imaginima

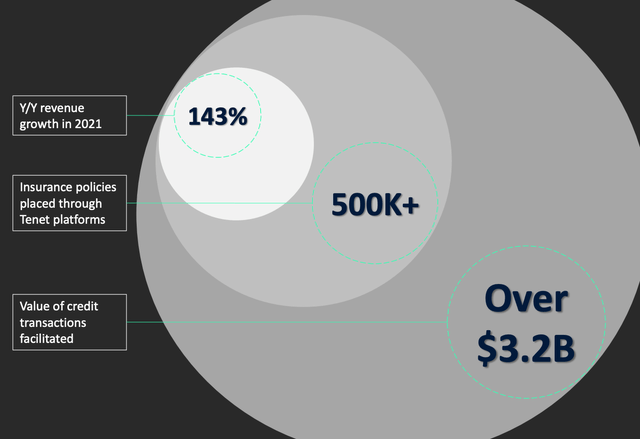

Tenet (CSE: PKK) (OTCPK:PKKFF) is a fintech holding company that has created a hub of small businesses across China. The company is poised to benefit from secular growth trends across AI, big data, and Fintech. The global fintech market was worth $115.34 billion in 2021 and is forecasted to grow at a rapid 26.2% compounded annual growth rate reaching a value of $936.5 billion by 2030. Tenet has a proven business model in China and is now rolling out its formula across Canada and the world. The company grew its revenue at a blistering 143% in 2021 but has recently experienced a series of headwinds due to the lockdowns in China.

Revenue growth historically (Investor Presentation)

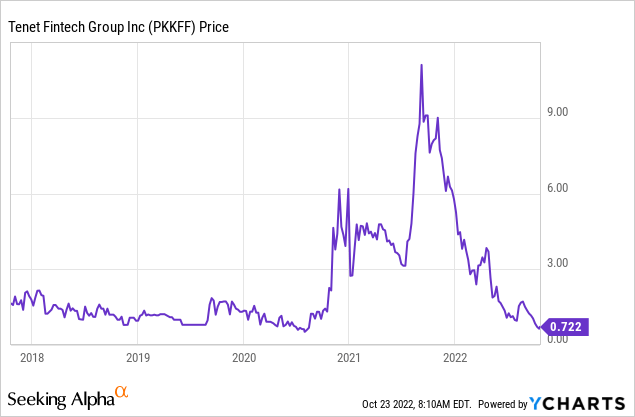

The company’s share price has been butchered by over 92% from its all-time highs in September 2021 and is trading at approximately $1 Canadian per share. Thus in this post I’m going to break down the company’s business model, financials, and valuation, let’s dive in.

Fintech Business Model

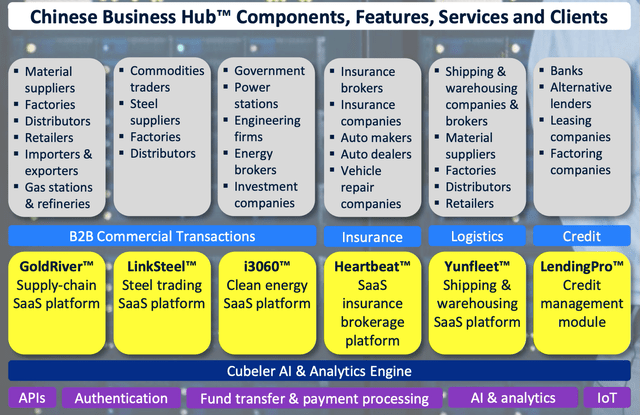

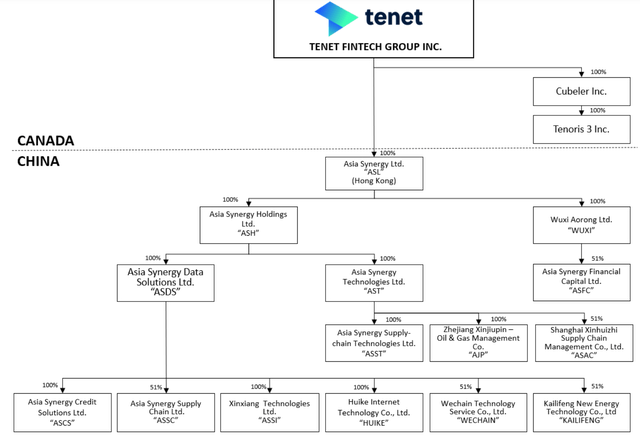

Tenet is the parent company of a plethora of fintech and artificial intelligence companies. The arrangement may look fairly complicated (on the graphic below) but I will break it down in the next section.

Tenet launched its “Business Hub” in China during 2018 in order to match small businesses and factories with lenders for purchase order financing and raw material requirements. According to one study, 28.4% of the world’s goods are manufactured in China and the country adds at least $4 trillion to the world economy. It is well known that small businesses are an underserved market when it comes to credit, therefore Tenet saw a huge market opportunity.

Over a period of years, Tenet added a series of software platforms to help serve its customers across a variety of niches. On the B2B commercial side, these SaaS platforms include GoldRiver a supply chain platform, LinkSteel a steel trading platform, and even a clean energy platform called i3060. The company also offers a SaaS insurance platform called Heartbeat, a shipping & warehousing platform called Yunfleet, and of course, a credit platform (LendingPro). Bringing all these platforms together, Tenet offers an end-to-end solution for businesses to buy, sell, finance, ship, and warehouse their products.

Chinese Business Hub (Investor Presentation)

Tenet has now realized that the company can replicate the “Business Hub” model in other countries around the world. The company has recently launched in Canada and is rolling its services out across several more countries to ultimately create a unified “Global Business Hub”. The company makes its revenue from a transaction-based model, in which each subsidiary charges fees to the business customers. Tenet bundles its platforms together to provide a range of solutions tailored to each client which offers great upsell opportunities.

Tenet has also begun to leverage the vast amount of data on small and medium-sized businesses [SMBs]. Small Medium sized businesses make up over 90% of all businesses globally which is astonishing. Therefore, small businesses are the true economic driver of economies. Thus their data is extremely valuable to investment institutions, capital providers, and even governments. To unlock the power of this data, Tenet enables small businesses to connect their accounting software directly to the “Business Hub”. This enables near-time updates on the financial health of businesses globally. The company then uses its Artificial Intelligence powered analytics engine to harness this data and derive insights. Tenet then sells this data and related consulting services to its Business Hub members. The company also sees a massive opportunity to disrupt the digital advertising market through the granular usage of this SMB data. For example, an advertiser can target businesses by industry, geography, and even job title. The digital advertising market is forecasted to grow at over a 10% compounded annual growth rate and reach over $1 trillion by 2027.

Steady Financials

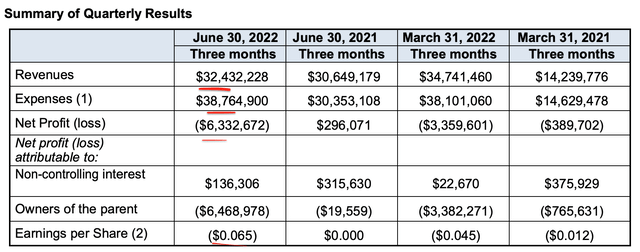

Tenet generated steady financial results for the second quarter of 2022. All figures below are in Canadian Dollars. Revenue was C$32.4 million which increased by ~6% from the C$30.6 million generated in the prior year. This revenue growth was much slower than the 143% generated in the prior year and management puts this down to the large number of hard lockdowns in China which is still ongoing due to CV19. The positive is the UK insurance business did well and the company is expecting strong volumes in China in Q3 and Q4.

Tenet’s expenses increased by 27% year over year to C$38.7 million in Q2 of 2022. This was driven by an increase in salary costs after the hiring of new employees in Canada, software development costs, and costs associated with the creation of new subsidiaries in Beijing and Guangzhou. The good news is over consulting service expenses declined to just C$55,092 which is much lower than the C$148,988 expenses paid in the equivalent quarter of 2021.

The company generated a net loss of $6.3 million in the second quarter of 2022, which was worse than the $296,071 in profits generated in the second quarter of 2021. This was driven by the aforementioned extra expenses and China lockdown issues which look to be short-term investments, thus I forecast increased profitability in the future. The company also has plans to list on the London Stock Exchange which should act as a catalyst for increasing the liquidity as the business trades on the Canadian stock exchange only.

As a small-cap company, analyzing the balance sheet health is vital. In this case the business has just $11.7 million, which is not a massive amount. However, with just $100,000 in long-term debt this is actually relatively healthy if the business can become profitable again. If the business burns through the same amount of cash in the next two quarters, it will quickly eat into its cash position and then may have to raise debt or funds from the capital markets. Therefore the balance sheet and unprofitable position is a risk overall.

Advanced Valuation

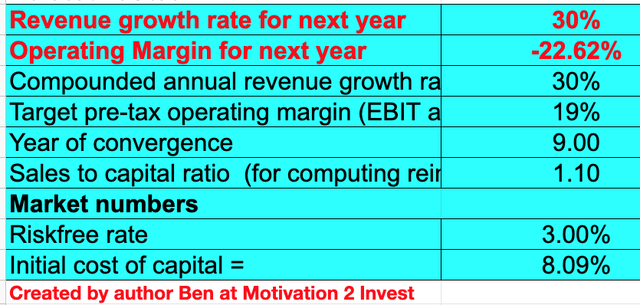

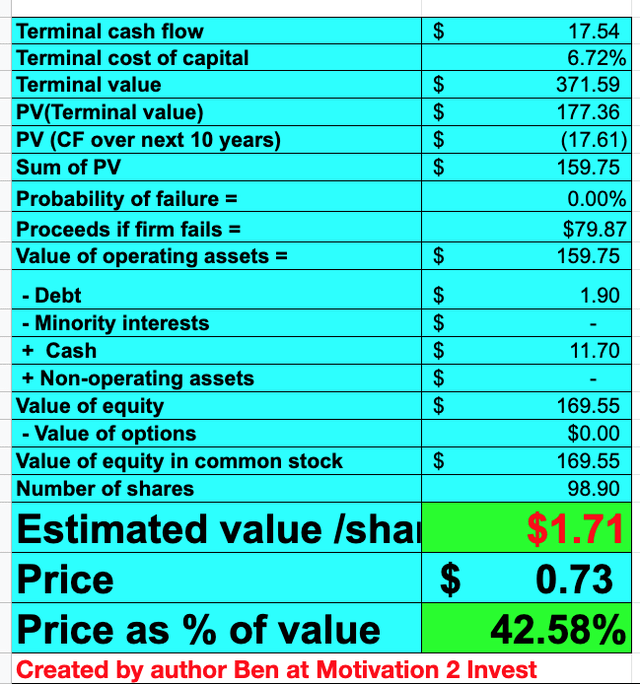

Valuing Tenet is fairly difficult as it is a small-cap company which has a bold vision and lots of growth potential in the future. The business grew its revenue at a staggering 91% growth rate in the year 2020 to 2021, thus management forecasts a return to strong growth in the future, after the recent slowdown, although they didn’t reveal specific numbers. Therefore I will be conservative and forecast 30% revenue growth per year over the next 5 years.

Tenet stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted the business to increase its operating margin to 19% over the 9 next years. I forecast this improving profitability to be driven by the Canadian and other country Business Hubs. As the company has already invested a substantial amount in Capex for the new regions (discussed prior) this should mean lower fixed costs long-term.

Tenet stock valuation 1 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $1.71 [USD] per share, given the share price is approximately $0.73 USD per share at the time of writing, the stock is ~57% undervalued.

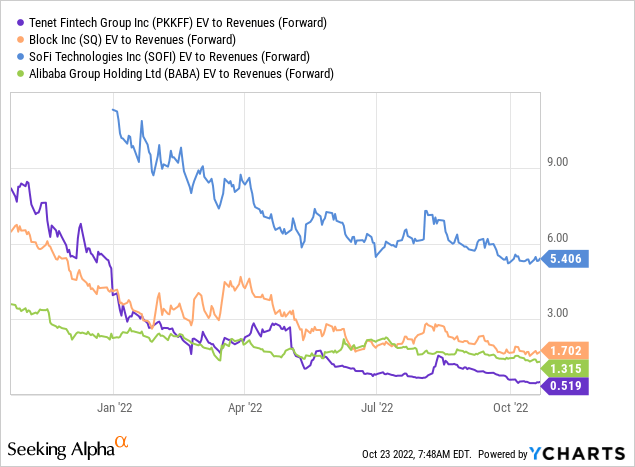

As an extra data point the business trades at an EV to Sales ratio = 0.54 which is substantially cheaper than historic levels. As Tenet has a fairly unique business model it is quite difficult to compare it to other companies. Thus, just for extra information, I have compared it to much larger and more established businesses such as Block (SQ) as they are in the small lending space. In addition to SoFi and Alibaba as they are also in the small business/fintech space. The stock is undervalued relative to these entities.

Risks

The business could fail

The issue with small-cap companies is the chance of failure is heightened if unprofitable and thus this adds extra risk investors will need to take into account. Although I believe in this case the company’s headwinds look to be mostly short term and when they list on the London stock exchange that should help with liquidity. Keep in mind the company has had negative to low profitability and ROIC over the past few years.

Recession

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. In this scenario I like to think of small businesses as small boats on a rough sea, they feel the waves much more. Therefore these small businesses may be less inclined to sign up for new platforms given economic uncertainty. A recession in the west also impacts China massively as slow economic demand means a lower supply of goods is required.

Final Thoughts

Tenet is a unique business that has built up a valuable ecosystem of small businesses across China. The company has a vast amount of potential to benefit from secular growth trends across fintech and big data. However, the recent unprofitability could be an issue given the balance sheet, thus shareholders may be diluted. Therefore on balance, I will label this stock as a “hold”, although it is also trading at a significantly cheap level to be considered a buy also for one’s speculative portfolio.

Be the first to comment