ijeab

R1 RCM (NASDAQ:RCM), a leading outsourced provider of revenue management services for hospitals and physician practices, recently provided a timely guidance update following the close of its Cloudmed acquisition. The timing was a surprise, given it came just before the Q2 2022 close and a couple of weeks before when RCM typically discloses its quarterly numbers, but the in-line (if not conservative) numbers should reassure investors heading into the August report.

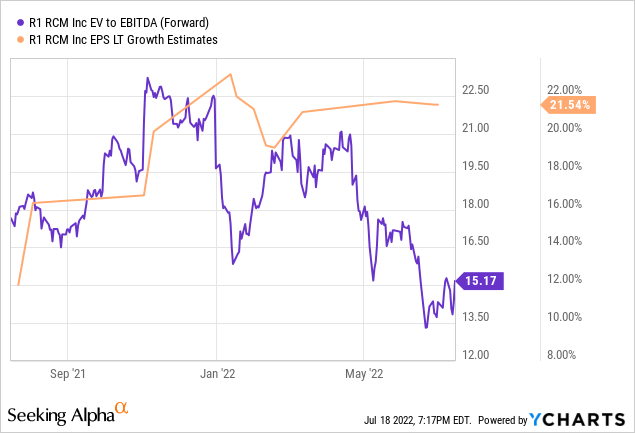

Long-term, the thesis remains intact – amid the ongoing pressure on billing compliance as well as inflationary pressures (mainly labor), hospitals and physician practices are increasingly incentivized to outsource internal functions to providers like RCM. With the company also looking to tap into digitization opportunities and leverage P&L gains from the recent Cloudmed acquisition, RCM is well-positioned to build out a stickier, recurring revenue base from which to grow for the years to come. Net, I view RCM’s premium valuation as warranted relative to its mid-teens revenue growth and >35% margin target, with positive earnings revisions likely as it unlocks incremental synergies from Cloudmed down the line.

Puts and Takes from RCM’s Guidance Update

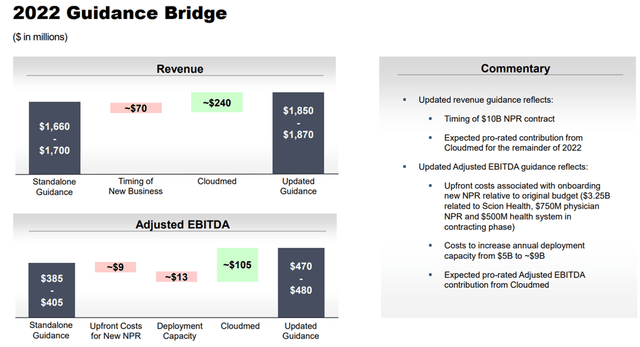

Despite the slightly lower Q2 2022 guide, investors will likely look ahead to the upbeat 2022/2023 adj EBITDA commentary – to recap, the company is now expecting $1.85bn to $1.87bn in revenue (up from its previous of $1.66bn-1,7bn guidance) and $470m to $480m in adjusted EBITDA (up from its previous guidance of $385-405m) for the full year. A few caveats are worth noting for the sequential decline in Q2 2022 EBITDA, though, given it does incorporate one-offs such as upfront costs from new business wins and (planned) RevWorks attrition post-Cloudmed acquisition.

The Cloudmed guide also strikes me as conservative – there are no material cost synergies in addition to the ~$105m Cloudmed contribution penciled in for the year (i.e., a single-digit contribution), while only $15-30m of synergies are guided for 2023. In sum, the bar is low heading into 2023, so I think the onboarding of new net patient revenue (NPR) and the incremental contribution from Cloudmed could drive upward revisions ahead.

Cloudmed Addition to Unlock Untapped Growth Opportunities

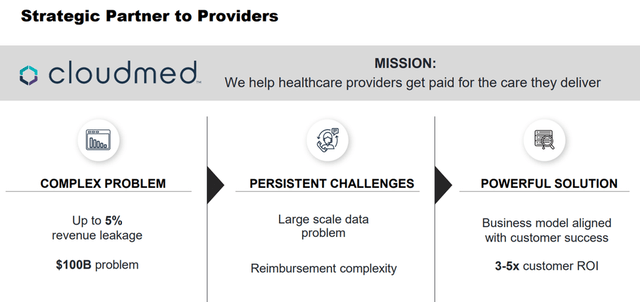

Building on the near-term updates, the company also reaffirmed its long-term outlook of 12% to 14% NPR growth and 20% modular growth, culminating in >17% adj EBITDA growth and an >35% margin target. This seems conservative, in my view – with Cloudmed under its banner, RCM will be equipped with a full end-to-end offering covering the full spectrum of the total NPR available for revenue capture. In essence, RCM’s one-stop value proposition will make its offering stand apart within the end-to-end revenue management outsourcing market. For context, standalone RCM pre-deal covered ~95% of client NPR, leaving an ~5% NPR leakage from patient claims historically seen as outside of its scope (mainly due to costs/complexity). Given the latter is specifically targeted by Cloudmed, RCM will now have the capabilities to cover complex and smaller dollar claims as well.

Thus, Cloudmed’s complementary product offerings and client base offer significant growth potential and synergistic cross-selling opportunities for RCM. Much will depend on management’s execution but assuming it is successful in unlocking the targeted cost and revenue synergies, the addition of Cloudmed presents incremental earnings upside over the next few years. There could be some near-term headwinds from the closing and onboarding of the ~$10bn contract, though, driving uncertainties and lumpiness in results over the new few quarters. Still, the level of tech scalability and interoperability offered by Cloudmed in the health system market is invaluable, in my view, and should outweigh any short-term hiccups in the post-M&A integration process.

A More Balanced Approach to Capital Allocation Post-Cloudmed

Now that the Cloudmed deal is done and dusted, RCM’s near-term focus will shift to keeping its leverage levels low and buying back stock opportunistically over more M&A. While RCM is comfortable with the 2-3x leverage ratio following the close of Cloudmed, prior management commentary has indicated a leverage target closer to ~2x – a positive for the credit rating long-term. Given RCM’s consistent cash generation, though, I wouldn’t be surprised to see a capex boost as well, particularly with recession fears on the rise and the revenue cycle also emerging as a priority in health system budgets. In particular, the current macro environment of rising inflationary pressures (e.g., labor costs) could work as a tailwind for RCM, accelerating the long-term trend toward health systems outsourcing back-end functions to cut costs. Thus, RCM’s strong pipeline growth could outpace expectations, allowing it more flexibility to ramp up reinvestments and solidify its competitive advantages over time.

Long-Term Growth Story Remains Intact

The pandemic has been a double-edged sword for RCM, as utilization and selling disruptions have been balanced (if not outweighed) by secular outsourcing pressures as providers struggle to cope with recruitment and wage inflation. At this point in its growth story, the company’s one-stop value proposition is clear, supported by a steady stream of new contract wins and a margin uplift towards its long-term target. With market trends likely to remain supportive of this business through the cycles and the post-Cloudmed gains yet to be fully unlocked, the current valuation premium seems warranted, in my view.

Be the first to comment