Avalon_Studio

Investment thesis

Since I was a kid, I used to play with yellow excavators, dozers, compactors and articulated trucks. When I drew construction equipment the only color I used was yellow. Only many years later I realized they were all Caterpillar merchandising and this made me think about how strong of a brand Caterpillar (NYSE:CAT) is in order to enter into a kid’s imagination and set the link between construction equipment and yellow.

Since I began investing a few years ago, Caterpillar has been on my watchlist for my dividend growth portfolio. However, so far I haven’t yet gone long on the stock as I am waiting for a better valuation.

A few months ago, I wrote my first article about Caterpillar. I outlined how the company found itself not as prepared as others in accounting for inflationary pressure on production costs. This led to margin contraction which brought some multiples up a bit. In addition, I also pointed out that a lot of future growth was already priced into the stock as the Infrastructure Investment and Jobs Act passed in late 2021 was already well-known. On the other side, I outlined Caterpillar’s beautiful dividend history which led the company to the status of Dividend Aristocrat while keeping its payout ratio around a healthy 40%.

In summary, I rated the stock a hold since I was expecting further margin contraction that would have hit again Caterpillar’s well-known profitability. I still believe the stock is a hold at the moment, even though as long as the share price is below $200 I believe there are reasons supporting a buy rating, too. As for me, I usually try to buy with at least a 20%-25% margin of safety, which at the moment is still lacking. This is why, though interested in owning the stock I am still on the sidelines, rating it as a hold, until it reaches the range between $170-$180. The stock traded within this range between June and July, however, at that moment I didn’t have the liquidity aside to grab the opportunity and I had to pass.

Q2 2022 earnings

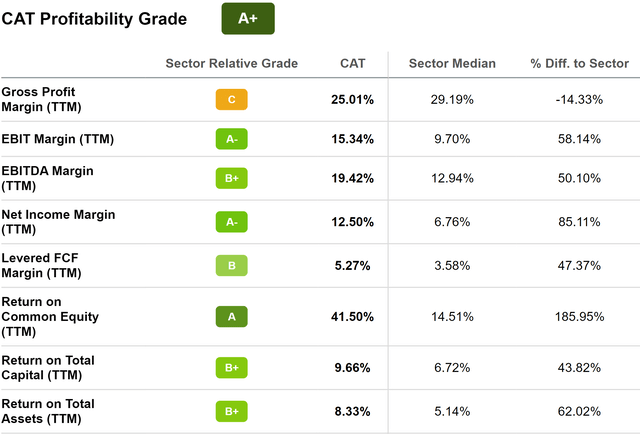

The main factor I was eager to look at as the earnings report was released was profitability. In fact, as shown on Caterpillar’s profitability page on Seeking Alpha, the company sits on top of the industry regarding most metrics.

Gross profit margin, although rated with a C, is still very high for a machinery manufacturer. EBIT margin and net income margin are rated in the A range and the ROCE is impressive at 41.5%.

This is why it was not good news to see the Q1 operating margins of all three main segments Caterpillar has (Construction, Resource, Energy and Transportation) go down by 2 to 5 percentage points.

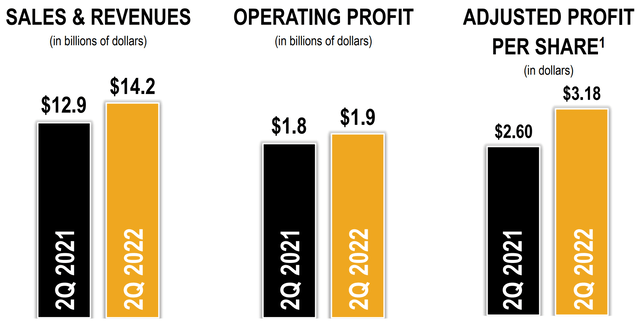

Now, Q2 sales and revenues increased YoY across Caterpillar’s three primary segments. All regions were up except for EAME (-3% YoY), which confirms what many other machinery manufacturers are reporting. Caterpillar’s sales in North America rose by 18% and the company saw quite a bit of strength in Latin America, too, where a 48% sales growth was reported.

The slide below shows, however that margins are still going down a bit both YoY and vs. the prior quarter where the company reported a 13.7% operating profit margin.

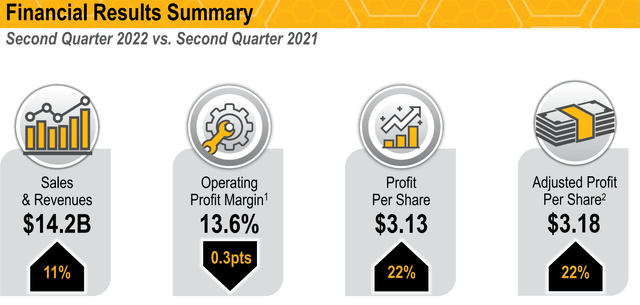

As we can see from this other slide taken from the Q2 Results Presentation, there is a difference between the increase in operating profit and the profit per share. The first one grew by $100 million, which is equal to 5.5% YoY; the second grew by 22%. The explanation is simple: profit per share increased by 22% because it was supported by the buyback program that repurchased $2.6 billion of common stock in 2021 and then another $1.9 billion during the first six months of this year. In May, Caterpillar’s Board announced a new buyback program of an additional $15 billion of common stock which has been effective since August 1st. This is approximately 15% of the current market cap.

Caterpillar Q2 Results Presentation

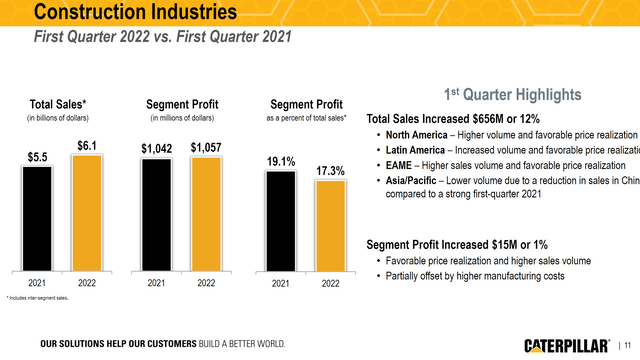

As we already said, even though sales increased, operating margin decreased. We can take as an example the construction segment result. Below we see that while sales increased 12%, the segment profit as a percent of total sales decreased by almost 2 percentage points to 17.3%.

The resource segment, too, saw its segment margin shrink by 1.7% from 13.7% last year to 12% in the past quarter.

The energy and transportation segment saw an even larger decline since its profit margin came down by 3.2% from 14.8% to 11.6%

The explanation Caterpillar gave in its report is quite simple:

The decrease was mainly due to unfavorable manufacturing costs and higher SG&A/R&D expenses, partially offset by favorable price realization and higher sales volume. Unfavorable manufacturing costs largely reflected higher material and freight costs.

The company had already warned investors that this year, given the particular economic conditions, things would have been the other way around as usual, with profit margin down in the first half and up in the second half as the effects of price realization will take place.

Given this fact, it is very good news for investors to know that Caterpillar’s total backlog, as shown in the picture below, increased by about $2 billion in the quarter, and by $10.1 billion YoY, led by Energy & Transportation. Although there will still be inflationary pressures in manufacturing costs, investors should now expect that pricing in the second half will more than offset these cost increases for the full year.

Free cash flow

As Andrew Bonfield, Caterpillar’s CFO, reported during the earnings call:

We generated about $1.1 billion in ME&T free cash flow during the quarter, a decrease of about $600 million versus the second quarter 2021. […] Looking ahead, we expect stronger free cash flow in the second half due to the absence of the payment of incentive compensation. We also do not anticipate our working capital rise as it did in the first half of the year. Therefore, we continue to expect to achieve our Investor Day ME&T free cash flow target of between $4 billion and $8 billion for the full year.

These words are particularly important because it is clear that the $1.1 billion in free cash flow generated in the quarter was not enough to support the dividend and the share repurchases of $1.7 billion. In fact, the cash position of the company at the end of the first six months of the year decreased by $4 billion YoY. However, this is also due to high inventories, a problem that has hit many manufacturers and that will be solved as the finished machines are shipped over the coming months. Since the company’s guidance has been reiterated, I personally don’t see the shareholder return program at risk, as even the low end guidance of $4 billion of free cash flow is more than enough to fully cover the dividend ($1.1 billion paid in the first six months). After all, the current free cash flow yield is 4.82% and the dividend yield is 2.28%.

Valuation

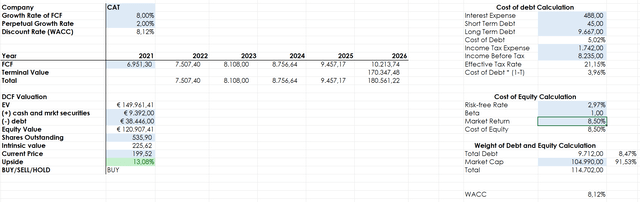

Caterpillar trades at a 15.9 fwd PE and a fwd price/cash flow ratio of 14.2. In my discounted cash flow model, I projected for the next five years an average FCF growth rate of 8% which is in my opinion sustainable even in case of an upcoming recession. In fact, this scenario would see Caterpillar with a strong backlog while raw materials should come down in price, as they often do during economic contractions. The result I get is that the fair price could be around $225 per share, leaving a 13%-15% upside from the current valuation.

As I said before, this is not enough for me to rate it fully as a buy, since I have a rule for my portfolio to start buying only with a 20%-25% potential upside.

However, I do see why investors could use the current price to initiate a position or add back to it in case it has a higher average cost that can be dollar averaged down.

Author, with data from Seeking Alpha

Conclusion

I will keep on following Caterpillar in order to monitor its performance and see if the opportunity opens up for the stock to enter into my portfolio. The valuation is getting more and more interesting and the company is a well-known brand that will go through any kind of cycle without going bankrupt. Caterpillar is one of the most followed stocks on Seeking Alpha and I would like to know in the comments what Seeking Alpha members think of the current situation in order to keep on going deeper in the understanding of the company and the stock.

Be the first to comment