Kuzmik_A/iStock via Getty Images

I last wrote about medical instruments company Becton, Dickinson (NYSE:BDX) just about one year ago. At the time, I called shares a strong buy, highlighting that it: “is one of the most stable predictable low-volatility health care stocks out there.”

And that’s exactly what BDX stock delivered in 2022. Since my prior article, Becton, Dickinson shares are up 3%, while the S&P 500 has dropped 19%. Up 3% is no game-changer in its own right, but it’s been a solid performance in an otherwise turbulent year for investors.

And, heading into 2023, I expect more of the same for Becton, Dickinson. The firm’s metrics are picking back up after a recent bump in the road. At worst, shares should be relatively steady, even if the market overall continues to slide. Meanwhile, with any upturn in broader sentiment or a repricing of health care names in particular, BDX stock could top $300.

Becton, Dickinson: A Set & Forget Defensive Health Care Name

The primary appeal of Becton, Dickinson is that it is an extremely stable and low-volatility company. The firm provides absolutely necessary medical tools and implements. Think of things such as needles, syringes, and diagnostic instruments. The company makes many of the basic tools needed to practice modern medicine.

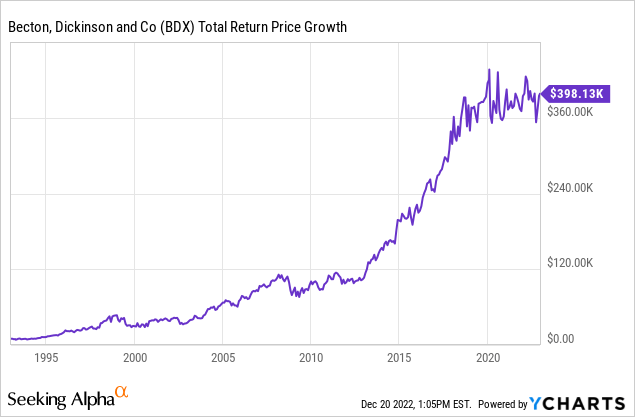

These sorts of products have a much more predictable and lower risk profile as opposed to things like pharmaceutical drugs or new medical device prototypes where there is a much bigger variation in potential risk and reward. Becton, Dickinson has built an exceptionally steady business that will never awe you any particular year, but which adds up to tremendous returns over the long haul:

Over the past thirty years, a $10,000 investment in BDX stock has now grown to $398,000 including dividends. And it has made that 40x return without any massive drawdowns or stomach-turning volatility. Johnson & Johnson (JNJ) is the classic “sleep well at night” of health care growth and income stocks, but I’d throw BDX stock in that same bucket.

Additionally, like J&J, Becton, Dickinson is a Dividend Aristocrat. In fact, it just got promoted to being a Dividend King as, in 2022, the company made it 50 years in a row of annual dividend increases. This is befitting of a firm that has been in business for more than a century, and which has a tremendous earnings track record. Even in the 2008 financial crisis, for example, Becton, Dickinson had flat earnings or rising earnings every year during that stretch. This sort of consistency powers the steady dividend increases and gradually rising share price demonstrated above.

Income investors might point to a relatively modest 1.5% starting dividend yield as a drawback. However, the dividend rises reasonably quickly, with a 7% annualized growth rate over the past decade. In addition, Becton, Dickinson has found ample opportunity to reinvest in its own business, judging by its satisfactory earnings and cash flow results over the years.

That said, Becton, Dickinson has seen a slowdown over the past few years, and the stock price has been essentially flat since 2019. What’s going wrong, and when will shares resume their march upward?

Messy Recent Results, But Stock Is Fine Looking Forward

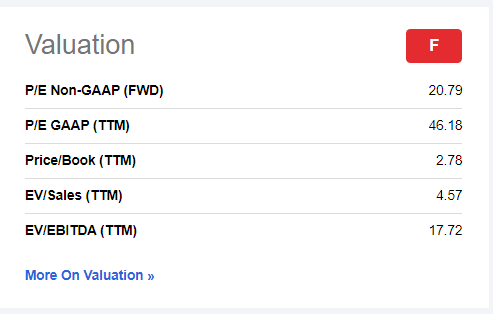

Becton, Dickinson currently looks expensive when you look at its trailing 12-month financial metrics:

BDX valuation (Seeking Alpha)

To that point, Seeking Alpha’s proprietary ranking model currently gives the stock an “F” rating based on valuation. And that’s understandable just from looking at the numbers as presented.

However, consider that the company has had several outside factors in recent times that impact results.

For one, Becton, Dickinson spun off its diabetes business Embecta (EMBC) in April of this year. As always, there are a host of one-time costs and accounting quirks that come when a firm spins off a business.

On top of that, Becton, Dickinson is dealing with costs related to several product recalls, and there are continuing inventory and demand issues related to the impact of Covid-19 on hospitals and the health care system.

All this makes it complicated to try to value Becton, Dickinson on current results. It’s not just earnings either, EBITDA and free cash flow are both down significantly from normal as well, which make it hard to make an apples-to-apples comparison to business performance prior to the pandemic.

That said, I would note that heading into 2022, Becton, Dickinson was at its cheapest price/free-cash-flow ratio since 2014. I believe it will be around the same discounted valuation level once results normalize, given that the stock price is essentially flat since that point.

You might be wondering if earnings power is less now that Embecta has been spun off, however that asset was only around 5% of the company’s total revenues before the spin off. So the impact on the firm’s long-term earnings power shouldn’t be too material.

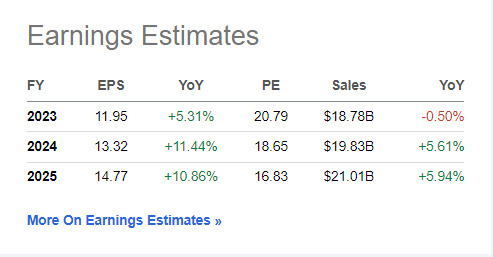

Looking forward, analysts expect a return to double-digit earnings growth and mid-single digits revenue growth in FY’24 and beyond:

Becton, Dickinson earnings outlook (Seeking Alpha)

Shares may not look tremendously cheap at 21x ’23 earnings and 19x ’24 earnings, respectively. But this is hardly a bad deal for such a stable predictable business as this one. Historically, Becton has traded closer to a 23x median P/E multiple over the years, suggesting shares are at a modest discount to their fair value today.

Selling needles, syringes and the like is much steadier than most of the rest of the health care industry. This is the perfect sort of industry in which to generate steady 8-10% earnings growth and annual 7% dividend hikes for the foreseeable future, and indeed, is a big part of how Becton, Dickinson got to be a Dividend King in the first place.

Becton, Dickinson’s Bottom Line

In my previous write-up, I highlighted the appeal of the company as a simple way to invest alongside the aging of America theme. Last year, I wrote:

Investors like to make things too complicated.

Something like aging is a simple enough concept. Currently, an estimated 54 million Americans are over the age of 65. In 2060, that figure is modeled to be 98 million. Add 44 million more over-65 people to the population and you’ll need way more medical care.

This is where many stock pickers would start weaving a narrative about robotics, gene-altering drugs, or other such moonshot investments. And that stuff could certainly work out.

However, it’s a crapshoot which science-fiction type new technologies will actually bear fruit. Meanwhile, there are other things that are far more certain. For example, if you have 44 million additional older people in the future, you’ll need way more needles, catheters, medication dispenser units, and so on.

Becton, Dickinson is not a particularly fast-moving firm even at the best of times. And it has been slowed even further due a variety of issues over the past couple of years. The current investor apathy around the stock is totally understandable and has some justification.

Over the longer-term, however, management is making moves to ensure that the firm remains that paragon of stability that is has previously been. The Embecta spin-off was an interesting move to sharpen the firm’s operational focus. Becton, Dickinson is slowly moving into high-margin areas such as informatics and having data and interconnectivity between various Becton products.

The firm has guided to longer-term growth in the mid-single digits. That should work out to reasonably strong total returns off the firm’s starting P/E ratio. Throw in its Dividend King status and track record of solid annual dividend increases, and this is an easy-to-own growth and income stock that should see increasing business over the years thanks to demographics.

Be the first to comment