asbe

Beam Therapeutics (NASDAQ:BEAM) reported Q3 2022 EPS of -$1.56 missing analysts’ estimates by $0.47. It fell against revenue of $15.80 million representing a rise of 1,970% (YoY) with a cash balance of $1.09 billion. Beam shares are down 45.61% (YTD) and 49.31% below the 52-week high of $88.18. BEAM uses base editing to develop precision genetic medicine. As an investor, I am looking forward to seeing base editing advancing into clinical development due to the rapid progress of nuclease editing systems. It can usher in a period where patients with serious genetic diseases can access potential one-time treatments.

Thesis

Beam Therapeutics accelerated its plans for BEAM-101 by enrolling its first patient in the BEACON trial. The Phase 1/2 clinical trial aims to evaluate the safety and efficacy of BEAM-101 as a treatment of sickle cell disease (‘SCD’) in adult patients. The FDA also lifted the clinical hold on its BEAM-201 clearing the way for its application for the treatment of relapsed/ refractory T-cell lymphoma. The portfolio progress also encompasses the initiation of IND-enabling studies for BEAM-301 coupled with the selection of a development candidate for Alpha-1 and BEAM-302.

Pipeline Development

Beam Therapeutics has prioritized the clinical execution of BEAM-101. This transplant-based medicine is expected to increase the expression of fetal hemoglobin (HbF), as the lead program in its SCD Wave 1 strategy. It announced the recruitment of its first patient in the middle of November 2022 where subsequent patients will be required to undergo transfusion and mobilization process for hematopoietic stem cell (‘HSC’) investigational therapy. The company is expected to intensify its recruitment of adults with severe cases of SCD with more US clinical sites opening into 2023.

My interest in Beam’s announcement came after Editas Medicine (EDIT) announced positive safety and efficacy data from its first two patients enrolled and treated under the Ruby trial. The trial of EDIT-301 is also for the treatment of severe sickle cell disease.

BEAM-101 is designed to help the body curb the production of faulty hemoglobin (HbS). It then makes the body switch back on the production of fetal hemoglobin (HbF) thereby easing the symptoms of SCD. In my view, BEAM will work to prove that BEAM-101 can make patients attain at least up to 65% HbF in the clinics through base editing. As noted earlier, the up-regulation of the expression of HbF will be the key component in the Wave 1 SCD strategy. This strategy may involve the electroporation of mRNAs, a system also applied by CRISPR Therapeutics (CRSP) and EDIT.

For Wave 2, BEAM will employ an ex vivo approach by lowering the toxicity conditioning regimen for SCD patients going through the Hematopoietic Stem Cell transplantation. Wave 3 strategy will involve an in vivo delivery of base editors directly to HSCs. BEAM announced that with this delivery, it will be forfeiting its IND application for BEAM-102 in 2022 and instead adopt the Makassar approach that also includes the up-regulation of HbF.

BEAM-201 IND

Beam Therapeutics received the green light from the US Food and Drug Administration (‘FDA’) for its investigational new drug application (‘IND’) for BEAM-201- an immune cell therapy. This approval means the company can administer the IND to patients with relapsed/ refractory T-cell acute leukemia in the clinics. In July 2022, the IND application for BEAM-201- a multiplex-edited antigen receptor T-cell development candidate had been put on clinical hold by the FDA and the news of its approval is a reprieve to the cancer gene therapy market.

According to research, this market is expected to be worth $8.7 billion by 2030. It is projected to grow at a CAGR of 19.99% from 2022 to 2030 buoyed by new therapeutics. In 2021 and during the Covid19 pandemic there was a surge in cases of adults with acute lymphoblastic leukemia. This condition accounted for up to 25% of cases in all adults and 15% of cases in children in North America while growing at a CAGR of 7.8%. Further statistics indicate that there were about 6,600 new cases of acute lymphoblastic leukemia in 2022 with 3,740 being males against 2,920 females in the US.

BEAM 301 and BEAM-302

Beam Therapeutics initiated the IND-enabling studies for BEAM-301 in Q3 2022 to boost its liver portfolio. The company believes that this treatment will be the first gene-editing product to correct directly a genetic mutation in vivo. BEAM-301 is a lipid nanoparticle (LNP) base-editing reagent formulation targeting the liver that treats glycogen storage disease 1a (GSDIa). This autosomal disorder (recessive) is caused by mutations in the G6PC that prevent the maintenance of glucose homeostasis.

This product’s operation is almost similar to Verve Therapeutics (VERV) VERVE-101 whose heart-1 clinical trial began in New Zealand in July 2022. This investigational gene-editing drug is a single-course treatment that fights the PCSK9 gene in the liver. It aims to lower the low-density lipoprotein cholesterol (LDL-C). Interim data on heart-1 clinical trials especially on safety parameters and blood levels of PCSK9 and LDL-C are expected to be released in 2023.

However, BEAM-301 stands out in that its proprietary lipid nanoparticles (LNP) will be a game changer in immunology and oncology. We are looking at an in vivo delivery to T-cells and natural killer (NK) cells. The prevalence of glycogen storage disease in Europe and North America ranges from 1 in 20,000 and 1 in 40,000. I hope the drug continues to show an improved stable liver-editing strategy that will mean better metabolism in candidates. This understanding is essential since BEAM had indicated that it was advancing towards IND-enabling studies for BEAM-301 before the end of 2022.

BEAM-302 on its part is the base editing treatment for Alpha-1 antitrypsin deficiency (Alpha-1). This product is essential as it will demonstrate Beam’s potential on heightening base editing for a “challenging target site.” Its editing approach involves the correction of the E342K mutation.

What we can see here is that the FDA is also advancing its understanding of the application of base editing which will further contribute to the improvement of in vivo base editing in general.

Risks to the Downside

Beam Therapeutics’ IND application for BEAM-101’s treatment of sickle cell disease was cleared by the FDA in November 2021. This means that it took one year to enroll its first patient for the BEACON trial after the FDA’s clearance. From an investment standpoint, I would prefer data from at least two patients with a gap of 5 months to take an ideal standpoint on the value of BEAM-101. Ideally, we are looking to establish facts on the BEACON trial by H1 2024. By then Verve will be working to validate its VERVE-101 data and may pose strong competition.

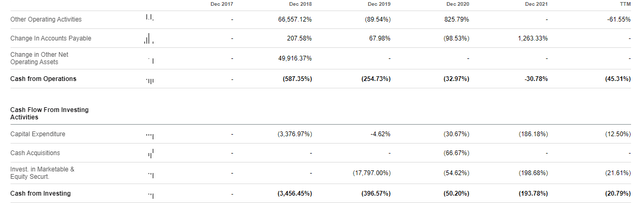

It appears to have a stable cash position of $1.1 billion as of Q3 2022. However, the company used up to $574.8 million in investing activities in the nine months ending on September 2022. This position was boosted by $91.7 million brought in by operating activities in the same period.

However, this was an increase of more than 165% from $216.6 million used up over the same period in 2021. The company has stated that it expects to use this cash for at least 12 months. Based on the required capital expenditures planned for 2023 it appears the money will only last the company until June 2023 or until the beginning of Q3 2022. This situation may occur if the CapEx at $574.8 million rises above 100% in the remaining 9 months. We must also remember that the company has just enrolled its first patient for the Beacon trial with more enrolments and opening of clinical sites expected in 2023. Further, it is involved in continuous upgrading of its base editing platform which requires licenses and other delivery modalities.

Bottom Line

BEAM’s announcement on its enrolment of its first BEAM-101 BEACON trial patient comes against the backdrop of efficacy and safety data announcement by Editas Medicine. The success of this trial will act as a proof of concept for BEAM-301 and BEAM-302. However, the company is expected to raise its CapEx into 2023 as it prepares to accelerate its clinical programs after FDA’s IND application approval. The stock is trending almost 50% below its 52-week high and may be affected by any delay in data release into the year. For these reasons, we propose a hold rating for the stock.

Be the first to comment