Michael Vi/iStock Editorial via Getty Images

Introduction

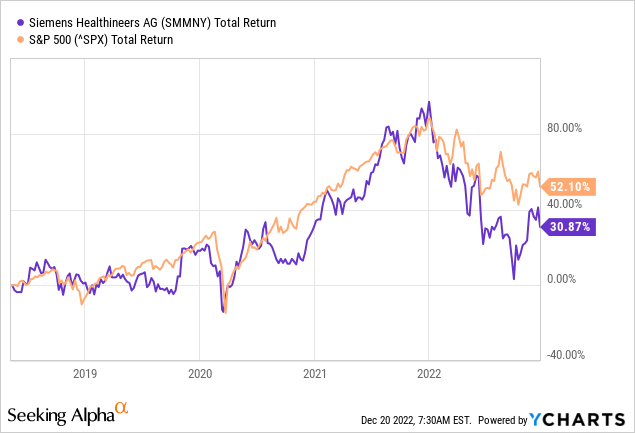

Siemens Healthineers AG (OTCPK:SEMHF) is a company specializing in healthcare imaging; more than half of its revenue come from this segment. Siemens Healthineers is a subsidiary of Siemens Aktiengesellschaft (OTCPK:SIEGY). Its 5-year total return is lower than that of the S&P500 (SP500), but the company expects strong growth in earnings per share through fiscal 2025. Despite the strong growth, the Siemens Healthineers stock valuation is on the high side. This prevents me from buying the stock at its current price.

Company Overview

Siemens Healthineers is a German-based company that develops a range of diagnostic and therapeutic products and services for healthcare providers worldwide.

The company consists of the following business segments:

- Imaging (51% of total revenue)

- Magnetic resonance imaging, computed tomography, X-ray systems, molecular imaging, and ultrasound systems.

- Diagnostics (28% of total revenue)

- In-vitro diagnostic products and services, and workflow solutions.

- Varian (13% of total revenue)

- Cancer care technologies, and solutions and services to oncology departments in hospitals and clinics.

- Advanced Therapies (8% of total revenue)

- Products that are designed to support image-guided minimally invasive treatments in various areas, such as cardiology, interventional radiology, and surgery, and others.

Fourth Quarter Fiscal 2022 Earnings Were Mixed

Figures for the fourth quarter of fiscal 2022 were mixed, with revenue of $5.5 billion (down 8% year-over-year). Earnings per share came in 20% lower, but the company announced strong growth prospects for the near future.

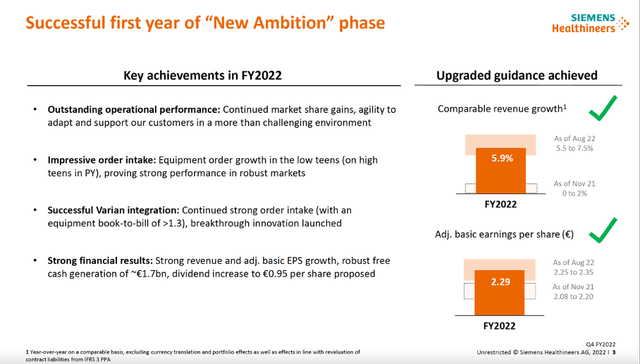

Key achievements in fiscal 2022 (Siemens Healthineers 4Q22 investor presentation)

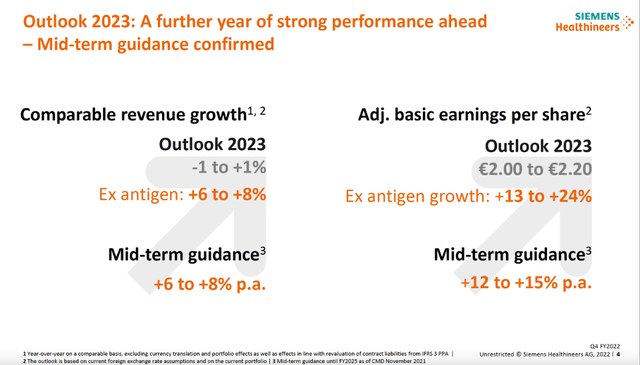

Siemens Healthineers expects solid growth prospects through fiscal 2025. Sales are expected to grow by 6% to 8% annually and earnings per share by 12% to 15%. These are strong growth ambitions.

Fiscal 2023 outlook (Siemens Healthineers 4Q22 investor presentation)

Dividends And Share Repurchases

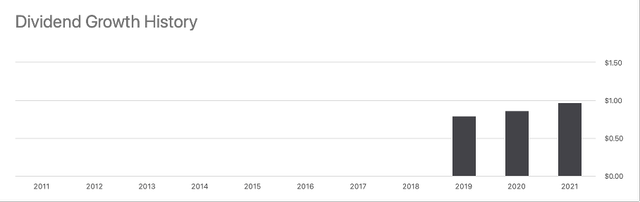

Siemens Healthineers offers a solid dividend of 1.85% (dividend rate = $0.97 for SEMHF stock). The dividend increased as much as 11.5% last year and is well covered by free cash flow. The dividend payout ratio (relative to free cash flow rather than earnings) is 38% in fiscal 2021.

Dividend Growth History (Seeking Alpha SEMHF ticker page)

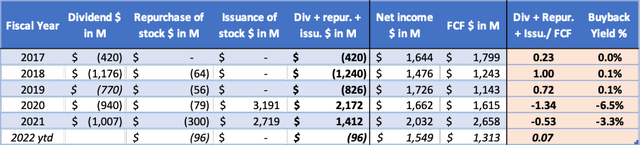

In addition to dividend distribution, the company repurchases shares, which should gradually increase the stock price because investors “own” more of the company after the buybacks.

The company repurchased $300 million in fiscal year 2021, representing only a 0.5% buyback yield (excluding share issuances). The share issues were partly due to the acquisition of Varian Medical Systems.

Siemens Healthineers Cash Flow Hightlights (SEC and Author’s own calculations)

Although the buyback yield is quite low, the dividend per share is well covered by free cash flow. The low dividend payout ratio allows the company to further increase its dividend per share.

Valuation Looks Expensive

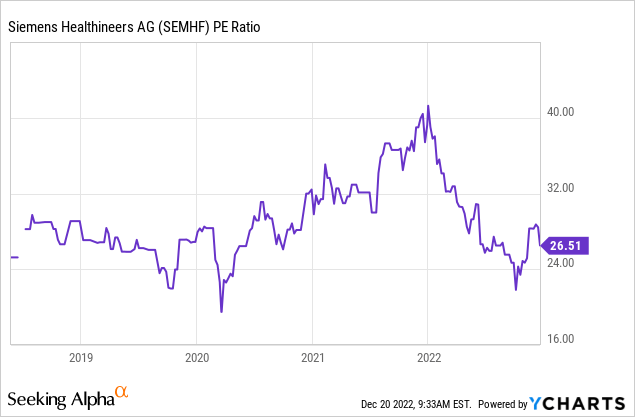

The stock’s valuation is generally quite expensive, with a P/E ratio of 27. Still, the stock’s average P/E ratio is also 27, but in today’s uncertain economic times, I think this is a high valuation of the stock. Siemens Healthineers expects medium-term earnings per share growth averaging 12% to 15% annually through fiscal 2025. The company will have to deliver on this growth to justify the high P/E ratio.

The stock is expensively valued in an environment of rising interest rates, so I give the stock a hold and wait for a lower stock price.

One risk is that the OTC stock trades in low volume, especially large investors may have problems buying and selling the stock. The company is also listed on the German stock exchange (DAX), where daily volume is high. Thus, investors are better off buying shares on the DAX.

Conclusion

Siemens Healthineers is a medical equipment company headquartered in Germany. More than half of its revenues come from its imaging segment, and Siemens is a leader in this segment. Siemens Healthineers expects strong growth in both revenue and earnings per share through fiscal 2025. The company pays a dividend and buys back shares; the dividend yield is currently about 1.9%, and the dividend per share increased 12% over the past year. The dividend payout ratio is 38%, giving the dividend per share room to grow. Despite high expected annual earnings growth of 12% to 15% per year, the Siemens Healthineers AG share valuation is very high. The high valuation of the stock keeps me from buying Siemens Healthineers AG stock at this price level.

Be the first to comment