The Good Brigade/DigitalVision via Getty Images

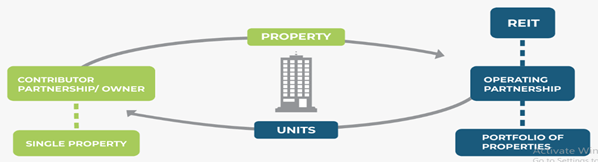

Equity Residential (NYSE:EQR) is a large-cap residential real estate investment trust (REIT) with a market capitalization of $34.13 billion. This REIT either develops or acquires apartments and then leases out to high quality long-term renters. EQR operates through an Umbrella Partnership Real Estate Investment Trust (UpREIT) structure. UpREIT is a type of “property acquisition transaction, where a property owner contributes his/her property to a REIT in exchange for ownership in the REIT”. It means that EQR may not directly own those properties. EQR also invests directly in equity joint-venture structures, pre-sale transactions at market cap rates, and in multiple property pools. EQR generally seeks to invest in well located assets with quality construction in communities of 100 or more apartments.

UPREIT – What Are They & How It Works (Royal Oak Property Trust)

Equity Residential has been paying a steady quarterly dividend with a decent yield since 1993, i.e. for the past 28 years. It has generated an average annual yield of 3.2 percent over the past five years. This REIT recorded an operating Cash Flow of $1.26 billion and levered Free Cash Flow of $937 million in 2021. EQR has a pretty high operating margin of 25 percent. As many as 980 institutions are holding around 95 percent of EQR’s equity shares. However, the top 10 institutional holders are holding almost 60 percent of its equity. The big three investment management companies – Vanguard Group, Inc., BlackRock Inc. (BLK), and State Street Corporation (STT) – hold approximately 32 percent of its holdings.

Residential lease rental incomes are much more reliable and recession resistant than other real estate investments and have enough growth potential in the long term. Equity Residential owns or has investments in 291 properties consisting of 74,712 apartment units, in its six established markets in Boston, New York, Washington, D.C., Seattle, San Francisco, and Southern California. Southern California is its largest market with almost 22,000 apartment units in 90 properties. Besides Los Angeles, it also has properties in Orange County and San Diego. EQR also expanded into four new markets – Denver, Atlanta, Dallas, Austin – with 5,695 apartment units in 19 new properties. In addition to its existing portfolio of residential properties, EQR is developing three additional properties with 1,136 units.

Equity Residential has an average rental occupancy of 97 percent and it’s almost the same in all the twelve cities that it operates in. Quarterly or monthly lease renewals of existing clients is around 60 percent. Despite higher occupancy, lower renewals may increase the operating cost of EQR. Lower renewals may also impact the rentals of this REIT in the long run.

Equity Residential is fast expanding its rental portfolio. In the year 2021, the Company acquired 17 properties, consisting of 4,747 apartment units with an average property age of two years, for an aggregate purchase price of approximately $1.7 billion. Approximately $1.4 billion, or 82% of all acquisition activity in 2021, was in expansion markets – Denver, Atlanta, Dallas, Austin. The Company funded these acquisitions by selling 14 older properties located within established markets, consisting of 3,053 apartment units, for an aggregate sale price of approximately $1.7 billion. The average age of the properties sold was approximately 30 years.

During 2021, the Company completed three development projects, consisting of 824 apartment units, for a total cost of approximately $602.8 million and started four development projects, consisting of 1,241 apartment units, for a total anticipated cost of approximately $452.7 million. Thus, going forward, an average monthly rent of $2,700 on its approximately 82,000 rental units will create a strong revenue. “The Company provided full year 2022 operating guidance that anticipates a 19.5%, 15.2%, and 15.4% increase in EPS, FFO per share and Normalized FFO per share, respectively, driven by expected total same store revenue growth of 9.0%.”

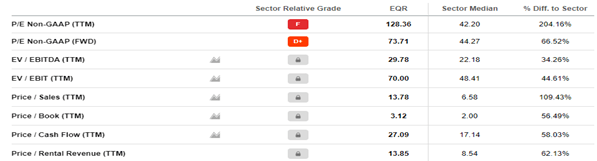

Undoubtedly, Equity Residential has strong fundamentals. However, its price multiples are extremely high when compared to its peers. EQR has a price/cash flow of 27 as compared to sector median price/cash flow of 17. Price/Rental Revenue, a very important indicator for residential REITs, is also quite high at 13.85, compared to sector median of 8.5. EV/EBITDA is also high around 30 compared to sector median of 22. Price to Sales of 13.78 is more than double than that of sector median. P/E, though abnormally high, hasn’t been considered here due to EQR’s nature of business. Being in a real estate business, price responds little to earnings and is more in sync with its quality and growth of assets. P/B of 3.12 is also around 56 percent higher than its sector median.

EQR Ratios (Seeking Alpha)

In the medium run, Equity Residential had a reasonable price performance. This REIT has recorded a growth of around 26 percent, and 44 percent over the past one and five years, respectively. Its price took a major hit during 2020 due to the Covid-19 pandemic related stock market crash in March 2020. S&P500 recorded a growth of around 11 percent, and 92 percent over the past one and five years, respectively. If we discount the impact of Covid-19 pandemic, the average price growth can be said to be satisfactory.

Considering the fact that leased apartment units are some of the most affordable options for living, companies like Equity Residential will always be in revenue generating mode. As an essential commodity, residential REITs should also benefit from macroeconomic growth. Moreover, all the long-term moving averages of EQR are placed below its short-term moving averages. This implies that momentum is on its side. This REIT also pays a steady dividend of around 3 percent. I expect this stock to deliver growth to investors in the short and medium term.

However, the price growth in the longer period, i.e. 10 years, had been disappointing at 73.6 percent as compared to 224 percent of S&P 500. EQR stock has witnessed high volatility during the past 10 years. It never had positive growth for three consecutive years. This may seem surprising considering EQR’s strong fundamentals, but it also suggests that the stock has a tendency of being overvalued due to increased investor interest, especially from large institutional investors. So, despite residential REITs having strong and steady growth prospects, the downward price movements on regular intervals pose a risk to investors over the long run. However, an investment horizon of three to five years seems more suitable.

Equity Residential is historically an extremely volatile stock, so it becomes highly susceptible to downward movements at regular intervals. As EQR is trading only at one percent discount to its 52-week high and the price multiples are already quite high, there is always a possibility of incurring a short-term loss within the next six or seven months. In order to be on the safer side, I’d like to hedge this residential REIT with calls and put options with duration of six months or more.

Though a number of call and put options are available for October 21 (6.5 months forward), within a strike price between $60 to $105, both call and put options are available only at the strike price of $85. So, I’ll try to put more emphasis on this strike price, which is also very close to the current market price. In order to safeguard my investments from a steep downfall, I would prefer to spend another $4 to buy an October 21 put option at a strike price of $85, so that my principal investment does not incur a loss beyond 12 percent.

Be the first to comment