Darren415

This article was first released to Systematic Income subscribers and free trials on Sep. 11.

Welcome to another installment of our closed-end fund (“CEF”) Market Weekly Review where we discuss CEF market activity from both the bottom-up – highlighting individual fund news and events – as well as top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the first full week of September. Be sure to check out our other weekly updates covering the BDC as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

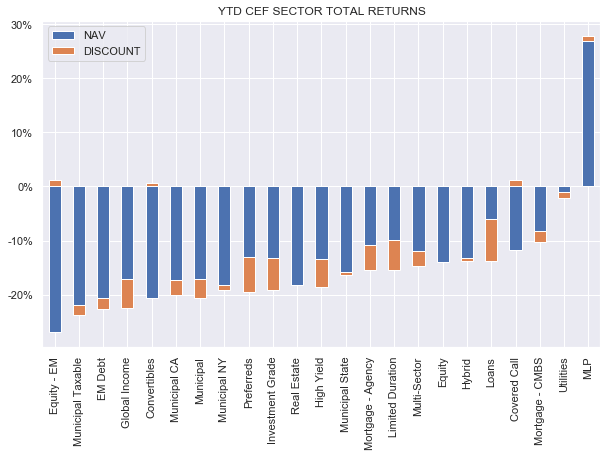

CEFs had a positive week overall as higher Treasury yields were more easily digested by credit and equity-focused CEF sectors. Municipal sectors underperformed.

Year-to-date, sectors that have underperformed are the longer-duration ones like Munis as well as Emerging Markets and higher-beta convertibles.

Systematic Income

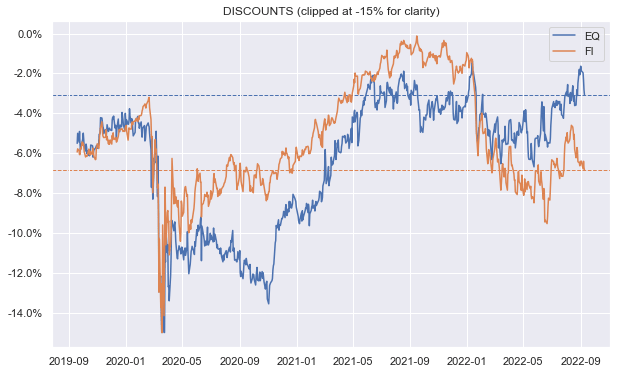

Despite an overall upbeat mood in the CEF space, discounts widened, in aggregate, across both equity and fixed-income CEF sectors.

Systematic Income

Market Themes

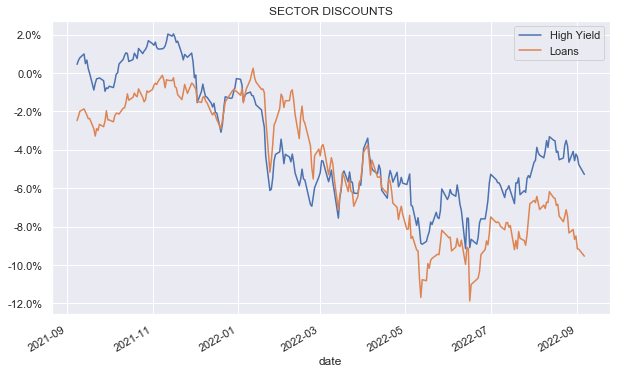

There was a question on the service about what to make of the fact that loan CEF discounts have sharply underperformed those of HY bond funds recently.

The behavior of the two CEF sector discounts has been very interesting. At the end of 2021, loan CEF discounts traded wider than HY bond CEFs, as the following chart shows.

Systematic Income

Then, as it became clear that the Fed was about to embark on a series of hikes (i.e., supporting loan fund income levels), loan CEF discounts outperformed HY bond CEFs by around 8% up to February. That didn’t last long, however. Since then, loan CEF discounts have steadily underperformed HY bond CEFs.

Now the loan CEF sector discount is about 4% wider than the HY bond CEF sector, which is oddly a bit worse than what the situation was in 2021. It’s as though none of the Fed hikes (which have allowed loan fund income levels to grow relative to bond fund income levels) mattered at all for relative valuation. What’s more interesting is that year-to-date loan CEFs are down 6.4% in total NAV terms while HY bond CEFs are down 15%. Again, it’s as though this outperformance didn’t happen. So, what’s going on? Why is the market ignoring the fact that loan CEF income levels have improved significantly while income levels of HY bond CEFs have fallen and why is the market also ignoring much better total NAV performance of loan CEFs?

One response here is that the CEF market is far from efficient and we shouldn’t expect the price action to make a lot of sense. Often it’s better to take advantage of the opportunities and just move on.

That said, it’s possible that there is some rationale to this. One is that rising rates put more pressure on loan borrowers who now have a higher interest expense to deal with whereas bond borrowers are not facing a rise in interest expense (of course some borrowers have both bonds and loans). So, all else equal, loans are now riskier relative to bonds and this could be turning investors against loans even as loan fund incomes are rising.

It’s also possible that the market is beginning to think that a coming recession means that Treasury yields will move lower as inflation peaks and subsides. In this case HY bonds will outperform loans, all else equal and this could be pushing investors to buy bonds over loans.

Third, HY bond yields have moved up sharply (due to the sharp drop in bond prices) already while loan investors have to wait for Libor to fully make its way into cashflows which only happens with a lag. In other words, HY bond yields have already risen nearly as much as loan income levels are expected to rise. The difference is that bonds have done this entirely through a steeper price fall rather than organically through higher coupons as loans have.

Finally, CEF investors could be simply targeting assets that have fallen the most, with the view that buying the worst-hit assets should generate stronger capital gains going forward. In our view this is very unlikely since for HY bonds to reverse all of their drop, Treasury yields would have to move back to levels of 1-1.5%. This is pretty tough given the messaging from the Fed and the level of inflation. If it does happen it will be because the U.S. economy has collapsed in which case credit spreads will rise more than Treasury yields fall, meaning HY bond prices will drop even more.

Overall, there are no fully satisfying explanations. At the same time, this is what makes the CEF space fairly compelling for investors with well-defined views.

Market Commentary

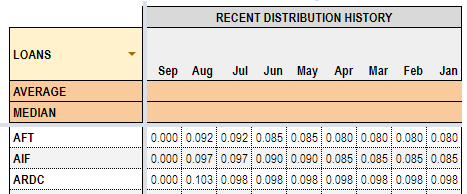

The Ares Dynamic Credit Allocation Fund (ARDC) issued a shareholder report. Net income rose around 8% from the previous year. This is despite some deleveraging as well as holding bonds in half of its portfolio. On the other side of the ledger (i.e. factors that push income higher) are the lack of Libor floors on CLO holdings as well as the fact that about half of its liabilities are fixed. The fund issued private fixed-rate term preferreds with a weighted-average dividend rate of 2.81% – that’s now well below where Treasuries trade.

The fund raised its distribution recently to $0.1025, however its net income came in at $0.1133 so there is still quite a bit of room to raise the distribution. Plus, the net income number is obviously delayed as the rise in short-term rates has not fully fed through and short-term rates are continuing to move up. The fund has $228m of floating-rate assets versus about $90m of floating-rate liabilities – that differential feeds straight to income. More broadly, this combination of floating-rate assets and fixed-rate liabilities (partly or fully) is obviously a good one in this environment.

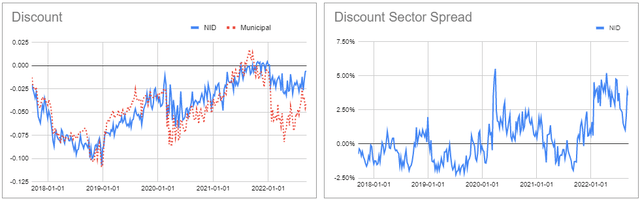

The boards of Municipal term funds Nuveen Intermediate Duration Municipal Term Fund (NID) and Nuveen Intermediate Duration Quality Muni (NIQ) earlier approved a proposal to eliminate their term structure. The way it usually works with Nuveen is that now it’s put up to a shareholder vote and shareholders will typically approve the proposal, i.e., they will vote to turn the term funds into perpetual funds.

Approval is the only reasonable step as shareholders don’t lose anything by approving and gain the continued existence of the fund. The reason shareholders don’t lose anything is because in case of approval there will be a tender offer for all shares at 100% of NAV – economically, it’s the same as waiting for termination since in both cases the discount will be zero.

Arguably, the tender offer is even better than a termination since the fund suffers less slippage in unwinding its portfolio since only a part of it has to be unwound in the case of a tender offer while all of it has to be unwound in case of termination.

If the remaining assets are above $70m, the funds will carry on as perpetual funds. For investors who want to stay with the fund, it still makes sense to tender the shares at 100% of NAV and then buy the fund shares back. This is because it’s very likely the shares will start to trade at a discount post tender offer – in line with the rest of the sector.

CEF Tool Update

This week we added a new feature to the subscriber CEF Tool which lists recent distributions paid. It can allow investors to quickly gauge a given fund’s distribution profile on a standalone basis as well as relative to its peers in the sector.

Systematic Income CEF Tool

Stance and Takeaways

This week we rotated from the Municipal term funds NID and NIQ mentioned above into the mostly investment-grade Angel Oak Financial Strategies Income Term Trust (FINS). Although NID and NIQ have not escaped unscathed from the struggles of the Muni sector, they have significantly outperformed the sector with an average total NAV return of -9% this year versus -20% for the Muni CEF sector.

A big part of the reason is that the term structure of these funds has anchored their discounts closer to zero as the following chart shows for NID. FINS features an attractive income profile which will continue to benefit from high and rising short-term rates. Current valuation offers a nice entry point as its discount has moved wider on the back of its recent distribution right-sizing.

Be the first to comment