Scott Olson

Twitter (NYSE:TWTR) stock has corrected since the recent Whistleblower complaint against the social media giant. In addition to other accusations, the Whistleblower Peiter “Mudge” Zatko also focused on the key issue around spam bots raised by Elon Musk.

Talking about bots, the whistleblower said that Twitter executives aren’t incentivized to identify the number of spam accounts on the platform. This is no surprise.

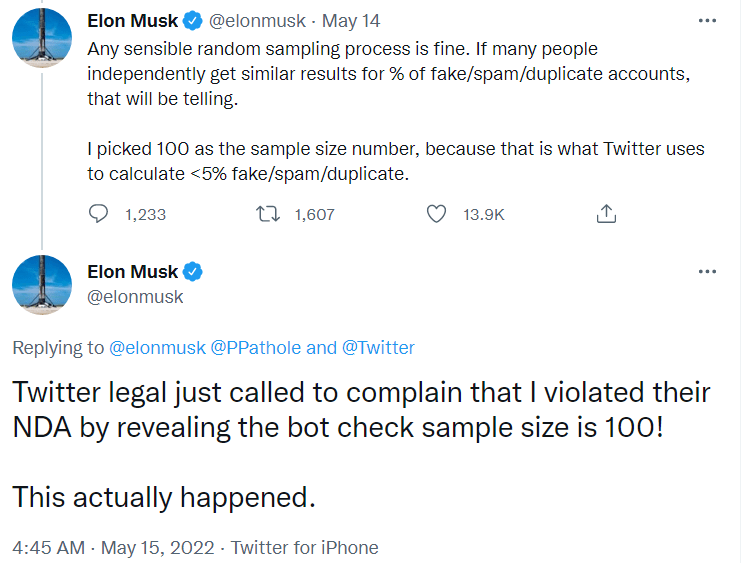

During an exchange on Twitter, Elon Musk highlighted that after using automated programs to delete fake accounts, Twitter does a manual check on a random sample of 100 Twitter accounts daily.

Elon Musk’s Tweet talking about Twitter’s Sample Size Number for Bot Estimation (Twitter)

One doesn’t need to be a student of statistics to figure out that this sample size for manual checks looks too small to make any meaningful conclusion. These 100 accounts can easily be examined by a single person alone if we assume he/she spends 4-5 minutes checking an account’s login history and the kind of posts/comments it has done. It is not like doing a manual check on a much higher number of accounts would be too difficult a task or cost prohibitive. Twitter can easily hire a good team of 100 people in a low-cost country like India and get 10,000 accounts (or 100x more) checked daily. All this should not cost more than a couple of million dollars – pocket change for the company preparing to get acquired for $44 bn.

The fact that Twitter is sampling such a low number of accounts shows a lack of desire by management to address this issue and certainly raises a red flag.

Another red flag which worried me about the bot issue and the accuracy of Twitter’s 5% claim happened a few years back in 2017. In Q1 2017, the company reported a 6% Y/Y increase in its MAUs but its advertising revenues declined 11% Y/Y. The way management tried to explain this decline was by citing a ~63% decline in cost per engagement (CPE). I find it difficult to digest. If 95%+ of a company’s users are genuine, how can the kind of revenue the company generates on average on their engagement see such a wild swing? So, I always had my doubts if the less than 5% spam claim that Twitter shares is correct.

Interestingly, after 2017, management introduced mDAU as a new metric representing monetizable Daily Active Users. There is very little clarity on how mDAU is determined and due to its opacity, management likely has some (or a good amount of) leeway in what they want to include in it and what not. The Whistleblower also complained about this opacity.

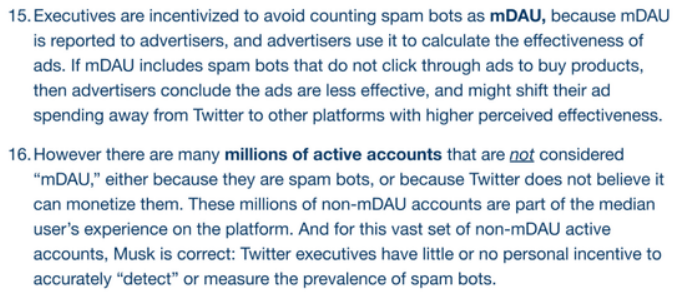

However, the interesting thing is management now quotes only this figure in their SEC filings and even by the whistleblower’s own admission, “executives are incentivized to avoid counting spam bots as mDAU, because mDAU is reported to advertisers.”

Excerpt from the Whistleblower’s complaint

Since I had my doubt regarding the company’s claim in 2017 that less than 5% of its MAUs are fake, the same scepticism continued even when the company started reporting mDAUs. But the recent whistleblower complaint seems to be suggesting otherwise as it says executives are incentivised for not counting spam bots in mDAUs. If we assume the whistleblower testimony to be correct, it seems likely that Twitter’s assessment that only 5% of mDAUs are spam/fake/bot accounts is correct and management is giving the true information post-2018 regarding mDAUs.

Now, the interesting thing is Elon Musk isn’t talking about mDAUs. Elon Musk cited the following reason for backing off the deal,

Twitter deal temporarily on hold pending details supporting calculation that spam/fake accounts do indeed represent less than 5% of users.”

He seems to be talking about the total number of users. But Twitter is not claiming that less than 5% of its users are fake in its filing or legal documents. Below is a quote from Twitter’s latest 10-K,

We have performed an internal review of a sample of accounts and estimate that the average of false or spam accounts during the fourth quarter of 2021 represented fewer than 5% of our mDAU during the quarter.”

They are saying less than 5% of their mDAUs are fake. Even in his response to Musk’s query, Parag Agarwal talked about mDAUs and not total users which Elon Musk seems to be referring. So, while Parag Agarwal may be misdirecting Elon Musk (as the whistleblower has said), legally he cannot be accused of wrongdoing as his comment and what Twitter mentions in its 10-K filings is most likely true.

If, at the time of the deal, Twitter has not claimed in its legal filings (eg. 10-K) that less than 5% of its total active users are fake, it cannot be held responsible for the accuracy of this assertion.

Now some (myself included) may say that Twitter was lying in 10-K filings prior to 2018 and a lot of doubts may be cast on their assertion below. Would it not impact their case?

We have performed an internal review of a sample of accounts and estimate that false or spam accounts represented fewer than 5% of our MAUs as of December 31, 2017.”

I believe it will be very difficult to prove the above statement wrong as the data that old might have not been preserved due to data secrecy norms. Even if one proves it to be wrong, what Twitter was doing five years back might not even be considered material adverse development as it has little bearing on Twitter’s current prospects.

In short, I don’t think Twitter currently claims in its legal documents that “spam/fake accounts do indeed represent less than 5% of users.” They claim that “spam/fake accounts represent less than 5% of mDAUs.” The whistleblowers’ testimony seems to be augmenting Twitter’s claim rather than harming it. So, I think Elon Musk’s argument about Bots appears weak if we trust the whistleblower’s testimony. So, focusing on Bots alone is unlikely to help Elon Musk get any relief.

There was other damaging content in the whistleblower’s complaint though, like Twitter’s lax privacy/security policy and the way it accede to demands from some foreign governments and allowed their agents to enter its rolls. The whistleblower is going to testify in the senate on this. Unless Elon Musk is able to make good use of his other reveals and lobby the government/regulators to take some action which can be considered a material adverse event, it will be difficult for him to achieve a win.

If we go by the initial developments in this case, the judge overseeing the Twitter v. Musk case, Kathaleen McCormick seems to be agreeing with Twitter’s line of arguments whether it was an early trial decision, calling Musk’s requests “absurdly broad” or calling Musk’s discovery conduct suboptimal.

These are just initial rulings and I am not doubting Musk’s capability but his lawyers have so far disappointed. If we look at the recent commentary on Twitter’s fair valuation sans this deal, we have seen a target price as low as $11 according to Rosenblatt analyst and $20 from Lightshed’s Rich Greenfield. If we compare Twitter’s EV/EBITDA valuation versus its peer Meta Platforms (META), it looks significantly overvalued trading at ~30.39x EV/EBITDA (FWD) versus Meta’s ~8.28x EV/EBITDA (FWD). I believe this is precisely why Elon Musk is desperately trying to avoid this deal. I have also discussed in a prior article the kind of leverage Twitter will be taking post-deal and there is a chance that Elon Musk sees a complete wipeout of his equity in a post-deal scenario.

It is still early to say if Elon Musk will be able to avoid this deal or not. The strategy he has used so far using bots as an excuse has not worked in his favour. Unless he uses other disclosures by the whistleblower regarding lax privacy and security, or foreign government intervention to get regulators or senators into action, I see little chance of him succeeding. So, I am upgrading the stock from my previous sell rating to neutral. However, I am still not going to buy because I believe there will be efforts from Elon Musk lobbying for regulatory action against Twitter and frankly, there is more downside (in case Elon wins) versus upside (in case Twitter wins.)

Be the first to comment