da-kuk/E+ via Getty Images

The iShares MSCI France ETF (NYSEARCA:EWQ) is a way to play the pretty interesting French stock market. EDF, the major utility exposure, just got nationalized, so you don’t see it anymore, but the rest of the portfolio is now in pretty solid exposures that are demonstrating above average resilience even during the onset of a recession. The probability of sustained or at least solid earnings growth is higher than most ETFs right now, and therefore some premium is justified. However, whether the current PE can be justified is unclear. Based on current growth rates, the implied earnings growth to justify the multiple in the current environment seem decent, but with it still being unclear how bad the recession could be, and if we’re just at the recession’s mouth, there could be downside.

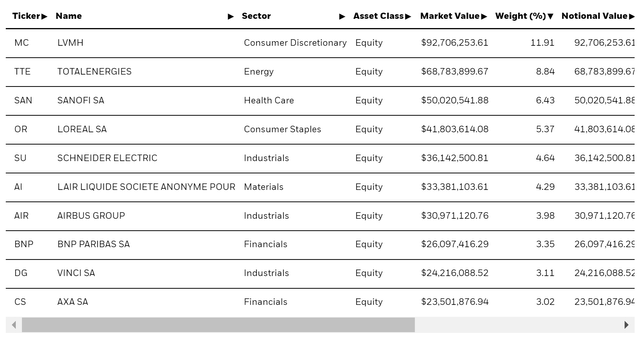

EWQ Breakdown

About 50% of the total portfolio is represented by the first page of the top holdings for the EWQ:

Let’s start with LVMH (OTCPK:LVMHF). Normally we’d be wary about consumer discretionary exposures, but the reality is that the skew towards luxury within the consumer discretionary bucket for the EWQ is to the ETF’s benefit. Luxury expenditure is not falling, and that is reflected in the revenue growth. They are exposed to lots of categories that have been provably strong of late, like alcohol, which is 10% of their revenue mix, and cosmetics. L’Oreal (OTCPK:LRLCF) is similarly managing substantial growth in earnings and revenue.

TotalEnergies (TTE) and Sanofi (SNY) are more exposures that should be pretty solid. TTE is oil price exposed of course, but the situation with supply cuts following any speculated demand declines likely keeps that price up, and profits relatively unharmed for the likes of TTE. L’Air Liquide (OTCPK:AIQUF) is similarly a more specialized commodity play that has been benefiting from rising prices of key industrial and medical commodities, even managing to grow gross margins with pricing action. Its specialty position makes it even a little more resilient than TTE. SNY has maybe a little more pressure because of its concentrated exposure to Dupixent and the fact that competitors are releasing drugs for similar treatment areas now.

Strong exposures like consumer staples and financials, as well as industrials with quite a few infrastructure players, occupy the rest of the portfolio and look strong.

Remarks

Of course there are some more exposed stocks within the industrials class especially, with companies like Airbus (OTCPK:EADSF) perhaps being riskier as they are levered to the macroeconomy and the propensity for CAPEXing as well as still levered to travel restrictions, where markets like China are still in lockdown, but there are a lot of companies who have assets to leverage for earnings growth.

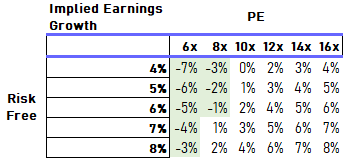

Our concern is that despite the resilience, the multiple could be questioned. The 12x multiple implies around an 8% earnings yield, which puts it ahead of risk free rates by only about 4% as of today, where a reasonable equity risk premium should be 6% if not more given the current environment.

Value Chart (VTS)

The earnings growth implied for the long-term is 2% given current rates and 4% given higher risk-free rates at 6% where we may get to. While earnings growth is very solid for these companies, we are awaiting more recessionary pressures as rates continue to rise and with the risk of an unemployment spiral as the Fed and other central banks try to achieve lower inflation through unemployment. Moreover, Europe is likely in a more structurally dangerous inflation environment than the US, so the pressure of demand destruction from totally shut off Russian supplies. Wealth is being destroyed.

However, just based on the currently managed earnings growth and the brand equity in some of the big portfolio movers like LVMH, the possibility of a 2% long term growth rate without interruption even from a recession is entirely possible, although we do believe the 2.5% growth assumption for GDP may be a little bit of the past. We merely question the PE, although it could be more than reasonable.

Be the first to comment