HQuality Video/iStock via Getty Images

Executive Summary

With the global semiconductor industry poised to grow strongly over the next decade and reach a global value of 1 trillion by 2030 (according to McKinsey & Co.), we believe the sector currently offers great investment opportunities to generate above-average returns.

After analysing this market for the past 3 weeks, we identify Advanced Micro Devices Inc. (NASDAQ:AMD) as one of the best companies in the industry that we believe has the potential to grow faster than its peers while capitalising on the industry-wide growth trend.

Precisely, we believe that AMD’s recent acquisitions of Pensando for data centre optimisation and high-performance & adaptive computing company Xilinx will fuel new growth for the business in the near future while we anticipate AMD to continue gaining market share in the industry as Intel (NASDAQ:INTC) faces tech capabilities challenges. In fact, we consider AMD’s leadership team and unmatched product offering diversification great competitive advantages that will allow the company to succeed over its peers. As such, we give AMD a Buy recommendation.

Quick Overview Of The Business

AMD is an American semiconductor company founded in 1969 that operates 2 main business segments: (i) the Computing & Graphics unit that focuses on desktop and notebook CPUs, microprocessors and chipsets, discrete and integrated GPUs as well as data centres and (ii) the Enterprise, Embedded & Semi-Custom unit that focuses on server and embedded processors, semi-custom System-on-Chip (SoC) products, development services and technology for game consoles.

Of all these product lines, EPYC, Ryzen and Radeon emerge as AMD’s leading product labels renowned in the industry as the company’s best solutions for server & embedded processors, notebooks & desktop PCs and Graphics. AMD also operates cross-licensing and technology exchange agreements with other companies to transfer and receive technology and intellectual property rights from other players in the market.

AMD’s Strategic Acquisitions Will Drive New Revenues And Accelerate Technology Advancements

Why are we bullish on AMD? One of the main reasons is because we believe that AMD’s recent acquisitions will compound revenues in the years to come as both Pensando and Xilinx provide a strategic positioning in the market by AMD that will allow the company to unlock new revenue streams respectively around data centres and high-performance & adaptive computing solution; both segments represent for AMD very solid growth opportunities to capitalise on according to AMD CEO Lisa Su:

The data centre remains one of the largest growth opportunities for AMD. The addition of the Pensando Systems team with their hardware and software portfolio will enable us to offer cloud, enterprise and edge customers a broader portfolio of leadership compute engines that can be optimized for their specific workloads.

Indeed, the addition of the Pensando Systems team strengthens AMD’s position in the data centre sector and will allow the company to offer its customers a larger variety of state-of-the-art compute engines optimisable for specific workloads, hence attracting more customers and driving higher retention with the potential to tap into an enormous TAM (total addressable market potent) as seen in the image below.

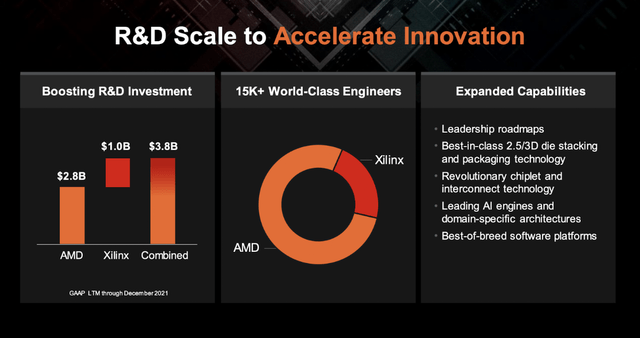

At the same time, the completed acquisition of Xilinx adds multiple high-margin, long-term revenue streams for AMD spanning a new set of markets to capitalise on, especially around high-performance & adaptive computing solutions. The acquisition of Xilinx in fact, allows AMD to take on Intel on the FPGA front after Intel purchased FPGA companies Altera in 2015 and Omnitek in 2019.

Despite Xilinx being relatively smaller in business size, what’s advantageous to AMD is Xilinx’s strong R&D focus with 28% of revenue directed to R&D in the last quarter alone (in comparison, AMD spent 17% of its revenue on R&D). We believe that thanks to Xilinx, AMD will be able to double down sharply on its efforts to design advanced semiconductors for consumer electronics and cloud computing, hence consolidating its leading positions in these markets. Furthermore, Xilinx’s higher profit margins will elevate AMD’s post-merger and the acquisition is expected to generate an additional $300 million in cost-saving per year once the acquisition is complete.

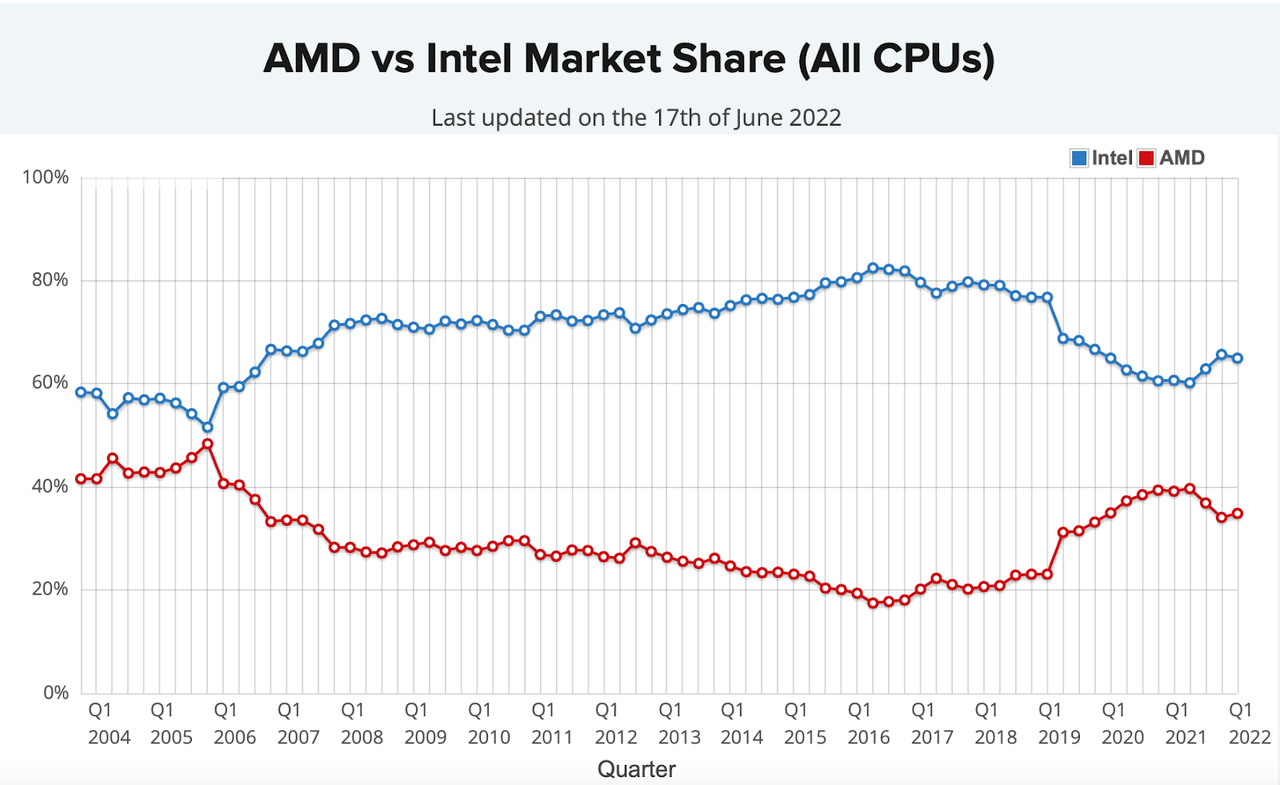

With Intel Losing Ground, AMD Has More Room To Grow And Gain New Market Share

Another reason why we anticipate AMD to outperform peers in the coming years is due to Intel’s performance. We have reason to believe that Intel’s recent weakening performances and technical challenges in keeping up with the development of next-generation microprocessors, in fact, will open up opportunities for AMD to gain new market share in the CPU sector, hence enabling the company to multiply revenues and accelerate growth in the space.

As of today, in fact, Intel is falling behind and losing ground to competitors when it comes to CPU technology capabilities as the company is yet to launch the Intel 4 (Intel’s own 7nm CPU) and has announced further delays in the production. The Intel 4 will be Intel’s next-generation processor that was initially planned to debut on the market in 2021, but after delaying the launch to 2022 due to a slow ramp to production, the company has recently announced further delays and is now estimating an official debut only in 2023.Meanwhile, AMD developed and launched its 7nm CPU back in 2020 and is launching later this year the Ryzen 7000, a first-generation 5nm CPU for computers that coronates AMD as the first company to launch on the market desktop processors running 5-nanometer cores. We believe this is a major milestone for AMD that will consolidate its leading position in the market, strengthen its brand and win new customers over the competition.

Source: TechPowerUp

Following The Recent Market Crash, AMD Stock Has Now Reached An Attractive Entry Price Point

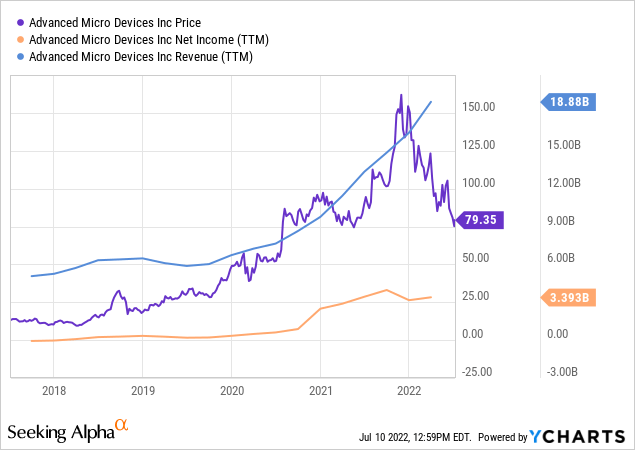

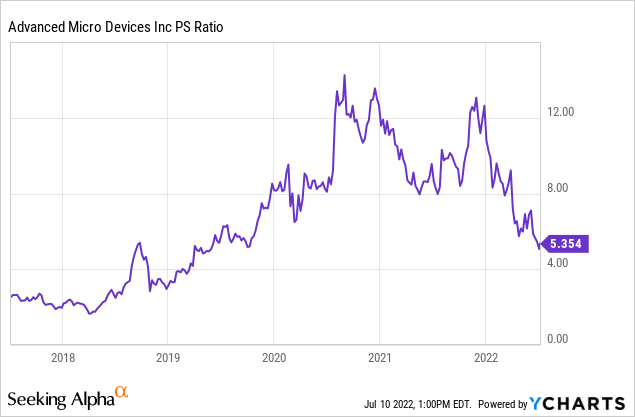

This is a recurring theme for a few stocks we’ve been monitoring in the last few months … following the recent market crash, in fact, we believe that the current market scenario presents a great opportunity to enter a position in AMD at an advantageous discounted entry-price point that makes the investment very attractive compared to a few months back.

As of today, AMD is trading at $79.35, a whopping -52% compared to the peak of $164.25 the stock reached in November 2021. For us, this is a nice entry-price point for AMD as it allows us to hedge some of the risks and presents an adjusted P/S ratio of only 5.35 vs. 14.25 reached in September 2020.

How Does The Chip Shortage In The Market Affect AMD?

We believe AMD is in a favourable position to be able to capitalise on the global positive trend in the semiconductor industry. Yet, this will happen only if the company will be able to mitigate some of the risks and beat the competition in specific market segments.

The first risk we identify relates to the global shortage of chips in the market; this is something that has been going on for quite some time now. The chip shortage originally sparked due to the sudden, exponential increase in demand during Covid-19 for work-from-home technology and increasing chip demand by car manufacturer companies requiring more chips on the new electric and automated vehicle models to enhance security during drives. This was coupled with a slow-down in manufacturing capacity, especially in South Asia where many activities of chip packaging and testing are carried out; a few months ago, new health measures were put in place in countries like Malaysia due to the Delta variant of the virus, hence further halting the supply chain.

Yet, with chip suppliers ramping up capital expenditure to open new production plants to cope with demand, we’re starting to see the situation getting back under control with AMD’s CEO Lisa Su anticipating the chip shortage to end towards the end of 2022. Therefore, unless sudden changes, we anticipate the current chip shortage not to represent an imminent threat to AMD’s ambitious growth plans.

Despite Increasing Competition, AMD Is Hedging Well Against Potential Threats

A second major risk we identify in our analysis is linked to competition. In fact, although we mentioned Intel’s weakening performance, we’re cautious about the possibility of new players gaining market share against AMD as they ramp up technology capabilities and manufacturing. Between these we identify Taiwan Semiconductor Manufacturing Co Ltd (NYSE:TSM) as one of the main competitors given its leading position in the market and strong manufacturing facilities that allow the company to benefit from overall demand growth for chips, hence making TSMC one of the more diversified semiconductor player.

In addition to TSMC, we also identify Micron Technology (NASDAQ:MU) and NVIDIA (NASDAQ:NVDA) as strong competitors that may affect AMD’s future performance as these players sell comprehensive products that enter in direct competition with some of AMD’s product lines, especially around CPUs and Gaming Graphics microprocessors; both companies could in fact potentially steal customers from AMD if they were to develop substantially better processors.

Finally, we must also acknowledge the fact that the same Intel could be able to do a strong come back and leverage its long-lasting and well-known brand to re-gain some of the market share lost in the past few years.

All in all, we believe that AMD is putting in place calculated and strategic moves to hedge all the risks we’ve just mentioned to succeed in its growth intent. By 2023 in fact, the company will open its new facilities in Malaysia to reduce its dependency on suppliers and is also developing new product lines to launch on the market in the coming years that substantially offer better performances at more modest prices than the competition (for instance, AMD just announced last month its new GUP card, the Radeon RX 6950XT that it claims offers up to 80% better performance per dollar compared to GeForce RTX 3090 developed by Nvidia).

Our Recommendation On AMD Is BUY As We Anticipate The Stock To Grow +166.48% In 5yrs Time

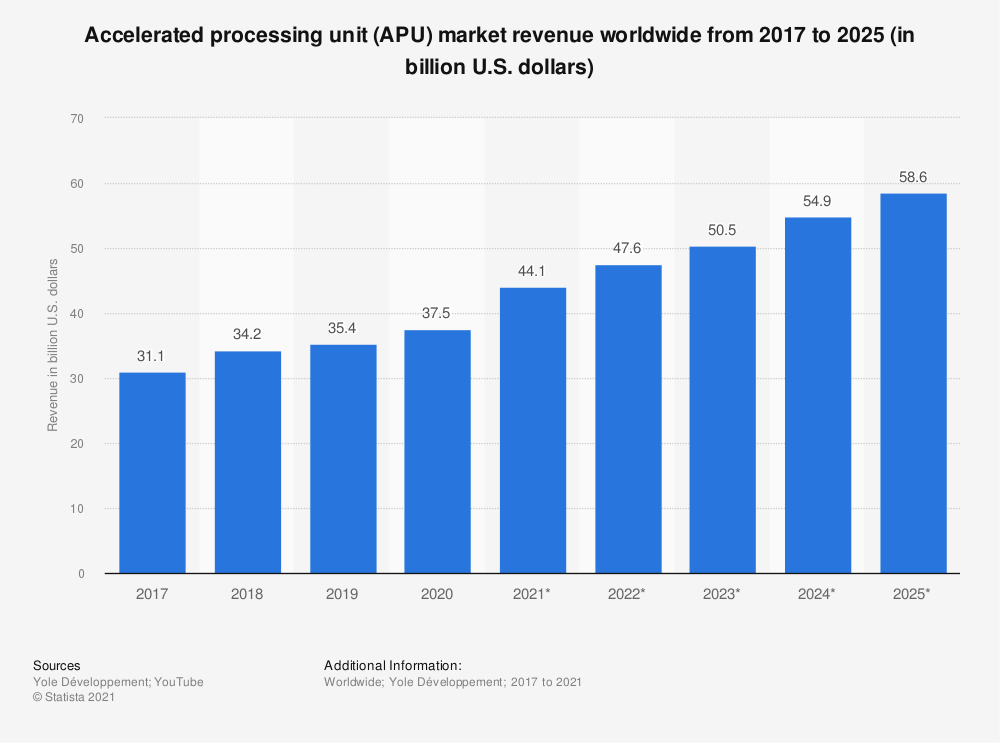

Based on our analysis and our assessment of the company’s financials, we give AMD a rating of BUY. We think AMD is particularly well-positioned to capitalize on Intel’s weakening performance and leverage the industry-wide uptrend in the semiconductor market to drive considerable growth over the next few years (see chart below from Statista as a reference for the market growth the semiconductor sector is expected to experience in the coming years).

source: Statista

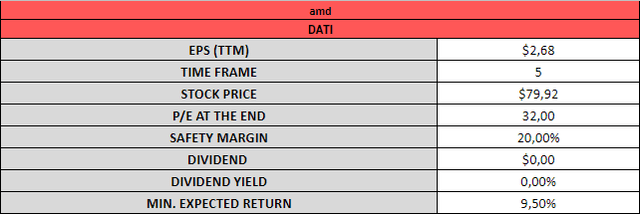

Precisely we expect the stock to grow 166.48% in 5 yrs reaching a price target of $212.97 in 2027 vs. $79.92 current stock price (at the time of writing). We arrive at this conclusion by analysing first of all the company’s balance sheet to determine AMD’s financial solidity and then focusing on the company’s income statements for the last 3 years to give ourselves a relevant overview of the current growth rates of the business. Below is a summary of the main data points we use in our calculations to arrive at our 5 years target price.

Image created by Finbuddy Investments based on internal calculations

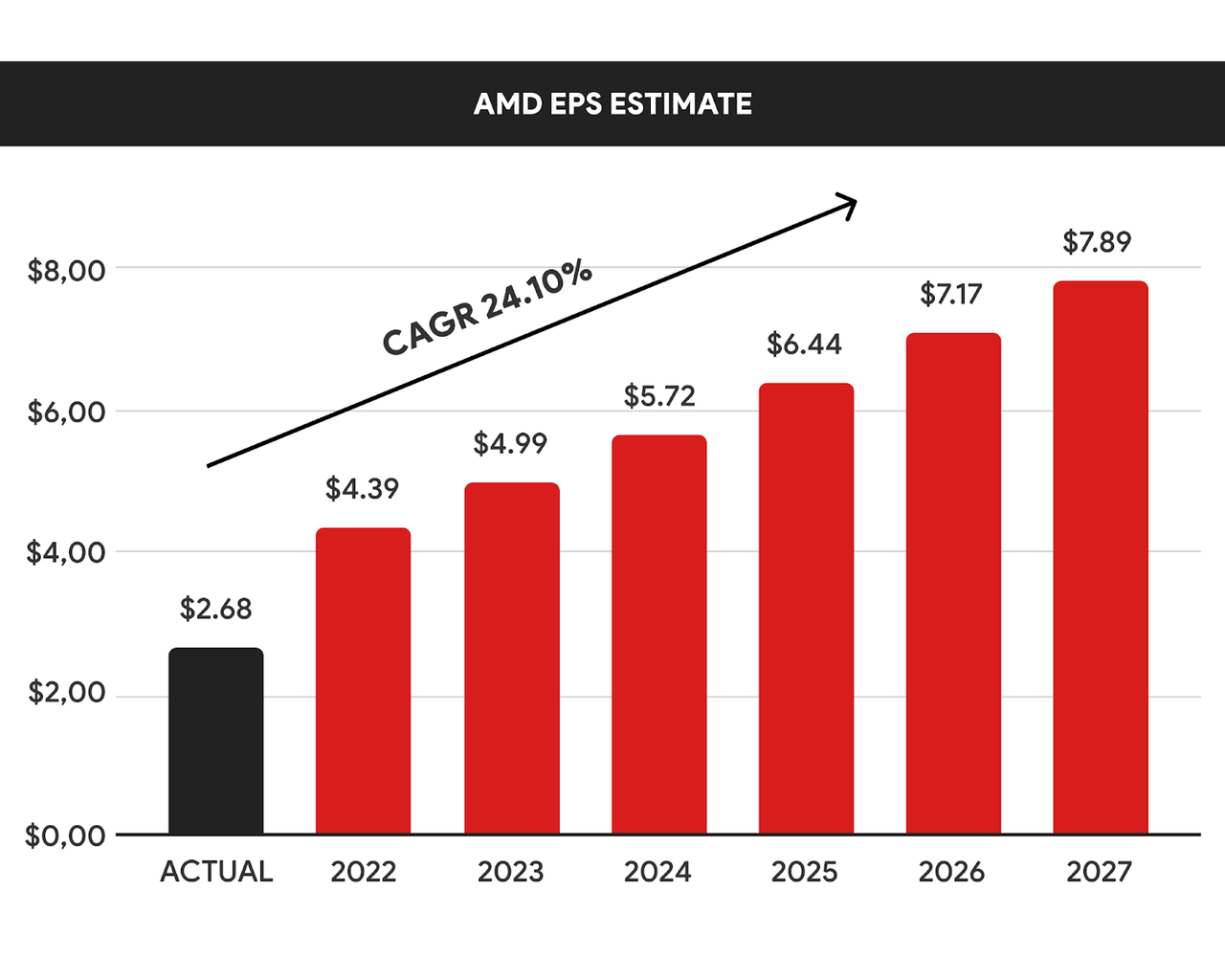

Our analysis highlights that AMD’s EPS have been increasing strongly at a CAGR of 120.39% in the past 3 years, but to evaluate the business correctly we cannot simply take this number as we must account for Covid-19’s positive impact on the entire microprocessor industry. During the pandemic, in fact, demand for work-from-home technology surged hence driving higher-than-expected revenues for AMD. As such, we anticipate AMD’s future EPS to continue growing but at a lower CAGR of only 24.10% (see image below).

Image created by Finbuddy Investments based on internal calculations

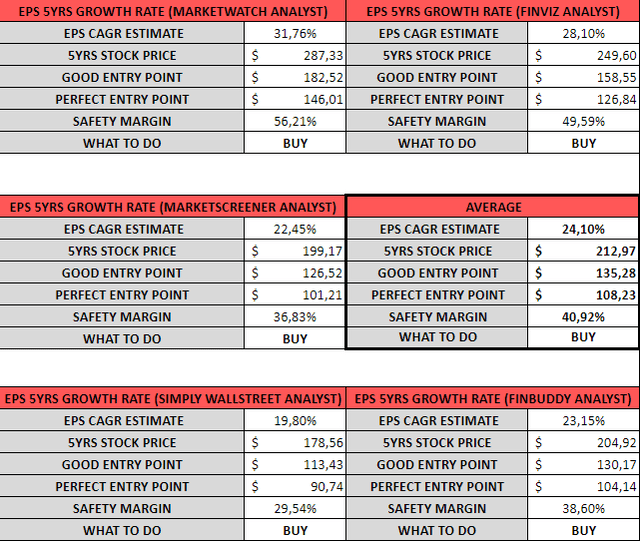

How do we arrive at this projection? We get to this data point by calculating the average between the growth estimate we attribute to AMD based on our internal calculations (23.15%) with 4 other different analyst estimates we take from official sources online (Finviz estimate, MarketWatch estimate, MarketScreener estimate and Simply Wall Street estimate); below we share with you the template we use to gather all the estimates we use in our calculations to help you better understand how we source data and conduct our valuation.

Image created by Finbuddy Investments with data from Marketwatch, Finviz, Market Screener, Simply Wall Street

|

EPS CAGR ESTIMATE |

it is the weighted average between our EPS estimate and 4 different official sources |

|

5YRS STOCK PRICE |

here’s the formula we use to get to this data:(Current EPS*((1+EPS CAGR estimate)^Time frame)*PE at the end)(2.68*((1+0.2410)^5)*27) |

|

GOOD ENTRY POINT |

entry price that would allow us to generate a 9.5% return on AMD |

|

PERFECT ENTRY POINT |

entry price that would allow us to generate a 9.5% return on AMD with a 20% safety margin |

|

SAFETY MARGIN |

the percentage we set as a hedge against potential market mispricing and inaccurate calculations |

AMD’s 5-Year Stock Price Target Based On 3 Different PE Scenarios

In order to avoid negative surprises, for every stock that we analyse we make sure to take into consideration 3 hypothetical scenarios to minimise risks and be aware of different possible outcomes. As such, below we calculate AMD’s 5-year stock target price based on 3 different scenarios contemplating different PE ratios.

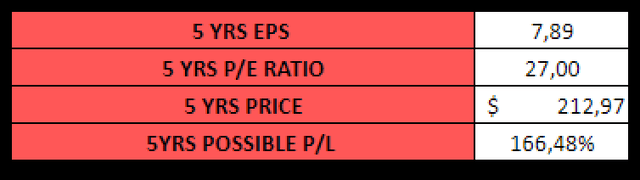

For the moderate scenario, we decide to account for AMD’s overweight results in the last 3 years caused by the higher-than-expected demand for microprocessors (as mentioned above) by adopting an adjusted PE ratio of 27 to discount AMD’s earnings for the next 5yrs.

Based on our personal experience, we believe that a PE ratio of 27 is reasonable in this context as it deducts from our calculations the sudden over-valuation of some specific sub-sectors of the semiconductor industry like the CPUs & GPUs during 2020/2021 due to the sudden demand increase because of the pandemic; the PE ratio we use in our analysis is in fact conservatively 73% lower compared to AMD average PE ratio of the last 3 years which amounts to 101.90 (AMD’s PE reached a peak of 270 in January 2020) and it’s rather in line with the 3 years’ historical PE ratio of the entire e-commerce sector in the U.S., which is equal to 27.6 from Simply Wall St.

Image created by Finbuddy Investments based on internal calculations

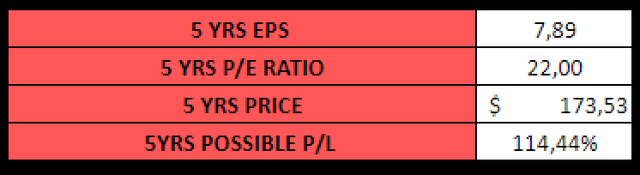

On top of that, we report below a scenario in which the PE is lower than expected wherein we anticipate the market to under-appreciate AMD and award the stock a PE ratio of only 22; if this was true, we would anticipate AMD stock to reach only a +114.44% performance over the next 5 years reaching a target price of $173.53 This could be caused by investors’ sentiment decreasing as the stock market continues to go down and capital flows into safer assets like bonds.

Image created by Finbuddy Investments based on internal calculations

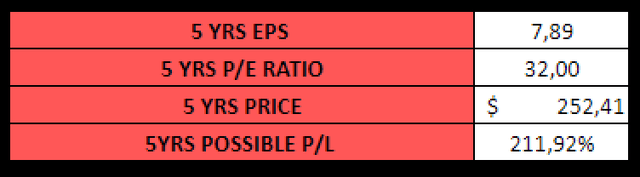

Finally, we also report a positive scenario in which the market instead over-appreciates AMD with a PE ratio of 32. Contrarily, this could be caused by investors regaining positive sentiment in the market and investing more capital in the market, hence appreciating stock prices. If this was the case, we expect AMD’s stock price to reach $252.41 in 5 yrs’ time.

Image created by Finbuddy Investments based on internal calculations

Concluding Notes

Despite growing concerns around chip shortages worldwide and strong competition, we believe that AMD remains a great investment opportunity in the semiconductor industry as the company’s recent acquisitions and product diversification will allow the company to hedge risk while compounding new revenue streams in the coming few years. In addition to that, we anticipate AMD’s new product line launches to drive new growth for the business as the company continues to lure customers from some of its competitors and will be able to ramp up production with new plants opening in 2023. Finally, we believe the current market landscape provides a great entry-price point that makes AMD stock very attractive.

Be the first to comment