PonyWang/iStock via Getty Images

Introduction

With the chip industry being under pressure in recent months, it’s time for value investors to look for potential opportunities. Taiwan Semiconductor (NYSE:NYSE:TSM) may be one to keep a close eye on. The stock has had an outstanding performance over the past 2 decades with annual capital gains averaging ~16%, well above of what the market has returned. With the stock down ~40% from its high of $143, it begs the question, “Is TSM finally reasonably priced again?”

Taiwan Semiconductor is the world’s most valuable semiconductor company. The company is a large contract manufacturer and designer with headquarter and main operations in Hsinchu, Taiwan. Despite the company’s size and their high market share, which accounts for 53% of the global foundry market, they still continue to grow at a high pace.

Fundamentals

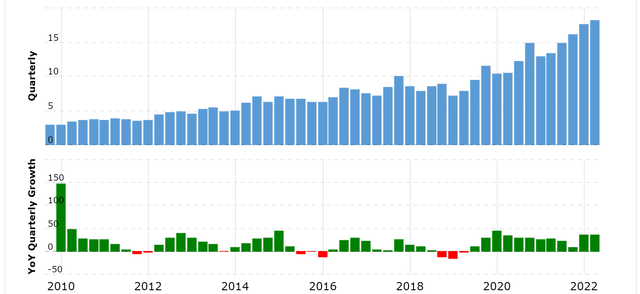

It comes as no surprise, that the company has consistently grown the top line by double digits. The growth in the top line has been a result of organic growth combined with various acquisitions along the way. Despite achieving above-average growth following the Covid crisis, analysts still expect the top line to increase next year.

Revenue (Macrotrends.com)

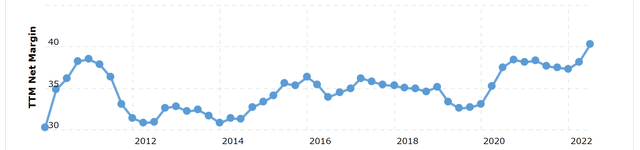

What’s more remarkable than the consistently fast-growing top line, is the company’s net profit margin. Although it is still a victim of industry volatility, it has maintained profitability for more than 20 years, and actually set a new high in terms of profitability this year. It clearly shows the strength of the company, and the moat they have built over the years.

Net profit margin (Macrotrends.com)

An increasing net profit margin combined with a top line growing by double digits, has led to a high amount of net income being generated. The majority of net income is reinvested back into the business, while the rest is paid out in the form of dividends.

Currently yielding 1.79%, the dividend is well supported by net income with a manageable payout ratio of ~30%. It is considered very safe and unlikely to be cut.

Capital allocation

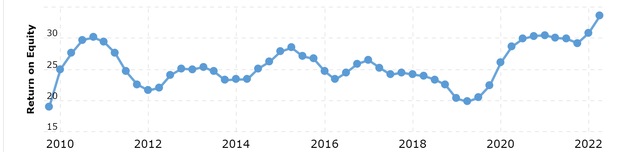

The management of TSM has extensive experience in prudent capital allocation. Return on equity has consistently been above 20%, which is excellent considering that equity is still increasing.

Profitability is currently setting new highs, which may only be temporary. to avoid overestimating future growth, I don’t expect its current ROE of 33% to be sustainable.

Return on equity (Macrotrends.com)

TSM has targeted a payout ratio of ~35%, which is currently yielding 1.79%. The rest of the earnings are reinvested into new cash-producing assets and thus equity. With an ROE averaging 24%, and the amount of capital reinvested being approximately 65% of earnings, the book value per share should rise by ~15.6% annually.

Investors can likely therefore expect annual capital gains of ~15.6% + dividends.

Valuation

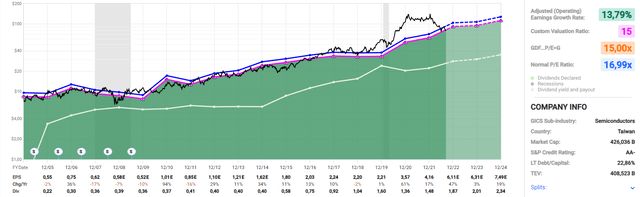

As with the majority of consistently growing companies, a 15 multiple is often a good guideline for intrinsic value. This has been the case with TSM in the past, as seen in the image below, and will likely continue to be, as ROI doesn’t seem to be slowing down.

The average multiple over the past 11 years has been 17.55. Excluding the sudden explosion in earnings after the Covid lockdowns, the average would have been 15.04. As growth normalizes, the given multiple should decrease accordingly. The stock has gone from overvalued back to fair value territory, at a current p/e of 14.3.

When valuing companies with p/e multiples, it is important to include the health of the balance sheet. In their last quarter, the company had debt of $29b with $47b in cash, cash equivalents and short-term investments. While it would be preferred that at least all of the net debt capital would be used, it is certainly a very strong balance sheet.

The balance sheet allows the company to capture future growth opportunities, and should easily, in combination with the average annual growth of ~15.6%, continue to justify a multiple of ~15.

Earnings per share with multiples (Fastgraphs.com)

Stock chart

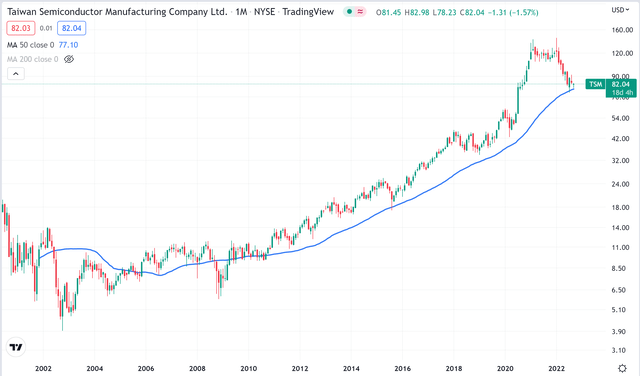

Quick disclaimer. A technical analysis in itself is not a good enough reason to buy a stock but combined with the company’s fundamentals, it can greatly narrow your price target range when you buy.

As with the majority of consistently growing companies, it comes as no surprise, that the 50-month moving average acts as support. This has been true several times in the past, and it will likely be true this time as well, in my opinion. I would consider anything below the 50-month moving average to be very attractive.

Monthly chart of TSM (Tradingview.com)

Final thoughts

The company clearly possesses strong fundamentals with a steadily growing top line, strong margins and a well-managed balance sheet. The company’s management has a good track record in terms of capital allocation, which does not appear to be slowing down.

The dividend is well supported and there is no danger of it being reduced. It should continue to match the growth of the company, which is growing by ~15.6% per year.

The fact that the stock currently sits at its 50-month moving average, which has been support in the past, and is historically close to intrinsic value based on its earnings, should make a buy at current prices attractive. This is backed by a strong capital allocation, healthy double-digit organic growth + a decent dividend yield.

While certainly not a “deep value” buy, future growth of ~16% + the current dividend yield should still deliver above average returns going forward.

Be the first to comment