Nicky J Sims/Getty Images Entertainment

Investment Thesis

Lululemon Athletica’s (NASDAQ:LULU) athleisure products have taken the world by storm over the past couple of years, but there is much more to this business than being just another lockdown beneficiary. The Lululemon brand has become incredibly valuable, with the company constantly looking for new ways to innovate and enhance its range of athletic apparel.

But does that make Lululemon a good investment right now? I put it through my framework to find out.

Business Overview

Lululemon is a designer, distributor, and retailer of athletic apparel and accessories, and is best known for its athleisure products – casual, comfortable clothing that is designed for both exercise and everyday wear. In particular, the company’s yoga apparel products shine through, and these helped to drive Lululemon’s success throughout the pandemic as more lockdowns resulted in less time in office clothes, more time sat around the house, and people around the world embraced athleisure as a result, as comfort became more of a priority.

Lululemon might have made its name through yoga products, but it has been able to rapidly expand across different verticals and geographies with a great deal of success. In terms of products, it offers a broad range of apparel for activities such as running, training, and (in their words) ‘most other sweaty pursuits’, as well as branching out into footwear, and even connected fitness with its 2020 acquisition of MIRROR. In particular, the company has been focusing a lot on its ability to grow its product range – and, it has succeeded, doubling sales of men’s products in just three years – among other notable achievements.

This is also a company with innovation at its core, and it has a strong focus on what it calls Science of Feel. Lululemon looks to bring technical innovation to its customers, and recent examples of this include its SmoothCover fabric for Yoga, the Air Support bra coming as a result of 5 years’ worth of research & development, and the License to Train short for men created from Lululemon’s High Impact Swift Pique fabric. These are just some of the examples, but if you get a chance, it’s worth reading through some of the Science of Feel products from Lululemon’s website – I personally found it fascinating: Science of Feel.

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

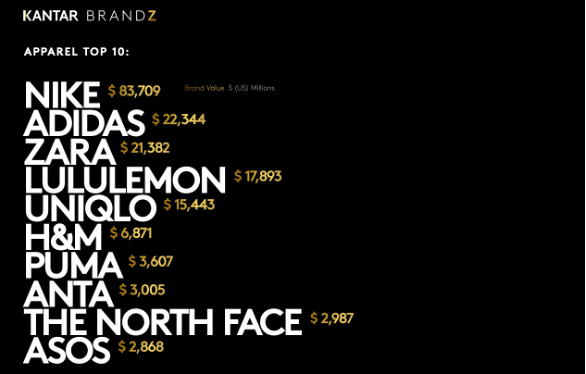

It’s not going to surprise anyone reading this that the first moat I’ll give Lululemon credit for is its brand. The company has grown into one of the most valuable apparel brands according to the Kantar Brandz Most Valuable Global Brands 2021 Report, and I don’t think anyone could argue with that.

Kantar BrandZ 2021 Most Valuable Global Brands

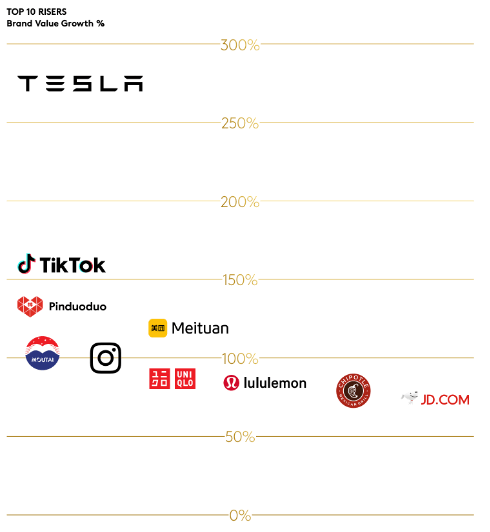

In fact, according to the report, Lululemon was actually one of the top 10 risers in terms of brand value growth throughout 2021. I believe this is a reflection of the tailwinds in the company’s favour (higher disposable income, work-from-home environment etc.) as well as its ability to successfully grow its brand.

Kantar BrandZ 2021 Most Valuable Global Brands

But even as times change, I don’t foresee any erosion of Lululemon’s brand – in fact, I see quite the opposite happening, and Kantar’s report highlights the flexibility in Lululemon’s business model that should help this brand continue to succeed:

More than ever, apparel brands are not confined to one particular niche: the gym, the playing field, the home, and so on. This move towards all-encompassing “lifestyle” offerings began before the pandemic: you may know it as the “athleisure” revolution. But it has only accelerated in the months since.

Lululemon is perhaps the poster child for how a brand can master the flexibility imperative. It’s not just that Lululemon clothes are physically stretchy – it’s also that they can move seamlessly across multiple day-parts and environments. Just as crucially in a post-pandemic world, Lululemon has retained its strong associations with health and wellness.

Even just one glance on the Apple App Store demonstrates not only how loved this company is by its customers, but also how much their investments in digital have paid off – you can love a company all you like, but you can still leave a rubbish rating if their app is useless (just ask Starbucks UK, with their 1.4 star rating).

I don’t think anyone here can deny Lululemon’s brand strength, and the company’s vertical integration and omnichannel approach enables it to control the customer experience and continue to strengthen that brand value.

And what comes with a strong consumer brand? Pricing power.

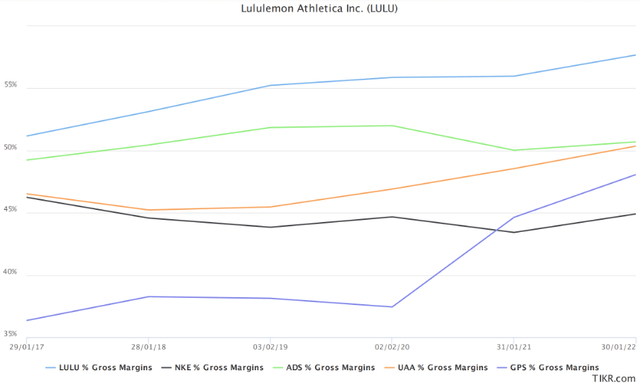

Whilst there is no perfect way to know this, a quick look at Lululemon’s profit margins compared to competitors NIKE (NKE), adidas (OTCQX:ADDYY), Under Armour (UAA), and The Gap (GPS) give a pretty good indication that this company has the ability to raise prices & generate higher margins. It’s also in the premium section of the market, and combined with its powerful brand, this should give Lululemon plenty of room to manoeuvre when it comes to pricing it the future (particularly as we enter a more difficult economic period).

Outlook

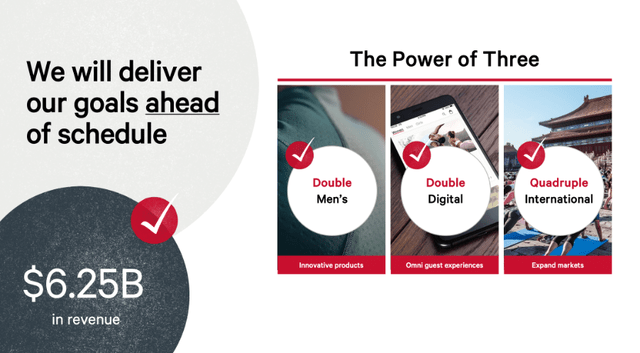

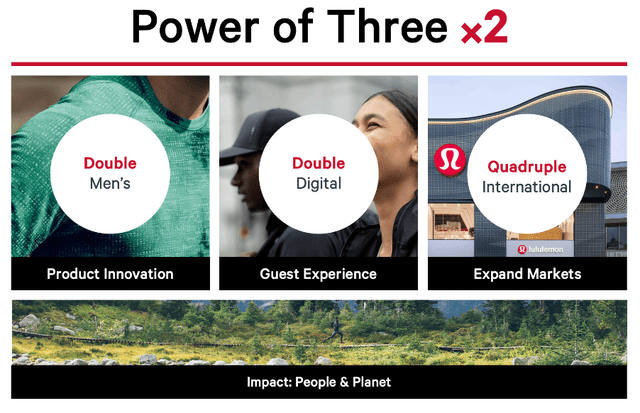

Lululemon previously achieved its Power of Three targets by doubling Men’s, Digital, and Quadrupling International sales – whilst growing revenue to $6.25 billion in just three years. Well, if something’s not broke then don’t fix it apparently, since Lululemon is trying to do exactly the same thing over the next 5 years, targeting revenue of $12.5 billion.

This business clearly still has a lot of growth levers left to pull, and the Global Activewear Market is only expected to get bigger – growing from ~$380B to $455B from 2022 through to 2027 according to Statista. Based on Lululemon’s revenue of $6.64B over the past 12 months, it currently has less than a 2% market share of the $380B market, so plenty more room for growth ahead. And the company is not holding back, as it’s already on track to hit its 2023 targets in terms of international expansion.

Management

When it comes to growing, innovative companies, I always aim to find founder-led businesses where inside ownership is high. Unfortunately we don’t have a founder-led business here, although that may not be a surprise since Lululemon was founded in 1998. Current CEO Calvin McDonald took the corner office role in 2018, with his predecessor resigning following misconduct allegations. So, not the smoothest of rides for Lululemon, but McDonald has certainly delivered for shareholders since he took the helm.

I also want to invest in companies where leadership has skin-in-the-game, and it probably won’t be a surprise that Lululemon does not succeed here – generally, companies without founders still involved will lack skin-in-the-game. It’s worth highlighting that the Lululemon founder Dennis Wilson still owns ~8.6% of all shares in the company, but unfortunately he is no longer involved with the business & left the Board of Directors in 2013.

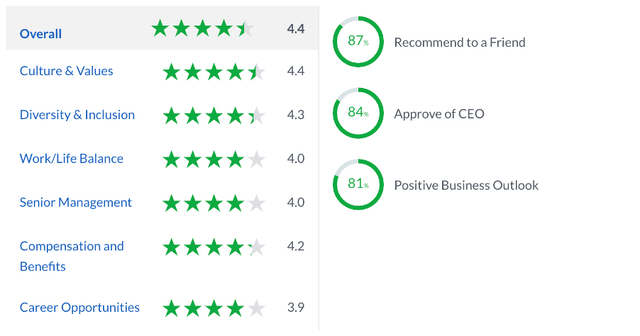

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Lululemon gets some very strong scores from the 5,682 reviews left by employees. Any score over 4.0 is impressive, and Lululemon achieves this almost across the board. It receives particularly high scores for Culture & Values, and Diversity & Inclusion, two aspects that make for a great workplace, and are necessary for a fast-growing company to thrive. It’s also worth highlighting the high score of 81% for Positive Business Outlook; this is generally one of the worst performing categories when it comes to Glassdoor reviews, so it’s great to see that employees at this company actually believe in its ability to succeed.

All in all, some brilliant scores for Lululemon – clearly, management have successfully created a fantastic culture & employees love working there.

Financials

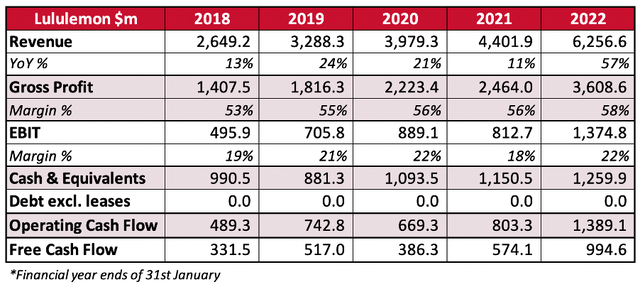

Lululemon boasts really impressive financials, with the company having grown revenues at a 24% CAGR from 2018 through to 2022 all whilst increasing gross profit margins from 53% to 58%. It has also successfully expanded EBIT margins (which comes almost naturally to retail businesses as they scale up) from 19% in 2018 to 22% in 2022. It has a pristine balance sheet as well, with ~$1.3B in cash and zero debt, plus the company is both operating and free cash flow positive, bringing in almost $1B in free cash flow during 2022.

I don’t have a negative word to say – these are great financials!

Actually no, I lied – I have one negative thing to say, as per this extract from their Q1 results:

The fiscal year ending January 29, 2023 is referred to as “2022”, the fiscal year ended January 30, 2022 is referred to as “2021”, and the fiscal year ended February 2, 2020 is referred to as “2019”.

What kind of company refers to a financial year ending in 2023 as “2022”?! Lululemon is lucky that its financials are so pristine, otherwise I’d be holding it against them…

Valuation

As with all high growth, innovative companies, valuation is tough. I believe that my approach will give me an idea about whether Lululemon is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

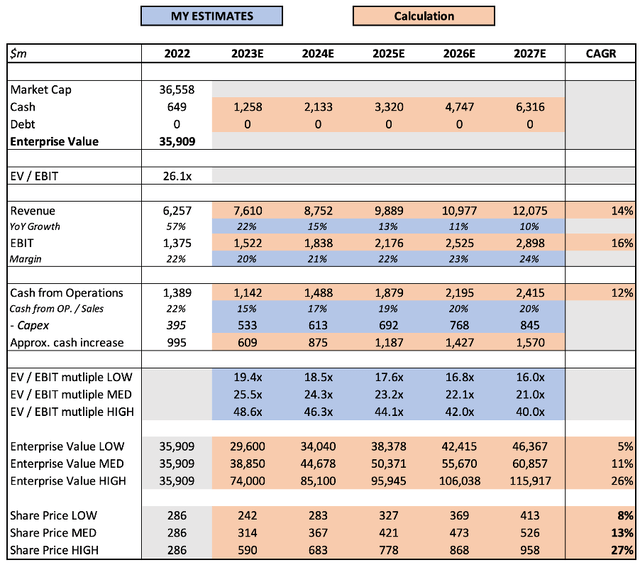

In terms of revenue growth, I have used the low end of management’s guidance in Lululemon’s Q1 earnings press release, due to the deteriorating macro environment that I believe will impact companies like Lululemon more severely (although it has navigated the macro environment well so far). I have also assumed a reduction in EBIT and operating cash flow margins in 2023, as inflation and supply-chain disruptions are likely to cause substantial impacts on any businesses – even those with pricing power.

I have assumed a 2027 EV / EBIT multiple of 21x, which I do believe to be conservative; I would expect Lululemon to merit a higher multiple (Nike has averaged ~26x over the past decade, and Lululemon has more expansion room ahead), but when it comes to these valuation models I always prefer to err on the side of caution.

Put all that together, and I can see Lululemon shares achieving a 13% CAGR through to 2027 in my mid-range scenario.

Risks

Perhaps unsurprisingly, there are quite a few risks that I currently associate with Lululemon – with most of them being macro related, and so no prizes for guessing the first risk that comes to mind.

Lululemon offers a premium consumer discretionary product, and I think these might get hit more substantially than other businesses in a recession. We’re clearly entering difficult economic times, and I would not be surprised to see a substantial slowdown in sales compared to management’s guidance. Furthermore, the company’s expansion into China has been hindered by the new lockdowns in the company, throwing another spanner in the works for Lululemon.

The other long-term risks for Lululemon are both brand erosion (no sign yet, but be mindful) and a potential shift in consumer behaviour. There is the risk that Lululemon’s 2021 success was driven purely by lockdowns, and as the world opens up there will be less demand for Lululemon’s products. Personally, I feel like athleisure is a trend that will stay with us for a quite a long time, and Lululemon is bringing out a whole host of new products that are appropriate for any “new normal”.

Bottom Line

This is one of the most difficult Hold / Buy decisions that I’ve had to make. I want to own shares in this business; I think its brand is fantastic, and the current share price looks relatively attractive. But there is the backdrop of a looming recession & a potential shift away from athleisure’s popularity…

I am just, just landing on the Buy side.

When I invest in businesses, I want to own them forever. The valuation is important, but not critical, and the quality of the business itself is what truly matters. Looking at Lululemon, I see a high-quality company with a brand that should not be underestimated. Plus, the company has handled the macroeconomic environment extremely well so far, with a beat and raise in the first quarter – another positive for investors.

Could shares fall substantially from here? If the recession risks materialise, then shares absolutely could.

Yet I’m not buying this company to make a profit over one year, and I would only start a small position were I to invest today. My plan would be to hold and add to these shares through to 2030, provided that Lululemon continues to execute on its strategy & deliver for shareholders. I see this company as a tentative buy right now, but a buy nonetheless.

Be the first to comment