improve productivity to remain competitive, and so find themselves pushing to be among the more advanced organizations in the world when it comes to this aspect of the competitive world.

These companies stop relying upon a “weak” currency to make them competitive in world markets.

This effort is very beneficial for the company, itself, but the effort is also of enormous benefit for the nation. Innovation grows and spreads more rapidly in a country that doesn’t just protect the competitive position of its businesses.

The current timing of the “strong” dollar, in my mind, could not have come at a better time.

The strong dollar can, I believe, contribute substantially to the strong position of the U.S. economy in the world going forward.

We are coming out of a “pretty sick” time. The U.S. economy…as well as the world economy…is very disjointed and disrupted.

But, we have to move on with the new technology and the new leadership.

Let’s move on with a strong dollar, with the strong incentive to drive productivity to the next stage, and with financial strength, once this is achieved following the fight with inflation.

Let’s take the U.S. leadership in the world another step further and build our innovative strength into the next era of technological advancement.

Be the first to comment