JHVEPhoto

One of the understandable limitations of quantitative analysis is its inability to predict executive actions. Micro Focus International (NYSE:MFGP) scored poorly on Seeking Alpha’s dividend scorecard and grading system. This suggested the struggling firm would cut its dividend.

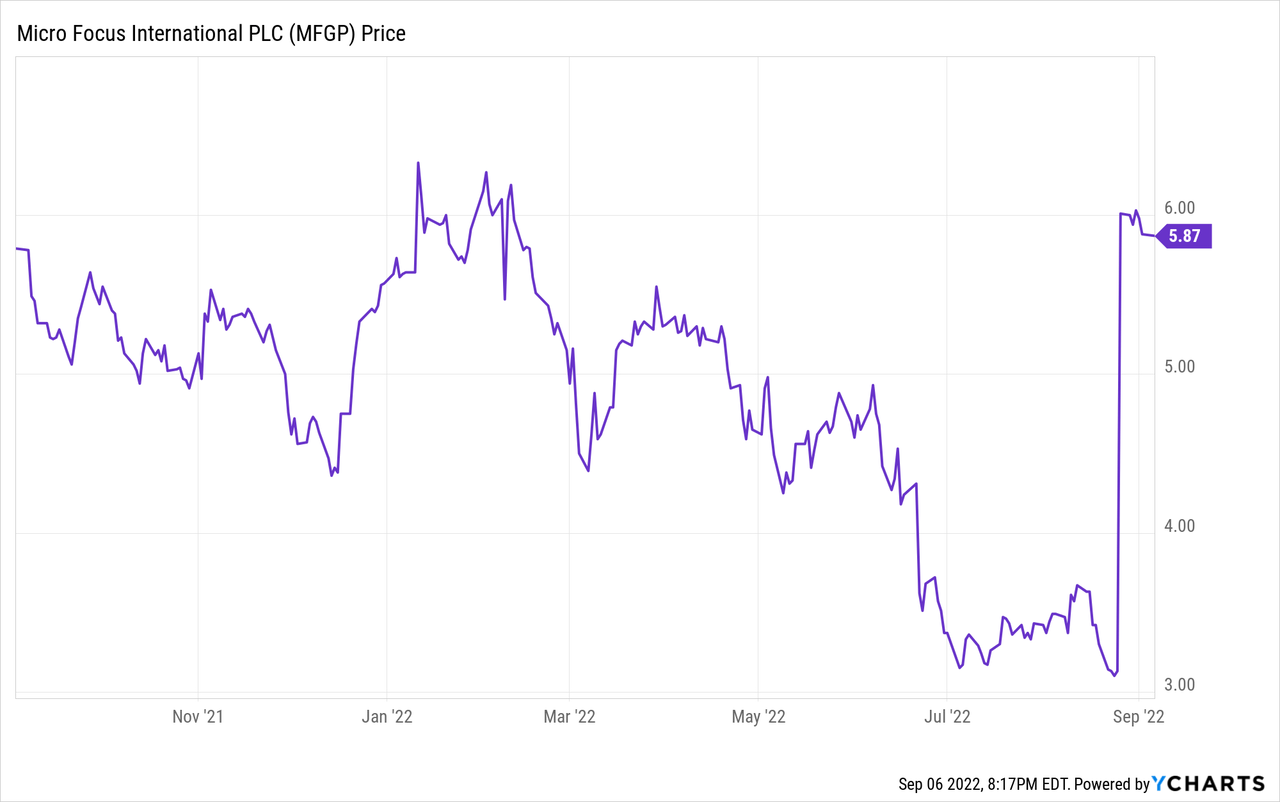

This is not a criticism of quantitative stock scores. It is a reminder that investors need to complement those figures with fundamental analysis. MFGP stock gained 73% on an unpredictable turn of events. Open Text (NASDAQ:OTEX), a Canadian software firm, offered to buy Micro Focus for an enterprise value of $6 billion. Open Text is serious about the deal. It is buying the company in an all-cash deal. Conversely, AppLovin’s (APP) bid for Unity (U) appeared suspect. If agreed upon, Unity shareholders would receive 55% of the combined company’s outstanding shares.

What should Micro Focus investors do? Is the stock a hold until the deal closes? Is Open Text a buy?

Deal Details

Open Text will offer MFGP shareholders cash at an enterprise value of $6.0 billion. Enterprise value is the sum of market capitalization plus total debt less cash and cash equivalents.

EV = MC + Total Debt – C.

At a $5.87 share price, Micro Focus has a market capitalization of $1.9 billion. In its quarter ended October 2021, the firm had total debt of $4.524 billion. After subtracting $578.7 million from its April 2022 quarter, its enterprise value is $5.845 billion.

Shareholders who hold until the deal closes will earn another 2.65% from here. By comparison, the 1-3 year Treasury Bond (SHY) yields 0.67%. The return from MFGP here is comparable to the 30-year Treasury Bond ETF (TLT), which yields 2.17%. The difference is that shareholders face a low risk of the deal falling through. TLT investors risk further downside as stock markets price bigger interest rate hikes.

Investors should have a high level of confidence that the deal will close. This suggests they hold MFGP stock until the deal closes.

Combined Strength

Open Text sells information management software. Its cloud-native solution enables customers to master modern work, digitize supply chains, and create communication-centric experiences. By acquiring Micro Focus, it will increase its company size, customer base, and global scale.

Micro Focus customers benefit from Open Text’s expertise in accelerating customer digital transformation activities. Companies must realize higher efficiencies to lower operating costs. The two firms have a combined total addressable market of a whopping $170 billion. Open Text CEO & CTO Mark J. Barrenechea believes the company will realize higher adjusted EBITDA immediately.

Debt Raised

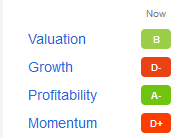

Open Text will fund the aggressive acquisition using its existing cash and raising new debt. It will also tap into its existing revolving credit facility. It is getting an excellent deal. MFGP stock has strong scores on valuation and profitability:

SA Premium

In the last few years, it failed to realize growth. Shareholders suffered because the stock fell from over $6.00 at the start of the year to a low of around $3.00. Recent speculators doubled their return.

Open Text has equally poor SA growth quant scores with a D- grade:

SA Premium

OTEX stock momentum scores a D+. Before Open Text announced the deal, the stock trended consistently lower.

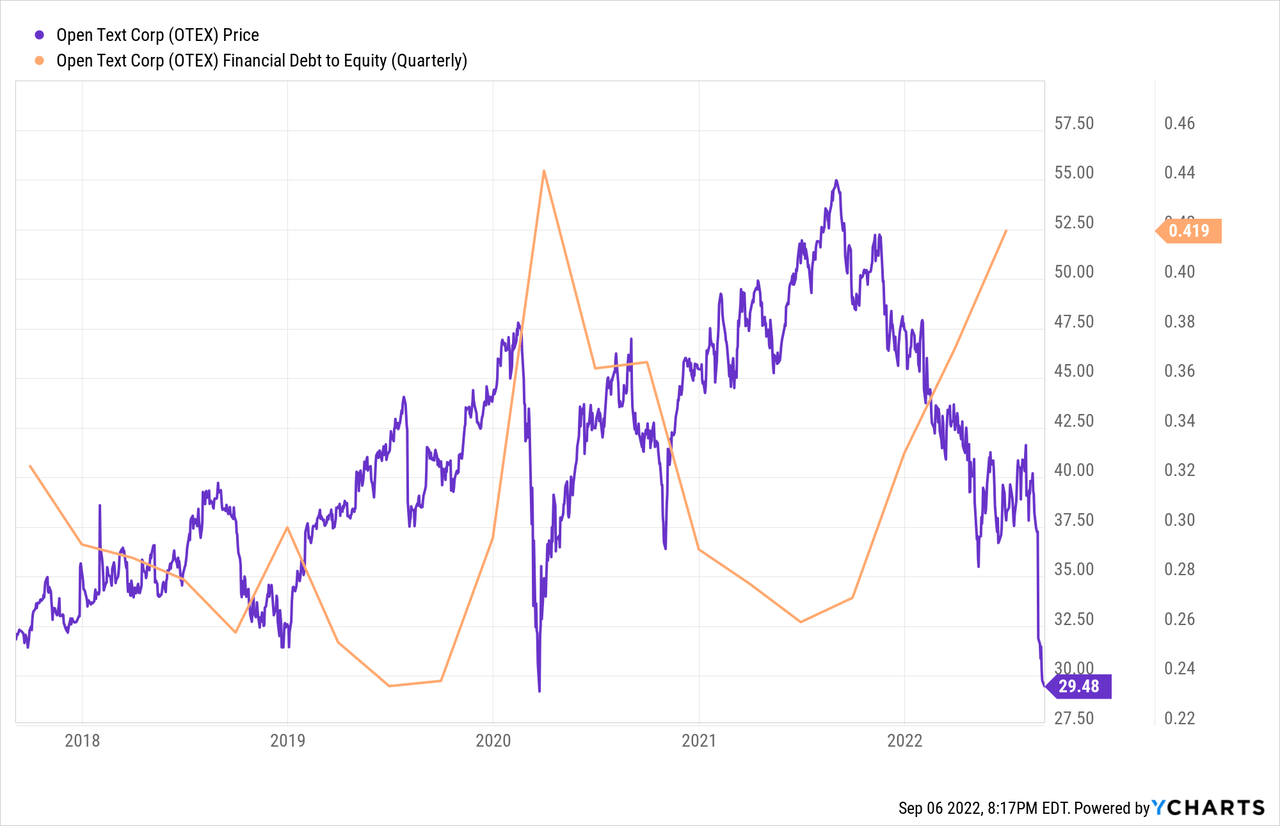

In the above chart, Open Text stock fared well when it reduced its financial debt to equity.

The stock broke down from horizontal support at $40 after the deal announcement. It closed at $29.47 on Sept. 6, 2022.

Weak Prospects

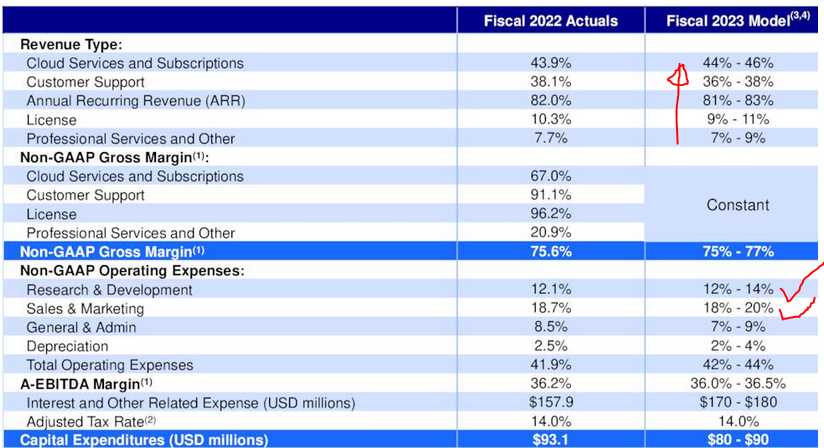

In the fourth quarter, Open Text posted anemic growth rates. Total revenue rose by only 1.0% and 4.7% in constant currency terms. Still, annual recurring revenue accounts for 82% of total revenue. It grew by 6.6% Y/Y or up by 9.8% in constant currency. Cloud revenue grew by 14.3% Y/Y. Non-GAAP earnings of 80 cents a share are unchanged from last year.

Growth in Open Text’s cloud revenue will continue. Customers are migrating from off-cloud to its content cloud. The stock is underperforming because investors are worried the digitization trend will lag.

The company’s growth might stall not from an industry slowdown but limited staff resources and skill availability. As Open Text expands globally, these staff skill limitations will intensify. Fortunately, the company has a steady long-term through 2030. For example, it is Toyota’s (TM) supply chain partner. Toyota has 2030 electrification goals.

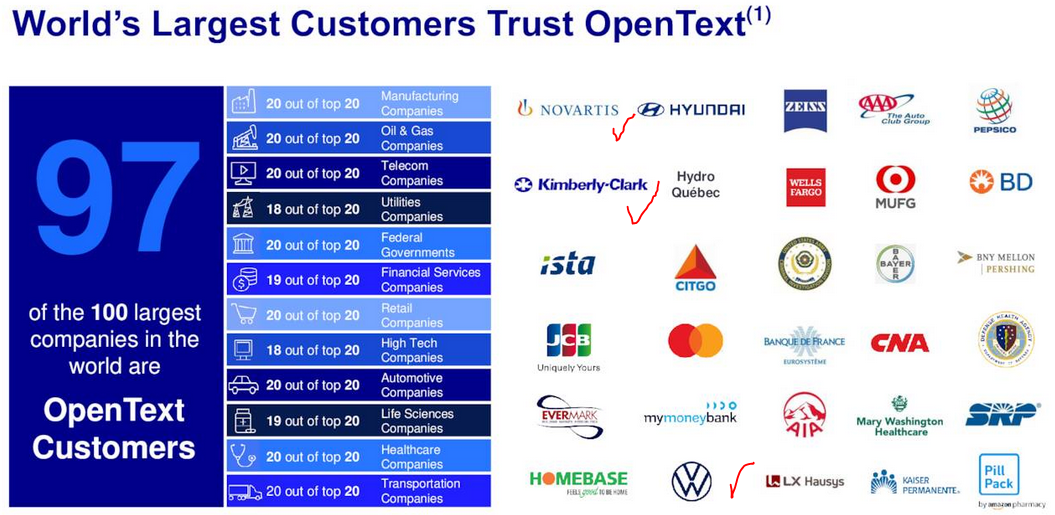

97 of Open Text’s customers are among the 100 largest companies in the world:

Open Text Q4/2022 Presentation

Data courtesy of Open Text Q4/2022 Presentation

Outlook

Before the deal closed, Open Text forecasted strong revenue growth for fiscal 2023. It is also expected to raise its research and development costs:

Open Text Q4/2022 Presentation

The deal does not come without risks. Higher administration costs related to the deal could weigh on OTEX stock. In addition, customer demand may slow as the economy worsens through 2023. This would pressure management to lower its revenue guidance excluding Micro Focus.

Your Takeaway

Current MFGP shareholders who bought the stock after this article lost 17% or -10% in total return. Investors should hold the stock until the deal completes to realize the small discount.

Using the cash proceeds to buy Open Text stock is too risky at this time. Most companies I tracked post-integration fell 12-18 months after the deal closed. Consider waiting for a few months until after the deal closes before considering OTEX stock.

Be the first to comment