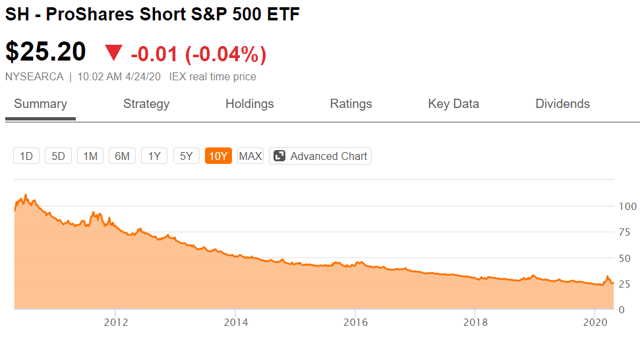

When it seems like the world is ending, it can be quite tempting to just buy a short index fund like the ProShares Short S&P 500 ETF (SH).

Those who bought the short ETF in February made a great return, but here is the problem; markets go up over time.

Frankly, unless someone got the timing almost perfectly this has been a losing trade.

There are 3 things that make successful short selling quite challenging:

- Market timing is not reliable. I don’t believe there is anyone who can consistently time the market. Perhaps there is some genius out there who can, but I certainly cannot.

- Markets generally go up over time. This causes naked shorting in general to have a negative expected return. In other words, the alpha of the short must be greater than the positive movement of the market in order for a naked short to be profitable.

- Capped upside and infinite downside. The most one can make on a short is 100% of the initial investment because stocks cannot go below 0. The losses, however, can be infinite. The shorted stock can theoretically go up 30X or more.

In times like this when there is increased uncertainty and wildly diverging opinions as to the fundamental outlook, it can be quite tempting to enter into some short positions. Indeed, there is more opportunity to short presently as the uncertainty means there is more mispricing which makes it easier to overcome the cost of carry. This article will discuss the process of building short positions in a way that minimizes some of the aforementioned problems.

The key to a good short is a good long

Hundreds of years of stock market history have demonstrated that markets go up over time. Low interest rates and reasonably high multiples (relative to history) suggest that average returns per year will be lower going forward, but it is very likely still positive in the long run. Therefore, without the ability to reliably time the market, shorting will on average lose money. For this reason, going net short is probably not a good idea as a repeatable strategy.

Even the greatest minds who are famous for shorting will rarely if ever go net short. Jim Chanos is the short artist whom I most admire, and despite being known as a short seller, he is usually net long. The way this works is going long 150% and short 50%, one is still net long the same amount as if they had just invested their capital in the traditional long fashion. In having such a portfolio, if the market goes up 3%, the investor would still gain 3% assuming no alpha positive or negative.

Constructing a portfolio as 150% long and 50% short simply provides more opportunity for alpha (positive or negative) as compared to the traditional long 100%. This merely allows someone to hold short positions without facing the uphill battle of a market that tends to rise over time. At the start of this article, we discussed the 3 main problems of short selling and maintaining a net long position largely corrects for the first 2 problems (market timing being unreliable and markets tending to go up).

Assuming one chooses to have a net long portfolio that has both longs and shorts, the question becomes which longs and which shorts. While it may seem obvious, the answer is to be short the stocks that you believe will do worse and long those you believe will do better. I phrase it this way to draw focus on the concept of relative performance.

Agnostic to direction

If in a particular area one has an equal weight paired trade, they can be agnostic to whether that sector goes up or down. For example, in looking at industrial REITs, I believe STAG Industrial (STAG) will substantially outperform the sector and that Terreno (TRNO) will underperform the sector. If I were to pair a long position in STAG with a short in Terreno, it does not matter if the industrial REIT tide lifts both so long as STAG does relatively better than TRNO. This can be a nice technique when one is unsure about the prospects of a sector but likes or dislikes the positioning of a particular company.

Cost of carrying a short

In holding a short position, there are a couple of carrying costs of which to be aware.

- Hard to borrow costs

- Dividend yield

In order to short a stock, one must borrow shares from someone who is long the stock. In most cases, the custodian (TD Ameritrade, Schwab, E-Trade, et cetera) will track down the shares for you. When other people hold stock in their brokerage accounts, those shares are usually made available to the custodian such that they can be lent out to short sellers on the same platform.

Some securities that are either illiquid or heavily shorted will be marked as “hard to borrow” meaning it is challenging or expensive for your custodian to find shares to borrow in order for you to short the stock. If this is the case, the custodian should display this status when one attempts to place the short. There will be costs associated with borrowing the stock and it can be anything depending on how hard it is to locate shares.

Most stocks are not hard to borrow but some are very hard to borrow. When I tried to short Beyond Meat (BYND) during the hysteria, I chose not to execute the trade because the hard to borrow cost would have been 80% annually. A cost this high makes it nearly impossible to make money on a short because the stock not only has to drop, but it would have to drop 80% in a year just to break-even. In addition to hard to borrow costs, the short seller must pay the dividend of the stock shorted. In sum, these costs are referred to as cost of carry.

Establishing positive carry

A long time horizon is crucial for responsible investing, so we must be cautious to not do things that limit our time horizon. If we take on a short position that has a high cost of carry, there is a limit to how long we can hold it. Not only would we have to be right, but we have to be right within a certain time frame. When fighting the clock, it can force an investor into making adverse decisions that would not be made if it weren’t for the pressure of time.

For this reason, I find it safer and more reliable to short in a way that has a positive carry. If we return to the long STAG and short TRNO pair trade, it has a positive carry.

TRNO is not generally a hard to borrow security and its 2% dividend yield is significantly lower than STAG’s 5.5% yield. This creates a 3.5% positive carry to the pair trade so time is on our side and we do not need to be in a hurry to close out the positions.

Thus far, we have covered a way to minimize 2 of the 3 main problems facing short sellers, but how does one deal with the potential for infinite loss and capped upside?

Fundamental volatility is not a short’s friend

This may sound counter-intuitive because when one thinks about short ideas it is often the highest-risk stocks that come to mind. However, given the potential for unlimited loss, stocks with binary outcomes or high leverage do not make good short targets. A biotech startup trying to get approval for their new drug is a risky short even if one is bearish on that drug’s prospects, as an unexpected FDA approval could multiply that stock’s price overnight.

In the present environment, there are seemingly thousands of small biotechs working on coronavirus drugs and many of these have already gone up massively on the mere hope that they are successful. The value principles inherent to my DNA are screaming that most of these are overvalued, but yet they are not valid short targets in my opinion. On the off chance the stock I short is the one that finds the cure or treatment, that $70mm startup is suddenly worth billions. I don’t feel like that is a responsible way to short even if it would work most of the time.

Leverage works in a similar way. If a REIT is running at 90% leverage 10% equity, it might be too risky to hold a long position, but it is also too risky to hold as a short. If the property values of that REIT go up just 11%, the equity value fully doubles (check the NAV math). Small changes to cap rates or the economy can often cause an 11% delta in property values, so that is not even an unusual occurrence.

To me, the best short targets are companies that are low volatility and overvalued. This minimizes the problem of gains from shorting being capped at 100% and loss potential being infinite.

For a full toolkit on building a growing stream of dividend income, please consider joining Retirement Income Solutions. As a member you will get:

- Access to Two Real Money REIT Portfolios

- Real-Time Trade Alerts

- Continuous market commentary

- Data sets on every REIT

You will benefit from our team’s decades of collective experience in REIT investing. On Retirement Income Solutions, we don’t only share our ideas, we also discuss best trading practices and offer members a chance to participate and grow.

We welcome you to test it out with a free 14-day trial. Lock in our founding member rate of $240 before it expires!

Disclosure: I am/we are long STAG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Full Disclosure: All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person. Please see our SA Disclosure Statement for our Full Disclaimer

Be the first to comment