Sundry Photography

This article is about whether XPO Logistics, Inc. (NYSE:XPO) will be worth buying now that it has officially spun off RXO, and previously GXO, not to debate which of these is better.

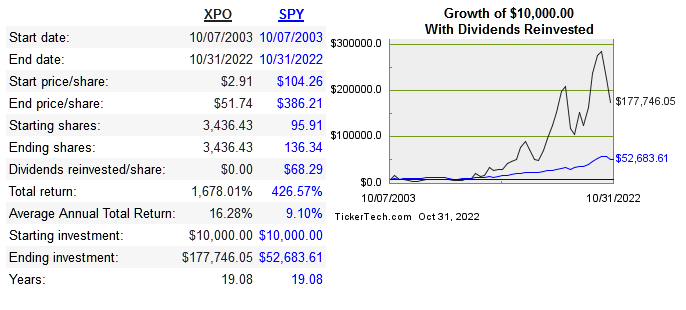

XPO is an integrated logistics business founded in 1989 and then IPO’d in 2004. It has been one of the better performing stocks during that time period:

dividend channel

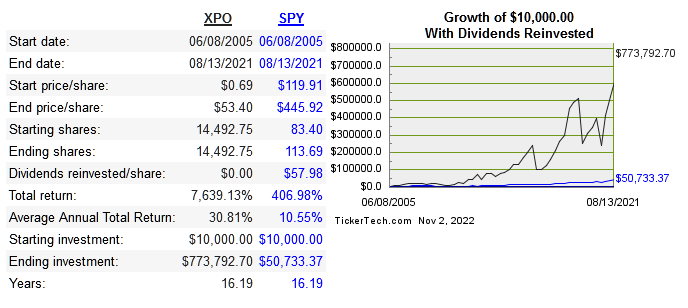

Below is the returns from timing the absolute bottom and top of the stock:

dividend channel

The LTL (less than truckload) industry estimated to grow at 5% for the next few years.

Below are the return metrics among competitors:

|

Company |

Revenue 10-Year CAGR |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF/Share 10-Year CAGR |

|

XPO |

53.4% |

3% |

0.9% |

n/a |

n/a |

|

9.5% |

31.6% |

24.6% |

15.4% |

18% |

|

|

8.4% |

42.9% |

22.7% |

9.2% |

-8.3% |

|

|

8.3% |

15.5% |

12.5% |

35% |

n/a |

|

|

10.6% |

18.7% |

9.2% |

21% |

13.1% |

|

|

21.4% |

12.8% |

11.5% |

15.8% |

44.8% |

|

|

7.6% |

8.2% |

6% |

43.6% |

17.7% |

Capital Allocation

XPO has acquired close to 20 companies, but has also been selling off businesses as well. So far the M&A track record can’t be criticized too harshly as the stock returns have outperformed and the company hasn’t been overloaded with debt. Long term debt is at moderate levels, but total debt repayment ramps up when necessary.

They paid dividends from 2011-2019 but currently don’t. They began repurchasing shares in 2018, but share count has only been reduced by 6% due to more common shares being issued last year.

The table below shows how capital is being allocated:

|

Year |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Acquisitions |

58 |

459 |

814 |

3,887 |

548 |

0 |

0 |

0 |

0 |

0 |

|

Dividends |

3 |

3 |

3 |

3 |

5 |

7 |

8 |

8 |

0 |

0 |

|

Repurchases |

0 |

0 |

0 |

0 |

0 |

0 |

536 |

1,347 |

114 |

384 |

|

Debt Repayment |

4 |

0 |

205 |

1,216 |

2.371 |

2,418 |

2,799 |

2,802 |

102 |

3,073 |

Risk

Only time will tell if the RXO spinoff will add value. The biggest risk then is the potential that XPO underperforms without the freight brokerage. The debt repayment and recent emphasis on share buybacks should drive EPS enough to provide average returns even if the fundamentals don’t strengthen.

Valuation

I personally don’t like a complicated mix of acquisitions plus spinoffs/asset sales, but if shareholder returns are high as a result of these actions then that’s all that matters. So far the stock has outperformed, but what about the returns starting from today’s price?

Below is comparison of price multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

Div Yield |

|

XPO |

0.6 |

6.5 |

38.9 |

3.4 |

n/a |

|

LSTR |

0.7 |

8.8 |

21.5 |

6.6 |

0.7% |

|

CHRW |

0.5 |

8.9 |

68.8 |

5.9 |

2.2% |

|

SAIA |

2 |

8.9 |

45.4 |

3.9 |

n/a |

|

TFII |

1.1 |

7.4 |

16.7 |

3.4 |

1.5% |

|

KNX |

1.2 |

5.2 |

11 |

1 |

0.9% |

|

ARCB |

0.4 |

3.7 |

6.6 |

1.9 |

0.6% |

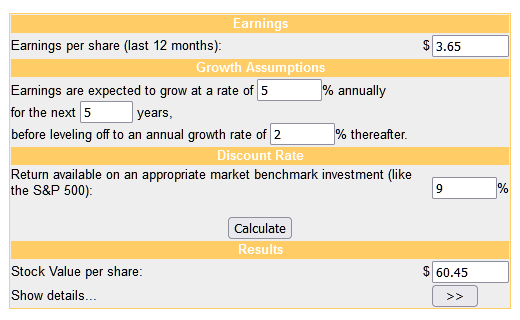

Below is the dcf model:

money chimp

The multiples comp doesn’t show a discount as far as price, but using a fairly conservative EPS estimate, the stock is clearly cheap enough now to consider. The problem however is knowing exactly what returns on capital will be going forward. I personally don’t get very bullish on the idea that most spinoffs add value because each entity can focus on its own line of business. This same objective can be accomplished by using a more decentralized approach where managers of each part of the business have a lot of autonomy. It’s true that multiple businesses as one are challenged by compensating managers of one segment with shares, when that segment doesn’t contribute a huge amount to the business. The solution shouldn’t always be separation though. I would rather see more creativity in compensating managers of each segment while staying under one corporate umbrella.

Conclusion

XPO is a business that looks very different over time. This latest spinoff was another example of this, and only time will tell if it was the best move for shareholders. For now I do think the stock is undervalued to what they will earn over the next several years, but I’m not convinced this spinoff was the right thing to do, therefore it is a hold.

Be the first to comment