alfexe

Over the past several months, the Federal Reserve has been embarking on a rising interest-rate policy, which has had the effect of causing most assets in the stock market to decline. Indeed, the S&P 500 index (SPY) is down 22.31% year-to-date with every sector except for energy handing losses to investors. This Federal Reserve policy is being driven by the incredibly high inflation that we have been experiencing in the United States and, as that inflation has yet to be contained, the policy is unlikely to be changed anytime soon. That will likely result in the stock market continuing to deliver losses to investors.

However, there are some assets that will benefit from rising interest rates. One of these is floating rate loans, which are debt instruments that change their interest rate based on interest rates in the market. These assets admittedly can be hard for more ordinary investors to access but one good way to do it is to buy a closed-end fund that invests in floating-rate loans. These funds benefit from professional management, which can be helpful in analyzing this asset class and can in many cases deliver a higher yield than the underlying loans themselves possess.

In this article, we will look at one of these funds, the Nuveen Floating Rate Income Fund (NYSE:JFR), which currently yields an impressive 10.01%. This is likely to be a very appealing distribution yield to any investor, so let us investigate and see if this closed-end fund (“CEF”) could deserve a place in your portfolio.

About The Fund

According to the fund’s webpage, the Nuveen Floating Rate Income Fund has the stated objective of providing its investors with a high level of current income. This is hardly an unusual objective for a fixed-income fund. After all, fixed-income securities are not really known for delivering much in the way of capital gains, especially when they are compared to stocks. As most of these securities deliver the majority of their returns through the interest and dividend payments that they make to investors, we can generally expect a debt fund to aim for the provision of current income.

The fund aims to achieve its objective by investing in adjustable-rate senior loans, which might be guessed by the name of the loan. These are effectively leveraged loans that are senior to many other forms of debt that the borrowing company may have.

A leveraged loan is a type of debt instrument that may be unfamiliar to many readers, as it is a very different type of asset than the stocks and bonds that we are all familiar with. Investopedia has an excellent definition of this type of security, however:

“A leveraged loan is a type of loan that is extended to companies or individuals that already have considerable amounts of debt or poor credit history. Lenders consider leveraged loans to have a higher risk of default, and as a result, a leveraged loan is more costly to the borrower.”

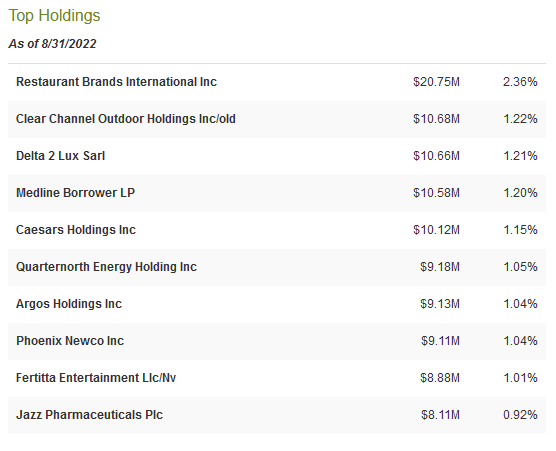

The fact that these loans are considered to have a much higher default risk than ordinary investment-grade bonds might put off some conservative investors from investing in a fund like this. After all, the higher risk of default means that there is a higher risk of losing your money than there would be if the money was invested in a high-rated bond fund. In order to offset that risk, the fund is incredibly well diversified and only has a small percentage of its assets invested in any single position. We can see this quite clearly by looking at the largest positions in the fund. Here they are:

CEF Connect

As we can see, even the largest position only accounts for 2.36% of the fund’s total assets. The overwhelming majority of the fund’s positions represent a much smaller percentage of the fund’s total assets. In total, the Nuveen Floating Rate Income Fund has 478 positions, so we can pretty clearly conclude that any default will represent a very small principal loss. The exception to this might be if a large number of companies default all at once, but if that happens then it is a pretty good bet that the economy has bigger problems than a few people losing their money! Overall, then, the higher probability that one of these loans will go into default compared to an investment-grade bond is a risk that we probably do not really have to worry about.

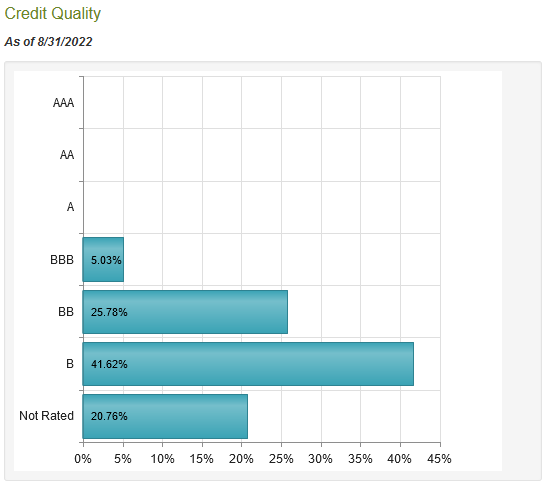

Although the fund invests in leveraged loans, analysts do not think that the default rate across the portfolio is especially high. We can see this by looking at the ratings that have been assigned to the loans:

CEF Connect

Anything rated BBB- or higher is considered investment grade, so that is 5.03% of the portfolio. The overwhelming majority of the loans held by the fund are rated either BB or B (67.40%), which are considered to be the highest quality of the below-investment-grade debt securities. According to the official bond rating scale, companies with these ratings typically are strong enough to weather short-term economic problems but are not quite as strong as companies with investment-grade credit ratings. This should provide further reassurance that the risk of losses from any defaults among the companies in whose debt the fund has invested should be relatively low.

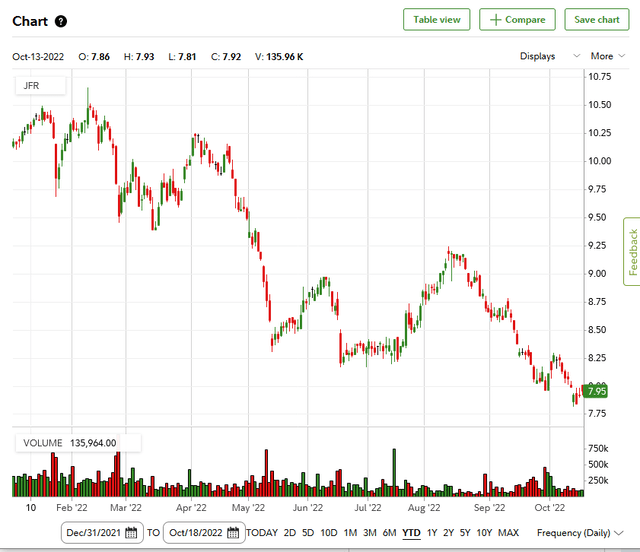

One of the defining characteristics of these loans is the reason why they could be a good holding as interest rates continue to rise. In short, the interest rate paid by the borrowing company periodically changes in response to the market interest rate. Thus, the amount that an investor receives should grow over time as interest rates rise. This helps these securities keep their value much better in such an environment. Indeed, we can see this in the fund’s performance so far this year. Although the fund is actually down year-to-date, it actually raised its distribution.

The fact that the fund’s share price has declined despite its assets benefiting from rising interest rates is somewhat surprising but it could represent an opportunity for investors. This is something that could be caused by traders getting margin calls from other things in their portfolios and being forced to sell everything indiscriminately in order to raise cash. This is something that is not uncommon during steep market declines, such as we have seen so far this year. We will discuss the distribution later in this article but the fact that the fund increased is a clear sign that the portfolio as a whole is not doing too poorly.

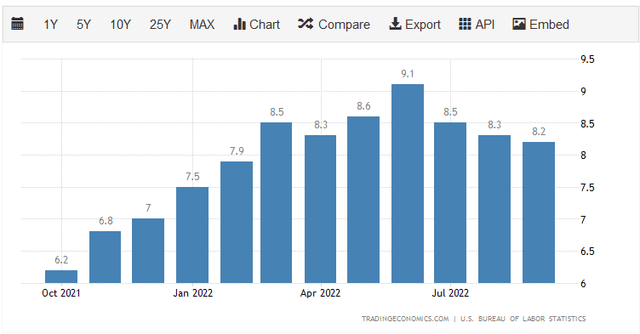

Inflation, Interest Rates, and Federal Reserve Policy

As I mentioned in the introduction, the Federal Reserve has been aggressively hiking interest rates over the past several months as part of an effort to combat inflation. This has caused the price of just about everything in the market to decline. Unfortunately, though, so far the Federal Reserve’s policy has had minimal effect. The latest inflation report puts the current inflation rate in the United States at 8.2%. This is far above the Federal Reserve’s goal of 2% inflation, but it is the lowest rate since February:

The fact that inflation is still well above the central bank’s goal though indicates that it will likely continue with further interest rate hikes over the coming months. Indeed, the Federal Reserve has said as much, stating that it plans to hike interest rates to 4.6% in 2023. It is quite likely that this forecast is far too low, though, as a 4.6% rate is nowhere close to enough to stop 8% inflation. This is why some people are foreseeing the Federal Reserve hiking interest rates to 9% or higher, which is pretty close to the rate that is really needed to contain inflation. If the interest rates that we have seen so far have caused most stocks in the market to fall 20%, imagine what further rate hikes would do. The assets that the Nuveen Floating Rate Income Fund invests in should still hold their value just fine, though, because the interest rates paid by the borrowing companies will also increase.

Leverage

In the introduction, I stated that closed-end funds such as the Nuveen Floating Rate Income Fund are frequently able to deliver higher yields than the underlying assets possess. One way that they are able to accomplish this is the use of leverage, which this particular fund uses. Basically, the Nuveen fund is borrowing money and using that borrowed money to invest in senior floating-rate loans. As long as the interest rate on the borrowed money is lower than the interest rate on the loans, then this strategy works pretty well to increase yield since it gives the fund control of more income-producing assets with the same amount of equity investment. As the fund can borrow at institutional rates, this will usually be the case.

However, the use of borrowed money is a double-edged sword. This is because leverage boosts both gains and losses. Thus, the fund will likely lose more during a market collapse or similar event than it would if it had no leverage. For this reason, I generally do not like to see a closed-end fund utilize leverage exceeding about a third of its portfolio. Unfortunately, this fund is quite a bit above that level. As of the time of writing, the Nuveen Floating Rate Income Fund has a leverage of 39.40% of its assets.

While this is higher than the level that I really want to see, it is probably okay for the time being. This is because the fund’s assets generate more income during periods of rising interest rates. This higher income actually makes it easier for the fund to carry its debt obligations, which tend to be at fixed rates. It is when interest rates fall that the fund’s leverage could become a problem but, as we have already seen, that will not likely be the case in the near future.

Distribution Analysis

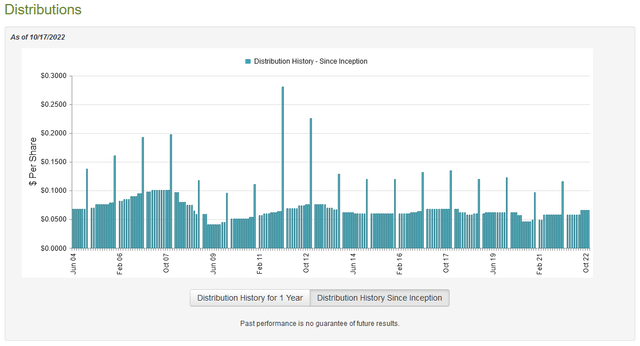

As stated earlier, the Nuveen Floating Rate Income Fund has the stated objective of providing investors with a high level of current income. As such, we might expect it to have a very high distribution yield. This is in fact the case as the fund pays a monthly distribution of $0.0660 per share ($79.20 per share annually), which gives it a 10.01% yield at the current price. However, it is important to note that the fund’s distribution has varied considerably over the years:

This might reduce the appeal of the fund for someone that is looking for a long-term position that simply generates a monthly check. However, we do see here that the fund’s payout varies with interest rates. The periods of time that had the lowest interest rates also had the lowest distributions. This reinforces the statements that I have been making throughout this article that the Nuveen Floating Rate Income Fund is a very attractive way to play a rising interest rate environment like we have today. It is admittedly not intended to be a long-term buy-and-hold investment. With that said, anyone buying the fund today will receive the current distribution and yield so we should investigate the fund’s ability to afford the distribution that it pays out.

Fortunately, we have a very recent financial report to consult for that purpose. The fund’s most recent financial report corresponds to the full-year period ending July 31, 2022. As such, it should give us a very good idea of how the fund performed during the initial stages of the Federal Reserve’s fight against inflation. During the full-year period, the Nuveen Floating Rate Income Fund received a total of $42,810,889 in interest and dividends off the assets in its portfolio. When we combine this with a small amount of income from other sources, the fund brought in a total income of $44,274,534. The fund paid its expenses out of this amount, leaving it with $31,747,379 available for investors. This was not nearly enough to cover the $40,070,601 that the fund actually paid out in distributions during the same period. This is certainly concerning since the majority of the fund’s investment return is the income that it receives from the assets in its portfolio.

With that said, the fund does have some other ways in which it can earn the money that it pays out in distributions. For example, it might be able to get some money through capital gains. Unfortunately, the fund failed miserably at this over the full-year period. It realized $6,113,575 in losses and had another $40,639,786 of unrealized capital losses. Overall, the fund’s assets declined by $55,076,583 over the period. Thus, it does not appear that the fund can afford to pay its distributions so it is somewhat confusing why it actually increased it. I would admittedly not be concerned about the capital losses if the fund’s net investment income were enough to cover the distribution but that does not appear to be the case here. With that said though, a significant part of the full-year period had interest rates at much lower levels than today so it is possible that the income is now high enough to support the distribution and that the fund over-distributed during the second half of 2021. This is something that we want to keep an eye on though.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a closed-end fund like the Nuveen Floating Rate Income Fund, the usual way to value it is by looking at its net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them for a price that is less than net asset value. This is because such a scenario implies that we are obtaining the fund’s assets for less than they are actually worth. That is indeed the case here. As of October 18, 2022 (the most recent date for which information is currently available), the Nuveen Floating Rate Income Fund had a net asset value of $9.04 per share but only trades for $7.95 per share. This gives the fund a 12.06% discount on net asset value. This is a fairly attractive price for the fund and it is also quite a bit better than the 9.99% discount that the fund has averaged over the past month. Overall, the fund might be worth buying at this price.

Conclusion

In conclusion, the recent spate of interest rate hikes by the Federal Reserve has crushed most things in the market. However, the assets held by the Nuveen Floating Rate Income Fund actually produce more income as the interest rate increases, which helps to offset this problem. As it appears certain that interest rates will continue to climb in the near future, it might make sense to invest some money into a fund like this in order to generate a growing stream of income. The fact that the fund has a very attractive valuation only adds to its appeal. My only concern here is that the fund might be overdistributing so we will need to keep an eye on its finances. Overall, though, it might be worth adding to a portfolio.

Be the first to comment