georgeclerk

Amazon.com, Inc. (NASDAQ:AMZN) is down below $100 / share after hours, an almost 50% decline from its 52-week high, wiping out hundreds of billions of dollars’ worth of shareholder value. We’ve discussed our concerns about the company before, namely dilution concerns, and the company’s overvaluation. Looking at the company’s earnings, we expect the factors it struggles with to get worse.

Dilution

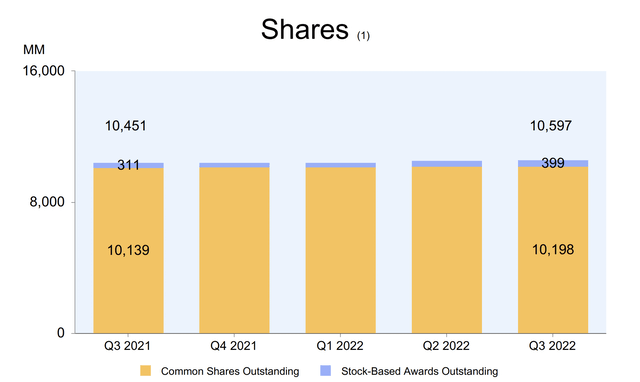

The primary concern we have for Amazon, that we feel isn’t priced into the company’s share price, is dilution.

For those unfamiliar, tech hiring is a competitive process and an expensive process. To attempt to balance costs, many tech firms cover a substantial percentage of employee’s high salaries with RSUs (restricted stock units). From a shareholder standpoint, those awards are a “bill” or “dilution” even if they don’t affect the company’s margins.

Historically Amazon has been known for both back-weighting its stock awards and assuming 15% annualized share price growth for the $ value. However, as the company’s growth has stagnated, it’s been forced to adjust its compensation. That tale is coming home to roost not just in the company’s base but also its stock compensation.

YoY the company’s stock-based awards outstanding has increased from 310 million shares to almost 400 million shares. That’s ~1% annualized dilution. That might not sound like much, but it’s a hidden $10 billion / year cost, one that isn’t being accounted for in Amazon’s profits. For a company with $2.5 billion in operating income in the most recent quarter, that’s all of it.

Tough Macroeconomics

More so, we expect Amazon’s situation to continue getting worse.

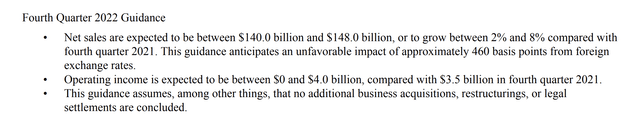

As we’ve discussed before, we don’t view Amazon as a low-cost competitor to companies like Walmart (WMT), we view it as an “everything store.” That means, in our view, it’s much more susceptible to macroeconomic conditions. That’s clear in the company’s guidance where 4Q 2022 YoY net sale growth is expected to be ~5%, not even matching inflation YoY and indicating a real dollar revenue decrease for the company.

Operating income is expected to drop as well, hurting the ability to drive shareholder returns. Investors have gotten used to a central-bank supported bull market, and even the COVID-19-related price collapse was incredibly short. It’s been more than a decade since a true lengthy market downturn, and we expect Amazon will struggle much more.

Cloud Computing Competition

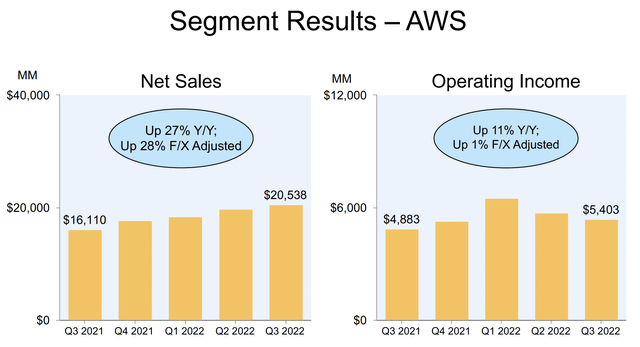

Another risk for Amazon, in our view, is cloud computing competition.

Amazon has seen net-sales perform well YoY, however, QoQ especially the growth rate has been slowing down. The trend in the company’s operating income for the division, traditionally a high-margin division, has definitely slowed down substantially. From a company that was early to the party, in our view, this is concerning.

There are some bright spots to see. The company’s ARM based Graviton chips perform well and enable it to improve margins / reduce costs versus traditional x86 systems and more. However, there are a lot of sore spots. Azure and Google Cloud are both massive investments that have been ramping up and are backed by trillion-dollar companies with billions to invest.

Both companies remain committed to their strategies and have achieved enough scale to continue investing. If anything else, the businesses will at least put pressure on the company’s margins. That competition will impact Amazon’s ability to drive additional returns.

Profitability

Amazon has been growing well for a number of years. In the 2000s and 2010s when investors were concerned about the company’s valuation, the answer was always Amazon “could” make money. The classic point of view was that the company could always switch from an investment focus to a returns focus and drive shareholder returns.

Our fear is that this isn’t the case.

The company’s TTM 12-month FCF (free cash flow) was just under -$30 billion not counting the company’s equity issuance. The company’s sales growth has slowed down dramatically to just 10% YoY revenue growth. Investments are no longer out-proportionally increasing revenue, but the cost of investments are actually increasing faster YoY.

The company’s operating income has continued to decline and the company’s net income remains volatile until zero. We expect the company to struggle to profit.

Our View

Unfortunately, to us, Amazon is looking more and more like a traditional retailer with a separate and impressive cloud-computing business. If we were in charge, we’d split AWS from the company to let it grow independently, without retailers refusing to use it as their cloud provider, focusing on the online retail operations and becoming more and more like a traditional company.

Regardless of how Amazon structures its operations, we expect that it’ll continue to struggle to profit. At a valuation of more than $1 trillion, the time to drive shareholder returns is now. The time to prove the ability to drive shareholder returns is now. Investing capital for some arbitrary future opportunity is getting meaningless.

Until that point, we recommend against investing.

Thesis Risk

The largest risk to the thesis, in our view, is that Amazon remains a dominant company in consumer’s minds. In a non-recessionary environment, the company could continue to drive substantial cash flow. Another important aspect is the company is in an oligopoly for cloud computing, which has continued to grow. If Microsoft or Google decide the market is too expensive, the company’s position could become that much more dominant.

Conclusion

Amazon remains one of the most dominant tech companies in the world, with a market capitalization of more than $1 trillion. The company’s AWS business remains dominant despite new found competition, and its retail business remains one of the largest in the world. However, below an impressive surface, there are some cracks.

Cloud computing is seeing competition increase substantially. If nothing else, we expect that to negatively impact the company’s margins. The company’s retail business, which has always been marketed as being able to drive additional profits, has struggled. We expect the company’s financials to struggle to justify its valuation, hurting its ability to drive future returns.

Be the first to comment