sankai/E+ via Getty Images

After a few months of steady price performance, STMicroelectronics (NYSE:STM) is up by more than 15% in the last month. In our previous analysis, we commented on its quarterly result with a publication called Broad-Based Beats, whereas today we are going deep into Mare Evidence Lab’s key takeaways as also reported in our Initiation of Coverage. As a reminder, aside from the MICRO reasons, our buy case recap was based on: 1) early EV adoption and STM’s involvement in the new auto production era; 2) higher reinvestment CAPEX plans, 3) the EU Chips Act, and 4) the iPhone refresh cycle and its lower dependency based on the company’s revenue growth.

What’s new?

There is a new collaboration phase between STMicroelectronics and Soitec on silicon carbide substrates (SiC). It expects the Italian-French semiconductor company to qualify the SiC substrate technology of Soitec, a French company that produces innovative semiconductor materials, over the next 18 months.

STM’s adoption of Soitec’s SmartSiC technology for the future production of 200 mm substrates from 150 mm wafers will allow a substantial increase in production capacity, making it possible to almost double the useful area for the production of integrated circuits and consequently increases the number of chips by 1.8-1.9 times. SiC is a very innovative compound semiconductor material, whose intrinsic properties allow for higher levels of performance and efficiency than traditional silicon. This will support rapid power applications in the fields of electric mobility and industrial processes. This move to a 200mm SiC wafer will bring substantial benefits to STM’s end customers as they accelerate toward EV transition and more electrification of products and systems.

In light of growing demand in automotive and industrial applications, STMicroelectronics announced a new silicon-integrated manufacturing facility in Sicily, with support from the European Commission. Brussels already declared that it granted €292.5 million from Italy under the new Recovery and Resilience plan to support the industrial plant construction. In detail, investment CAPEX is set at €730 million and the focus will be silicon carbonate wafers construction. This output serves as the basis for microchips in many end markets such as electric vehicles and fast charging stations. According to Margrethe Vestager, responsible for competition in the EU Commission, the approved measure will strengthen the supply chain of semiconductors in Europe. The new plant will support SiC growing demand for devices in automotive and industrial applications for STM customers who aim to make the transition to electrification and require higher energy efficiency. Production is expected to start in 2023 and a more balanced SiC supply between internal materials produced and purchased from external suppliers. More specifically, the plant will be the first of its kind in Europe for volume production of 150mm SiC epitaxial substrates and will integrate all steps of the production flow.

Aside from granting new funds, the EU is really pushing chip production in the old Continent. The commission agreed to support with a dedicated fund of almost €45 billion to reduce EU dependency on chip imports. At the moment, the EU chip output accounts for only 8% of the total global capacity and is down on a yearly basis since 2000. STM and Infineon could be the real beneficiary of this positive development.

Conclusion And Valuation

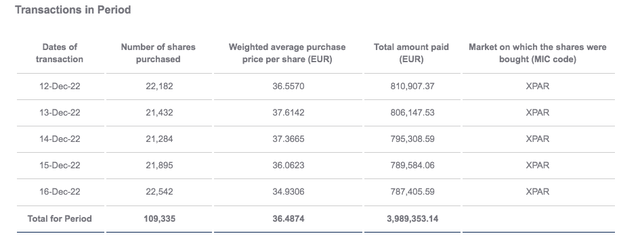

All the above news is very supportive of our STM’s investment thesis. The company is also moving on with its share buyback program. Currently, it holds almost seven million in treasury shares, which are approximately 0.8% of its share capital.

STM buyback

Source: STM corporate website

The company is transforming its global manufacturing operations, with additional capacity in 300mm manufacturing and a strong focus on broadband semiconductors, supporting its ambition to reach $20+ billion in revenues. Therefore, we continue to overweight the company with a buy target of €60 per share based on a 20x Price Earning multiple in our 2023 numbers. Here at the Lab, we really believe that the current valuation is not justified – STM is trading at just 10x EV/EBIT on 2023 accounts. With guidance reiterated and an important order backlog, we maintain our buy.

Be the first to comment