kemalbas

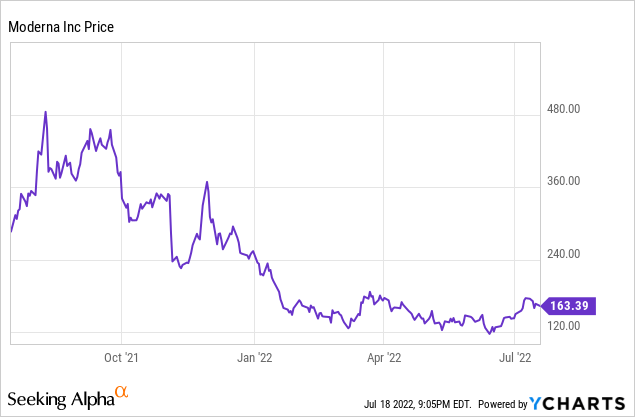

Moderna (NASDAQ:MRNA) was propelled to unexpectedly early success with its mRNA therapies when it quickly developed and commercialized a vaccine for COVID. Those who invested before the pandemic did extremely well. The stock was running near $20 per share for much of 2019. It peaked at $497.49, which is the 52-week high, in September 2021. Then it slumped back to the current reality, closing at $166.91 on July 15, 2022. In terms of both revenue and stock price, we have seen a classic bolus: a larger-than-usual mass moving through a system, like a mouse swallowed by a snake.

This article will discuss vaccine revenue and to what extent it is sustainable post bolus. Then the emphasis will turn to the long-term value of Moderna and its mRNA platform. To a large extent I will be returning to the analysis made in my 2019 article, Moderna: mRNA Therapy Potential Worth Accumulating. Since that time there has been some pipeline development and a lot of cash accumulation that should make the program easier to accomplish. The caveat is that just because one mRNA therapy worked and was approved by the FDA does not mean any or all of the rest of the therapies in the platform will see the same degree of success. Given the slump in the price of MRNA, I see this as an opportunity for investors with long-term horizons to accumulate a stock at a reasonable price.

Moderna COVID Revenue Bolus and Future Sales

Spikevax, or mRNA-1273, was developed in 2020, largely using funding from the federal government. Waiving the usual regulatory process that takes years, it was given an EUA (emergency use authorization) in December 2020. Here is the revenue history, by quarter:

Table 1, COVID vaccine revenue

|

quarter |

Revenue, $ millions |

|

Q4 2021 |

200 |

|

Q1 2021 |

1,730 |

|

Q2 2021 |

4,200 |

|

Q3 2021 |

4,810 |

|

Q4 2021 |

6,900 |

|

Q1 2022 |

5,930 |

Compiled by author from Moderna press releases

Just based on the results shown, one could not say this is a bolus. It is a lot of revenue suddenly, but that sometimes happens with new therapies that are going to generate similar or even greater sums during their patent lives. Even the Q4 to Q1 dip may just be a fluctuation, though unlike revenue based on higher priced drugs, it is not due to the Medicare deductible.

Moderna will be reporting Q2 2022 results on August 3. It will be interesting to see if sales are holding up or decreasing, given Americans’ ambivalence to booster shots and shots for children, even among those who got the initial two shots. There are, in addition, other nations with populations with varying attitudes towards the pandemic and vaccines, and there is competition with other vaccines. Moderna reported it had $21 billion in Advanced Purchase Agreements for 2022, which would imply about a $5.25 billion run rate, plus any additional sales. It is possible that vaccine doses are being shipped and paid for, but not getting into people’s arms. The recent BA.5 variant surge may change some people’s attitudes, but the large number of people catching that variant despite being vaccinated and boosted has led to some cynicism among the public.

If a booster that addresses a current variant is approved by regulators, that might convince people to get yet another booster. Especially if a new variant emerges that is more serious than the current ones. But I suspect we are seeing the tail end of the bolus. I would not be surprised to see sales drift down under $2 billion per quarter by 2023. Still, that is a lot of money that was not in the Moderna plan in 2019. It would certainly keep investors’ hopes up until other therapies start coming to the market.

Moderna’s Pipeline

To see how extensive Moderna’s pipeline of potential therapies is, check out the Moderna pipeline page. It is possible to build a model to guess a future revenue and profit trajectory by guessing: the chances of receiving regulatory approval; when each therapy might be approved; and given the target disease, how much revenue each therapy might generate. Such models need to be seen statistically, because in reality assigning a probability of regulatory approval is itself just a guess, at least until Phase 3 results come in.

I will use the VEGF-A myocardial ischemia potential therapy as an example. It has been licensed by AstraZeneca (AZN), which is paying Moderna milestones and royalties, if the milestones are reached and the therapy is approved and generates revenue. AZD8601 is currently in Phase 2 trials. Myocardial ischemia, more commonly called heart disease, is due to narrowing arteries of the heart, or atherosclerosis. In November 2021 AstraZeneca reported AZD8601 Phase II results, at least for the safety and tolerability portion of the trial. AZD8601 mRNA encodes for VEGF-A, which aids in new blood vessel formation. Patients treated had elective coronary artery bypass surgery. The AZD8601 patients trended better than patients receiving a placebo in post-surgery efficacy endpoints. But only 7 patients received the therapy, with 4 more getting the placebo. Heart failure is very common, as is bypass surgery, at least in the nations where healthcare systems can afford it. If AZD8601 were to become a standard of care with these surgeries, the revenue could be tremendous. But with only 7 patients treated in the first Phase of the trial, any statement of the type “there is a X% chance that the therapy will achieve FDA approval” is premature.

It seems that the mRNA platform is very flexible in the types of diseases it can address. In addition to addressing viral diseases, potential products in the pipeline target autoimmune disorders, cancers, and diseases resulting from gene mutations. But the most advanced therapies (besides for COVID) so far are for viral diseases: flu, RSV (respiratory syncytial virus), and CMV (cytomegalovirus). All are in Phase 3 trials. According to management, at the Q1 2022 analyst conference, this could lead to three commercial launches of respiratory therapies over the next two to three years. I think it is reasonable to assume that positive Phase 3 trial results for these indications are reasonably likely, and to look forward to revenues in these markets. More good news could come this year if the personalized cancer program, propionic acidemia, and methylmalonic acidemia programs generate positive, proof-of-concept results.

Cash Balance

In Q1 2022 Moderna total revenue hit $6.07 billion. After expenses net income was $3.66 billion or $8.58 per share on a GAAP basis. Operating cash flow was $2.8 billion. The ending cash balance was $19.3 billion. However, some of that cash was deposits against future vaccine sales. Clearly, cash is adequate for years of R&D efforts even if COVID revenue tapers off and there are delays in getting approvals for other therapies.

Conclusion

Investors are already thinking post-bolus, as is indicated by the rather dramatic stock price drop since September. Moderna has a market capitalization of $65 billion, but also a low P/E ratio (TTM, GAAP) of just 4.91. The cash pile is extraordinary. Even if I am right that the COVID revenue will trail off significantly in the next year, there are three new vaccines that could come on the market in the foreseeable future. Despite the size of the pipeline, I think it can be extended even further, since mRNA could generate almost any protein needed to treat a disease. So, while the stock price may fluctuate, or even trend down as COVID vaccine revenue falls, I think long-term investors can pick up the stock with a reasonable degree of confidence that in a few years, certainly by the end of the decade, Moderna will have several therapies on the market and will greatly exceed current revenue. Post bolus, I think Moderna is in good shape, so the stock price is attractive, whatever the bolus tail turns out to be.

Be the first to comment