Sundry Photography

Our devoted readers know that we usually summarise our buy case recap and the main company’s event in the first paragraph. Today, we immediately start with STMicroelectronics’ Q2 performance analysis in order not to influence your view.

Q2 Results

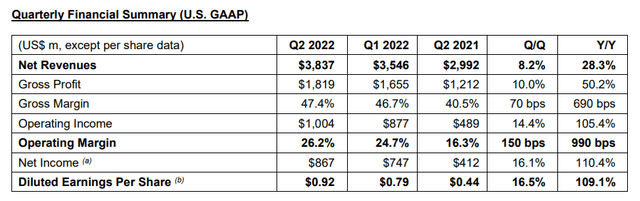

STMicroelectronics (NYSE:STM) recorded an increase in top-line sales of 28.2% and reached $3.84 billion in the quarter. Sales were supported by all product groups: Automotive and Discrete division signed a +35% to $1.45 billion, Microcontrollers and Digital ICs division increased by another +39.5% to $1.25 billion, and Analog, MEMS and Sensors delivered a +11.3% to $1.12 billion. The gross margin stood at 47.4% and was supported by favorable prices and a better product mix, partially offset by cost inflation. The figure is 140 basis points above the interim value of the company’s guidance. Going down to the bottom line, profits more than doubled to $867 million compared to $412 million in the same period of 2021. Free cash flow also improved significantly to $230 million ($125 in the same quarter of last year) and the company distributed cash dividends for $54 million and repurchased its own shares for $87 million as part of the buy-back plan currently in place. The Italian-French chip maker’s EPS grew from $0.44 to $0.92.

Our assessment

“Q2 net revenues and gross margin came in above the mid-point of our business outlook range driven by continued strong demand for our product portfolio” explained the CEO. Love for our ears.

Looking at the Wall Street analysts’ expectations, STMicroelectronics beats estimates in almost every line. Sales and operating income were above consensus by 3% and 12% respectively.

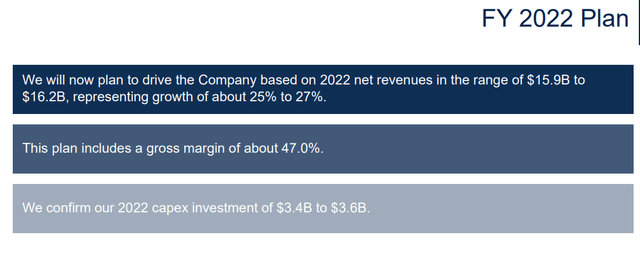

The company raised its 2022 revenue and gross margin target. More in detail, turnover is expected at the end of the year between $15.9 billion and $16.2 billion and the gross margin at around 47%. The previous analyst guidance was for revenues between $14.8 billion and $15.3 billion and the average consensus gross margin was at a lower level than 46%.

Conclusion and Valuation

We are sorry for all the numbers and we say no more. Our internal team now expects that analysts will materially upward the company’s outlook and the implied target price. Today, we were not surprised by the positive stock price reaction. Concerning the valuation, we reaffirm our buy rating valuation at a price target of €60 per share. This is based on a 21x P/E multiple versus a current P/E of 18.7x. The company is currently trading at a significant discount compared to its historical average.

If you are curious to read our buy case recap, have a look at our previous publications:

Be the first to comment