Justin Sullivan

Thesis

SoFi Technologies, Inc.’s (NASDAQ:SOFI) Q2 earnings release corroborated our thesis that it truly bottomed out in June, even as the market was pessimistic over FinTech stocks then.

We concur that SoFi’s remarkable performance in Q2 surprised us after seeing how Upstart (UPST) blew its quarter. It demonstrated that SoFi’s focus on prime customers (average FICO score: 748) for its personal loans segment helped drive robust growth as refinancing demand surged. Notably, investors saw in Upstart’s Q2 update that its focus on the “less prime” segment of borrowers saw funding sources cratered as investors justifiably turned their focus toward the prime pool. Therefore, it corroborated CEO Anthony Noto & team’s strategy of only focusing on customers with excellent risk profiles, undergirding its revenue visibility.

Also, cross-buying by customers across its segments helped improve its operating efficiencies significantly, spurring an adjusted EBITDA margins beat. Coupled with the cost of funding improvement and strong deposit growth from SoFi Bank, Q2 is likely the quarter that has effectively proved SoFi’s business model amid harsh macro stresses. Therefore, we are very confident that SOFI has staged its long-term bottom in June as the market looks ahead.

Notwithstanding, we believe the near-term upside in SOFI has been reflected, despite its double-beat earnings print, with guidance raised.

As such, we reiterate our Hold rating on SOFI and encourage investors to wait patiently for a retracement first before adding.

Solid Execution Justifies SoFi’s Diverse Business Model

Even as its high-margin student loans segment is not expected to return until January 2023, personal loans have continued to outperform. Investors need to give due credit to management, as it was pretty ugly from Upstart’s perspective as its personal loans segment declined steeply QoQ.

However, SoFi management highlighted the resilience of its personal loans segment, as it rode the tailwinds on refinancing demand, given the interest rates hikes. Management emphasized:

Q2 originations grew 9% YoY to $3.2B and were driven by record volumes in our personal loans business, which grew 91% YoY to $2.5B. Our personal loans borrowers’ weighted average income is $160K with a weighted average FICO score of 748. This focus on quality has led to strong credit performance. Our on-balance sheet delinquency rates and charge-off rates remain extremely healthy and are still approximately 50% below pre-COVID levels. And we’re in an environment where some of the best credit profile individuals are out there looking to refinance their debt from higher variable cost debt into fixed rate debt and also fixed maturities so they can lower their cost of borrowing and also manage their budgets. And that’s creating a lot of demand. (SoFi FQ2’22 earnings call)

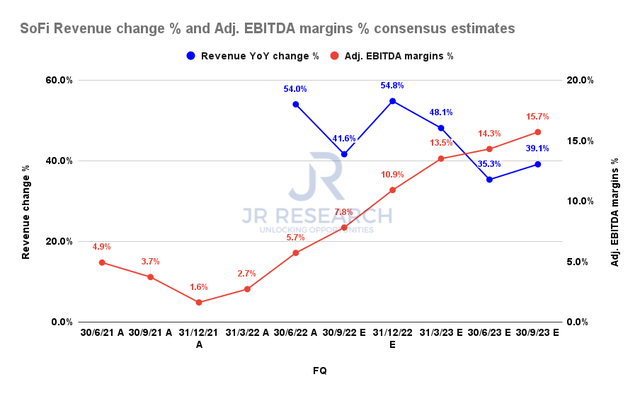

SoFi revenue change % and adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

The post-Q2 revised consensus estimates (bullish) remain confident that SoFi can continue driving solid operating leverage through FY23 as it works through its fixed costs.

We believe the company has delivered a robust print despite harsh macros, underpinned by SoFi Bank’s strong deposit flows and stable funding profile.

Consequently, we are confident that the company is on track to delivering its $1.51B in revenue guidance, up 49.5% (midpoint) for FY22, with an adjusted EBITDA margin of 6.5%.

The company has also guided for a robust H2, as it expects its H2 adjusted EBITDA margin to come in around 9.5% (midpoint). We believe the company is seeing solid momentum in its various segments, leading to its optimism. Noto accentuated:

We have a lot of flexibility. We’re investing at a really high rate. If you look at our Lending business, it’s operating at really strong profitability. It’s not as profitable as it would otherwise be with the student loan business but still quite profitable. Our Technology segment revenue, as Chris mentioned, has a very high margin. And then we’re making a really sizable investment in customer acquisition costs in our Financial Services segment, which has a lot of upside to profitability and some huge milestones in front of us. (SoFi earnings)

Is SOFI Stock A Buy, Sell, Or Hold?

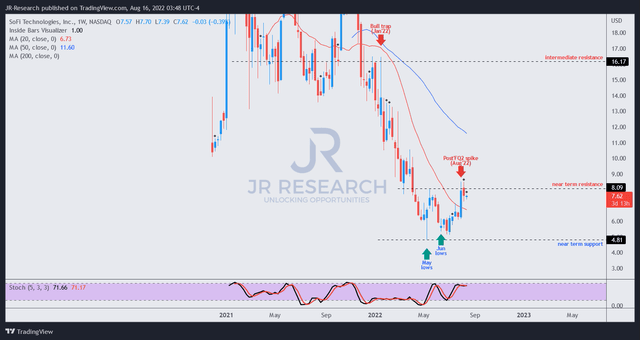

SOFI price chart (weekly) (TradingView)

In our previous two articles, we posited that SOFI had already bottomed out in June. Given the price action we observed over the past few weeks, we are increasingly confident of SOFI’s medium-term June bottom.

Notwithstanding, we think SOFI’s near-term upside has been adequately reflected, and therefore, the risk/reward profile in the near term remains pretty well-balanced.

Hence, we urge investors to wait for a deeper retracement from its post-FQ2 momentum spike first before considering adding more positions.

As such, we reiterate our Hold rating on SOFI.

Be the first to comment