Alex Potemkin

Thesis

On a TTM basis, Clipper Realty (NYSE:CLPR) trades at over a 5.5% cap rate when adjusting for non-productive assets. This is cheap for the quality of real estate that Clipper owns which I believe would command around a 4.5% cap rate on the private market.

CLPR’s rental revenue is currently depressed by cheap leases which were signed during the pandemic. Over the next 12-16 months these should roll off and be replaced by much more profitable leases.

Clipper also has two development projects one of which is expected to be completed in Q4 2022. Currently, the debt from these development projects is being counted against Clipper. Once the development is completed the rent from these projects should be additive to the bottom line.

Owning real estate has been a great long-term bet in NYC. If we believe that real estate prices in NYC will continue to appreciate in the future, the cheap entry point and large leverage in CLPR offer us a great chance to benefit from its long-term appreciation.

A bet on NYC real estate

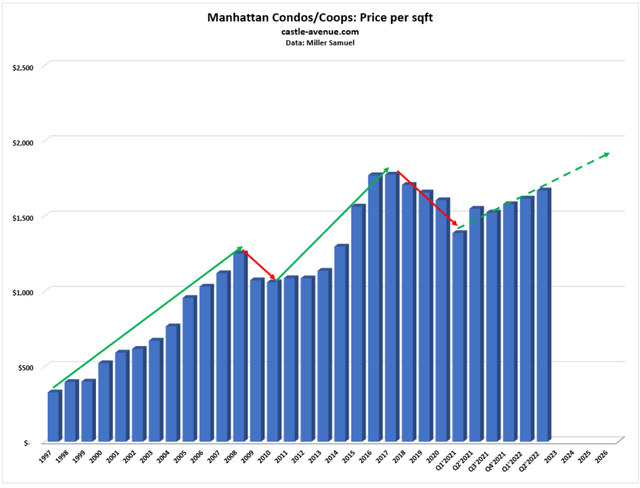

CLPR is a bet on the long-term capital and rent appreciation of New York City. This has been a good bet over the past 20 years. From 1997-2019 the price per square for a Manhattan Condo increased at a 7.6% CAGR. This compares to a 3.4% CAGR for the price of the S&P 500. If you do not believe that New York real estate will continue to appreciate over the next 20 years this is not the investment for you.

Price per square foot of Manhatten Condos 1997-Present (Miller Samuel www.castle-avenue.com)

Over the past 20 years, demand for NYC real estate has grown along with the prosperity of NYC and the USA. Combined with the limited supply of new buildings this has led to this massive appreciation.

There has been a lot made since the start of the pandemic of the death of “superstar” cities and the move to remote work. However, the quiet facts don’t seem to support this narrative, at least in NYC. Rent and property prices have been exploding since the vaccine became widely available.

Rapidly increasing rents

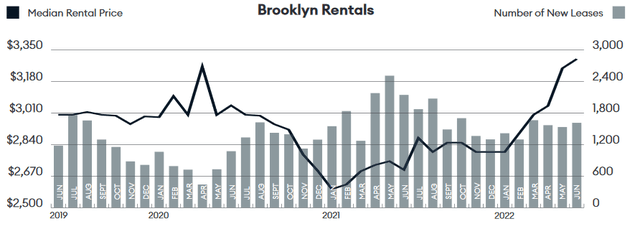

Over the past 12 months, rents in NYC have been rebounding strongly. In June median rent on a new lease was up 24.7% YoY for Manhattan and 22% for Brooklyn.

Average brooklyn rental price 2019-present (Douglas Elliman elliman.com/marketreports)

The company is already beginning to benefit from this increase in prices.

“base rent per square foot increased at the Tribeca House property to $64.76 (98.8% leased occupancy) at March 31, 2022, from $62.43 (96.5% leased occupancy) at March 31, 2021. ” –Q1 2022

While this is only a 4% per square foot rent increase we have to remember that more of the leases were signed during 2021. I expect the price per square foot to continue to increase through 2022 and into 2023 on CLPR’s market-rate apartments.

The City of New York recently approved a 3.25% rent increase on rent-stabilized apartments. This is the largest rent stabilized increase in a decade. About 40% of CLPR’s rent currently comes from rent-stabilized apartments.

Upcoming development

The company has two development projects. At Dean and Pacific street. Currently, these two properties are counting against the company’s net debt, but are not yet generating any rent.

The company has stated that the Pacific street project should be completed and begin leasing in Q4 2022. This building is expected to add $5.2MM in NOI.

The Dean street project is supposed to take about 2 years to complete so I wouldn’t expect it to be completed until the begging of 2024. It’s expected to generate about $7.1MM in NOI. Since the non-operational costs for these buildings, interest payments, are already being paid by the company most of the NOI should fall through the bottom line.

Redevelopment of Clover house

The Clover house (CLPR investor relations)

The company follows a pattern of buying properties, improving them, and then refinancing the mortgage to pull some of its equity out.

To understand what this looks let’s look at Clover house. CLPR bought Clover house in May 2017 for $87.6MM. Between May 2017 and November 2019 they spent $58MM renovating the property. They then refinanced their debt pulling some equity back out. This left them with $82MM in debt and $63.6MM in equity.

The property has about 1.3 Million in operating expenses and 2.9 Million in interest expenses. Its 2021 annualized December rent was 6.2 Million dollars. This means the building is creating 2 Million dollars a year in cash flow. This is only a 3% return on the equity still left in the building. Given the amount of leverage used this is not exactly exciting.

This math underlines that an investment in CLPR is a bet on the long-term appreciation in New York real estate and rent prices. If rent payments don’t continue growing over time this type of investment does not make sense.

I also think that it underlines the large amount of operating leverage that is inherent in CLPRs portfolio. If rent increases by 20% during 2022, the other costs should be largely static. Meaning the building will be cash flowing $3.2M a year.

Livingston St buildings

CLPR investor relations (Livingston building)

To highlight the compounding potential of NYC real estate we’ll examine CLPR’s properties at Livingston St. These two properties were acquired by a predecessor of CLPR in 2002 for $53.3M. They have had $33.9M of improvements done to them since acquisition. These two buildings currently have a mortgage of $225M. Meaning they have $-137.8M in equity invested.

The Livingston office buildings generated $27.1M in annualized rent in December 2021. There is not a good estimate in any of the company’s filings on the operating expenses but let us just say that they are 50% of the rent, $13.5M. The Debt on the property requires $7.75MM in annual rent. These two buildings are generating $5.9M in free cash flow.

These buildings were bought over 20 years ago, so the return on investment here is over a very long time period. These buildings highlight the compounding nature of owning New York City real estate. There are not many investments that I believe will be compounding value in 20 years, New York City real estate would be on the list.

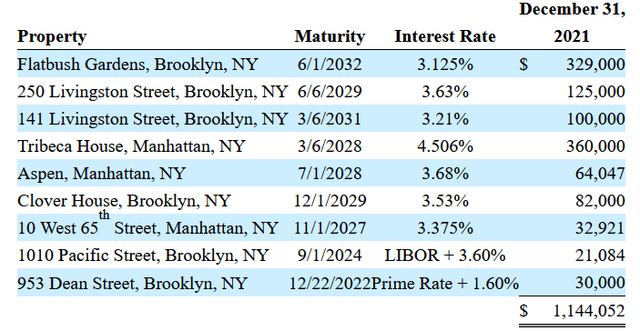

Risk – Debt load

The company carries a large amount of debt, about $1.1B. The debt is held as mortgages against the various properties in the portfolio. If one building ends up being enormously unprofitable it won’t bring down the rest of the company. Other than the debt for construction financing on the company’s assets in development none of the maturities are due until 2027. Giving the company plenty of time to wait out any freezes in the credit market.

CLPR mortgages by maturity and property (CLPR 2021 10K)

Even with the long maturity, any long-term downtrend in the price of rent in the New York rental market could end up forcing the company to lose many of its properties. Such a downtrend would have to last multiple years and severely affect the price of rents.

I consider it positive that the company just proved they could weather COVID. Not only did they end up surviving COVID CLPR was cash flow positive for most of the pandemic and were confident enough in their prospects to buy back shares in 2020.

Risk – Rent Regulation

New York City has a long history with rent regulation. About 40% of CLPR revenue is rent stabilized. CLPR can only increase rent by an amount approved by NYC’s rent guidelines board. I’ve assumed that the company will only be able to raise the rent on its rent-stabilized apartments by 1% a year.

The current laws for rent-stabilized apartments are tenant friendly. With limited options for landlords to increase the price of rent. The biggest risk in this area would be if NYC added rent controls to non-rent stabilized apartments. I view this as an unlikely outcome. But, it would be a devastating one, greatly reducing the value of CLPR’s portfolio.

Risk – Insider conflict of interest

The CEO of the company David Bistricer is a long-time New York City real estate mogul. This comes with advantages such as long-standing relationships and a great sense of New York real estate. It also comes with conflicts. From the company 2021 10-K:

“Our charter contains a provision that expressly permits our officers to compete with us. Our officers have outside business interests and may compete with us for investments in properties and tenants. There is no assurance that any conflicts of interest created by such competition will be resolved in our favor.”

The risk is that David and the other officers of the company may not bring the best deals to CLPR saving them for themselves.

While this is a real risk, there are two things I find re-assuring. The directors own 49.4% of the overall interest in the business and over 20% of the common shares outstanding. Even if they might compete with the company on some deals it is still in their best interest to find good deals for CLPR. The communications they have had with the shareholders since going public have seemed honest to me. The deals they’ve brought to CLPR been delivered as promised and been accretive to shareholders from my perspective.

Valuation

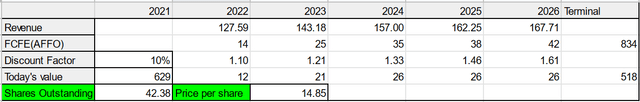

I estimated CLPR’s future rent and AFFO for the next 5 years based on historical rent growth and projections about when announced buildings would begin collecting rent. I used a 20 times price to AFFO multiple for my terminal value. As always this type of projection makes a lot of assumptions and is more meant to give an idea of how I’m valuing the business. I tried to use conservative assumptions when making these calculations.

CLPR discounted cashflow model (Author’s work)

Another way to look at the valuation is cap rate. CLPR generated 65 Million in NOI in the TTM. If we also subtract the over $100M the company has invested in Dean and Pacific street and are currently generating no income we get about a 5.5% cap rate on the rest of the portfolio. My rough estimation is that CLPR properties would fetch closer to a 4.5% cap rate on the open market. A 4.5% cap rate would imply an equity valuation of 15.01 per share.

Final thoughts

I believe that CLPR is attractively priced for an entry point into the New York real estate market. The management team has a proven playbook for expanding the portfolio and significant skin in the game. I plan to open a position Monday.

I’d also like to give credit for where I originally heard of this idea. Bill Chen presented the stock pitch on the excellent Yet Another Value Podcast.

Be the first to comment