peepo/E+ via Getty Images

Investment Thesis

Despite the initial announcement in partnership with Teladoc Health (TDOC) for Aetna Virtual Primary Care in August 2021, it appears that CVS Health Corporation (NYSE:CVS) has a massive big change of heart. The company decided to launch CVS Health Virtual Primary Care independently in May 2022, while finally announcing its telehealth software provider in American Well Corporation (NYSE:AMWL) on 05 August 2022 instead.

The turn of events was more than alarming, since CVS is reportedly also interested in acquiring Signify Health (NYSE:SGFY), according to The Wall Street Journal on 07 August 2022. That would prove to be the start of the intense battle in the increasingly crowded virtual healthcare market, since Amazon (AMZN) recently acquired One Medical (ONEM) on 21 July 2022 to further its primary care ambitions, on top of offering Amazon Care to corporate clients.

Though CVS reported robust revenue/ net income growth and Free Cash Flow (FCF) generation thus far, it still possesses $49.39B of long-term debt in FQ2’22, with an enormous $2.37B of annual interest expenses. In addition, the company also spends up to $2.75B in dividend payouts every year. Therefore, we are uncertain about CVS’ potential growth in memberships and earnings in the virtual primary care market, since TDOC continued to struggle with profitability thus far. Especially worsened by the irrational “smaller private competitors” with massive venture capital funding and “economically irrational decisions.” We shall see since CVS seems set on this path.

CVS Continues To Perform Well During Reopening Cadence

S&P Capital IQ

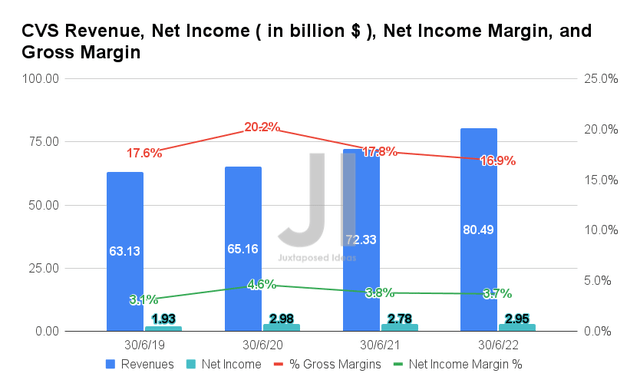

CVS continued to perform well post-reopening cadence, given its revenues of $80.49B and gross margins of 16.9% in FQ2’22. It represents a YoY increase of 11.2% though a moderation of -0.9 percentage points, respectively. In the meantime, the company reported an excellent net income of $2.95B and net income margins of 3.7%, representing an increase of 6.1% and relatively in line YoY, respectively.

S&P Capital IQ

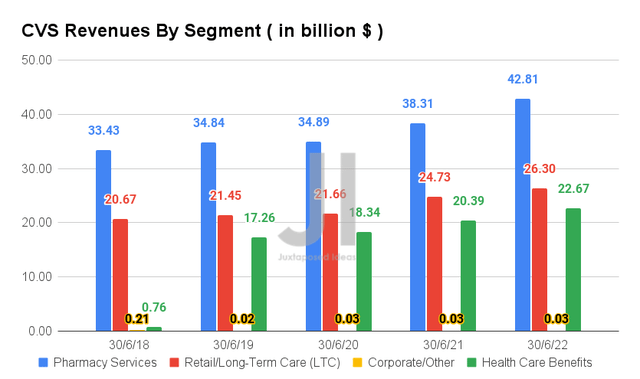

Based on the chart above, it is evident that CVS Pharmacy and Health Care Benefit segments continue to report robust YoY growth, recording a remarkable increase of 11.7% and 11.1%, respectively. In the meantime, its Retail/LTC segment performed decently, with a 6.3% YoY increase.

In FQ2’22, CVS reported 45M unique digital customers and 6M active users on its individualized health dashboard, with a tremendous increase of 1.5M and 20% QoQ, respectively. Combined with a 5.7% YoY increase in total pharmacy claims processed (excluding the COVID-19 vaccinations), there is no wonder that the company was able to report a 5.7% YoY growth in adj. operating income for the Pharmacy segment to $1.85B.

CVS has also definitely benefited from the increased Medicare memberships with over 2M unique members reported in FQ2’22, contributing to the exemplary YoY revenue growth for its Health Care Benefit segments. Combined with its 98% client retention rate and 3.8% YoY growth in medical membership to 24.4M, we expect CVS to perform well ahead, given the 13.4% YoY growth in its adj. operating income to $1.83B.

S&P Capital IQ

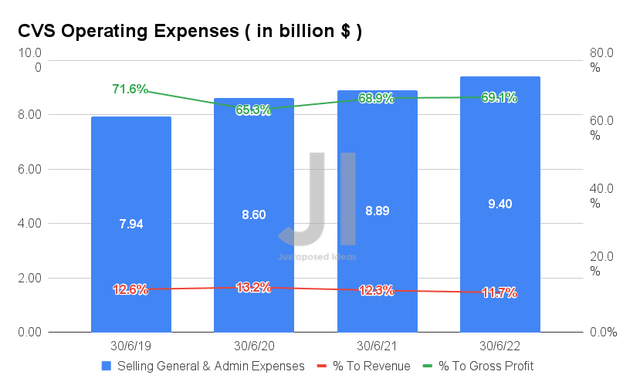

In the meantime, CVS’ operating expenses continue to be elevated at $9.4B in FQ2’22, representing an increase of 5.7% YoY. However, it is also evident that the costs have remained relatively stable, since these only account for 11.7% of its growing revenue and 69.1% of its gross profits. Given CVS continued optimizations to 9.76K stores as of August 2022, we expect to see a further improvement in its operating cost efficiencies in the short-term, as seen in FQ2’22, with a 6.8% QoQ increase in its adj. operating income of $4.81B.

Nonetheless, given CVS’ aggressive expansion into the primary care market, we may see a sudden spike in its operating expenses ahead, thereby impacting its net income and FCF profitability in the short and intermediate term.

S&P Capital IQ

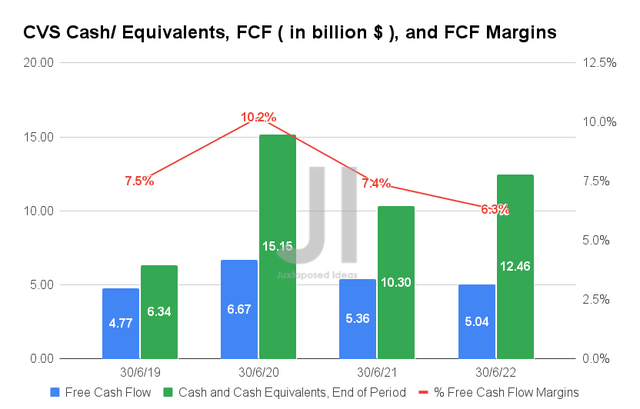

In the meantime, CVS continues to report decent FCF generation, with an FCF of $5.04B and an FCF margin of 6.3% in FQ2’22. Its cash and equivalents of $12.46B on the balance sheet look robust as well, thereby highlighting the company’s ability in financing its speculative acquisition of Signify Health, with a market cap of $4.66B as of 05 August 2022.

CVS May Suffer In The Short Term As The Battle In Virtual Health Care Rages On

S&P Capital IQ

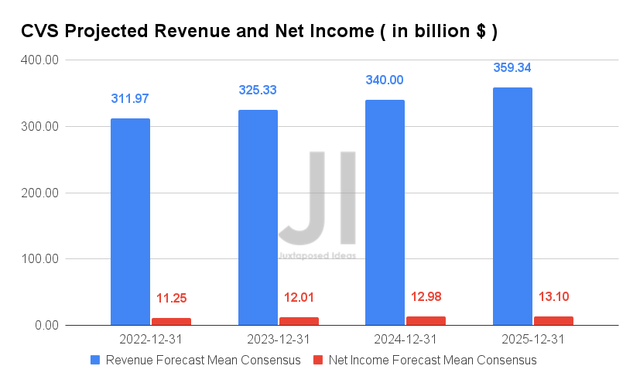

Over the next four years, CVS is expected to report revenue and net income growth at a CAGR of 5.42% and 13.44%, respectively. It is essential to note that its net income margins are expected to marginally improve from 2.6% in FY2019 to 3.6% in FY2025, indicating a 38.4% upside. For FY2022, consensus estimates suggest that the company will report revenues of $311.97B and net incomes of $11.25B, representing a notable upgrade of 1.1% and 0.8%, respectively, since our previous analysis in May 2022.

The upgrades are the result of the CVS management raising its FY2022 GAAP EPS guidance by 4.2% to $7.23 to $7.43. Its raised cash flow of up to $13.5B has definitely helped its recent stock rally as well, from $95.37 on 02 August 2022 to $102.26 on 05 August 2022, combined with the timely announcement of the American Well Corporation partnership. Given the recent optimism surrounding the stock, we expect CVS to remain expensive and hyped-up for a while. Interested investors, please be patient.

In the longer term, assuming adept management, CVS may possibly do well in the virtual healthcare segment, since the company is actively expanding on its existing capabilities, namely its 1.1K MinuteClinics and HealthHUB services in its pharmacies. In addition, assuming synergistic efficiencies, we may see the company further improve its virtual operations ahead, as it is doing with its store optimization nationwide. Nonetheless, we remain cautiously uncertain about the profitability of the segment, given the intense competition offered by multiple big players, such as Amazon, Walgreens Boots Alliance (WBA), TDOC, amongst others.

In the meantime, we encourage you to read our previous article on CVS and TDOC, which would help you better understand their position and market opportunities.

- CVS: Formula Milk Is Not The Problem – Recession May Be

- A CVS Takeover May Save Teladoc’s Broken Business Model

So, Is CVS Stock A Buy, Sell, or Hold?

CVS 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

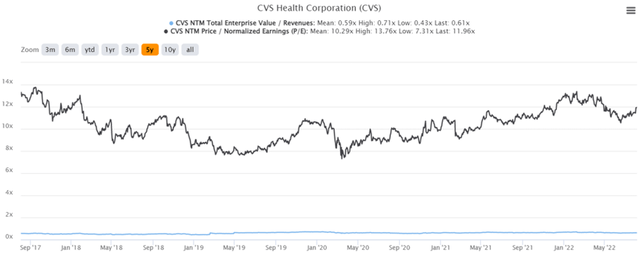

CVS is currently trading at an EV/NTM Revenue of 0.61x and NTM P/E of 11.96x, slightly higher than its 5Y mean of 0.59x and 10.29x, respectively. The stock is also trading at $102.26, down 8% from its 52-week high of $111.25, though up 28.8% from its 52-week low of $79.34.

CVS 5Y Stock Price

Seeking Alpha

Therefore, it is evident that CVS’s stock is still trading at a premium, given consensus estimates’ price target of $119 and a minimal 16.37% margin of safety for any interested investors. Given the recent spike, the stock is also trading above its historical 50-day moving average of $94.61. As a result, we encourage investors to wait for a deeper retracement before adding to their portfolio.

Nonetheless, we retain our previous conclusion that CVS still looks expensive for now, especially since Amazon is more than ready to invade the primary care segment. Walgreens Boots Alliance is likely next in line to announce another key partnership/ acquisition to further its primary care ambitions as well. Therefore, margins may, unfortunately, fall during the skirmish ahead.

Therefore, we rate CVS stock as a Hold for now.

Be the first to comment