tifonimages/iStock via Getty Images

Base and precious metals have seen a slight decline in price over the past year with gold at -5.51%, silver at -28.12% while copper tumbled more than 35% from its March 2022 peak. Fears of a global recession have continued to rise sapping demand for these metals. To combat the rising inflation, major central banks have embraced tightening to raise interest rates. Investor sentiment has declined in the meantime tagging along with the demand for soft physical commodities. This trend has elevated the U.S. Treasury yields and also the U.S. dollar with the dollar index trading above the 20-year highs above $108.

TradingView

Thesis

Despite losing⁓ 61% in its share price over the past year, Copper Mountain Mining Corporation (OTCPK:CPPMF) expects to build momentum through a large throughput and mineral production increase in Q2 2022. The company intends to begin mining higher-grade minerals from Phase 4 in mid-2023 thereby instilling a positive effect on its cost per pound. Higher copper recovery is expected to continue in Q2 2022 in line with the plant improvement projects. Notable also is the fact that CPPMF has reduced the CapEx relative to EVA, with market speculation that it plans to sell the copper project.

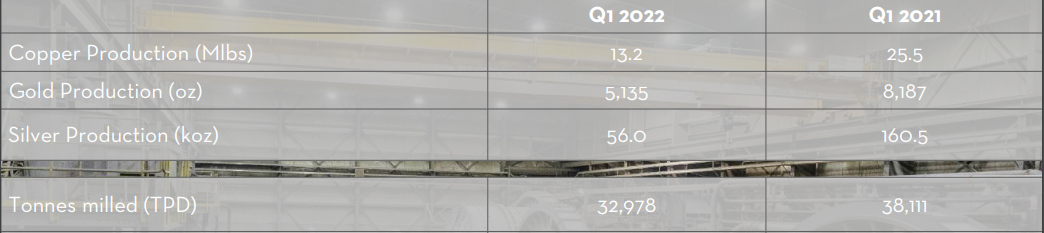

Throughput and Mineral Production

Q1 2022 saw CPPMF record a decline in production due to low grades combined with minimal tonnage rates. Copper production declined 48.24% to 13.2 Mlbs, gold production was down 37.28% while silver production was the worst hit at -65.11% having declined from 160.5 Koz in Q1 2021 to 56.0 koz in Q1 2022.

Copper Mountain Mining Corporation

Milled tonnages ticked 13.47% lower than the previous years. While there was a decline in production it can be deduced that Copper Mountain Mining Corp has been shifting to lower-grade mineral ores. The shift has not been driven by the exhaustion of high-grade deposits but rather by its dilution of mineral grades. Some factors that are attributed to this change include the improvement in metallurgical technologies, the need to increase volume while lowering extraction costs, and the extension of the life of old mines as compared to establishing new mines.

CPPMF’s CEO Gil Clausen, while releasing the Q1 2022 results stated,

With a new mine, you have to spend all the capital to get the mine up and running. I think we can do meaningful chunks of expansion with incremental investments. So that is the advantage that existing mines have over new construction.”

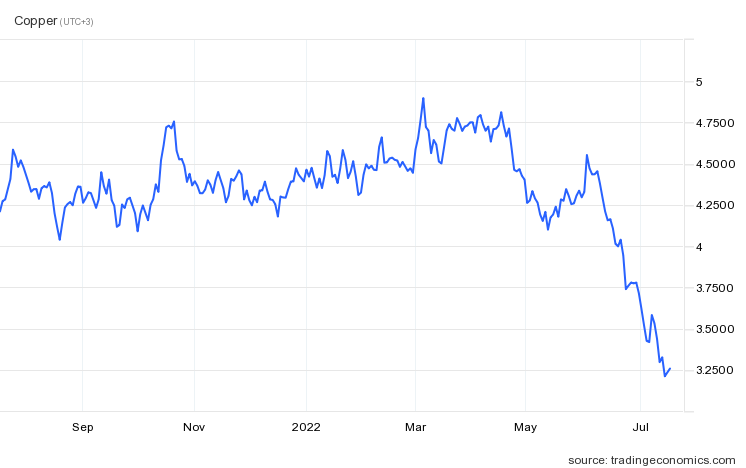

The company also raised its daily production guidance from 65,000 tons to 100,000 tons through the concentrator indicating a stronger forecast for increased metal prices. Despite tumbling towards the $3 price change, copper reached its all-time high price at $5.02 per pound on March 6, 2022.

Trading Economics

Widely described as the global economic barometer, analysts are of the view that copper supply shortages are likely to grow to unprecedented and untenable levels in the coming decade. Producers such as CPPMF are grappling with the expected increase in demand by 2035 despite the global shift towards green energy and away from fossil fuels. Copper prices per metric ton are expected to soar back to $10,845 after they fell below $7,500 in Q2 2022. According to S&P Global, this price increase will be motivated by the embrace of clean energy and the growth of the transport industries that use this metal.

Trolleys and GHG emission control

CPPMF has declared that it has the potential to be the lowest GHG-emitting open-pit copper miner in the world. To prove its stand, the company successfully commissioned the Trolley Assist Project in Q1 2022. This project aims to lower carbon emissions at the Copper Mountain Mine by at least 30%. Using the trolley-capable haul truck, the company will be able to consume only $7.40 of electricity for a 1 trolley section as compared to $83 of electricity (a reduction of 91.08%).

Notable is that Copper Mountain’s electric-powered trucks will double the speed of diesel trucks using a tenth of the unit energy’s cost (at almost zero GHG emissions). The company also explained that it is expecting to continue with positive drilling at its New Ingerbell Mine after adding 28,000 meters there bringing the total drill to 50,000.

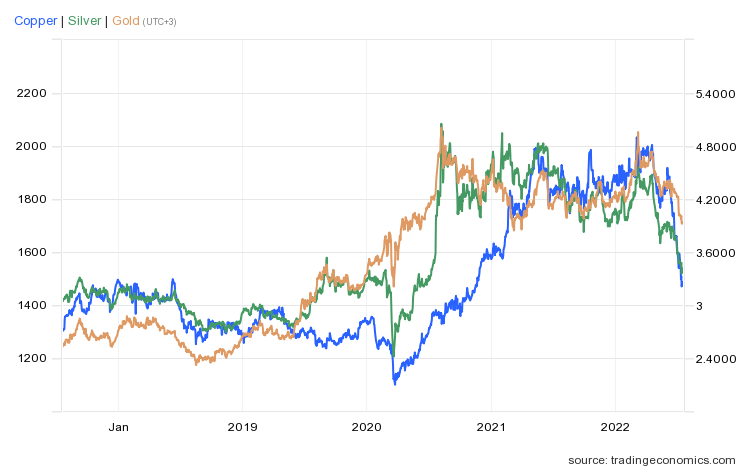

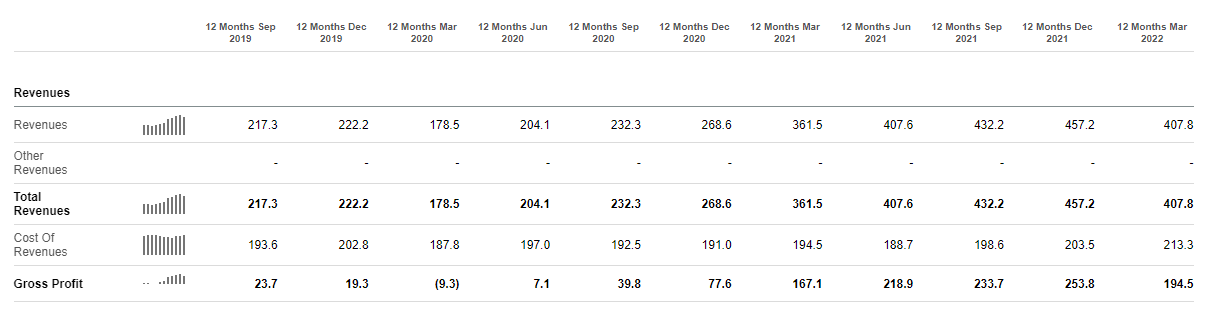

However, the decline in mineral prices led to reduced revenues within the quarter as compared to Q1 2021. Still, prices were better than the 2020 lows experienced after the global lockdown at the heart of the pandemic.

Trading Economics

A five-year analysis shows that the price of gold, silver, and copper hit a steady rise in mid-2020 after the onset of the COVID-19 pandemic.

Copper Mountain Mining’s Q1 2022 results

While the metal prices were higher in Q1 2022 as compared to Q1 2021, it did not stop the company from realizing a substantial decline in gross profits (YoY). The company’s gross profit declined by more than 80% to C$18.6 million or $14.9 million. Of course, the cost of sales was higher in the quarter not just for CPPMF.

Over the past year, Freeport-McMoRan (FCX) has fallen 24.46% while Southern Copper Corporation (SCCO) declined 26.58%. Both SCCO and FCX’s cost of revenue in the 12 months trailing to March 2022 grew by 3%. Nonetheless, SCCO offered a better deal to investors in terms of dividend growth yielding 8.84% against FCX at 1.16%.

Copper Mountain aims to lower its cost of sales to the range of $2.25 to $2.75 per pound in the second half of 2022 from the current cost of $3.58 per pound. The company realized a higher all-in cost of $5.08 per pound further explaining why it had a drastic reduction in gross profits despite realizing lower revenues in the quarter.

Price growth prospects and assumptions for 2022

CPPMF explained that it closed Q1 2022 with zero-cost collar option contracts on a monthly balance of 3.3 million pounds of copper. While the floor price of this copper was $4 per pound, the company set the average ceiling at $4.91 (for the rest of the year 2022). This guidance is higher compared to the current copper price traded at $4.54 in Q1 2022. Further, production guidance was also set in the range of 80 million pounds to 90 million pounds of copper.

Since copper is now trading slightly below $3.50 per pound, the price will probably rise slightly towards $4. With Copper Mountain selling at least 80 million pounds of copper (at an average of $4) for the remaining part of the year. We are looking at a revenue of $320 million from copper alone (in the nine months until December 2022). The company’s guidance also shows the company intends to take copper production to the range of 90 million pounds to 105 million pounds by the end of 2023.

Copper Mountain also produced 5,135 ounces of gold (down 37.28% from 8,187 ounces) and approximately 60,000 ounces of silver (down 65% from 160 million ounces realized in Q1 2021). As noted before revenues for gold and silver have stood at a third that of copper is the main revenue stream for the company. As of Q1 2021, CPPMF hit $162.2 million in sales against C$93.9 million realized in Q1 2022. In Q2 2022 of the C$93.9 million realized in sales, approximately C$62 million was attributed to copper leaving out C$31.2 million attributable to gold and silver. In Q1 2021, of the C$162.2 million realized in total sales, about C$107.3 million was attributed to copper leaving out C$54.9 million for gold and silver. From these statistics, we can conclude that gold and silver take up a third of total revenues (as of now). The numbers may change in the future as Copper Mountain increases production and shores up higher-grade minerals as indicated in its Q1 2022 earnings call.

Arguably, both gold and silver in the remaining 9 months to December 2022 may realize at least C$100 million in sales if copper manages to hit at least $320 million (from the Q1 2022 guidance standpoint). A revenue balance of $420 million in the remaining 9 months of 2022 will help to grow the share price and help to create value for shareholders. However, various risks exist that may limit this growth.

Risks

Copper Mountain’s cost of sales has grown by 10.18% (in a TTM analysis) from September 2019 to March 2022.

Seeking Alpha

The production guidance of 80 million pounds to 90 million pounds of copper is the largest forecast for the company and it is yet to reach this point. Still, it remains achievable since the company will concentrate its production in the proven sections of the North Pit with a lower-cost pit. The company also expects to complete its three plant improvement projects (in Q2 and Q3 2022) that will grow production levels with improved recovery times and greater tonnage capacity to handle high-grade tonnages.

Copper Mountain’s recovery is pegged on the price of copper, silver, and gold. These minerals have been declining in price after hitting premium levels in Q1 2022. A further reduction in these prices will not only lower the revenue levels but also affect metal output. A price increase will have a direct effect on production and sales.

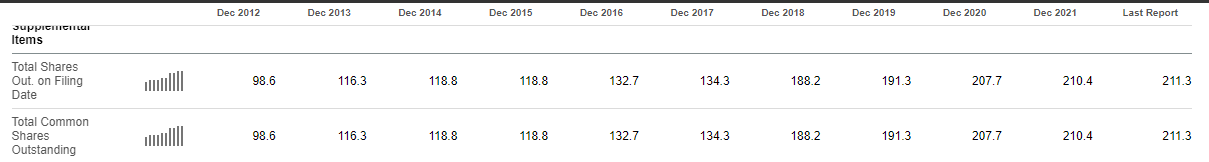

Copper Mountain’s outstanding share balance is at 211.3 million up from 207.7 million- recorded by year-end 2020 (an increase of 1.73%).

Seeking Alpha

Investors will be hoping that the dilution level remains under 10% for the remaining part of the year to ensure it does not affect the stock price which sits under $1.50 a share.

The company has also witnessed an increase in CapEx from $53.1 million in the 12 months leading to March 2021, to $141.3 million in the 12 months leading to March 2022. Cash used in investing has grown 166% and is expected to increase into the second half of the year. However, the company has continued to generate money from operations (currently at $215.3 million) thereby neutralizing the growth in CapEx). The company’s cash balance also stands at $114.8 million (down 15.53% from $135.9 million recorded in the quarter ending December 31, 2021) against a net income of $48.9 million. These numbers are low as compared to the total debt balance that currently stands at $281.7 million. CPPMF’s share price has been driven lower by the growing debt against the declining cash levels.

Speculation is rife that Copper Mountain may be looking to sell its Australian copper mining project, EVA. The project which is slated for commissioning in 2024 is expected to boost production by up to 100 million pounds of copper. While the company responded to these allegations by noting that it had no pending transactions concerning the EVA project, it did however affirm that it had engaged Macquarie Capital to evaluate the strategic opportunities attached to the project. At the moment, Copper Mountain is running out of cash and it may do well to sell the project and advance on its current mines to realize growth.

Bottom Line

Copper Mountain Mining Corporation’s success is pegged on the pricing strength of copper, gold, and silver. While copper remains its dominant metal, it has tumbled by more than 35% from its March 2022 highs. Additionally, the company has raised its production guidance to a high of 90 million pounds in the remaining part of 2022 and up to 105 million by the end of 2023. These levels will shore up revenue levels with estimates indicating it could be approximately $300 million in revenues in the nine months leading to December 2021. However, there is an imbalance between the growth in debt and the cash levels which may force the company to dilute the stock. In our view, the sale of the EVA copper project in Australia will add shareholder value as it will inject the much-needed cash needed to boost production. Due to the uncertainty regarding this sale as well as the apparent inability to increase boost production towards the proposed 90 million mark, we recommend a hold rating on the stock.

Be the first to comment