sudok1/iStock via Getty Images

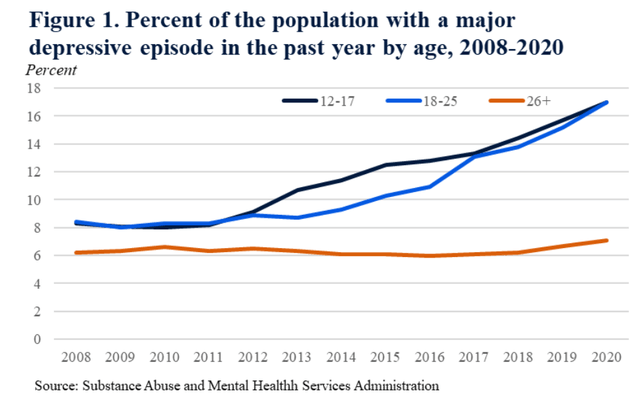

Even prior to the COVID-19 pandemic, Americans were experiencing a mental health crisis, according to the Whitehouse. Between 2008 and 2019, the percentage of adolescents (ages 12 to 17) reporting at least one major depressive episode in the past year rose from 8.3% to 15.7%, while young adults (ages 18 to 25) rose from 8.4% to 15.2% (Figure 1). In 2019, over one in five adults age 18 or older were classified as having a mental illness, and more than 13.1 million (or 5 percent) of adults had disorders that were classified as serious.

Figure 1 – Percentage of population with major depressive episode (SAMHSA)

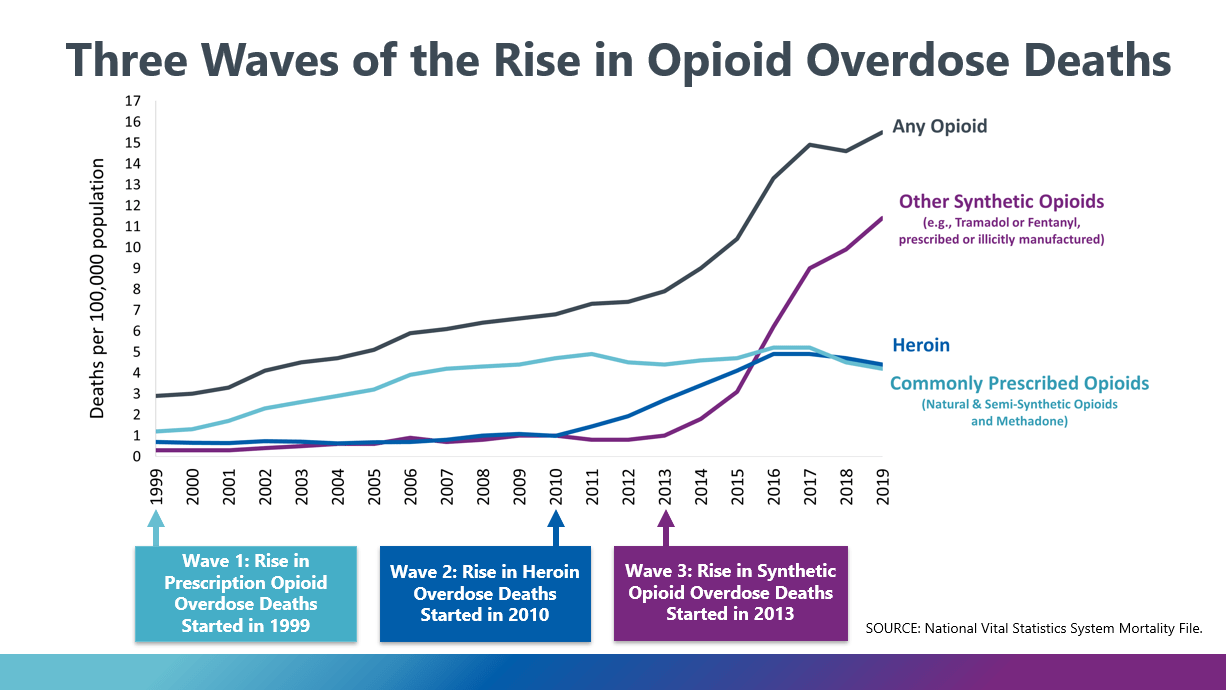

Over a similar time frame, opioid and other substance abuse has been called an ‘epidemic’ by the CDC, with opioid overdose death rates rising more than 5-fold from 3 deaths per 100,000 in 1999 to over 15 deaths in 2019 (Figure 2).

Figure 2 – Opioid overdose death rate (CDC)

One company that is poised to benefit from treating this mental health and substance abuse epidemic is Acadia Healthcare Company, Inc. (NASDAQ:ACHC).

Acadia is the only pure-play company offering exposure to the mental health and substance abuse treatment market. The business has shown tremendous stability throughout the COVID-19 pandemic, and is poised to reaccelerate growth in the coming years as the country grapples with the mental health repercussions of the pandemic. While shares are fairly valued relative to the healthcare sector, they may be attractive for investors looking for stability in times of economic turmoil.

Introduction to Acadia

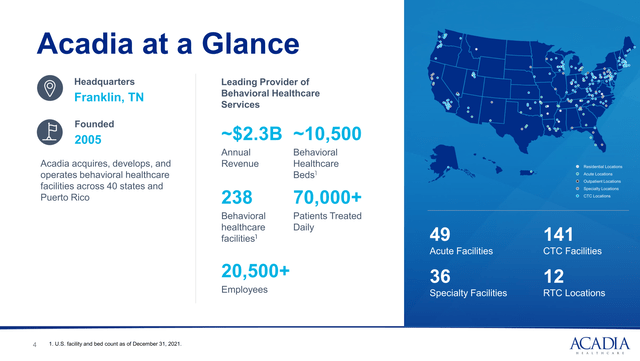

Acadia was established in 2005 to develop and operate a national network of behavioral health facilities providing psychiatric and chemical dependency services to its patients. In layman terms, Acadia operates mental hospitals and rehab facilities and clinics. As of 2022, Acadia operates a network of 238 facilities with approximately 10,500 beds. Figure 3 summarizes Acadia’s business.

Figure 3 – Acadia business summary (Acadia investor presentation)

Segments Overview

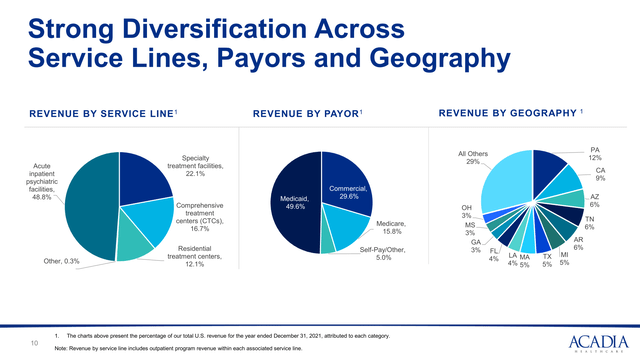

Acadia splits its business into four segments: Acute inpatient psychiatric facilities, specialty treatment facilities, comprehensive treatment centers, and residential treatment centers (Figure 4).

Figure 4 – Acadia business summary (Acadia investor presentation)

Approximately half of the company’s revenues, or $1.1 billion, is derived from operating 49 acute inpatient psychiatric facilities. Acadia believes the mental health treatment market is worth $30 billion with Acadia commanding a tiny 3.7% market share. However, if we look at the number of private psychiatric hospitals (463 total, from SAMHSA’s 2020 Annual Survey), Acadia has a higher 10.6% market share. This is because the vast majority of mental health treatment is provided in outpatient clinics, community health centers, and specialized wings of general hospitals, with only 5% of 12,275 total facilities being dedicated psychiatric hospitals like those that Acadia operates.

Acadia’s next two segments by revenue are Specialty Treatment Facilities with $510 million and Comprehensive Treatment Centers with $390 million. Specialty Treatment facilities treat patients suffering from substance use or eating disorders, while Comprehensive Treatment Centers combine behavioral and medication treatments for patients that require medication in addition to behavioral treatment (often those with opioid addiction).

Finally, Acadia provides treatment services to children and adolescent with behavioral health disorders in a non-hospital setting through the Residential Treatment Centers business segment that is worth $280 million.

Treatment Demand Outstripping Supply

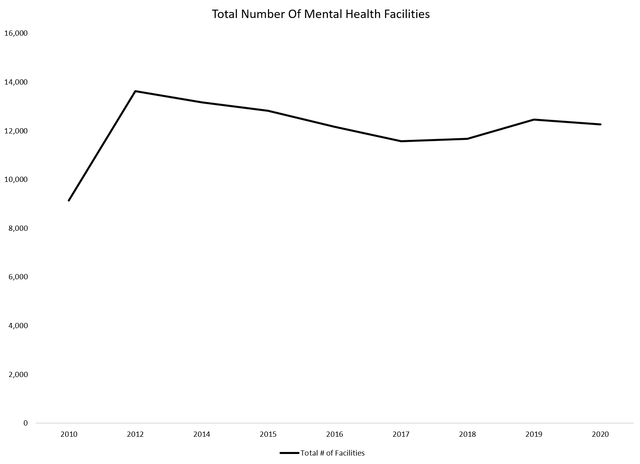

While data from SAMHSA and CDC in Figure 1 and 2 indicates the demand for mental health treatment services have seen strong growth over the past two decades, the total number of facilities providing these crucial services have been stagnant at approximately 12,000 (Figure 5) for the past decade. This implies demand for services provided by operators such as Acadia is outstripping supply.

Figure 5 – Total number of mental health treatment facilities (Author created with data from SAMHSA)

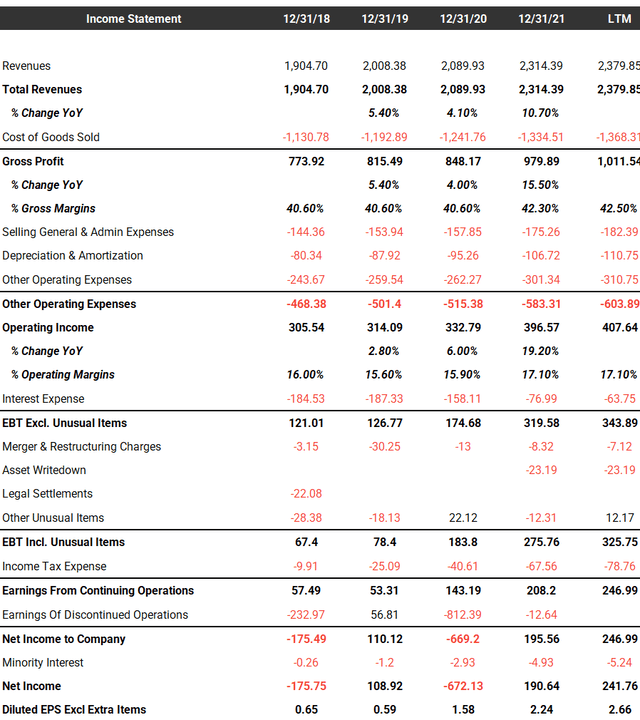

Financials Support Thesis That Mental Health Treatment Services Is In High Demand

This is confirmed by the company’s financials, summarized in Figure 6. As we can see, despite the COVID-19 pandemic limiting in-person treatments, Acadia was able to deliver 4.1% and 10.7% revenue growth in 2020 and 2021. The business also generated exceptionally strong operating margins between 16-17%.

Figure 6 – Acadia summary financials (tikr.com)

Business Unshackled From Debt

Astute readers will notice that although the company had strong operating income, it reported a large net loss in 2020. What was that about?

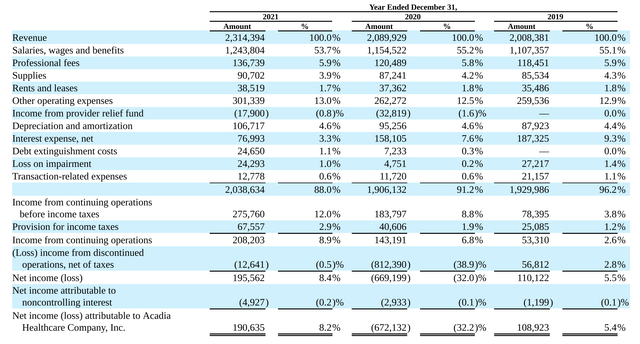

Through years of expansion and acquisitions, Acadia had accumulated more than $3 billion of debt up to 2020. This debt was a heavy burden, requiring 9.3% and 7.6% of revenues to service in 2019 and 2020 respectively (Figure 7).

Fortunately, in January of 2021, Acadia was able to pay down $1.6 billion of debt by selling its UK business for $1.4 billion in net proceeds. The large net loss was the result of a $870 million loss on sale of the UK business.

Figure 7 – Acadia summary financials (Acadia 2021 10K)

As a result of the debt reduction, we can see that interest expense fell to only 3.3% of revenues in 2021, allowing Acadia to show net margins of 8.9% for the year.

Operating Momentum Continues Into 2022

Acadia’s strong operating momentum carried into 2022, with the recently reported Q1/2022 revenues growing 11.9% YoY. Operating margin remained stable at 16.0%. Operating EPS was $0.68 / shr, a 170% gain from Q1/2021. Acadia’s same facility revenue increased 8.6% YoY in the first quarter, another strong sign of demand.

Multi-pronged Growth Strategy

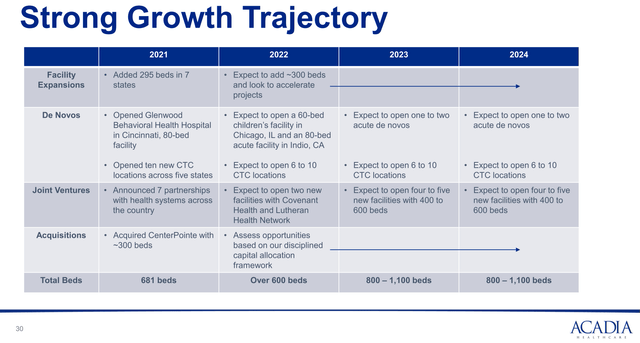

As mentioned above, the mental health and substance abuse treatment markets are large and in high demand. Acadia has adopted a multi-pronged approach to grow and gain market share. Over the next 3 years, Acadia plans to increase treatment capacity by 20-25% through a combination of facility expansions, de novo openings, joint ventures with healthcare providers, and M&A transactions (Figure 8)

Figure 8 – Acadia growth plans (Acadia investor presentation)

Valuation Is Fair

Our analysis above shows that Acadia has a highly profitable franchise, with stability through the COVID-19 pandemic and double-digit operating margins. But is this priced into the stock?

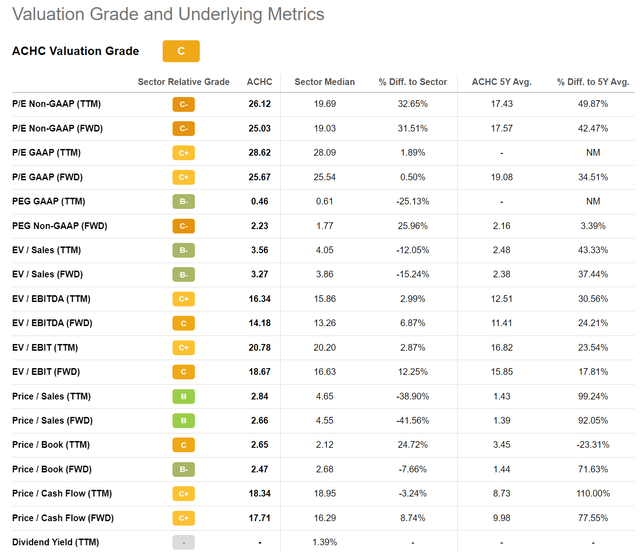

Using Seeking Alpha’s valuation tool, we can see that Acadia’s current valuation is fair (Figure 9). GAAP Fwd P/E of 25.6x is in line with the healthcare sector’s 25.5x, while Fwd EV/EBITDA of 14.2x is slightly ahead of sector’s 13.3x.

Figure 9 – valuation grade is fair (Seeking Alpha)

Moreover, valuation is only half the story with Acadia. If we think about the business, high demand for services is driving HSD (“high single digit”) same store revenue growth (8% in Q1/2022), with facilities expansions/de novo/JV/M&A looking to add another 7-8% to growth. Combined, this should generate 15-20% top line revenue growth for the next few years. With modest operating and financial leverage, we could see 20%+ earnings growth for the next few years.

Risks To Acadia Story

Government Reimbursement

The US Government represents 65% of Acadia’s revenues. Government payors in the U.S., such as Medicare and Medicaid, generally reimburse healthcare providers on predetermined rate schedules. As a result, healthcare providers like Acadia are limited in the amount they can charge for their services. Sometimes, government payors may even seek to reduce payments for services, impose stricter authorization guidelines for reimbursement, or seek to move patients to a lower level of service in order to save costs. This could have a negative impact on Acadia’s business.

Debt

As we had mentioned previously, Acadia had incurred significant levels of debt to support its growth. As of Q1/2022, Acadia has approximately $1.5 billion of debt outstanding. High levels of debt may restrict Acadia’s operational and financial flexibility. In particular, as debts comes due, Acadia may not be able to refinance, or refinance at attractive interest rates.

Inflation

As the vast majority of Acadia’s revenues are set from predetermined rate schedules (95% of revenues are from government payors or commercial payors), if costs escalate at a rapid rate, Acadia may not be able to adjust pricing to adequately compensate for rising costs.

Telehealth

There is also an increasing focus on the use of telehealth to address the growing mental health and substance abuse crisis. While telehealth can connect patients with psychiatrists and other service providers from the comfort of their own home, it is doubtful telehealth can displace face-to-face treatments provided by companies such as Acadia. For example, even during the COVID-19 pandemic when large swathes of the population were ordered to stay-at-home, Acadia did not see their revenues fall.

Rather, telehealth will most likely increase service offerings for non-serious mental health issues such as anxiety and mild depression, while more acute patients will still require a stay in psychiatric hospitals or rehab clinics to treat their conditions.

Technical Analysis

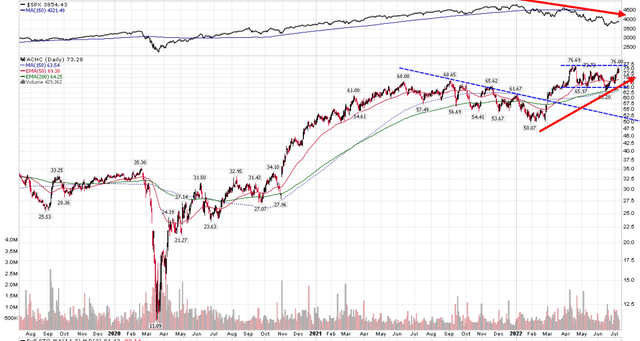

After bottoming from the COVID-19 crash, Acadia’s stock price has recovered strongly and is now trading at approximately double the valuation pre-pandemic. It has recently broken out of a multi-month downtrend and has formed a bullish pennant while showing strong relative performance compared to the S&P 500. A breakout above $76 should target $85 to $90.

Figure 10 – ACHC is poised to break out (author created with data from stockcharts.com)

Conclusion

As the only pure-play in the space, Acadia is poised to capitalize on the mental health and substance abuse epidemic that is afflicting America. Its business showed strong resiliency during the COVID-19 pandemic. While valuation is fair, investors may find the stock attractive for its operating stability. Technically, the stock is poised to break out.

I would recommend investors accumulate shares, as sadly, the macro trend driving demand for the mental health treatment industry is forecasted to grow for years to come.

Be the first to comment