Boarding1Now

The stock market is so negative on the airline sector that Southwest Airlines (NYSE:LUV) reinstating the dividend has provided no help to sector stocks. The airline stock regularly traded around $60 pre-COVID and even during a rally in early 2021, but Southwest Airlines now trades below $40. My investment thesis remains bullish on the stock and just about any airline at these valuations.

Dividend Reinstatement

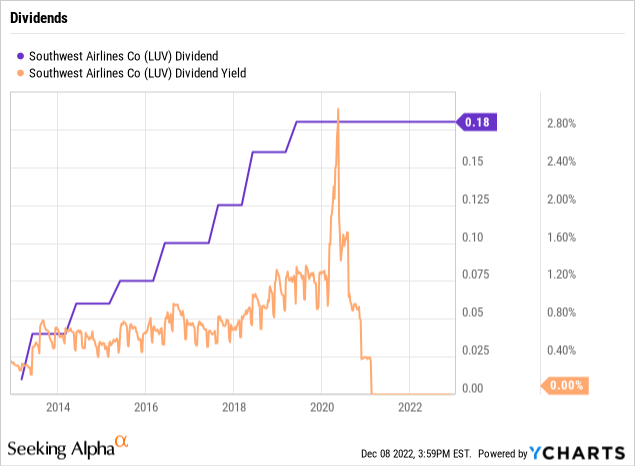

Not only did Southwest Airlines reinstate the dividend, but the airline reinstated the dividend back at $0.18 per quarter. The company had only paid this dividend for the year prior to COVID, with the quarterly dividend at $0.16 back at the start of 2019.

A lot of corporations reinstate dividends at lower levels to start out following a disruption. Airline demand is so strong that Southwest Airlines directly reinstated the dividend at the prior levels, placing the dividend yield at 1.95% to easily top the peak around 1.2% before COVID hit.

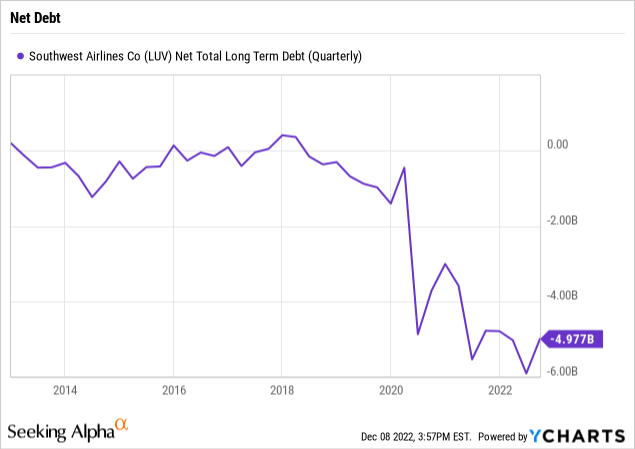

The stock actually fell nearly $2 on Dec. 7 following the dividend reinstatement announcement. The airline reported net cash of nearly $5 billion at the end of September, so investors clearly don’t understand the balance sheet scenario with the reinstatement of capital returns.

Southwest Airlines already plans to repay $2.6 billion worth of debt this year with free cash flow generation in a very profitable year. Possibly the market is focused on the large $8.7 billion worth of debt on the balance sheet, but the airline has a cash balance of $13.7 billion to easily repay the debt when possible.

The airline isn’t in a huge rush to repay all the debt. Besides, the quarterly dividend will only require a quarterly payout of $115 million, leading to an annual payout of just $460 million for a company set to produce a couple of billion in annual profits now.

Limited Capital Returns For Now

The fear is clearly that airlines will face another COVID disruption or some other event that severely limits air travel again. Investors have a tendency to overfocus on these events due to recency bias, despite the once-in-a-generation COVID event in 2020.

The airline sector likely overspent on share buybacks in prior periods instead of building up the balance sheet. Southwest Airlines spent $2.0 billion in share buybacks during 2019 and a total of $2.4 billion on capital returns, but the airline now has total liquidity of $14.7 billion to avoid any risk of getting squeezed again.

On the Q3’22 earnings call, CFO Tammy Romo made it clear the airline would begin with reinstating the dividend and repay debt with share buybacks in the future:

With our strong balance sheet and continued financial strength, we will soon discuss our 2023 capital plans with our Board of Directors, but our capital allocation priorities remain unchanged. We have a long-standing dividend history, and reinstating a dividend remains a high priority. We will also continue to look for opportunities to reduce debt. We will continue investing in the company and our people, and we are focused on wrapping up negotiations with all of our open contract labor groups.

Last but not least, and at the right time, we intend to resume share repurchases as part of our shareholder return equation as we have in the past. And all of these intentions assume that the travel demand environment remains steady and we continue producing consistent quarterly profits.

The airline is forecast to produce a 2023 EPS of $3.35. The stock only trades at 11x these EPS targets. Southwest Airlines produced a 2019 EPS of $4.27 suggesting analyst estimates are probably far too low with the sector normalizing next year.

The airline sector should see a full recovery in 2023, especially with signs that China is finally reopening. TSA traffic has been running at ~94% of 2019 levels for the first week of December.

Takeaway

The key investor takeaway is that Southwest Airlines has fully reinstated their dividend, and the market has just yawned. The airline has an impressive balance sheet and strong profit forecasts, yet the stock only trades at $40 compared to $60 when the dividend was last at this level.

Investors should continue to use the market negativity as an opportunity to build positions in Southwest Airlines.

Be the first to comment