jittawit.21

Realty Income Corporation (NYSE:O) is one of the best real estate investment trusts on the market right now for income investors.

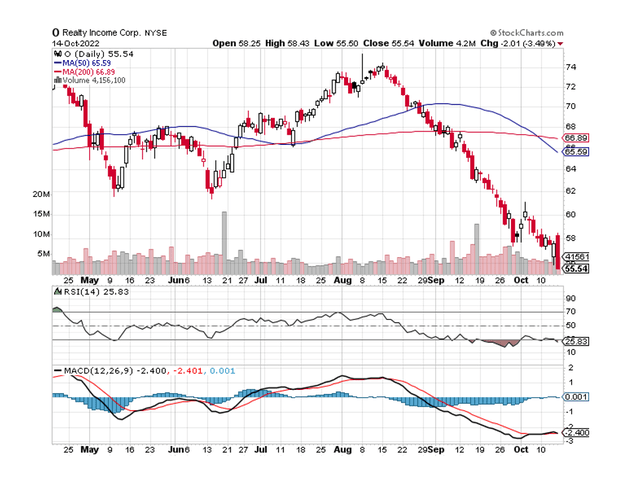

According to the Relative Strength Index, the trust has formed a double-top formation, is now in a short-term down channel, and is oversold.

At the same time, Realty Income provides one of the most secure and consistent dividend growth rates in the real estate investment trust sector.

Since the trust’s stock price has dropped to $55 in the last two months, I believe there is an opportunity for income investors here even if Realty Income’s stock price falls further.

Why Realty Income Is Now Oversold

Realty Income’s stock price has fallen from $75 in August to $55 in October, and we may see a couple of dollars more downside in the near term.

However, Realty Income completed a double-top formation (a bearish sign) in August before the stock began to fall, and Realty Income is now oversold based on an RSI value of 25.8.

This, in my opinion, is the best time to invest in the retail-focused commercial real estate investment trust since the peak of the Covid-19 crisis in the summer of 2020.

RSI (StockCharts)

The reason for Realty Income’s stock price correction is that the central bank raised interest rates by 75 basis points in September, the third such increase in 2022.

Furthermore, August inflation was 8.2%, indicating that the extremely hawkish central bank will continue to raise rates and shrink its massively bloated balance sheet.

As a result of these monetary actions, mortgage rates last week reached a new 20-year high just below 7%. High mortgage rates are a drag on the real estate market and many home buyers, potentially signaling a slowing of mortgage demand, lower real estate prices, and fewer real estate transactions.

Realty Income Has A Very High Margin Of Safety

The safety of Realty Income is derived from the company’s broad portfolio diversification and very low dividend pay-out ratio.

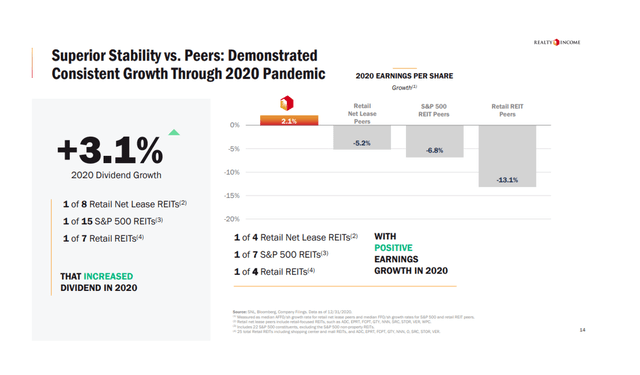

In the previous year, Realty Income’s pay-out ratio was 76%, and the trust was one of the best performers in terms of earnings growth at the peak of the Covid-19 market crash. Despite a tanking market and significant stress in the commercial real estate market, Realty Income generated 2.1% earnings growth in 2020.

Earnings Growth (Realty Income Corp)

Why The Market Is Overreacting To Higher Interest Rates

While high interest rates, inflation, and mortgage rates may dampen demand for new mortgages, there is no evidence that they have a significant negative impact on Realty Income.

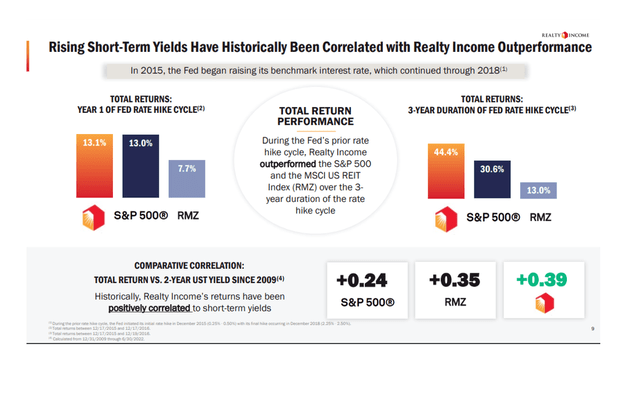

In fact, if the real estate market slumps as a result of higher mortgage rates, Realty Income may become even more aggressive in terms of acquisitions. During previous FED rate hike cycles, Realty Income’s stock either kept pace with or outperformed the S&P 500.

Total Return Performance Versus S&P 500 (Realty Income Corp)

Bargain Valuation

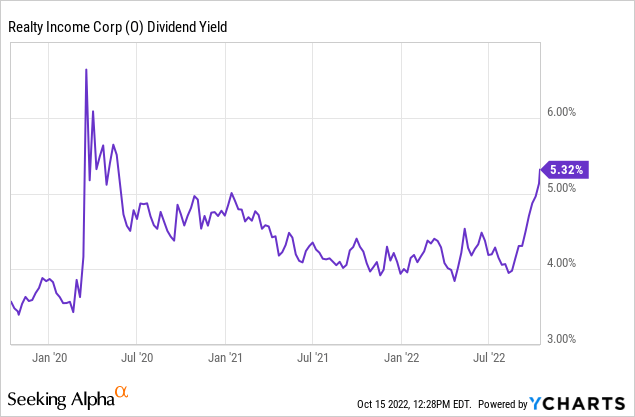

The valuation of Realty Income has never been lower in the last year than it is now. Realty Income has an AFFO multiple of 14.2x, the lowest the stock has traded at since July 2020, based on expected adjusted funds from operations of $3.84 – $3.97 per share in 2022. The valuation, in my opinion, is extremely compelling, and the trust’s yield has risen to 5.32% as a result of the correction.

Why Realty Income Could See A Lower Valuation

Realty Income’s stock price has dropped from $75 in August to $55 in October, a $20 decrease. In the short term, the trust’s stock price may fall a few dollars more, but the stock is already oversold, so I believe that dipping a toe in the water can make sense for income investors who value Realty Income’s extremely safe dividend.

In the short term, Realty Income’s stock will be vulnerable to further interest and mortgage rate increases, which could dampen mortgage demand for both home buyers and professional real estate investors. These factors should have no long-term impact on the dividend or the valuation of Realty Income.

My Conclusion

Realty Income is not in jeopardy. The stock price is down significantly and oversold, but the trust’s high-quality dividend is a buy regardless.

While the trust’s stock price may fall even further, I believe Realty Income’s dividend will be covered by adjusted funds from operations.

Furthermore, I believe investors are panicking as interest rates rise. Because mortgage rates have risen, the commercial (retail) real estate market may experience slower growth and fewer transactions.

Whatever the direction of the real estate market, Realty Income is well-positioned to continue paying its highly attractive monthly dividend.

Be the first to comment