gorodenkoff

FactSet Research Systems (NYSE:NYSE:FDS) provides data and analytics to the investment management and financial services industry. The platform is nearly an essential tool for buy-side funds, banking clients, and wealth advisors as part of the portfolio management process. The company’s success in growing market share while earning a reputation for quality solutions explains FDS’s fantastic 190% return in just the past five years. FactSet benefited from strong financial market activity during the pandemic boom leading to a record year for earnings. On the other hand, we note that the operating environment has shifted this year amid several macro headwinds.

Ahead of the company’s upcoming quarterly report, we highlight several reasons to take a more cautious view of the stock. FDS appears a bit overvalued and technically overbought against deeper uncertainties in the financial services sector as it relates to FactSet’s core customer base. We see either weaker near-term earnings pressure or poor guidance from management pressuring the stock. This is a solid business with a positive long-term outlook, but expect higher volatility going forward.

FDS Q4 Earnings Preview

FactSet is scheduled to release its fiscal Q4 earnings on September 22nd. The consensus for EPS of $3.21, if confirmed, would be an 11% year-over-year increase. The revenue forecast at $488 million is 18% higher compared to the period in 2021 which includes the boost from some smaller strategic acquisitions.

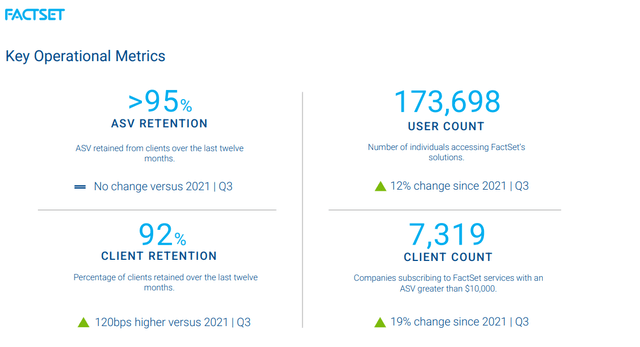

The setup heading into this report is continued momentum from last year’s growth runway considering subscriptions represent over 95% of the total business amid high customer retention. The key metric for FactSet is its organic annual subscription value (ASV) which climbed by 10.1% y/y in Q3. FactSet’s global user count also climbed by 12% while client retention even bumped higher by 120 basis points to an impressive 92%.

The expansion and effort towards more value-added services have translated into firming margins and strong profitability as the Q3 adjusted EBITDA at $173k was up 30% y/y. Including the upcoming Q4 report, management last guided for full-year revenue of $1.815 billion as a midpoint estimate, up 15% compared to 2021. The company’s fiscal 2022 operating margin target is between 33% and 35% compares to 32.5% last year.

Is FDS A Good Long-Term Stock?

There’s a lot to like about FDS with its financial results speaking for themselves. The company is on track to deliver its 42nd consecutive year of annual revenue growth and 26th in terms of higher adjusted EPS. Within the S&P 500, FDS is also close to attaining the informal “Dividend Aristocrat” title considering its 23-year annual dividend growth history. The current quarterly rate of $0.89 yields a modest 0.8% while the company also regularly repurchases shares for an additional shareholder yield.

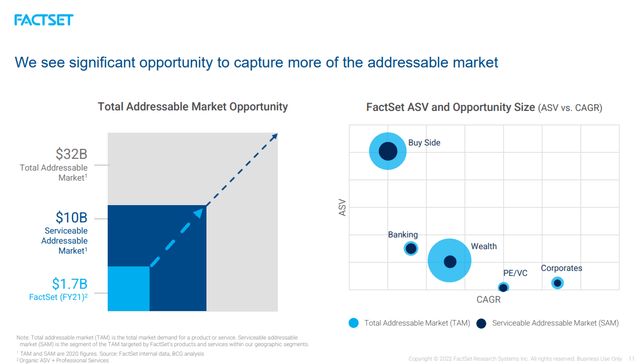

The company believes it operates within a $10 billion addressable market across its various offerings from research and advisory, analytics, and trading, along with the technology groups. Some of the growth initiatives include services for private equity and deeper sector-specific content. End users on the buy side and from wealth management are seen as growth opportunities.

Over the medium term, the expectation is for annual organic ASV growth between 8% and 9%, while earnings climb around 12% benefiting from a margin expansion. Again, the attraction of the stock is its steady growth profile and otherwise high-quality fundamentals.

Headwinds In Financial Services

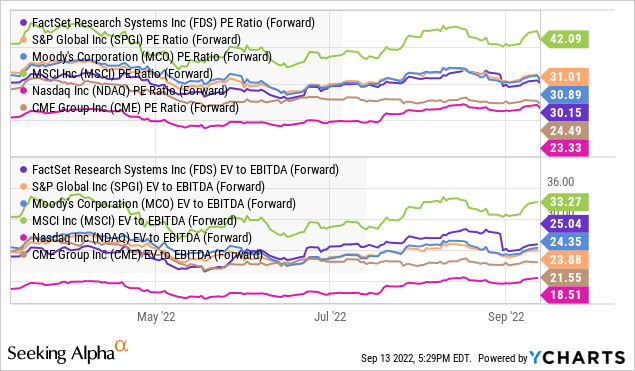

All that said, FactSet is far from being a secret reflected in its premium valuation as FDS trades at a forward 12-month P/E multiple of 30x, and 34x on fiscal 2022 adjusted EPS guidance around $13.00. The market is rewarding the company with this type of growth multiple based on its segment leadership and the understanding that cash flows should have generally low variability as institutions are sticky to the platform.

This dynamic is also observed in other financial data or exchange players like S&P Global Inc (SPGI), Moody’s Corp (MCO), MSCI Inc (MSCI), Nasdaq Inc (NDAQ), and CME Group (CME). In this case, FDS appears otherwise in line with its peers while understanding that each company has key differences.

The bearish case for this entire industry is simply that economic conditions deteriorated leading to a contraction in capital markets activity, limiting growth particularly compared to high expectations. We are particularly concerned about recent headlines suggesting pending Wall Street layoffs targeted at “deal-making” and generally front office investment management type of roles. This also includes private equity and other types of banking, at least at the margin. The context here is that compared to the record 2021, more volatile macro conditions defined by persistent inflation and climbing interest rates have hit the operating environment for financial services.

As it relates to FDS, while we’re not calling for its clients to start shutting down shop and abandoning their contracts, the issue here goes back to growth and its hit at the margin. We mentioned the ASV and users on the platform as key operating metrics. If layoffs take hold, those figures will slow to a crawl as the company would only be dependent on price hikes or attempting to find new business. There is also an argument that the “low-hanging fruits” of potential clients within its addressable markets have already been picked.

In other words, we see room for growth and earnings to underperform for the entire sector while FDS may be a bit more vulnerable compared to the trading exchange operators or index providers that have a balancing source of sales momentum. Whether or not the Q4 top-line or EPS figure for FDS meets expectations, the risk is that management comes out with poor guidance for fiscal 2023 against the recent headlines. Shares would sell off to reprice a broader slowdown.

FDS Stock Price Forecast

This is a tough spot for FDS where, in our opinion, risks are tilted to the downside. The upcoming Q4 earnings report will be critical to confirm the financial targets are on track and hear an update on business conditions from management.

We rate shares as a sell and believe it can retest the low from June under $350.00 representing around a 20% downside from the current level as an initial downside price target. To the upside, we believe FDS will need to come out with exceptionally strong guidance for the year in an environment where economic conditions and investing sentiment end up stronger than expected.

Be the first to comment