Anita_Bonita/iStock via Getty Images

Investment Thesis

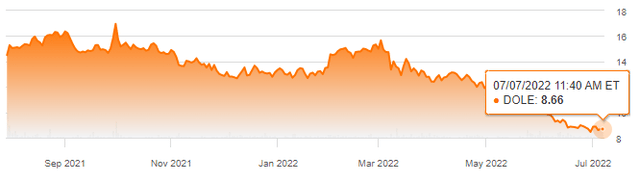

Dole Plc (NYSE:DOLE) shares are trading within percentage points of their 52-week low, almost 41% below its price a year ago. The stock has been on a downward trajectory since September 2021.

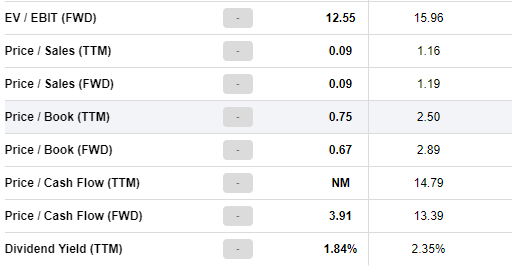

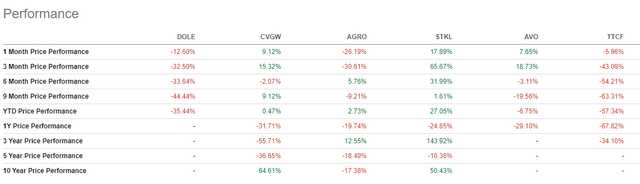

DOLE has underperformed compared to both the broader market and the industry. Here is a chart that displays Dole’s performance across multiple timeframes compared to similar companies.

Most companies reported a fall in their share values, with every single company displayed falling over the last 12 months (Dole has not been listed for 12 months, but it has certainly been falling.) This suggests that the industry and market faced difficulties. Still, DOLE did worse than most, losing almost 45% of its value in nine months. Several macroeconomic and microeconomic issues are to blame for DOLE’s poor performance, from inflationary pressures to contaminated harvesting equipment and consequent recalls.

Management is responding well to these issues, and I am confident in the stock’s long-term prospects. The company’s leadership has devised a strategy to improve the company’s dismal performance. The corporation is working with its suppliers to coordinate supply and demand to combat the risk of supply disruptions. Regarding development, Dole Exotics is a brand-new subdivision launched by the corporation. Mangoes, avocados, and other exotic fruits will be grown, procured, ripened, and sold as part of the initiative. They’ve also branched out into commercial cargo, taking advantage of their backhauling capabilities.

I am confident that DOLE’s long-term results will benefit revenues and share prices because none of the strategies are short-lived. The low share price makes it easier for new investors to get in on the action. As a result of the affordable share price and potential methods, I am optimistic about DOLE and confidently rank it as a buy.

The Company

American-Irish multinational firm Dole plc, formerly Dole Food Company, Standard Fruit Company, is a global agricultural enterprise based in Ireland. The corporation is the world’s largest producer of fruits and vegetables, employing 74,300 full-time and temporary workers to oversee the production of more than 300 different products for distribution in 90 countries.

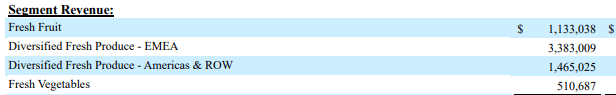

Dole’s core business sells fresh and frozen fruits and drinks, including strawberries, pineapples, bananas, grapes, and salads. The company operates under four segments generating revenues as indicated below.

DOLE

There is a smaller portion of the business known as “Ocean Cargo Express,” which provides services such as cross-ocean vehicle shipment and refrigerated transport.

Bright days ahead? Normalcy following Value-Added Salads recall

A source of the downtrend in DOLE’s share price is the two related recalls in December 2021 and January 2022.

On December 22, 2021, Dole issued a voluntary recall of packaged salads processed at its North Carolina and Arizona plants, following the detection of Listeria monocytogenes on the equipment involved in the harvesting of the iceberg lettuce. Due to the need for adequate investigation and sanitary measures, both facilities were placed on hold until the problem could be identified and solved.

The further investigation prompted the second recall of packaged salads, issued on January 7, 2022. This recall affected products produced at their Ohio and California facility. The recall didn’t wholly halt operations in these plants. Genetic testing and FDA collaboration proved that the harvest equipment was the cause, and their processing plants were not contaminated. The plants are back to their total capacity.

Recalls impact on their operations

Recalls and temporary plant closures come with tremendous costs, both in actual costs related to resolving the situation as well as lost revenue as a result of the shutdown. Fresh Vegetables is anticipating losing $17.6 million largely due to these unusual one-time expenses in 2021. This loss can be seen on the bottom line, the firm expects to lose $3.3M in Adjusted EBITDA in 2021 due to transitory volume losses and fixed-cost absorption. Here is a quote from the Chief Operating Officer found in their 1Q22 conference call explaining that excluding the losses incurred as a result of the recall, revenue grew YoY.

While the group has delivered results in line with plan, with the exception of the loss incurred in fresh vegetables as a result of the value-added salads recall which we discussed and flagged on our full-year earnings call back in March, revenue more than doubled on a reported basis to $2.2 billion for the quarter following the acquisition of the remaining 55% of Dole Food Company in 2021. On a pro forma comparative basis, revenue declined marginally. However, excluding the 16% reduction in revenues in fresh vegetables due to the impact of the value-added salads recall. On a like-for-like basis, in all the divisions, revenue actually increased by some 4%.

With the adverse effects of the recalls and temporary plant closures behind them, the company can move forward. I am optimistic about the company’s revenues because, as a result of the recalls, the packaged salads were a source of cost, and they will now likely return to a source of revenue and profit.

Pricing, Diversification remedies to Inflation and Soaring Operating Costs?

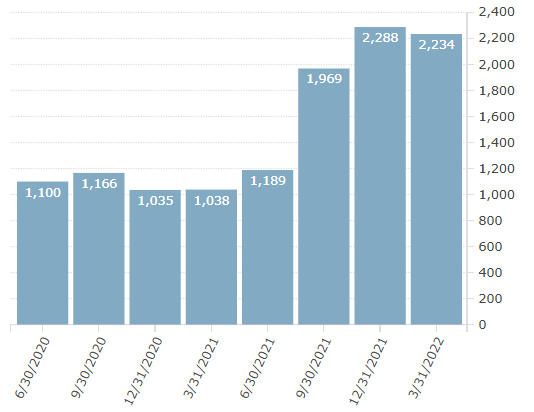

DOLE operating expense has been on an upward trajectory since 2020.

Total operating expenses as shown on Finviz (Finviz)

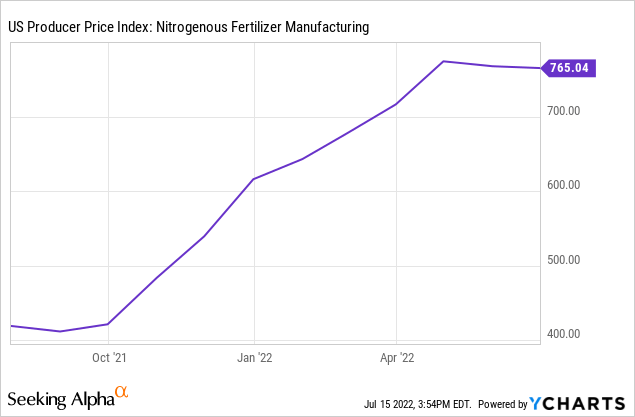

The principal cause of this trend is increased input costs such as products like fertilizers and fuel resulting from inflation. The consumer price index for June showed inflation in America at 9.1%, but this increase hit some sectors much harder than others.

Inflation hit certain areas of agriculture especially hard. Here is a look at the cost of nitrogenous fertilizer over the past year, which has nearly doubled.

DOLE management responded with a two-step approach to this matter, raising prices and leveraging their diversity.

Price increase

Firstly, they decided to hike the prices of their products. I looked through their earnings call, and they did not seem to clarify exactly what percent they raised their prices. I don’t forecast this having a huge effect on volume sold for the following reasons:

- Everything is going up in price, including competing products.

- This is a harsh reality, but the consumers of healthy foods like fruits and vegetables are generally middle to the upper class. They are less likely to be forced to cut corners when shopping for food.

That being said, a full-on recession, one that forces even the middle class to tighten their budget, would spell trouble for Dole. Here is a quote from a paper published about low-income families’ ability to afford a healthy diet.

When incomes drop and family budgets shrink, food choices shift toward cheaper but more energy-dense foods. The first items dropped are usually healthier foods – high-quality proteins, whole grains, vegetables and fruit. Low cost energy-rich starches, added sugars, and vegetable fats represent the cheapest way to fill hungry stomachs1,2.

Business diversity

In addition to price hikes, the company maximizes its diverse business to overcome current challenges. In particular, their commercial cargo business is being used as a way to offset the erratic nature of the supply chain right now.

Intuitively this is a good way to hedge their bet against rising operating expenses from high cargo costs. If they are positioned in a way to benefit from said high costs, which Ocean Cargo Express grants them, they are able to offset the increased price they are paying. This is working out for them, cargo shipment is a booming industry. I touched on that deeply in my Genco and Navigator articles.

As their Chief Operating Officer reported, the company made good use of the commercial cargo business to offset some significantly increased costs.

As another example of the importance of our diversified business strategy, I want to call out the continued excellent results of our commercial cargo business. This is a business that primarily provides backhaul services using our vessels after our fruit has been delivered to North American and European ports. As global logistics have become increasingly challenging over the last 24 months, this business has provided help in offsetting some of the significantly increased costs.

The Chief Operating officer further reported that they recovered most of the volume they could not serve at the start of the year through the price hikes. With these breakthroughs in price increase and the well-thought idea of rationally using business diversification, I am optimistic about DOLE’s prospects.

Raising the Bar?: The DFC acquisition & Dole Exotics Launch

DOLE is making significant progress in terms of development. These developments are impacting the company’s revenue significantly, and I believe they will continue to do so in the near and long time. The acquisition of DFC by TP and the debut of Dole Exotics are the two primary components of DOLE’s development that pique my curiosity.

Total Produce [TP] acquired the remaining 55.0% of Dole food company on July 29, 2021, becoming Dole Plc. The Group’s size and footprint have grown with acquisitions. The revenue has increased by almost 50% up to $6.5 billion compared to 2020. Their Pro-forma revenue of $9.3 billion in 2021 is up by approximately 114% compared to 2020. This has translated to the bottom line as well, with adjusted EBITDA gaining 15% to $290 million. The balance sheet also benefitted, with an updated $4.7 billion in assets, including 144,000 acres of land and 160 distribution and production plants.

The Dole Exotics Launch

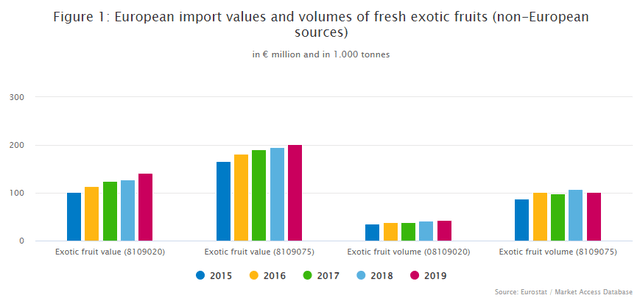

In their Q1 2022 report, DOLE announced the launch of Dole Exotics and BE Exotic brand, which focuses on procuring, ripening, and marketing avocados, mangoes, and other exotics primarily in European markets. This could be a smart move considering a growing number of Europeans are seeking out new fruit flavors and kinds. This figure shows the aggregate imports of exotic fruit to Europe, a trend that is growing in both value and volume.

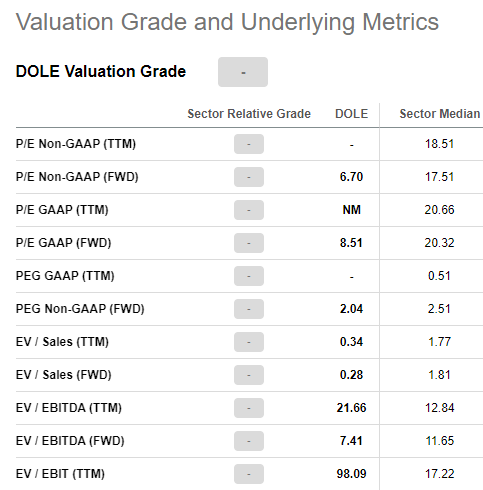

Valuation

The stock is cheap based on conventional valuation methods, with nearly all price ratios below the industry average. Its FWD-based PE, PS, PB, PCF, and PEG of 6.70, 0.09, 0.67, 3.91, and 2.04, respectively, are all significantly lower than their respective industry medians of 17.51, 1.19, 2.89, 13.39 and 2.51, respectively.

Seeking Alpha Seeking Alpha

Additionally, Simply Wall Street’s DCF shows that DOLE ($8.66) is trading below the estimated fair value of $25.46, further signifying it is undervalued and has solid growth potential.

Conclusion

DOLE has underperformed in the market compared to its peers due to several challenges, including recalls in value-added salads and rapidly increasing operating costs. However, they are showing signs of a rebound, especially with the increasing revenues reported in its Q1 2022 report.

Following the acquisition of the remaining 55.0% of DFC, the company has shown tremendous gains and asset ownership growth, which has yet to be factored into the share price. Furthermore, the launch of Dole Exotics caters to a strong and growing market in Europe.

Despite DOLE’s recent poor performance, I am still optimistic about the stock because of its long-term growth prospects. For deep value investors who like consumer staple stocks, Dole is worth consideration as it has promising opportunities in both its legacy operations and newer ventures.

Be the first to comment