Three Lions

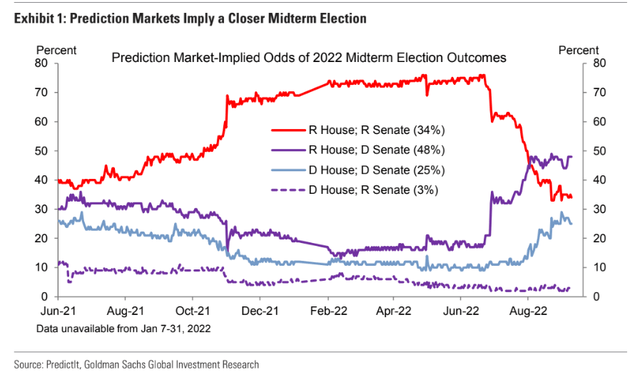

Political uncertainty is very high right now, with the U.S. midterms less than two months away. We have already seen a slew of bills pushed through to shore up positive fervor among voters. Meanwhile, the latest prediction markets show a dead heat in the battle for Congress. Domestic election risk pales in comparison to downright instability in South America, though.

Back in June, Colombia’s Gustavo Petro won a presidential election race, and that single event helped send many oil & gas company stocks into a tailspin all while the global energy market was selling off. One major Energy sector stock now trades at an extremely low valuation, but is all the risk priced in? Let’s dive in.

Political Risk Abroad & At Home: Betting Market Trends For Control of Congress

Goldman Sachs Investment Research

According to Bank of America Global Research, Ecopetrol (NYSE:NYSE:EC) is Colombia’s national oil company. Oil and gas production is currently approximately 692tboe/d (81% oil). The company also has a total of 287 tbpd of refining capacity. Other operating assets include oil and gas pipelines, and Ecopetrol has a growing renewables business. The company has downside risks due to heavy political uncertainty in Colombia. Recent elections back in June may lead to more government interference in the industry, pressuring how much in the way of profits and free cash flow can be returned to equity holders.

The $23 billion market cap Oil, Gas & Consumables industry stock within the Energy sector trades at a cheap 3.2 trailing 12-month GAAP price-to-earnings ratio and pays a very lofty 13.5% dividend yield, according to The Wall Street Journal.

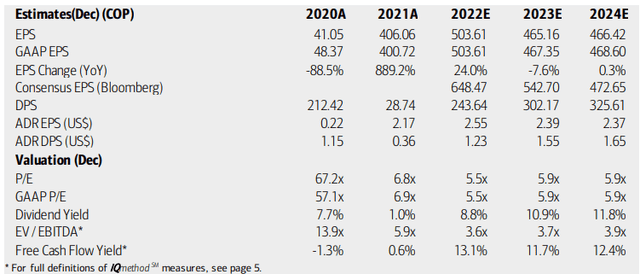

On valuation, BofA analysts see strong earnings growth this year, followed by an EPS drop in 2023. Earnings growth further out is lackluster. Amid so much political risk, the forward operating P/E is depressed, and it is hard to see much cause for it to recover. The upside for shareholders is that its free cash flow yield is high, so for now the dividend should be safe, but it’s hard to predict what the political winds will be in the coming quarters.

EC: Earnings, Valuation, Dividend Forecasts

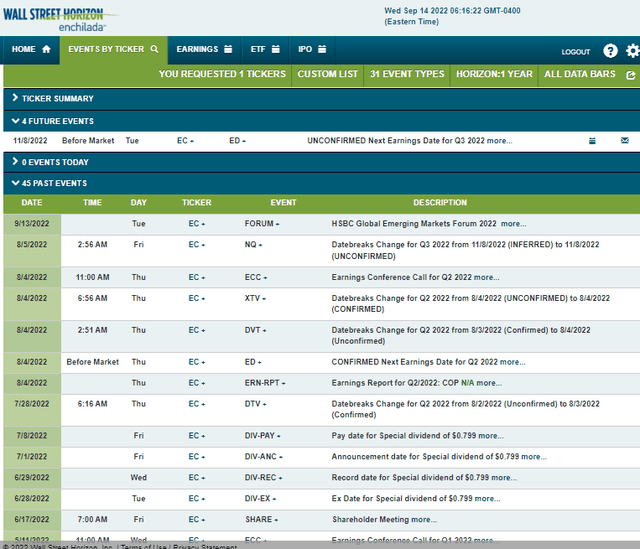

Ecopetrol’s corporate event calendar is light until the next earnings report, which is unconfirmed to take place on Tuesday, November 8, BMO, according to data provided by Wall Street Horizon.

Corporate Event Calendar

The Technical Take

EC is one of the not too many energy stocks that is caught in a very bearish pattern. After failing to climb above its late 2019 to early 2020 highs near $20 earlier this year, shares began to fall fast. A bearish gap down back in June took place after EC broke trendline support. It was not until the stock dropped more than 50% from its year-to-date high when it found some buyers under $9. Since late July, a bear flag has persisted – a period of corrective price consolidation. The presumption is that new lows will be made from this pattern.

Technically, I think the stock could go back down to either $8.50 from late 2020 or the March 2020 low in the low $6s. On the upside, expect $13.50 to be minor resistance – the gap fill point.

EC: Bear Flag After Breaking Uptrend Support

The Bottom Line

I would stay away from Ecopetrol for now. While its valuation is exceptionally low and the yield is extremely high, there is much political risk with this Colombia-based energy company. Moreover, the technical chart appears bearish to me. With so many global energy stocks trading at cheap valuations and shareholder accretive capital allocation policies, it’s better to stick with those which are more stable vs EC.

Be the first to comment