J. Michael Jones/iStock Editorial via Getty Images

A number of asset managers have taken a beating in recent months. While this may shake the confidence of some investors, one of the worst things an investor can do is to sell a quality stock during a downturn.

This brings me to Ameriprise Financial (NYSE:AMP), which is now trading well below its near-term high of $315 achieved as recently as late March. Let’s take a look at why AMP is worth buying at the current price.

Why AMP?

Ameriprise is primarily a U.S. asset manager that provides advice & wealth management, asset management, and retirement & protection solutions. It was spun off from American Express in 2005, and has one of the largest branded advisor networks in the industry, with a network of 10,000 financial advisors across the U.S.

About 90% of AMP’s pre-tax earnings are from the U.S. and its financial products include U.S. mutual and ETF funds, annuities, individually managed accounts, and property and infrastructure funds. This, of course, is a double-edged sword for asset managers as boom times can be great for AUM-based fees, but downturns can bring pain. This is reflected in the fact that the S&P 500 (SPY) just saw its worst first half performance in 50 years.

Nonetheless, AMP saw solid growth in its first quarter, with total AUM and EPS being up by 17% and 10% YoY, respectively. Moreover, AMP generated an impressive 49.9% ROE amidst a challenging market environment. This was driven by strong net inflows in AMP’s Advice & Wealth Management segment, from which it derives the bulk of its earnings, with client inflows being up 12% to $10.4 billion.

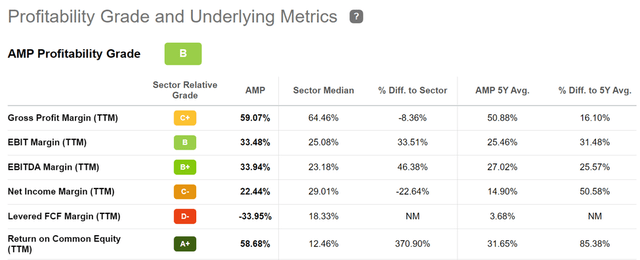

AMP also enjoys operating leverage due to its significant scale. As shown below, it gets a B grade for profitability, driven by an EBITDA margin of 34%, which is well in excess of the 23% sector median.

AMP Profitability (Seeking Alpha)

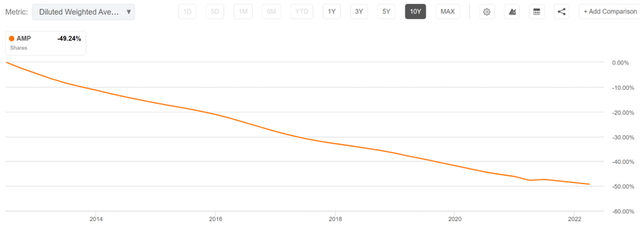

In addition, AMP also generates a very high return on common equity, and that’s due in large part to its aggressive share repurchases. As shown below, management has been rather shareholder returns focused, with the company having repurchased nearly half of its outstanding float over the past 10 years.

AMP Shares Outstanding (Seeking Alpha)

Looking forward to Q2 results and beyond, AMP may see near term headwinds stemming from continued global market upheaval. However, if history is of any indicator, the market could see a strong rebound in the second half of the year. This is reflected by the fact that the market downturn in the first half was the worst since 1970, and in that year, the S&P 500 promptly reversed those losses to gain 26.5% in the second half.

Besides, with a lot of client assets currently sitting on the sidelines in cash, this opens up a significant revenue opportunity for the company as it moves through the rest of the year and beyond. Moreover, AMP has a strong pipeline of financial advisors who want to join the firm, driven in part by healthy client satisfaction, as noted by management during the recent conference call:

With regard to recruiting, we continue to demonstrate the attractiveness of our adviser value proposition with another 80 experienced advisors joining us in the quarter.

The pipeline continues to look good. And in our surveys of advisers who have joined us, over nine out of 10 advisers have said they have better technology, financial planning capabilities and ability to acquire clients more easily than they did at their prior firms.

One of the things I’m proud of is how we consistently work with our clients and our strong client satisfaction. It’s great to see that Newsweek has named us one of America’s most trusted companies. That complements our investors’ business daily number one trusted Wealth Management ranking.

And earlier this year, we launched a new ad campaign, Advice Worth Talking About. That’s telling our story even more broadly in the marketplace. We showcased that nine out of 10 of our clients are likely to recommend Ameriprise to their family or friends.

Meanwhile, AMP sports a strong A- rated balance sheet, and pays a 2.1% dividend yield that’s well-covered by a 19% payout ratio. The dividend also has a 5-year CAGR of 8.5% and 16 years of consecutive growth. While the yield isn’t particularly high, AMP should be regarded as a total return story given its aggressive share repurchases, as noted earlier.

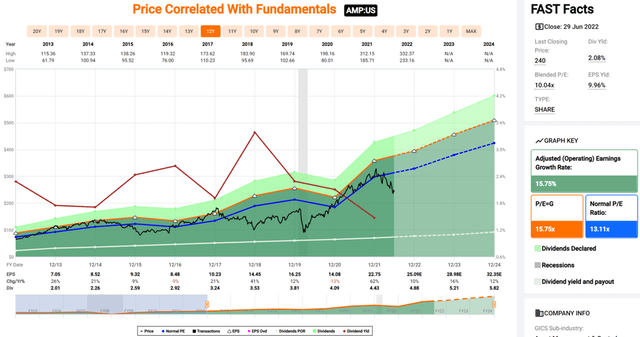

I see the recent dip as providing a good buying opportunity. At the current price of $237.68, AMP carries a forward PE ratio of just 9.45, sitting well below its normal PE of 13.1 over the past decade. Sell side analysts have a consensus Buy rating on AMP with an average price target of $321, implying a potential one-year 37% total return including dividends.

Investor Takeaway

Ameriprise Financial is a well-run asset manager that’s shareholder friendly, with a strong balance sheet, and enjoys significant scale advantages. It pays a well-covered dividend and has a stellar track record of repurchasing its shares. The stock looks attractively valued after the recent selloff, and offers a good combination of income and total return potential.

Be the first to comment