Justin Sullivan

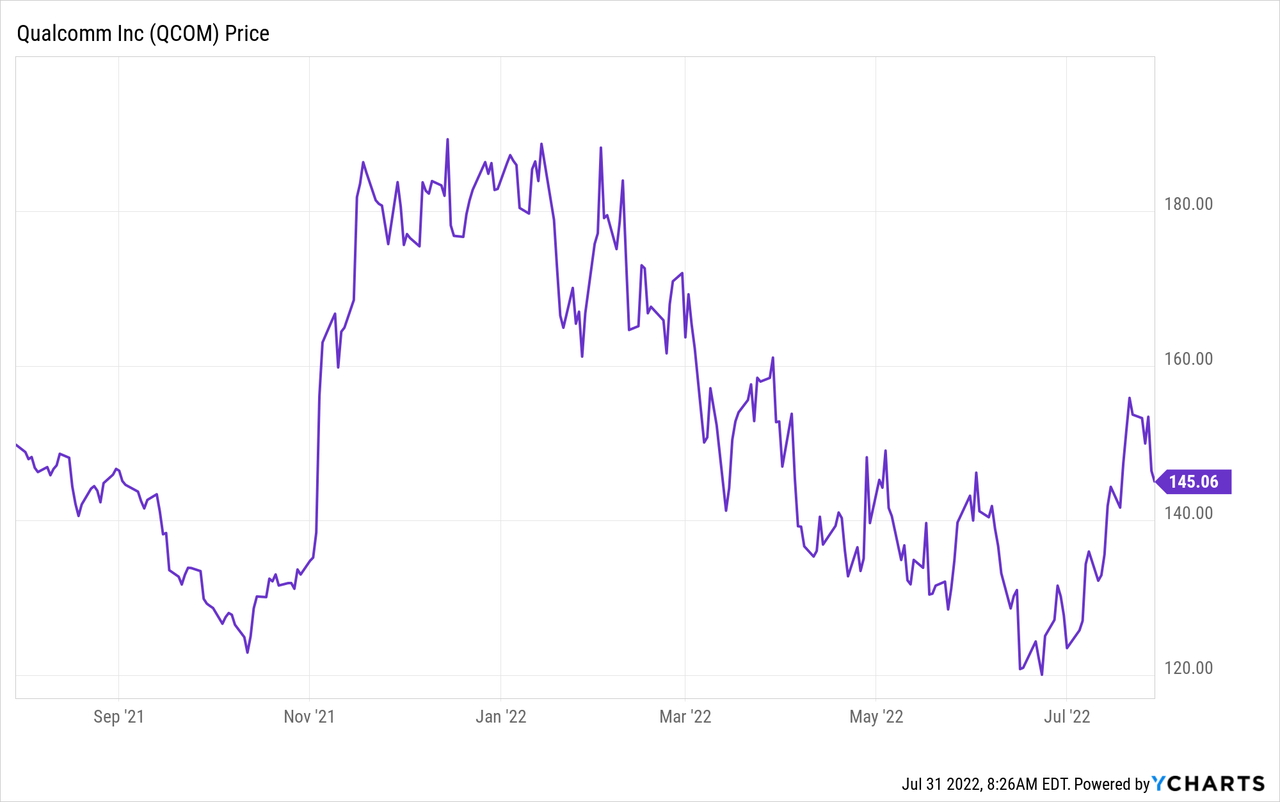

Qualcomm (NASDAQ:QCOM) is a leading technology company which designs innovative semiconductor chips. The company’s flagship “Snapdragon” powers ~70% of the Samsung Galaxy series and its recent partnership has increased the robustness of this agreement up until 2030. In my previous post on Qualcomm I announced the company has a “$700 Billion Market Opportunity” across Semiconductor Chips, IoT, AI, 5G and much more. The company recently announced solid earnings for Q322, but tepid guidance caused the stock price to slide by ~5%. However, it is still up ~17% over the past month and jumped by 27% a couple weeks after my last post (if you held through the dip). In this post, I’m going to breakdown the recent earnings, reveal the business drivers and revisit the valuation, let’s dive in.

Qualcomm Reports Strong Q3 Earnings

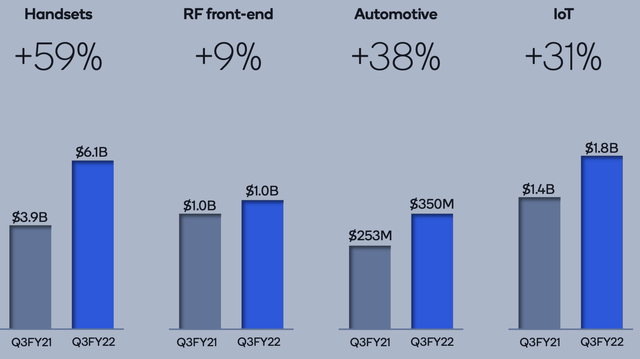

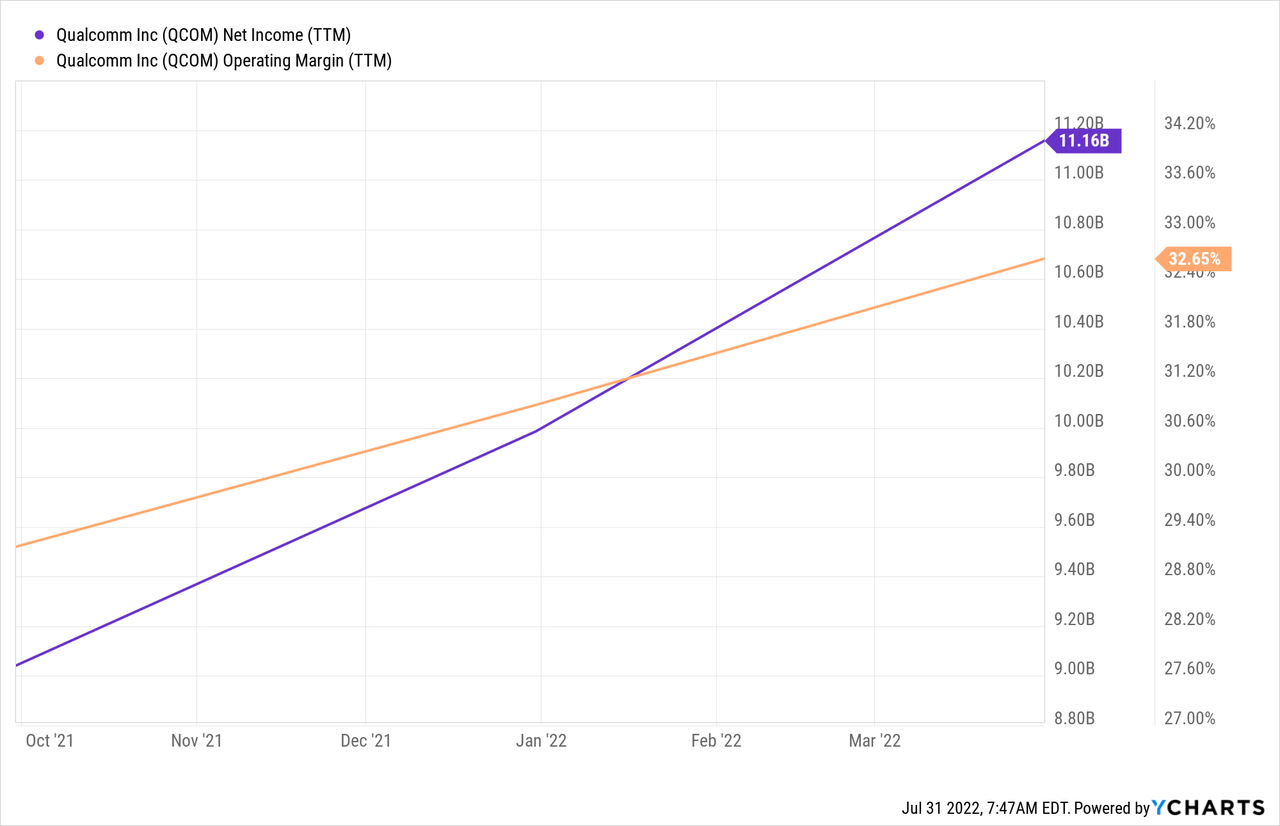

Qualcomm generated strong financials for Q322. Revenue popped to $10.9 billion, up a rapid 37% year over year and beating analyst expectations by $74 million. The main revenue driver of the company is its QCT segment (Qualcomm CDMA Technologies). This is the largest segment and makes up approximately 86% of total revenue. The segment includes semiconductor chip designs for Mobile Handsets such as the Samsung, RF front end, automotive and IoT. Handset revenue generated blistering growth of 59% year over year to $6.1 billion.

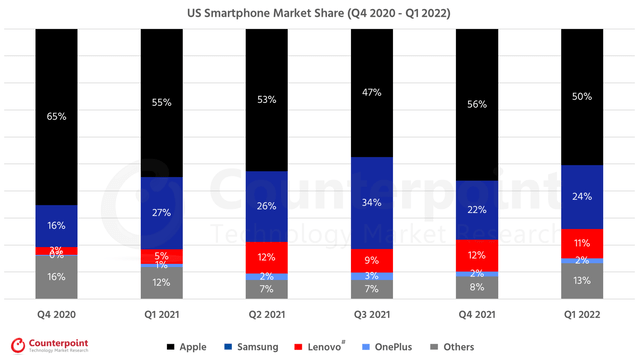

The company announced a major partner agreement with Samsung to extend its patent license agreement for 3G, 4G, 5G and even the upcoming 6G technology, through to the end of 2030. This means the company is expected to power up to ~70% of Samsung Galaxy devices such as the S23 in the upcoming years with its Snapdragon platform. The agreement also includes other “premium” Samsung products such as PC, tablets and even extended reality devices. The reason this is significant is that in many Western markets such as the US and Europe, consumers tend to choose mainly between and iPhone or a Samsung Galaxy. With the iPhone making up approximately a 50% market share and Samsung making up a 24% market share. Thus a bet on Qualcomm is really a bet on the success of future Samsung Galaxy models.

Smartphone Market share (Market Monitor Service )

Management is forecasting Handset Revenues to grow at slightly below 50% for the full year 2022, driven by increased processor content per device and expansion of their addressable market.

The partnership with Samsung is great, but it is also vulnerable to the cyclicality of the handset market. Thus management has made it a strategic priority to grow its IoT (internet of Things) and Auto Segments in order to diversify revenue and expand their TAM. Their strategy is working so far, as IoT revenue was a record $1.8 billion, up a rapid 31% year over year. This was driven by Windows of Snapdragon Compute platforms for on device AI. Also they announced new Wi-Fi 7 platforms, which is the latest generation of high speed Wi-Fi. In addition, to two new 5G ready Robotics platforms with AI features.

Qualcomm Financials (created by author Ben at Motivation 2 Invest)

The Automotive segment also generated record revenue of $350 million, up 38% year over year. This offers huge potential for the company given they already have a Design win pipeline of over $19 billion, which is huge.

Qualcomm has major partnerships with 26 global car makers such as BMW (OTCPK:BMWYY), GM (GM), Honda (HMC), Volvo (OTCPK:VOLVF), Renault (OTCPK:RNSDF) and even Ferrari (RACE). Its “digital chassis” platform enables these Automotive manufacturers to turn their vehicles into a rolling high powered computer, equipping customers with connectivity, AI and ultimately self driving features. QCOM recently scored a partnership with major automaker Volkswagen (OTCPK:VWAGY) (which owns Audi, Porsche, Lamborghini, Seat) and its software company CARIAD to help power future self driving vehicle solutions.

The prior acquisition of Arriver is also poised to help improve platform and its computer vision capabilities. Its RF front end sub segment also showed growth of 9%, on next generation Wi-Fi and Bluetooth RF front-end modules.

Qualcomm has also recently announced an “AI Stack Portfolio” which gives developers the ability to build AI applications at the Edge. The Artificial Intelligence industry is forecasted to be worth a staggering $1.5 trillion by 2030, growing at a 38% CAGR.

AI Stack Qualcomm (Investor presentation Q323)

Other Business segments include Qualcomm Technology Licensing which makes up ~13.9% of revenue. Revenue was $1.5 billion in the quarter which was only up 2%, but that was in line with the midpoint of the company’s guidance. Its Strategic Initiatives segments makes up a slither of revenue at 0.1%, and focuses on investing into new businesses, products and services.

Overall earnings per share were $3.29 for Q322, which beat analyst expectations by $0.81 per share.

Qualcomm has a solid Balance sheet with $6.8 billion in cash and short term investments. QCOM has $15.5 billion in total debt, of which the majority ($13.6 billion) is long term debt and thus manageable.

Tepid Guidance

Moving forward, Qualcomm’s management forecast adjusted earnings per share between $3 and $3.30 in the next quarter, which would represent a flat or a slight decline from the $3.29 EPS produced in the most recent quarter. The company is expecting total revenue for Q422 to between $11 billion and $11.8 billion, which would represent a slight increase from the most recent quarter ($10.9B) but lower than analyst expectations of $11.86 Billion.

The company’s CFO (Akash Palkhiwala) cited weakness in mid tier Android handsets as the main cause, as consumer demand falters.

A positive tailwind which many analysts have overlooked is the CHIPS Act, which was recently passed by the House of Representatives. This includes $52 billion in subsidies for domestic semiconductor chip production, tax credits of $24 billion and also $200 billion to boost scientific research into semiconductors over the next decade. This is driven by the political desire for the US to compete better with China and be less vulnerable to supply chain issues.

QCOM Stock – Advanced Valuation

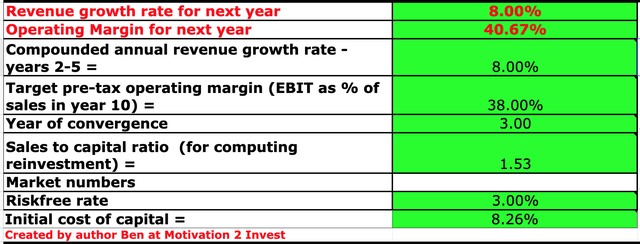

In order to value Qualcomm, I have plugged the latest financials in my discounted cash flow model. I have been very conservative with growth forecasts estimating just 8% growth per year for the next 5 years.

Qualcomm stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have also predicted its operating margins to actually dip slightly due ~38%, due to rising input costs and inflation.

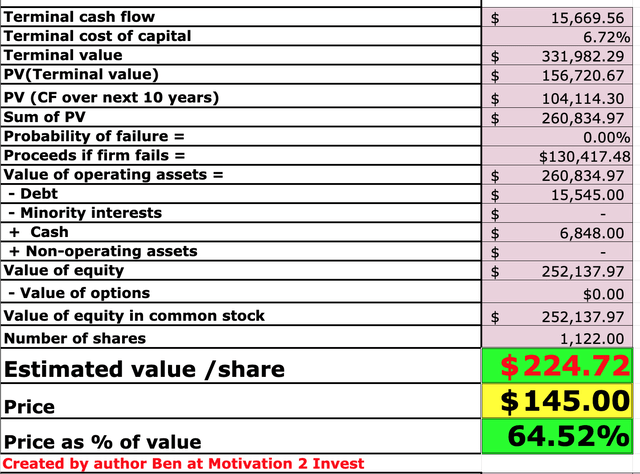

Qualcomm stock valuation (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $224 per share, the share price is ~$145 at the time of writing and is thus ~35% undervalued.

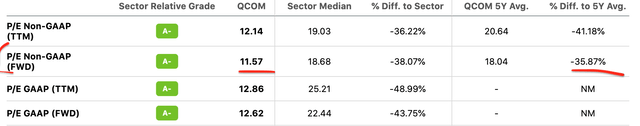

As an extra datapoint, Qualcomm is trading at a PE Ratio (FWD) = 11.57, which is ~36% cheaper than its five year average.

Qualcomm PE Ratio (Seeking Alpha)

Risks

Handset Revenue Concentration

Qualcomm makes approximately 55% of its revenue from Handset Semiconductors and a large portion of that comes director from powering the Samsung Galaxy series. Although, the company has recently extended their partnership till 2030, which adds revenue stability it is still heavily concentrated. The good news is management has made it a strategic priority to expand into other markets and have recently hit record IoT and Automotive revenue.

Recession

In the words of Warren Buffett “Inflation Swindles almost everybody”. The high inflation and rising interest rate environment is squeezing both businesses and consumers with higher input costs. Many analysts are forecasting a recession and thus Qualcomm may experience volatility. Management has already lowered guidance for the upcoming quarter.

Final Thoughts

Qualcomm is a fantastic company which offers best-in-class semiconductor technology, which powers the Samsung Galaxy Smartphones. Management has aggressively expanded its total addressable market and has grown its smaller segments strong. The stock is undervalued intrinsically and relative to historical multiples, thus this looks like a great opportunity for the long term. However, due to the aforementioned risks do expect short term volatility.

Be the first to comment