SimonSkafar

Volatility gets you in the gut. There’s no question that when prices are jumping around, you feel different from when they are stable. – Peter Bernstein

If you’ve been keeping track of my work over the years, you’ll note that one thing I always tell novice investors is to devote a portion of their portfolios towards segments that they absolutely hate. I couldn’t be certain, but I suspect the investment product that I’ll be covering today is one of those names that would appear to fit the bill.

I’m talking about the iShares U.S. Utilities ETF (NYSEARCA:IDU), which focuses on 44 U.S. companies that supply gas, electricity, water, etc. Granted, this sector may lack the oomph of the tech or consumer discretionary sectors, but it certainly has some very useful qualities that could come in handy during uncertain market conditions.

Why IDU?

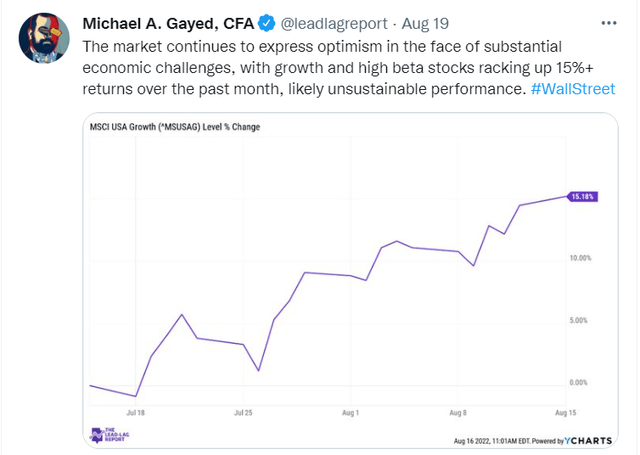

As I’ve said many times before, the utilities sector serves as an ideal proxy for those looking for bond-like segments within the equity market, and in my long history of covering the financial markets, I’ve learned that the bond markets have proven to be right more often than not. I’m a little concerned with the euphoria we’ve seen in the equity markets over the past month.

As noted last week in The Lead-Lag Report, market participants appear to have cast aside their seat belts and have been going gung-ho over the high beta and growth segments of the market thinking that everything is hunky dory once again. They could well be tempting fate here.

Subscribers of my paywalled research would note that I highlighted previous bear market rallies of over 20% or more, where growth, speculative and high-beta names led the market. Sadly, those rallies were quickly sold into, only for the market to establish fresh lows in due course. Just for some perspective, during the tech bubble, there were four separate rallies of this nature, all of which ended with the same outcome. Interestingly, you’d be interested to know that tech valuations (the largest component of the market) have once again crept above their long-term average; this could well serve as another catalyst for a fresh wave of selling.

Then, there’s also all the uncertainty around what the Fed is going to do with interest rates (the markets are still pricing in 125bps or so, but this could change quickly) and that will most certainly trigger a fresh wave of volatility. The inconsistent communication from the Fed has been a problem for the markets, and I touched upon some of the difficulties the Fed faces in a recent podcast episode of Lead-Lag Live with Jim Grant, Jim Bianco, and Axel Merck.

Essentially, the challenge here involves getting the balance right between taming inflation and avoiding a recession. We’re basically looking for a goldilocks scenario whereby inflation comes down fast enough over the next couple of months so much, so the Fed feels emboldened enough to pause rate hikes and prevent a “hard” landing. Truth be told, we may already be witnessing a “hard” landing in some vital cogs of the economy such as housing. The recent new home sales report was quite a disaster coming in 12% lower on a sequential basis (incidentally the lowest reading in over 6 years). In addition to that, the market is also sitting on a good 11 months of housing inventory that will need to be wound down.

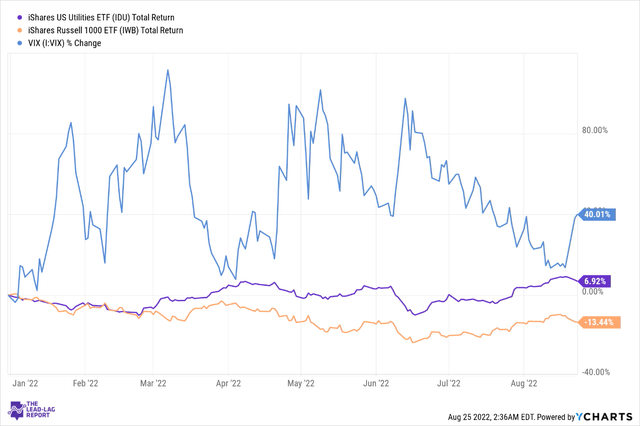

All in all, it looks as though the Fed has its work cut out in getting the balance right, and I suspect we will continue to witness ambiguous disclosures from the top brass there about what they intend to do with monetary policy. This will only likely fuel the VIX, and when volatility conditions spike, it would a great deal of sense to have some defensive plays such as IDU to fall back on.

Essentially, one needs to consider that the iShares US Utilities ETF is just a subset of the broader Russell 1000 Index. Consider how these two products have fared when the VIX gauge has spiked by 40% this year; IDU has comfortably outperformed the broader markets, delivering 7% returns even as the latter has floundered in negative territory.

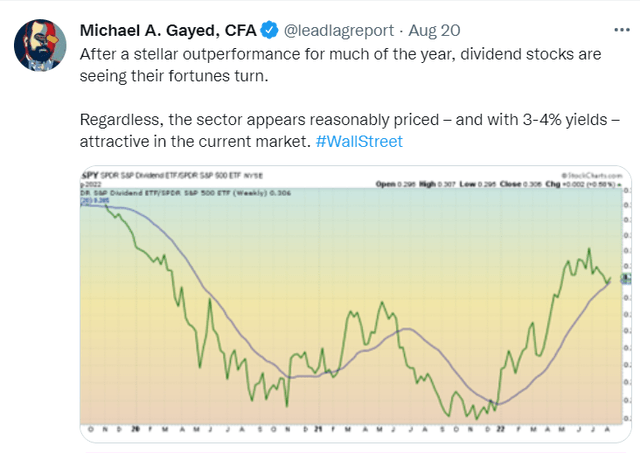

There’s also the dividend angle to consider; as noted in The Lead-Lag Report, dividend plays appear to have lost some luster in recent weeks but perhaps it would be a good time to own these plays at lower levels.

Most of utility stocks offer a healthy dividend component that could help you tide over prolonged drawdowns. For instance, consider something like IDU’s top holding- NextEra Energy, Inc. (NEE), which has a substantial weight of 14%. The company recently mentioned that they would be bumping up its annual dividend by at least 10% over the next 2 years. Currently, IDU offers a yield of 2.03%, more than 70bps higher than the iShares Russell 1000 ETF (IWB)

Conclusion

As laid out in this article, IDU appears to be an ideal product to navigate the uncertain conditions we’re currently witnessing in the market. Considering its defensive quotient and the alpha generated this year, it’s not particularly surprising to discover that its valuations don’t come cheap. The ETF currently trades at a hefty forward P/E multiple of almost 21x, which is a good deal higher than the Russell 1000 ETF which only trades at 17x.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment