JHVEPhoto/iStock Editorial via Getty Images

Roku, Inc. (NASDAQ:ROKU) is the leading TV streaming platform in the United States, Mexico, and Canada, and is at the forefront of the shift from linear TV to streaming. Whilst the company does offer hardware, such as streaming dongles that can be plugged into any TV & transform it into a connected TV, it is the software aspect of Roku that should excited investors.

The Roku platform is an operating system used by TV OEMs to run their connected TVs, and Roku generates platform revenue through both digital advertising and revenue-share agreements with content streaming services.

Since my previous article, Roku has been hitting the headlines. On 8th June 2022, Roku’s shares surged 10% after it surfaced that the company had “abruptly” closed the trading window for employees, meaning they could not buy or sell shares. Generally, this happens prior to an announcement that would have a material impact on the share price – in this instance, news outlets reported that there were talks of a potential acquisition by Netflix (NFLX) floating around inside the company.

More recently, on 16th June 2022, Roku’s shares jumped another 6% in early hours trading after it announced a “first-of-its-kind” partnership with Walmart (WMT) to turn advertisements into shoppable experiences.

Roku shares clearly reacted positively to both items of news, but what does this mean for Roku shareholders? Are the share price movements merited, or is it just another case of market volatility?

Don’t Believe The Takeover Talk

The history between Netflix and Roku goes back decades; Roku CEO Anthony Wood worked for Netflix on Project Griffin in 2007 – a set-top box that allowed Netflix users to stream content to their TV. The project ended up being cancelled by at the last minute by Netflix CEO & Founder Reed Hastings, with Netflix instead opting to spin off the business which would go on to grow into the Roku we know today.

Netflix itself has struggled this year. Having guided for 2.5m net adds in Q1’22, the company came in well below these figures – having actually lost 0.2m subscribers, or having gained on 0.5m subscribers once the impact of suspending services in Russia was taken out. Furthermore, the company’s Q2 guidance on subscriber numbers was for net adds to decrease by 2 million vs a 1.5 million increase from the year prior. So now we know the background, it’s easier to understand why Netflix might be looking to make a drastic move.

The general consensus now, and it’s one that I concur with, is that Netflix is not going to be looking to acquire Roku – rather, it will look to partner with Roku on an ad-supported tier that Netflix told employees it is looking to introduce.

Given Roku’s independence and leadership within the TV streaming market, combined with its past relationship with Netflix, this potential agreement is no surprise. Roku has tons of first-party data thanks to its direct relationship with users, and its partners have been able to leverage this using Roku’s OneView ad platform to serve relevant, targeted advertisements. The wealth of data that Roku has been able to acquire in the connected TV space is unmatched, and Netflix knows this – the partnership just makes sense.

Despite its current difficult period, Netflix still is the leading streaming platform globally, with more than 220 million paid members around the world – and, it has a 25% market share of the U.S. streaming market according to JustWatch.

The potential partnership with Netflix for an ad-supported model provides an incredible opportunity for Roku to turbocharge its growth, by bringing a streaming giant into its advertising ecosystem. Right now, I am watching to see what the eventual announcement will be, but make no mistake – this has potential to be a huge catalyst for Roku’s future growth.

When asked about the deal recently, Roku CEO Anthony Wood unsurprisingly said that he couldn’t comment on the rumors. He was quick to highlight the following:

Ads are great because they bring down the cost for consumers. We’ve been a big partner, we have a great relationship with Netflix for a long time. But we have great relationships with a lot of streaming content companies whether its Disney, YouTube or Hulu.

My thesis for owning Roku was always driven by the large opportunity in ad-supported video on demand, and the fact that advertising dollars are still in the early innings of making their way from linear to connected TV. The Netflix opportunity is huge, but as CEO Wood points out, Roku has the opportunity to work with many huge brands in order to generate advertising revenue – any potential Netflix partnership is just a step in the right direction.

Click Click Pay

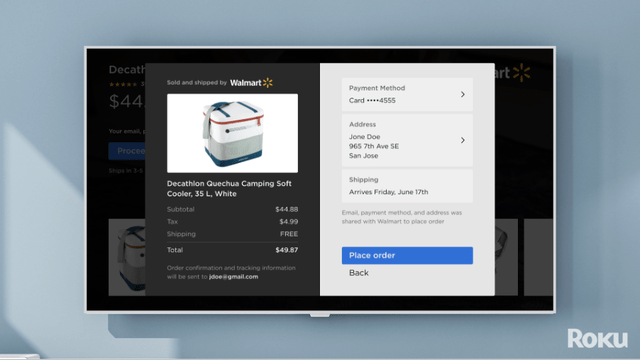

Getting out of the realms of rumors and back into reality, Roku announced a first-of-its-kind partnership with Walmart, enabling Walmart to be the exclusive retailer on Roku’s platform that allows streamers to purchase Walmart products directly from their Roku device.

This partnership will enable viewers to purchase a product in two clicks – which I find amazing as a Roku shareholder, but potentially dangerous for my wallet. An advert will pop up with a certain product, viewers can click “OK” with their remote, and they will proceed to the checkout with both payment and delivery details pre-populated by Roku Pay. Another tap of “OK,” and you’re good to go.

There are two main points here to highlight for Roku shareholders. Firstly, the fact that this is being powered by Roku Pay is a huge win. There are often ways that companies on Roku’s platform can skirt around having to pay Roku – for example, the revenue-share model for premium subscriptions such as Netflix are only revenue-accretive for Roku if the customers signs up to Netflix on Roku’s platform. Yet if customers are seeing this advert on Roku’s platform, that’s one revenue opportunity, and if they are paying through Roku Pay, that is another, as Roku will undoubtedly take a cut of the payment.

Whilst Walmart is the one and only exclusive partner for now, if this shoppable advertising experience is successful, I have no doubt that it will be rolled out by Roku to all its partners. There are often some question marks over what agreements Roku benefit from financially, and which have little impact to the company’s financials, but I think this is a huge opportunity to boost both Roku’s potential future partnerships as well as its top line.

The second opportunity for Roku comes from the data that will be generated through these advertisements. Roku already has a lot of data, meaning that it should be able to target customers effectively with these adverts & therefore generate even more revenue, but it will also continue to learn throughout this trial. A smaller point, but one worth highlighting.

Bottom Line

Whatever the outcome of these talks with Netflix, one thing is for certain – streaming is taking over, and companies like Roku can be the backbone of this huge opportunity. According to Statista, TV advertising revenue in the US will grow from $72.3 billion in 2021 to $81 billion in 2025, with global TV ad revenue increasing to $162 billion in 2024. Whether it’s partnerships with streaming companies such at Netflix and Disney+ (DIS), or innovative new ways to advertise such as the partnership with Walmart, Roku is continuing to drive more value out of its huge 61.3 million active accounts – and shareholders should continue to be pleased.

Be the first to comment