olm26250

Retirement planning is not overly complicated. But it does require strong will, some effort, and due diligence. First of all, one needs to recognize the importance of having a plan. It’s never too early to have some goals and a plan for how to achieve them. Retirement planning requires savings on a regular basis and investing those savings wisely and relatively safely. Another important factor is the length of time those savings could grow and compound. That’s why we cannot overemphasize how important it is to start saving at an early age. It makes retirement planning so much easier. However, unfortunately, most of us don’t get that wisdom in our 20s or even in our 30s. But at the same time, it’s never too late, either. Even if you are well into your 50s, you could still achieve your goals, though the path will definitely be harder and may require more sacrifices.

For the purpose of this article, let’s assume a hypothetical couple – John and Lisa, both are 50 years old at this time. Let’s also assume they wish to retire when they are close to age 62. As of now, they have saved about $200,000 in retirement savings in addition to some equity in their house. It’s not bad at all. However, they will need much more if they want to retire at 62, which is only a short 12 years away. It is entirely possible that they may change their mind and may decide to work much longer. However, they would still like to make plans on what if they were to retire at 62 due to some forced situation. They would like to accumulate retirement assets worth $1 million or more by the time they are 62.

Why retire at 62? Why not work longer?

Frankly, 62 is just a number. Besides, so many people like to continue to work beyond 62 years of age. Sure, if you look forward to being at your job every day and have no issues with the job continuity, in most situations, it’s simply better to work longer, at least until 65, especially because eligibility for Medicare starts at 65. So, for many who may have some health issues and do not have any other healthcare policy to fall back on, it may not be an option to retire prior to 65.

All that said, age 62 is significant in many ways. At 62, you become eligible to draw on your Social Security benefits even though your benefits are roughly 25% lower than if you were to wait until the full retirement age between 66 and 67. Moreover, once you are 59 and a half, you can withdraw money from your retirement savings vehicles like IRAs and 401Ks without any penalty. Also, if your spouse is younger and is going to keep his/her job and workplace medical benefits for a few more years, retirement at 62 could make sense. So, depending upon your personal situation, like retirement assets, spending needs, and your priorities in life, retiring early could make sense. But then, these are all individual decisions based on your specific situation.

There may be other good reasons to at least plan for early retirement, even if you decide not to when the time comes. The emphasis here is on retirement planning and not on actually retiring. There can be many unforeseen situations that may force you or provide enough incentives to retire early. It could be a voluntary retirement offer from your employer that’s sometimes too good to pass. On the other hand, many folks face situations like retrenchments or forced early retirements and, subsequently, find it difficult to find suitable employment in their chosen professions. There can be many other reasons that you cannot possibly visualize in advance, so it’s just a matter of good planning to prepare for any eventuality.

So, how much is good enough to retire?

Everyone’s needs are different. One size does not fit all. It depends on many factors, including your pre-retirement income, retirement location, spending habits, health situation, supplemental income like social security, pension, or part-time work income, but above all, your goals in retirement.

Until the early 2000s, $1 million was a good benchmark and was a sufficient amount to have a very comfortable retirement. Obviously, due to inflation (even at a low 2%-3%), $1 million is not the same as it used to be 20 years ago. Also, more recently, we are seeing very high inflation numbers that have not been seen in the last four decades. Inflation can be very bad for retirees who are, by and large, on a fixed income. It is fair to say that $1 million in the year 2000 would be the same as $1.60 million in 2022 due to inflation. So, it is best to save at least $1.5 million or more. That said, with some prudent strategic planning, $1 million worth of savings can still go a long way to fund a reasonably comfortable retirement for a couple, provided we believe that the other two pillars of retirement security, namely Social Security and Medicare, will remain intact.

Why saving early and saving enough are critical

We believe the most important factor that determines how wealthy you are going to be later in life has to do with how soon you are willing to start saving and paying yourself first. In other words, start saving for retirement. However, another equally important factor is how you invest your savings. There are so many folks who save regularly but are too scared to invest or simply do not invest enough. They just can’t seem to tolerate the idea of their savings losing any significant value. But they need to understand that sitting on large amounts of savings in cash is equally risky as it loses a tiny amount of value every day and week of the year. Sure, we are not suggesting that you should not have any cash savings. In fact, we strongly suggest that everyone should keep an emergency cash reserve of three to six months’ worth of living expenses.

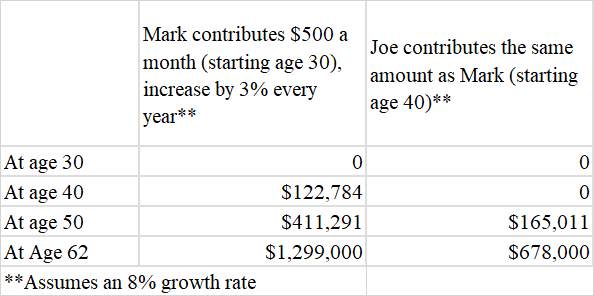

The table below shows how early savings can impact the quality of life in later years. This can be best illustrated with an example of two friends, Mark and Joe. Mark starts contributing $500 a month ($6,000 a year) at age 30 and increases it by 3% every year until 62. However, Joe waits for another 10 years but starts saving the same amount as Mark at age 40. Assuming they both get an 8% annualized return, Mark would end up nearly double what Joe would accumulate. If Joe wants to match the total savings that Mark would have, he will have to contribute almost double the annual amount starting from age 40 to 62.

This is how their savings at age 62 stack up, assuming an 8% annualized return:

Table-1:

Author

You are 50 and have saved $200,000

Let’s assume that you, as a couple, have saved $200,000 by the age of 50. That’s pretty good, but is that enough? It is certainly not enough if your target is more than a million dollars by age 62. That said, there’s no reason to be disheartened because you still have a lot of time on your side. But you need to realize you cannot delay retirement planning any further. Sure, you may have other pressing needs, such as saving and paying for kid’s college tuition fees. But at this stage, retirement savings have to become priority No 1. Saving for college tuition should not be at the expense of retirement savings. Probably, the same goes for any other pressing need or desire.

Let’s bring in our hypothetical couple: John and Lisa

We will use our hypothetical couple – John and Lisa, to help with the illustration.

Before we go any further, let’s see where John and Lisa stand today. Both of them are 50 years old. Their combined annual salary is modest at $140,000. So far, they have about $200,000 in their retirement accounts. John and Lisa want to be prepared to retire at 62 if need be. Sure, they can work longer, but that could depend on many situational factors. To be able to retire in 12 years, John and Lisa realize they will have to make some difficult choices and adjustments in their current lifestyle to be able to have a comfortable retirement later.

John and Lisa decided that they would save roughly 16% of their salary toward their 401K savings accounts going forward. These savings will be tax deferred and reduce their current tax liabilities. Until now, they were saving only 6% of their income. They are fortunate to get a good match from their employers for their 401K savings. On average, it works out to be 80% of their first 6% of the contributions. They have had no IRAs (Individual Retirement Accounts) until now. They will put away $10,000 ($5,000 each) toward IRAs. Since they qualify for tax-deductible IRAs, they will use traditional IRAs instead of Roth IRAs. This also will help bring down their current taxes. They also will open a college education fund for their kid and deposit $5,000 every year. However, this will be after-tax, but the qualified tuition withdrawals, including the growth, will be tax-free. Their target is to reach $1 million in retirement savings, excluding the primary home.

With the above decisions, and after accounting for the tax savings (due to pre-tax contributions), their take-home spendable monthly income will reduce by about $2,000, even though they will be saving an extra amount in excess of $2,400 every month.

Where to find an extra $2,000 a month?

There are several ways to find those extra $2,000. They can cut down their monthly budget to save this extra $2,000. They are going to look at several options and choose the ones that are appropriate for them. Some of the options that they are going to look at are:

- They could cut their spending budget drastically from every expense item and save about $2,000 a month. Though quite doable, it may seem difficult to achieve at first glance, and they may have to make some lifestyle changes.

- Alternatively, they could sell their current house and move to a smaller but newer house. This could save quite a bit of money and reduce the need to cut down on other expense items. However, this would involve a lot of extra headaches and uncertainties. In addition, in the current high mortgage interest rate environment, this option is not even feasible, and they may have to wait for at least a few years when mortgage rates are once again under 4%.

- Sure, there’s a third way, though there’s no guarantee of achieving it. They may look for new opportunities at work with added responsibilities and increase their earning power. Any success here will reduce their need to cut down on their expenses.

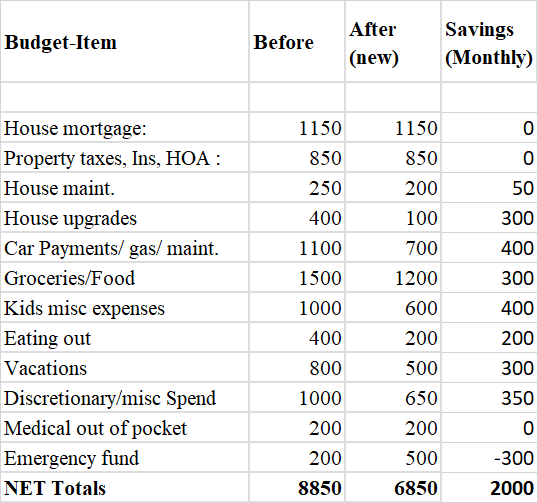

With $140,000 combined annual income, their current take-home income and the new plan would be as follows:

Table-2:

**This is a rough estimate for this couple based on income and two dependents, but it could vary a great deal based on the individual situation.

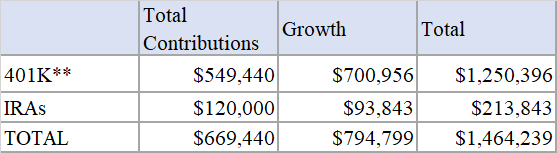

Where to cut down the monthly expenses?

Though it is very personal and can vary a great deal in individual situations, this is how John and Lisa work out the new household budget to make for additional savings of $2,000 a month.

Table-3:

Author

Retirement Planning Part-II: Investing Successfully

As we talked about it earlier, the first very important part of retirement planning is to save early in life and save enough on a regular basis. It can be best achieved when it’s done on autopilot. Being on autopilot means your investment account always gets paid first before you get money into your checking account to spend on things that are essential and non-essential.

So, while saving is very important, you cannot get wealthy simply by sitting on cash or keeping it in a savings account. The second part of retirement planning is how well you invest the money that you are saving so diligently. This is equally important as the first part, if not more. Not only do you have to protect your cash from inflation, but you also need to compound it over time. Growth and compounding will do wonders to your investment capital over time, and it is necessary to meet the needs of a comfortable and possibly long retirement.

John and Lisa decide to implement the following multi-basket strategy:

John and Lisa’s 401K:

For this discussion, we will assume their 401K accounts as one. Sure, in practical terms, their accounts would be different and would have to be managed separately.

They decide on two strategies and divide their 401K capital, roughly 50:50, between the two strategies.

Strategy 1

For half of the funds in their 401K, they decide on the following combination of funds (mutual funds or ETFs). This is assuming that most 401K accounts do not allow individual stocks (however, some do). Once this has been set up, the rest would really be on auto-pilot. Every paycheck, contributions will be invested in the proportions as selected. Since this portfolio is very balanced, they hope to get a minimum growth of about 8%-9% annualized for the next 12 years.

- 25% in the S&P500 fund

- 20% in the equal-weighted S&P500 fund

- 10% in high-growth Technology funds

- 10% in the Developed International fund

- 10% in Emerging Markets fund

- 15% in Bonds

- 10% in Treasury funds

Strategy 2

John and Lisa decide to deploy the balance of 50% of the 401K money in a risk-adjusted strategy to ensure that they get most of the gains of the market, but at the same time, it will hedge the risks in case of this bull market turns into a bear market. This strategy is discussed in the later section. They hope to get at least a 10% return from this strategy. Besides a decent return, this strategy will reduce the overall volatility to a great extent.

IRAs

Since both John and Lisa will be funding their IRAs every year to the extent of $10,000 total, they will self-manage these funds.

Lisa is a fan of DGI (Dividend Growth Investing) stocks and has decided to implement a DGI Portfolio (described below).

Investment Portfolios

DGI Portfolio for the IRAs:

This is the portfolio that John & Lisa will be building for their IRAs. They decided to build a portfolio of about 15-20 blue-chip stocks, which in theory, they could hold for the next 10-20 years. Obviously, things will change over time, and occasionally they may have to make changes.

For this part of the portfolio, most of the stocks they select will be ones that tend to do reasonably well during recessions and big corrections but still grow nicely over time. The idea is that low volatility will provide an easier ride than the S&P500 and ultimately translate into long-term performance.

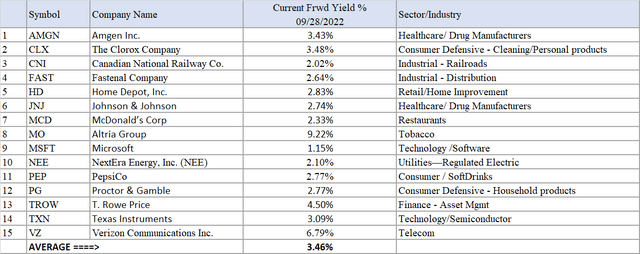

Stocks selected:

Amgen (AMGN), Clorox (CLX), Canadian National Railway (CNI), Fastenal (FAST), Johnson & Johnson (JNJ), Home Depot (HD), McDonald’s (MCD), Altria (MO), Microsoft (MSFT), NextEra Energy (NEE), PepsiCo (PEP), Procter & Gamble (PG), T. Rowe Price (TROW), Texas Instruments (TXN), and Verizon (VZ).

Table-4:

Risk-hedged rotation strategy for low drawdowns (for 401K accounts):

Since this strategy is being implemented inside 401K accounts, it needs to be simple and implementable. Most 401K accounts offer a limited number of funds that one has to choose from. John decides to implement one such strategy, which rotates on a monthly basis.

The strategy will be invested in one of the following three securities (or equivalent funds), which are:

- Vanguard 500 Index Fund Investor (VFINX)

- Vanguard Total International Stock Index Fund Inv (VGTSX)

- Vanguard Long-Term Treasury Fund (VUSTX)

- iShares 1-3 Year (Short-term) Treasury Bond ETF (SHY)

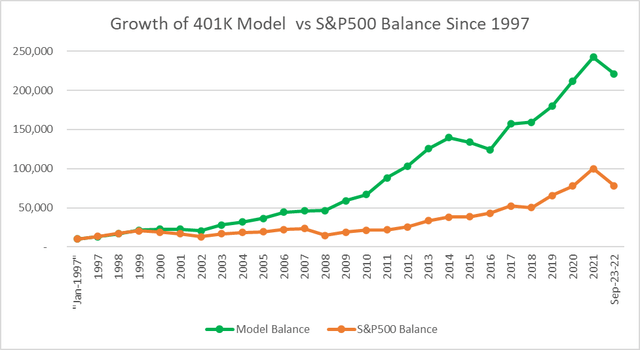

VUSTX and SHY are two of the hedging assets and will be used only when the other two main securities are not performing well. By deploying this strategy, since 1997, it has returned an annualized return of 12.79% compared to 8.33% from the S&P 500. In the year 2008, it was up slightly compared to -37% for the S&P 500. During the tech-bubble crash from 2000-2002, the RA (risk-adjusted) model was down only by 3.2% cumulatively, while the S&P 500 lost more than 43% during those three years. We would like to caution that backtesting results are no guarantee of similar results in the future because no two periods are going to be the same. However, the main advantage of using such a strategy would be to limit the downside and drawdowns during recessions and corrections.

Note: In our backtesting model, the short-term Treasury fund SHY was considered only from Jan. 2003 since it did not have a history prior to 2002.

Equivalent or similar ETFs that can be used for the above mutual funds:

Table-5:

At the end of every month, the strategy will check the performance of the three assets for the previous three months and select the best-performing asset. The portfolio will be invested in the top-performing asset for the next month. The process will be repeated every month. Below are the backtesting results since 1997 and performance comparison with the S&P 500. The model portfolio accumulated almost three times that of the S&P 500, mainly because of smaller drawdowns during the bear markets of 2001-2003 and 2008-2009.

Chart-1:

Risk-hedged rotation strategy for income (for IRA, 401K accounts):

Note: This strategy is for accounts where it is possible to trade individual stocks or funds. These days, many brokerages that manage 401K accounts also allow participants to invest in individual securities.

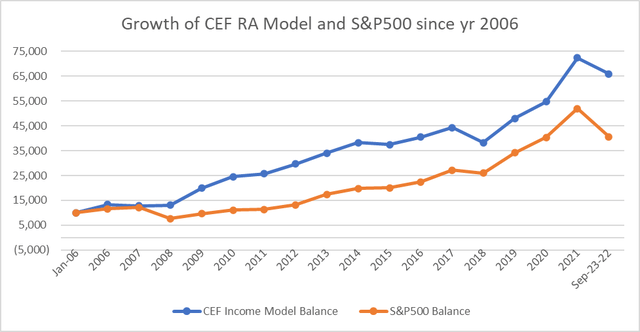

This Rotational model could be used to generate 5% to 6% income on a consistent basis with limited drawdowns and much lower risk than S&P500. The model uses five CEFs (closed-end funds) from various asset classes and uses a short-term Treasury fund as the hedging security. We compare the performance of each of the five securities (including distributions) during the previous three and seven months (average the two) and select the top 4 performing funds for investment. Any security that had a negative performance return is not selected and replaced with the hedging asset, i.e., SHY. This process is repeated on a monthly basis at the end of each month.

There will be times when the portfolio is partially or even fully invested in SHY (SHY generating little income), but most times (at least 2/3rd of the time), it will be invested in CEFs, generating nearly 8% income. If we average it out, it should be able to provide roughly 6% income.

The five CEF securities are:

- EV Tax-Advantaged Dividend Income (EVT)

- Flaherty & Crumrine Preferred and Income Securities (FFC)

- Kayne Anderson Energy Infrastructure (KYN)

- Nuveen Muni High Inc Opp (NMZ)

- Cohen & Steers Qty Inc Realty (RQI)

The hedging security is:

- iShares 1-3 Year (Short-term) Treasury Bond ETF (SHY)

Chart-2:

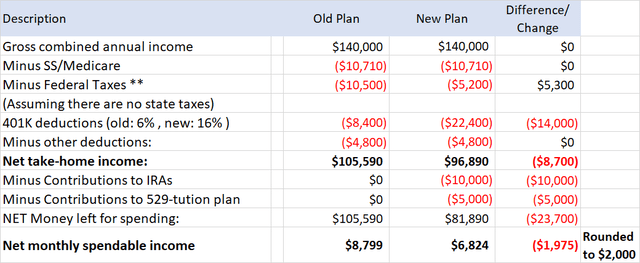

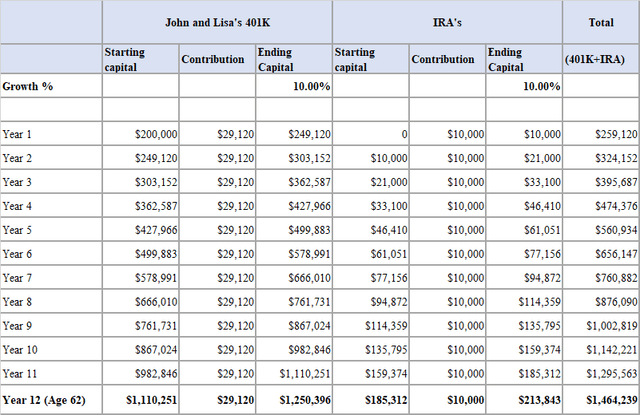

Portfolio’s values at 62 years

Assumed annual growth for 401K accounts (Including rotational): 10.0%

Assumed annual growth for the IRAs (DGIs): 10.0%

Table-6:

Total capital for John & Lisa at 62 years of age:

Table-7:

Author

** Includes employer’s contributions.

Conclusion

Most people understand and appreciate the importance of a high rate of savings and how it can lead to financial success. But it’s also important to emphasize the time factor (time left for the investments to grow). A dollar saved early in life and invested to compound is worth much more than a dollar saved later in life. Growth is directly proportional to the time these investments have to grow.

Ultimately, three factors define how much money you are going to have in retirement, namely, the rate of savings, time in the market, and the average rate of investment growth. The first two are directly controlled by you, whereas the third one does depend on decisions you make but also on extraneous factors like market and economic conditions.

In the above hypothetical model, John and Lisa exceeded their targets by about 40%. If they get lucky, they might exceed their target even more. Even if we consider a more pessimistic scenario, they should still comfortably hit their target. Sure, our assumption of constant returns is not practical at all – that’s not how the stock market works. But these are the averages over a 12-year period. They would have negative returns in some of the years but would also have very high returns in some other years. So, over a long period of time, it tends to balance out. Please note that in our model, we are not only diversifying in various stocks but are also diversifying in the form of three very different strategies. We particularly feel confident about the long-term performance outlook of the DGI portfolio and the rotational portfolios.

Be the first to comment