andresr/E+ via Getty Images

Intro & Thesis

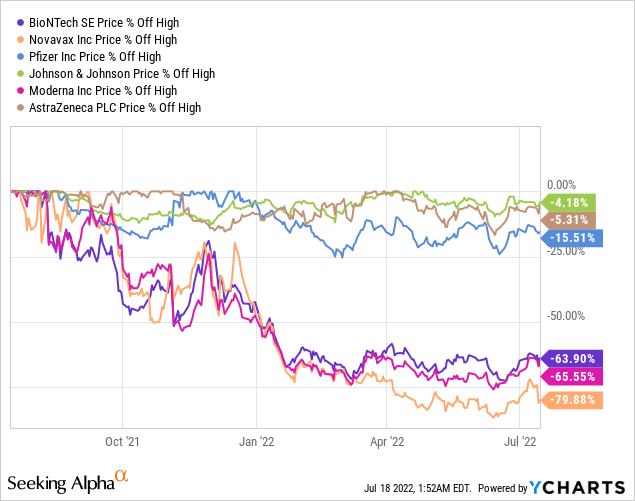

Since the beginning of the Russian war against Ukraine (February 24, 2022), geopolitics continued to be the main news in the world, and it seemed that everyone had forgotten about the pandemic COVID -19 – this was confirmed by the statistics on the decrease of new cases and deaths worldwide. The market immediately began to price this momentum into the share prices of vaccine manufacturers, which subsequently experienced a steep downward trend – only more diversified players like Pfizer (PFE) or Johnson & Johnson (JNJ) with a broad pipeline have survived.

Today, however, there are new signs of recovery in the fallen shares of this industry – the fall season is upon us, and already we are seeing an increase in the number of new cases in Europe that can quickly spread to the U.S. due to the hot tourist season. Fortunately, we know how to treat Omicron – with the help of boosters. In my opinion, one of the most undervalued and promising companies that can capitalize on new boosters’ demand is BioNTech SE (NASDAQ:BNTX).

Why?

First of all, I would like to explain in more detail my point of view on the coronavirus and its new wave.

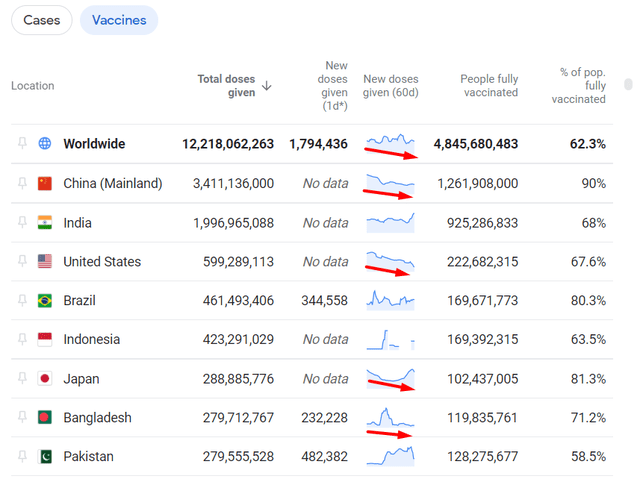

After long quarantine days, the world grew weary of coronavirus prevention – masks became optional and many people began to ignore updating their vaccinations, believing the virus was no longer dangerous. This can be seen in the dynamics of vaccination in the most densely populated countries in the world – in most of them there is a decline:

Google News, author’s notes

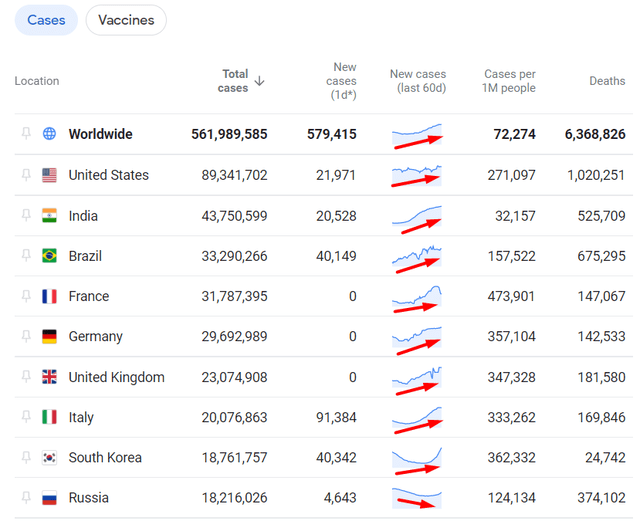

At the same time, we see a reverse (positive) trend in the number of new cases. Apparently, the widespread rejection of vaccination, resulting in the elimination of oversupply, has led to an increase in cases worldwide:

Google News, author’s notes

People are tired of sitting at home, and thanks to the hot summer they decided to go on vacation for the first time in almost 2 years – we can see that in the workload of airlines in the second quarter of 2022.

Airlines are resilient. People are flying in ever greater numbers. And cargo is performing well against a backdrop of growing economic uncertainty. Losses will be cut to $9.7 billion this year and profitability is on the horizon for 2023. It is a time for optimism, even if there are still challenges on costs, particularly fuel, and some lingering restrictions in a few key markets.

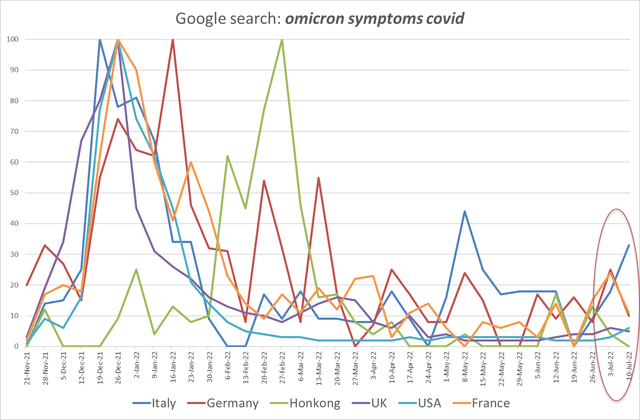

I recently returned from a vacation in Italy and got the impression that Milan, Rome, and Florence are 50% American in terms of population. No wonder now is high season for tourists, and when $1 = €1, it seems logical to relax in some of Europe’s most beautiful places, leading to increased demand for air travel. Many European countries have also abolished the requirement to present vaccination cards, which increases the number of tourists. However, since the start of the tourist season, the number of searches for omicron symptoms has skyrocketed – below is a graph based on Google Trends data.

Author’s calculations and notes, based on Google Trends

This is only a measure of the popularity of Google queries (measured from 0 to 100), not their absolute values. However, the result for Italy is remarkable (33 out of 100). The brain involuntarily tries to compare such an increase with the number of Americans I saw in Piazza Navona in Rome. I am afraid to imagine how quickly Omicron can spread again if even 3-5% of them bring the virus back to the U.S. in an asymptomatic form.

Therefore, as the flu season approaches, lasting from fall to early winter, I expect the increasing momentum of new cases in the U.S. and Europe to continue. In my opinion, the arrogance of people who have failed to update their vaccines could subsequently lead to increased demand for vaccines that have recently been thrown out due to oversupply.

Among the most oversold stocks in the vaccine industry – Novavax (NVAX), Moderna (MRNA), and BioNTech – BioNTech is my favorite.

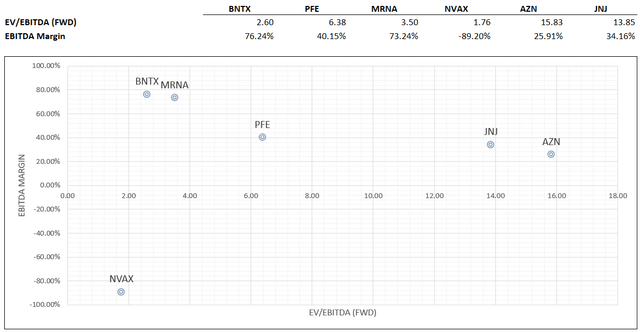

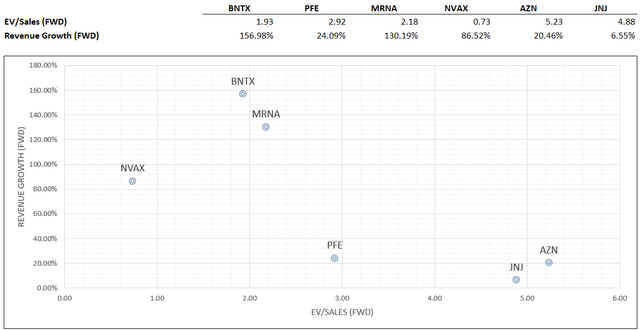

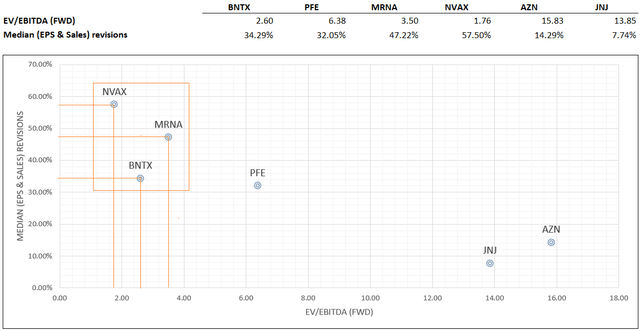

As I wrote at the beginning, the market began to factor in a fairly sharp decline in revenue and earnings per share in the shares of the fast-growing vaccine companies whose business was entirely dependent on the situation with the coronavirus in the world. For this reason, despite the astronomical growth of financial performance in the recent past, there was a sharp multiple contraction that brought BNTX, MRNA, and NVAX into the zone of apparent undervaluation compared to PFE, JNJ, and (AZN). No need to be surprised – the market always lives in the future. However, if my thoughts on the rise in case numbers are correct, then BioNTech is the most undervalued company in the sample, even taking into account that NVAX’s absolute valuation multiples are somewhat lower.

Author’s calculations, Seeking Alpha data

Author’s calculations, Seeking Alpha data

Author’s calculations, Seeking Alpha data

BNTX’s forward multiples are on average 37% lower than the median of the analyzed group, while its EBITDA margin is more than 2 times the median with forwarding revenue growth of 157% (the median is 55.31%). In other words, at a very low valuation, analysts expect BioNTech to more than double its sales by the end of this year (YoY), with the company’s high margins setting it apart from most other competitors.

Earnings revisions have improved recently. 29% and 40% of analysts have raised their EPS and revenue forecasts, respectively, which is in line with other peers. Therefore, the undervaluation of BioNTech stock cannot be explained by the “bleak future” – if it is coming, it should come equally for all companies with a small pipeline, not just BNTX.

I agree with what fellow SA contributor Edmund Ingham wrote in his recent article on BioNTech – the company should focus on mergers and acquisitions in the future to free itself from reliance on one drug:

BioNTech needs to deploy some of its $20bn of cash into some strategic M&A, in my view, in order to add more commercialized assets to its armory, and drive shareholder value.

Source: Edmund Ingham’s article

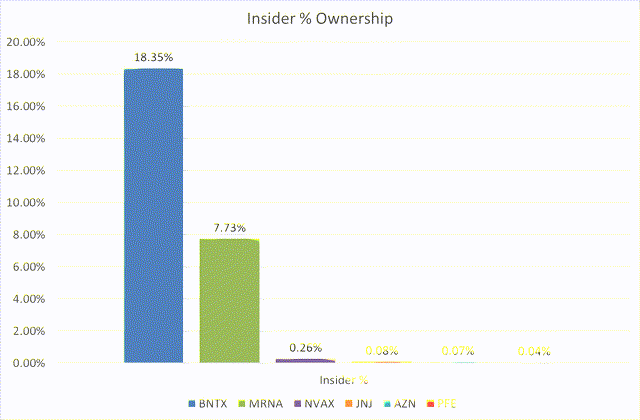

I think this can serve as an additional catalyst in the future – in any case, management has a motivation to do this because BioNTech is an owner-managed company where insiders hold >18% of all shares.

Author’s calculations, Seeking Alpha data

Talking about the technical picture, I think BNTX stock has managed to break out of its downward channel on the weekly chart and break through the levels of the 20-week and 100-week exponential moving averages, i.e. both the short-term and longer-term downtrends. Overboughtness, in this case, is not observed.

Investing.com, author’s notes

If we focus on horizontal volumes and match them with the movement of the stock, we can see that the next strong level of support/resistance is 27-30% above the current market price:

TrendSpider Software, BNTX (Heatmap feature)

Bottom Line

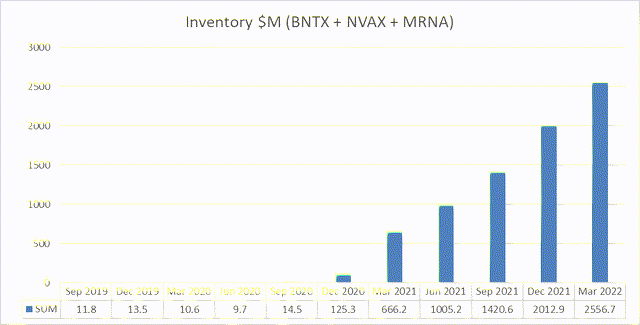

I must warn you about the significant risks of buying BNTX at current levels. I could be wrong about a possible recovery in demand for vaccines. Moreover, if we add up the book value of the inventories of NVAX, BNTX, and MRNA, we see that supply could be sufficient or even greater than needed to meet growing demand.

Author’s calculations, Seeking Alpha data

Also, my technical analysis may not match reality, because it is more art than science – if I see a breakout in the weekly chart, it does not mean that the stock “will definitely continue to soar”.

In any case, we are now seeing the trend of coronavirus returning to the news pages of various publications – people have gotten sick again, it is time to recall vaccines. As we head into flu season, Covid-19 prevention once again seems to be not a recommendation, but a prescription. Against this backdrop, BioNTech appears to be a clear favorite. The fundamentals are strong, the growth is high quality, the technical analysis is well positioned, and management is determined to lead the company to a brighter future.

Based on the above, I recommend that investors keep a close eye on this stock, buy on dips and hold it for at least the medium term.

Happy investing and stay healthy!

Be the first to comment