jiefeng jiang/iStock via Getty Images

The Templeton Dragon Fund (NYSE:TDF) is one of the longest running funds focused on Chinese investments. It trades at a deep discount to NAV due to investors’ negative sentiment towards Chinese equities. I believe we may be close to an inflection point regarding China, as investors have gotten extremely bearish. While the fundamentals have been poor, with a housing crisis, Covid lockdowns, and U.S. sanctions, a slight shift in sentiment can cause a sharp squeeze, as shown by this week’s rally in Chinese equities. I would be buying the TDF fund as a contrarian play.

Fund Overview

The Templeton Dragon Fund is a closed-end-fund (“CEF”) that gives investors exposure to Chinese companies. The Templeton Dragon Fund was one of the first funds to focus on the China investment theme with an inception date of September 21, 1994, years before China joined the WTO and became the global powerhouse it is today. The TDF fund currently has $359 million in assets.

Strategy

The Templeton Dragon Fund seeks capital appreciation by investing at least 45% of its total assets in equity securities of ‘China companies’. Templeton is primarily known as a fundamental, value-oriented investor, and the Templeton Dragon Fund’s main investment strategy claims to follow Templeton’s corporate values. In selecting investments for the TDF fund, the fund manager will consider bottom-up fundamental factors such as the company’s growth prospects, competitive positioning, labor costs, management skill, and returns on investment.

Portfolio Holdings

The TDF fund’s top 10 holdings as of September 30, 2022 are shown in Figure 1.

Figure 1 – TDF top 10 holdings (franklintempleton.com)

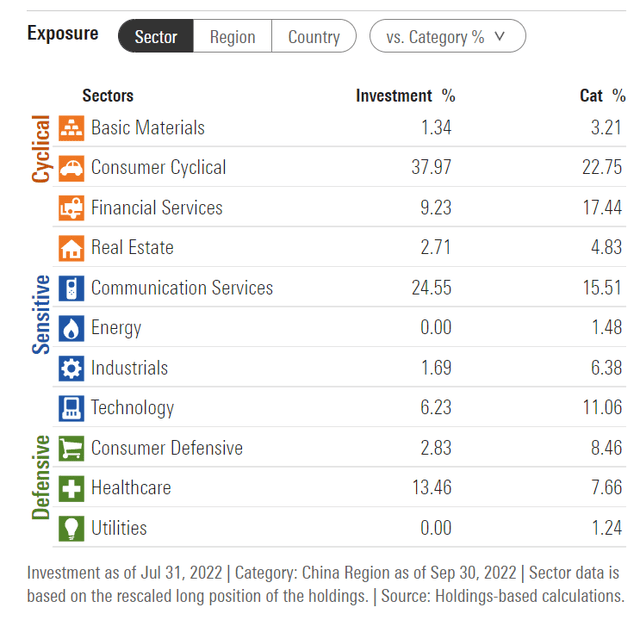

The TDF fund is predominantly invested in consumer cyclical and communication services stocks, which account for 62.5% of the portfolio as of July 31, 2022. The fund also has sizeable weights in healthcare and financial services, with 13.5% and 9.2% weights respectively (Figure 2).

Figure 2 – TDF sector allocation (morningstar.com)

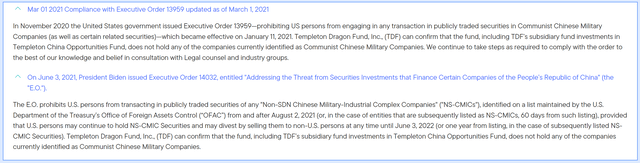

It is important to note that the TDF fund does not hold any investments in companies that are considered Communist Chinese Military Companies, hence the minimal weights in the materials, energy, and industrial sectors (Figure 3).

Figure 3 – TDF disclaimer on Communist Chinese Military Companies (franklintempleton.com)

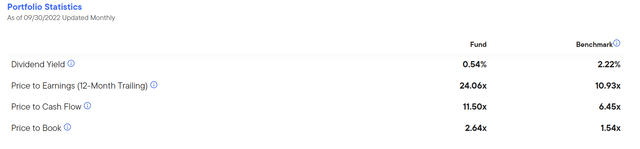

Interestingly, the portfolio statistics show that the TDF fund’s holdings trade at a significant premium to the benchmark index (“MSCI China All Shares Index”), which is counter to the marketing literature’s claim of the fund being value-oriented (Figure 4).

Figure 4 – TDF portfolio characteristics (franklintempleton.com)

Returns

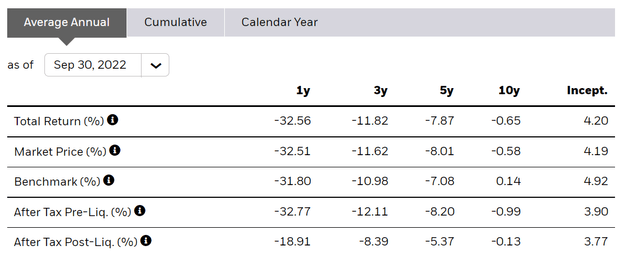

The Templeton Dragon Fund has had a year to forget, with 1-YR returns of -40.2% to September 30, 2022, erasing years of gains, and leading to 3Yr and 5Yr returns of -5.5% and -3.1% respectively (Figure 5).

Figure 5 – TDF fund returns (franklintempleton.com)

For comparison, the iShares China Large-Cap ETF (FXI) has returned -32.6%/-11.8%/-7.9% on 1/3/5Yr time frames, so TDF’s recent poor performance isn’t out of the ordinary, although it is lagging in the past year (Figure 6).

Figure 6 – FXI fund returns (ishares.com)

Distribution & Yield

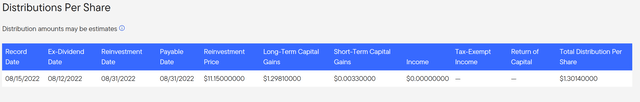

The TDF fund pays a semi-annual distribution (if available), and the most recent distribution amount of $1.3014 / share was paid on August 31, 2022. The distribution was paid out of long-term capital gains.

Figure 7 – TDF 2022 distributions (franklintempleton.com)

Fees

The TDF fund charges an expense ratio of 1.37%. For comparison, FXI’s expense ratio is 0.74%.

Well Known Case Against Chinese Equities

Over the past year, Chinese stocks have faced quite a number of well-known negative developments. First, there is an ongoing housing market crisis that began in the summer of 2021 when Evergrande Group struggled to pay interest on its debts. Evergrande was one of the largest and most indebted developers in China. However, its struggles were not isolated, as many other developers ran into similar problems. Capital.com has good coverage of the crisis with more details for those interested.

So far, although the Chinese authorities have been trying desperately to restart lending and construction in the property sector, home sales remain muted as Chinese consumers have adopted a ‘wait-and-see attitude’. In fact, many Chinese homebuyers that have been paying mortgage payments on homes under construction and are now boycotting those payments.

A second negative development has to do with China’s draconian response to the COVID-19 pandemic. While the rest of the world have resumed everyday activities and are ‘co-existing’ with the virus, China has continued its ‘zero-covid’ policies and are willing to lockdown whole cities and regions to prevent the spread of the COVID-19 virus.

Most recently, Shanghai Disney was placed into lockdown after a single case of the virus was detected, and the whole area surrounding Foxconn’s iPhone manufacturing plant in Zhengzhou was placed under lockdown after several workers fell ill to the virus. These erratic ‘stop and go’ measures have caused China’s GDP to grow at rates well below the official 5.5% target.

Finally, on the political front, global sentiment towards China have been put into a deep freeze and China did not help matters by refusing to condemn Russia’s invasion of Ukraine. Beginning with President Trump’s trade war, the U.S. and other western governments have been ratcheting up economic sanctions and restrictions on Chinese companies.

Chinese companies listed in America already face a ticking timebomb with possible delistings in 2023 due to the Holding Foreign Companies Accountable Act (“HFCAA”). However, bilateral relations were struck another heavy blow a few weeks ago when President Biden unveiled a blanket export ban on high-tech semiconductor chips and equipment to China.

With so many negative factors at play, it is not surprising that Chinese equities have been one of the worst asset classes in the world in the past year.

Has Sentiment Reached A Nadir?

However, looking forward, if investor sentiment towards China has reached its nadir, then we could be looking at an excellent time be a contrarian and ‘buy the lows’.

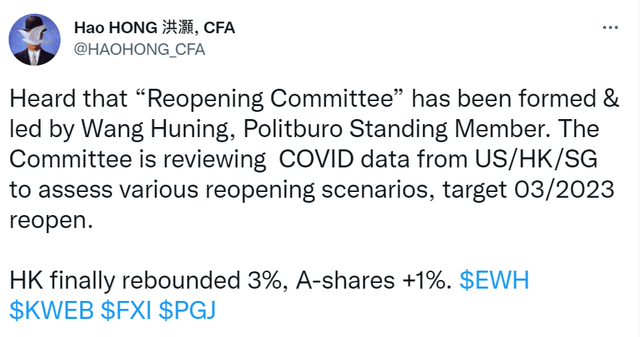

The past few days’ reversal in Chinese stocks suggest we could be near such an inflection point. For those not familiar with the story, apparently, the recent surge in Chinese equities was sparked by a tweet from Hao Hong, a noted Chinese analyst on October 31 (Figure 8).

Figure 8 – Hao Hong’s tweet on re-opening plans (twitter)

Hao’s tweet, along with another unconfirmed tweet detailing a few paragraphs of a re-opening plan, has led to a $450 billion rally in Chinese equities, as many investors have gotten too negative on Chinese equities and rushed to either cover shorts or add exposure.

At the heart of the issue is whether China can continue its draconian zero-covid policies indefinitely. I believe the answer is no, as the policies are beginning to lead to civil unrest among the populace. It is a matter of when and how, not if, China will loosen its covid restrictions.

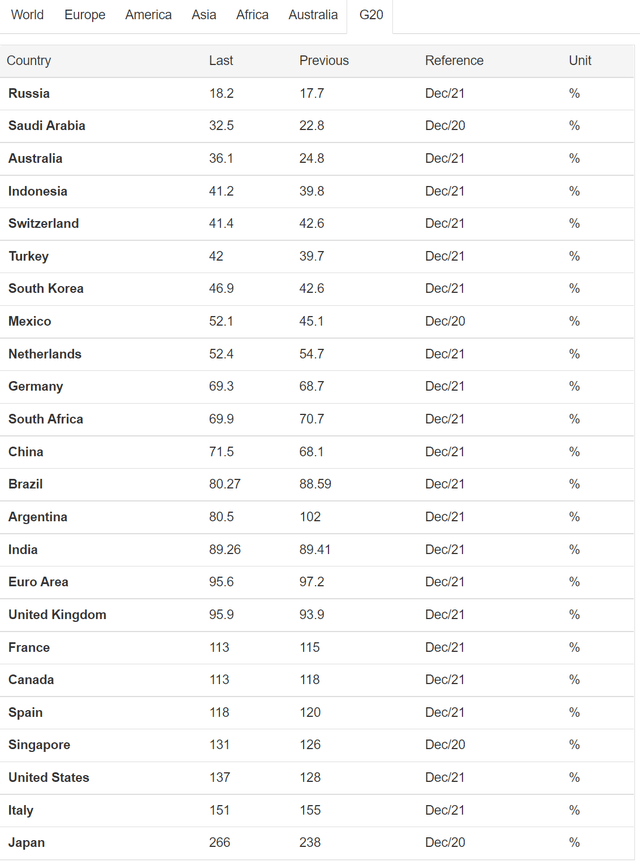

When China does eventually loosen its covid policies, I believe it will dovetail with stimulus measures to revive its flagging economy and housing sector. With government debt to GDP of only 71%, among the lowest of the major economies, China has a lot of scope to provide stimulus to boost its economy (Figure 9).

Figure 9 – G20 Debt to GDP ratios (tradingeconomics.com)

Dragon Fund Trades At A Deep Discount

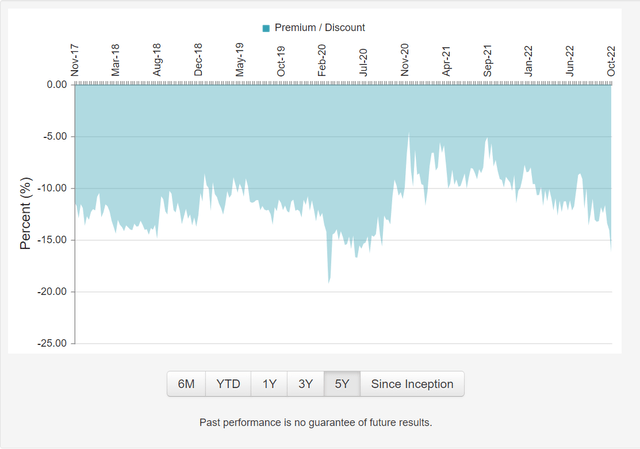

Another way to think about investor sentiment is to look at the TDF fund’s discount to NAV. Currently, the TDF fund is trading at a 18% discount to NAV, close to the widest it has been in the past 5 years. This indicates investors have no appetite for the TDF fund’s China strategy (Figure 10).

Figure 10 – TDF discount to NAV (cefconnect.com)

Conclusion

The Templeton Dragon Fund is one of the longest running funds focused on China investments. It trades at a deep discount to NAV due to investors’ negative sentiment towards Chinese equities. I believe we may be close to an inflection point regarding China, as investors have gotten extremely bearish. While the fundamentals have been poor, with a housing crisis, Covid lockdowns, and U.S. sanctions, a slight shift in sentiment from a disaster to simply bad can cause a sharp squeeze, as shown by this week’s rally in Chinese equities. I would be buying the TDF fund as a contrarian play.

Be the first to comment