Juan Serra Ortiz/iStock Editorial via Getty Images

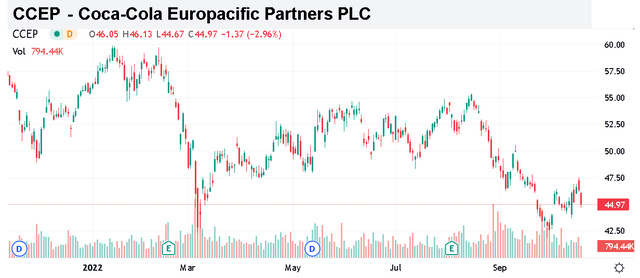

Coca-Cola Europacific Partners PLC (NASDAQ:CCEP) is recognized as one of the world’s largest independent Coca-Cola bottlers with operations in Western Europe along with Asia-Pacific countries like Australia and Indonesia. While an ongoing sales recovery compared to pandemic disruptions has been the theme over the past year, concerns of a broader macro slowdown and inflationary cost pressures are the latest headwinds. CCEP shares are down more than 25% over the past year amid the broader market selloff.

The company last reported its quarterly results back in August, highlighted by continued growth while the company even hiked full-year guidance. That being said, the challenge here is that economic conditions in the region have deteriorated in the period since. While shares offer a compelling 4.8% dividend yield, we expect shares to remain volatile amid significant uncertainties in the operating environment and financial outlook through next year.

CCEP Key Metrics

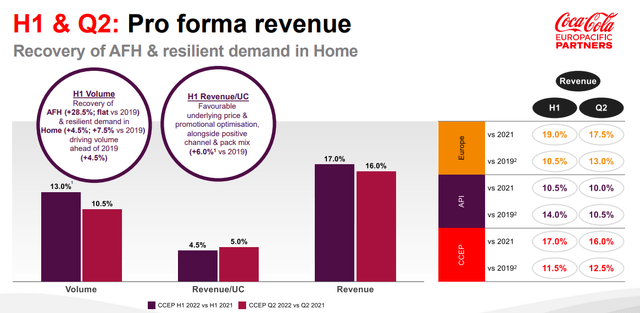

The story in the first half of the year for CCEP was the big rebound in volumes against depressed levels at the start of 2021. Adjusting for some acquisitions, first-half revenues on a comparable and FX natural basis climbed by 17% year-over-year to €8.3 billion.

Tourism into Europe with the return of international air travel has helped comparable revenues climb above 2019 pre-pandemic benchmarks. This was reflected in the “away from home” channels that include restaurants and entertainment venues where Coca-Cola beverages are served. At the same time, the home channel capturing grocery and retail sales was otherwise resilient.

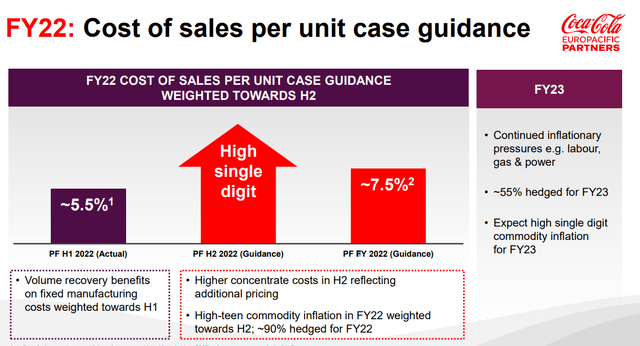

The topline momentum was driven by a 10.5% y/y volume increase while revenue per unit case increased 5.0% based on pricing initiatives. At the same time, the cost of sales per unit case was up 5.5% which is the big culprit in tighter margins from higher input and raw material prices.

Overall, even as profitability climbed compared to last year, the operating margin at 11.7% declined from a much stronger 25.0% in the first half of 2021. This decline also includes higher logistics expenses and supply chain constraints including labor gas, and power cost trends which management expects to continue.

In terms of guidance, the good news is that the target for full-year pro forma comparable growth is now in a range from 11-13%, up from the previous 9% midpoint estimate. Efforts toward raising prices are expected to balance some of the higher costs. The outlook is for the operating profit to climb between 9% and 11%, which was revised higher considering the stronger first half of the year.

CCEP Stock Price Forecast

The first point is that CCEP is fundamentally fine, considering its ongoing profitability and solid balance sheet. The company generates significant free cash flow, which supports a generous shareholder distribution policy with a 50% dividend payout ratio. CCEP benefits from its mutual relationship with the Coca-Cola Company (KO) as the exclusive distributor in the region. There is a positive long-term outlook.

That being said, this is a case where we see the risks in the stock price still tilted to the downside. Keep in mind that while the guidance from the Q2 earnings was positive, macro indicators have disappointed in the period since suggesting a weaker operating environment.

The concern is for a deepening slowdown through 2023 in key European countries. This was reiterated in the International Monetary Fund (IMF) latest world economic projections pointing to a technical recession in countries like Germany and Italy, while estimates for the Euro region have trended lower.

While there is a thought that ready-to-drink beverages and sodas are relatively resistant to an economic slowdown as a consumer staple, the setup is simply weaker demand in away-from-home consumer channels including restaurants and entertainment venues.

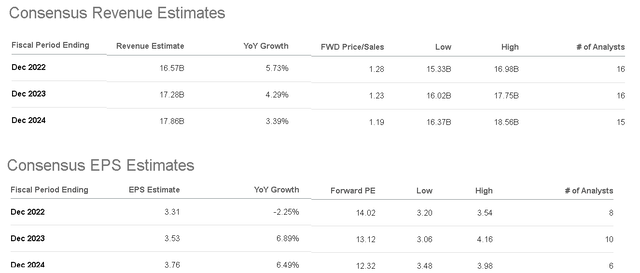

The bearish case for the stock is that company guidance and market estimates through next year underperform. According to consensus, the outlook is for topline growth to reach 5.7% this year and moderate towards 4.3% in 2023 and 3.4% in 2024. From an expected -2.3% decline in EPS this year, the market sees earnings rebounding by 6.9% next year. This point in particular will likely depend on how inflationary pressures evolve, with their impact on margins. Without clear evidence input costs are stabilizing or trending lower, there is significant uncertainty in these estimates.

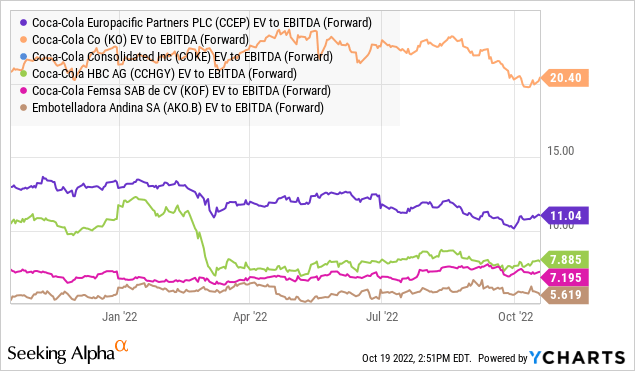

As it relates to valuation, we note that even with the share price weakness, CCEP trading at an 11x EV to forward EBITDA multiple still commands a large premium to some other global “Coca-Cola bottler” peers like Coca-Cola HBC AG (OTCPK:CCHGY) at 7.9x, Mexico-based Coca-Cola FEMSA, S.A.B. de C.V. (KOF) at 7.2x, and Chile’s Embotelladora Andina S.A. (AKO.B) at 5.6x. While not quite as pricey as KO at 20x, the spread particularly compared to the Latam players appears aggressive considering the unique headwinds in Europe that have the geopolitical risk component.

In regard to Coca-Cola Hellenic Bottling Company AG (OTCPK:CCHGY) (HBC), this bottling group operates in Eastern European across countries like Greece, the Czech Republic, Slovenia, and Poland which have more direct exposure to the ongoing Russia-Ukraine conflict given the geographical proximity. Historically, both CCEP and HBC traded with similar multiples, while the trading action this year suggests only HBC was materially discounted. We argue that CCEP is overvalued relative to its peers, with room for the earnings multiple to converge lower.

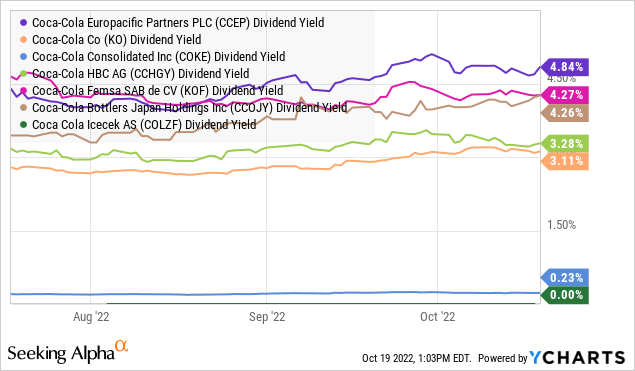

We can also look at CCEP’s dividend yield, currently at 4.8%. While this level stands out as higher than other Coca-Cola bottlers, KOF’s and Coca-Cola Bottlers Japan Holdings Inc. (OTCPK:CCOJY) are still relatively attractive at a close 4.3%. In other words, CCEP’s 4.8% dividend yield may not be enough to compensate for ongoing risks and has room to widen even further as the share price falls.

Final Thoughts

Our call is for CCEP to consolidate around the current share price level between $40 and $45 over the next several months. The next move in the stock will largely depend on how economic conditions in the region evolve, with the implication toward risk sentiment.

The bullish case for CCEP, where growth and earnings outperform expectations, will first need some evidence that inflation is trending lower which would help ease cost pressures and firm margins. On the downside, the risk here is that conditions could still deteriorate further from the current baseline. Indicators like labor market trends and consumer spending in major European countries are key monitoring points. Other factors at play include the Dollar strength (or Euro weakness) that is bearish for CCEP ADR holders.

Be the first to comment