metamorworks

Investment Thesis

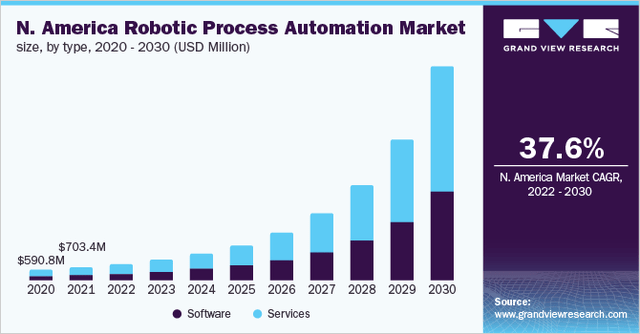

UiPath Inc. (NYSE:PATH) is a leader in robotic process automation, a software technology that makes it easy to build, deploy, and manage software robots that emulate human actions. The technology is exciting to say the least, and Grand View Research expects the RPA (robotic process automation) market in North America to achieve a 37.6% CAGR through to 2030.

Given that UiPath has been the top dog in this emerging industry for years, it made sense for me to take a closer look at the company earlier this year – and it ticked many of the boxes I look for: very high switching costs, a founder-CEO with plenty of skin-in-the-game, and a resilient balance sheet. I outlined my full analysis of UiPath in a previous article.

Yet it hasn’t been plain sailing for this business since its April 2021 IPO, with shares down 80% since coming public at an eye watering $36 billion valuation. Specifically, UiPath has been a bit all over the place when it comes to its results & guidance. In Q4’22, management gave guidance that was hugely below analysts’ estimates and the share price deservedly plunged – a few months later, the company blew past this guidance with its Q1’23 results, but the damage had been done.

So, did the results this quarter do enough to show investors & Wall Street that UiPath can be trusted to deliver strong results regularly? Not exactly…

UiPath Q2 Earnings Overview

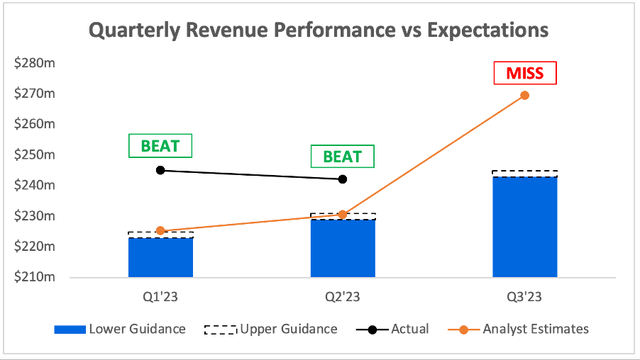

Starting with revenue, and UiPath saw its top line grow by 24% YoY to $242m. This came in safely ahead of management’s guidance of $229-$231m, and also beat analysts’ expectations of $231m.

Investing.com / UiPath / Excel

Unfortunately for investors, Q3’23 guidance posed a big problem. Management guided to revenue of $243-$245m, which indicates YoY revenue growth of a meagre 11% – not what you’d want to see from a ‘high growth’ business. This also took analysts by surprise, falling far short of the $270m consensus estimate for UiPath’s Q3 revenues.

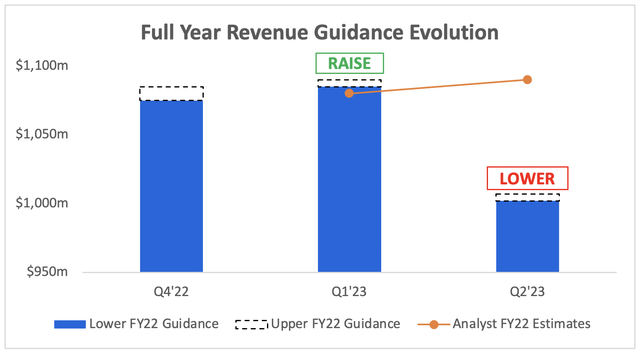

To add further misery, UiPath updated its full year revenue guidance, and I’m sure you can already guess the direction.

Consensus Gurus / UiPath / Excel

The company substantially reduced its full year outlook from $1.085-$1.090B to $1.002-$1.007B; a reduction of 8% in just one quarter. Unsurprisingly this also came in below analysts’ estimates, and compiled further pressure on management.

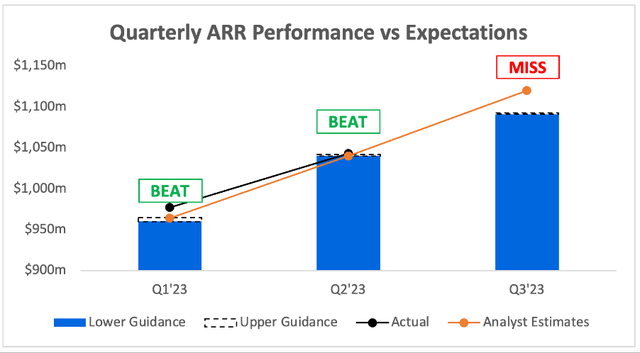

UiPath likes to focus on annualised recurring revenue, or ARR, as a preferred performance measure. Whilst quarterly ARR grew at a healthy 44% YoY to $1.043B, and UiPath beat its own guidance of $1.040-$1.042B in Q2’23, it was the Q3 outlook that once again disappointed & missed analysts’ estimates.

Consensus Gurus / UiPath / Excel

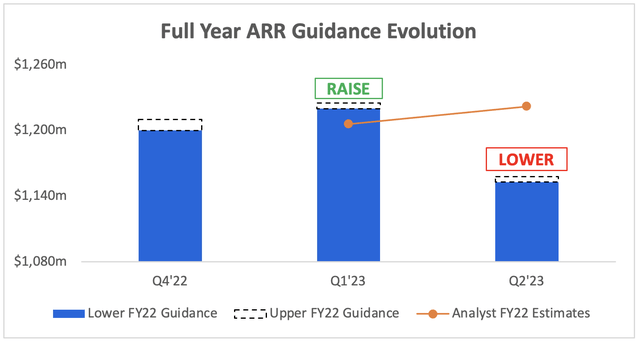

To top it all off, UiPath cut its full year ARR guidance from $1.220-$1.225B to $1.153-$1.158B, which was once again below analysts’ estimates.

Consensus Gurus / UiPath / Excel

When it comes to a company like UiPath, top-line growth is crucial to any kind of investment thesis, so this slowdown comes as a potentially huge red flag. Given this, it’s worth diving into the drivers behind yet another painfully disappointing outlook.

A Huge Host Of Headwinds

The biggest items focused on by management across both the earnings presentation & press release were macroeconomic uncertainty and exchange rate headwinds. As CFO Ashim Gupta stated in the press release:

While our global footprint is an asset to the business, it exposes us to foreign exchange and macroeconomic volatility which is reflected both in our fiscal second quarter results and our fiscal third quarter and full year 2023 financial outlook.

UiPath also highlighted that, excluding the total FX impact, it would actually be seeing YoY revenue growth in Q3’23 of ~22%, & that FX had an incremental negative impact of ~$(10) million. If I add this $10m impact back into the Q3’23 revenue guidance, I calculate the YoY growth to be 15%, not 22% – so, I think this is a case of management trying to paint the prettiest picture possible.

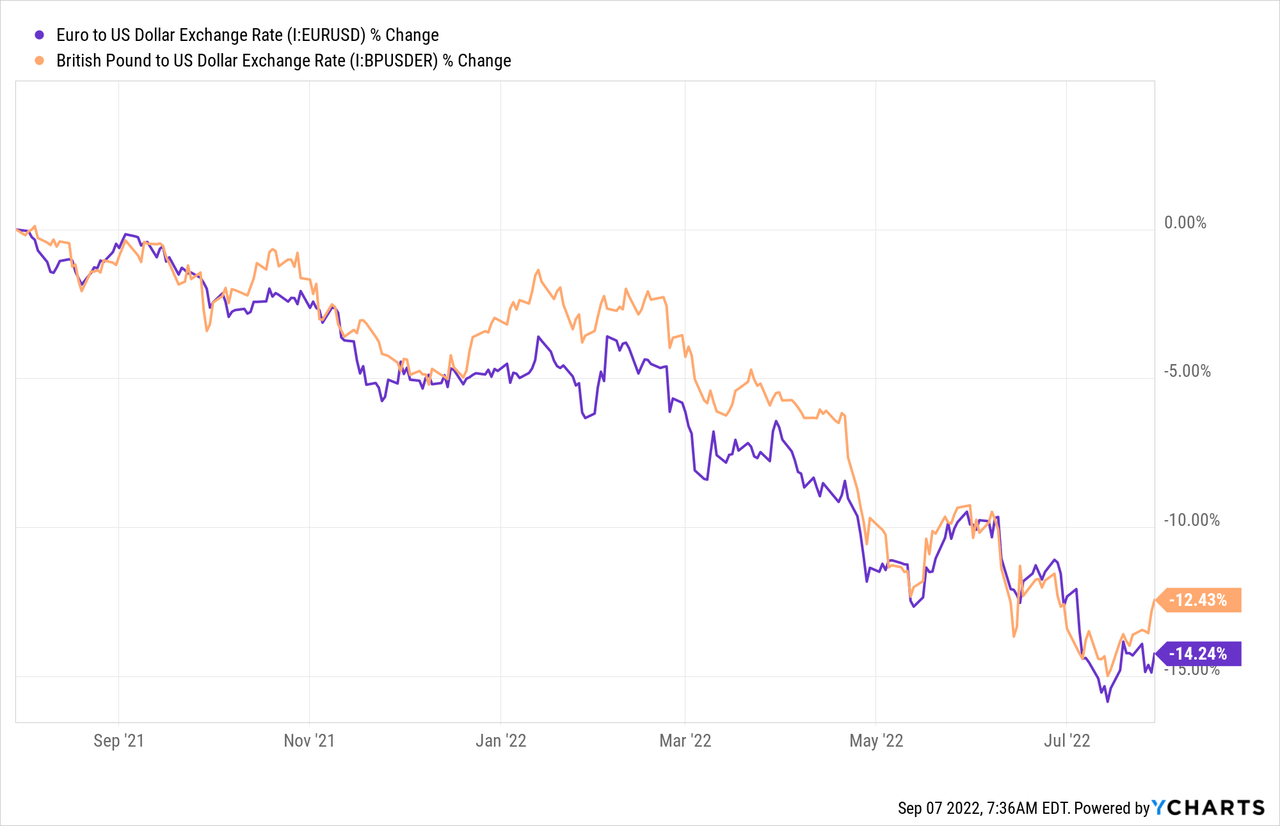

In fairness, however, the exchange rates of currencies against the dollar has certainly not worked in UiPath’s favour in the latest quarter. This globally diversified company is unsurprisingly hit by a strengthening dollar; I don’t think it’s an excuse for the poor quarter, but I certainly have some sympathy.

On the earnings call itself, Gupta gave a bit more colour to the headwinds:

Let me now turn to guidance. First, we guide to what we see in the pipeline, which continues to fluctuate given the choppy macroeconomic environment, which we anticipate will continue. Second, more than half of our business is outside the U.S., and we price in local currency, including euro and yen. And as a result, there is a material FX headwind for both ARR and revenue that has significantly increased as we move through the year.

Lastly, going forward, as Rob said, profitability is a core pillar of our go-forward strategy. While the reduction in our top line near-term forecast reflects the FX headwind of the macroeconomic environment and our internal repositioning, we are committed to our goal of achieving non-GAAP profitability and positive adjusted free cash flow in fiscal year 2024.

Gupta’s third and final point references newly appointed Co-CEO Rob Enslin’s aim to balance investing for long-term growth and expansion of operating margins. Whilst it’s great to see UiPath’s focus on reducing its cash burn, I really do not like that it is being used as an excuse for the lack of growth. This is a business that should be able to benefit from scale; profitability and growth go hand in hand. UiPath also has a stellar balance sheet, with ~$1.7B of cash and zero debt, so it’s not like the company has to desperately cut back on spending. If this is foreshadowing a prolonged slowdown in growth, it will truly test the patience of investors (including myself).

Another reason behind the slowing growth for UiPath is that companies appear to be pulling back on their non-urgent spending; or at least, taking more time to make decisions on large investments such as RPA. As Co-CEO Enslin highlighted:

We’re definitely seeing budget discussions taking longer, C-level executives getting engaged in as we view automation, obviously, as a key growth lever for companies

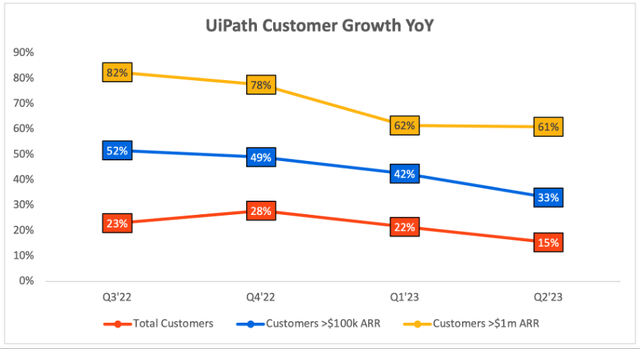

This has been reflected in the YoY growth rates when it comes to different types of customers for UiPath. Enterprise level customers are still seeing strong growth rates, and the number of customers with more than $1m in ARR grew 61% YoY, but this was still falling alongside the YoY growth for all customer types.

In short, there are some very real issues currently faced by UiPath – and macroeconomic uncertainty combined with FX headwinds are out of management’s control. I do, however, expect more from this company, and I’m unsettled by leadership’s apparent focus away from growth. Perhaps this is just to try and appease Wall Street until the macroeconomic environment improves, but there are certainly plenty of reasons for investors to be concerned.

It’s Not All Bad

… but it mostly is – yet it’s important to try and highlight the positives as well, and I believe there was one takeaway in particular that gives me encouragement when it comes to UiPath’s long-term success.

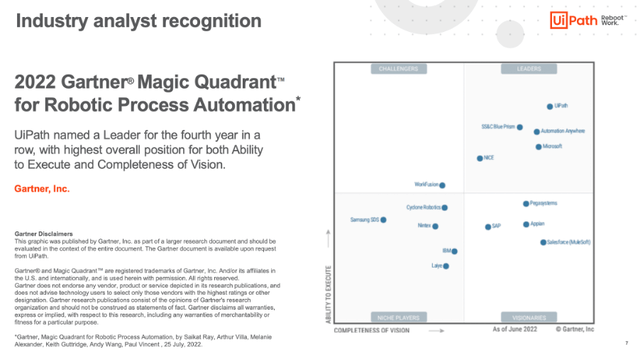

The company was recognised as the leader in Gartner’s Magic Quadrant for Robotic Process Automation for the fourth year in a row, remaining ahead of its competitors once again.

UiPath Q2’23 Earnings Presentation

Whilst the results of the company are taking a pummelling, it is somewhat reassuring to know that UiPath remains the technological leader in this emerging industry. At a minimum, this makes it a more attractive acquisition target, but that is not why I invest in businesses.

To me, this shows that if UiPath can start to land more deals, its technology will speak for itself & drive incredible benefits for its customers. CFO Gupta highlighted on the earnings call that dollar-based gross retention was 98%, and so clearly customers who use UiPath are sticking with the product & must be seeing the benefits. We remain in the very early innings of RPA, and despite current difficulties, UiPath is still where I’m putting my money.

PATH Stock Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether UiPath is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

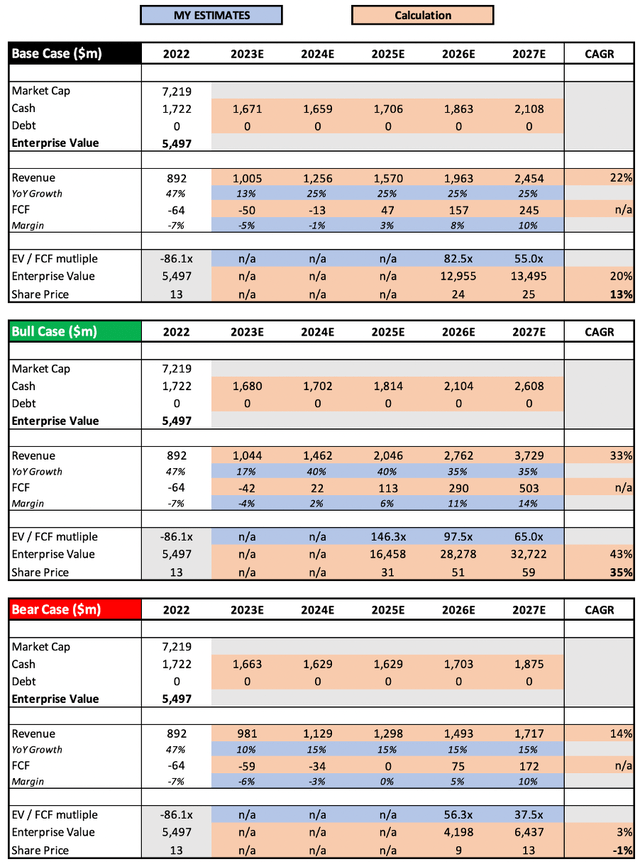

I have slightly changed the valuation model from my previous article in order to better demonstrate the potential of both the bull and bear case scenarios. My assumptions in the base case scenario remain similar to my previous model, with changes only made based on updates from management in these Q2 results – which, unsurprisingly, negatively impacted my model, particularly in 2023 since revenue growth will be much lower than originally thought.

In the bull case scenario, I envision UiPath riding out the macroeconomic storm & then going on to fulfil its potential as the leader in this rapidly growing industry, with FCF margins that expand as the company scales up. The bear case scenario effectively assumes the opposite; that this pain is here to stay for UiPath, and that it is a company-specific problem rather than a macroeconomic issue.

Put all that together, and I can see UiPath shares achieving a CAGR through to 2027 of (1)%, 13%, and 35% in my bear, base, and bull case scenarios respectively.

The implication is simply this; if the company executes on its strategy, I think it will be a stellar investment. If it fails to execute, I think it will be a poor investment. Right now the company doesn’t appear to be executing, so the question for long-term investors is whether or not you think it’s more the fault of management, of more the fault of uncontrollable macroeconomic factors?

Investment Thesis: On Track With Warning Signs

Whilst this was a bad quarter, I would say that my investment thesis is still on track for UiPath: it remains the leader in a fast growing, important industry that should only continue to expand, it still has a stellar balance sheet, it has a founder-CEO with skin in the game, and it has a strong gross margin profile.

Yet I would be foolish to ignore the warning signs; macro-induced or not, growth has decelerated rapidly. The best companies out there have weathered these macroeconomic headwinds, such as two of my largest holdings CrowdStrike (CRWD) and The Trade Desk (TTD) – so perhaps I’ll cut UiPath some slack, but poor macroeconomic conditions are by no means a complete excuse for poor performance. I still believe that there are many reasons to remain optimistic about UiPath’s future, but do not ignore the warning signs that keep flashing.

Until I see a change in UiPath’s success, specifically a rebound in growth rates, I will be pausing my personal accumulation. UiPath currently makes up ~2.5% of my portfolio, and despite the drop in share price that we’ll see when the market opens, I won’t be putting any more money into UiPath until I see evidence that this business is capable of returning to >25% YoY growth.

Given all this, I will downgrade my rating on UiPath from a ‘Buy’ to a ‘Hold’, and adopt a ‘wait and see’ approach over the coming quarters.

Be the first to comment