imaginima

At the Berkshire Hathaway Annual Meeting in 2022, Warren Buffett spoke about the importance of investing into productive assets that “produce something.” Buffett used the analogy of investing into apartments, he stated:

“If you offer me 1% of all the apartment houses in the country and you want another $25 billion, I’ll write you a check. It’s very simple.”

Of course these numbers should be taken with a large pitch of salt, but the moral of the story is, people will always need somewhere to live. In addition, the U.S. has a record number of single people with 4 out of 10 adults between 25 and 54 not married or living with a partner, up by 30% since 1990. These singletons often don’t require a large suburban five bedroom homes. Instead they prefer lower cost apartments in city locations with greater flexibility.

As a real estate landlord in the UK, I can attest to the value of apartment-renting demographic. Buying a house is nice, but when the average U.S. home price has gone up by 19% over the past year, affordability can be an issue especially with rising interest rates. Thus during this high inflation environment, exposure to cash flowing rental ready real estate makes a lot of sense.

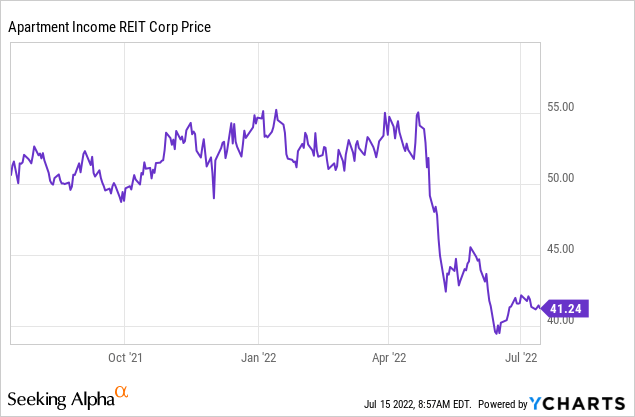

Apartment Income REIT Corp. (NYSE:AIRC), also known as Air Communities, is a real estate investment trust (REIT) which owns a diversified number of apartments across multiple U.S. states. The company is run by a veteran CEO, pays a delicious 4% dividend, and is undervalued relative to apartment REIT peers after the recent pullback in share price. Let’s dive into the Business Model, Financials, and Valuation to see why this stock looks to be a great inflation hedge.

Modern Business Model

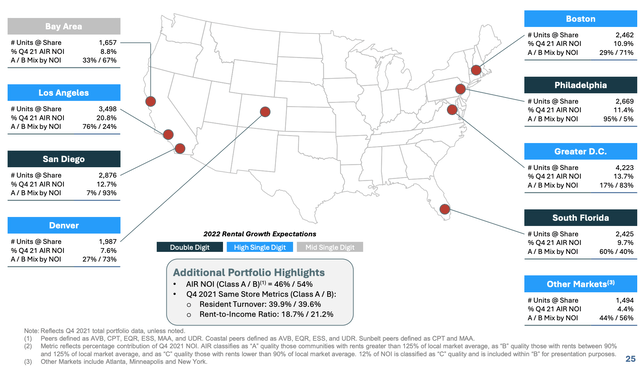

Apartment Income REIT Corp owns 77 properties and 25,384 Apartment houses across the USA. It’s properties are diversified across multiple U.S. states and price points.

Air Communities was a formerly part of Apartment Investment and Management Company (AIV), a REIT which developed and managed rental properties. However, in 2020 the management of AIV realized that property development is a higher risk business and thus decided to spin off 80% of the apartment owning business to Air Communities. Personally, I think this was a good move and should result in increased shareholder value for both companies. Air Communities can now fully focus on managing it’s ~$10 billion asset portfolio and grow by acquisitions only.

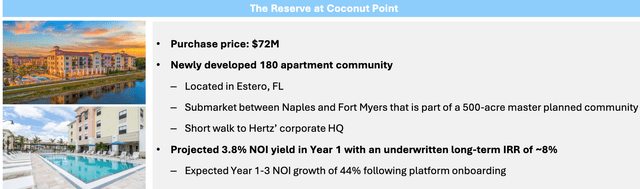

So far in 2022, management has made two new acquisitions. One is the Reserve at Coconut Point, a 180 apartment luxury apartment community in Florida, which was purchased for $72 million. The luxury apartment complex includes a shimmering outdoor pool, onsite gym, clubroom and more.

Air Acquisitions (Investor presentation June 2022)

The Net Operating Income (NOI) is forecasted to be 3.8% in year one, with an Internal Rate of Return (IRR) of approximately 8% which is fantastic.

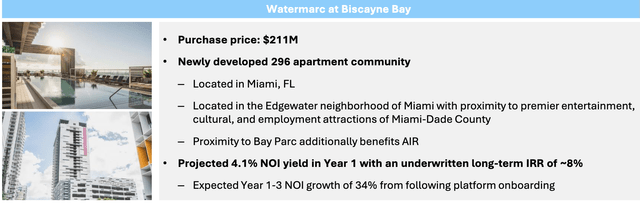

In addition, they acquired Watermarc at Biscayne Bay for $211 million. This is a newly developed 296 apartment community in Miami, Florida. This luxury apartment facility includes a 28 floor high rooftop pool and even health & wellness “sanctuary.”

The company is projecting a 4.1% NOI yield in year 1 and again expected ~8% IRR long term, which is great.

Air Acquisitions (Investor presentation June 2022)

Management has a disciplined approach to capital allocation and expected at least a 200 bps spread of it’s weighted average cost of capital (WACC) can be achieved for any investment activity, as with the prior examples.

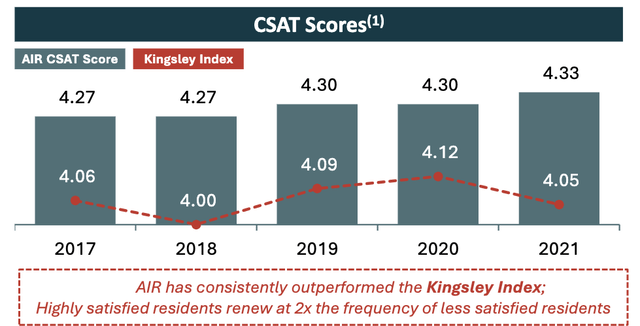

AIRC has a 98.1% same store average daily occupancy and has great reviews from tenants. The company has a “customer focus” style of operating which has an emphasis of community. Its customer satisfaction (CSAT) were 4.33 out of 5, which has been on a slight upwards trend since 2018.

Tenant Satisfaction (Investor Presentation June 2022)

Highly satisfied tenants renew at twice for frequency of those less satisfied and thus it makes sense to improve it’s service. A happy tenant, stays longer… it’s that simple. Managements strategy is working so far as AIRC had a 61.3% trailing twelve month (TTM) retention rate as of June 2022, which is a record high for the company.

Founder-Led CEO

The CEO of Air Communities is Terry Considine, a veteran of the real estate industry who founded AIV. Terry was with the company from 1994 till its split into two entities in 2020. Today, he is the CEO of Air Communities and acts as the director for AIV. Many founders tend to be more long-term focused and are intrinsically motivated by making the business a success. Many great founders are already extremely wealthy and thus are less motivated by “quick hits.” For example, in 2021 the CEO reduced his own compensation by $2.5 million in order to help the company meet its expense goals.

Stable Financials

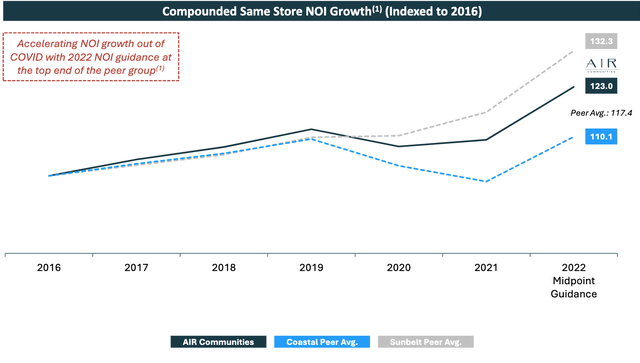

Air Communities has seen it’s Net Operating income (NOI) grow at a faster rate than the coastal peer average [in blue], which is great to see.

NOI Growth ( Investor Presentation June 2022)

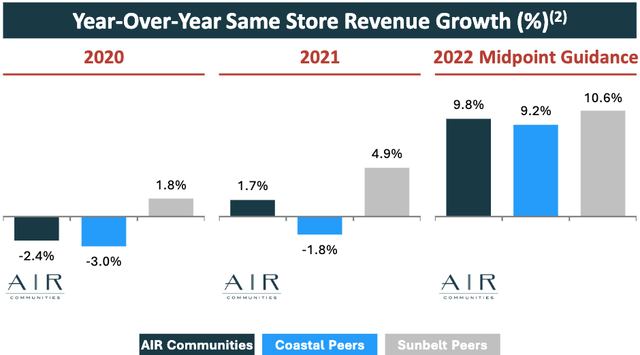

The company did experience a drop in revenue growth during the pandemic of 2020. However, the good news is the REIT’s properties did show some resilience, as revenue growth decreased by -2.4%, which was less than the coastal peer average. In 2021, its revenue growth has been 1.7% which is again higher than the -1.8% coastal peer average, this shows the company offers greater resilience and quality when compared to peers. For the full year 2022, management is guiding for an optimistic revenue growth rate of 9.8%, which is slightly higher than the coastal peer average of 9.2%.

Revenue Growth (Investor Presentation June 2022)

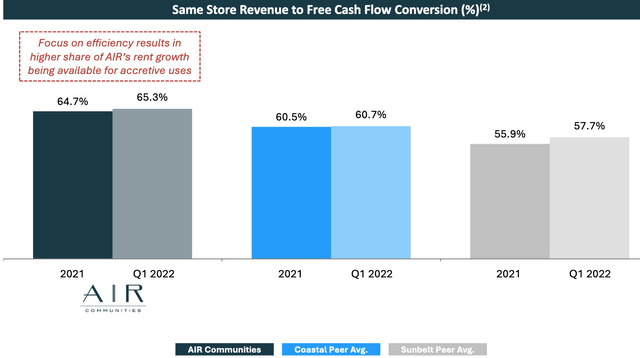

Air Communities is also showing greater efficiency in it’s operation and had a Same Store Revenue to Free Cash Flow Conversion Rate of 65.3% in the first quarter of 2022. This was a slight uptick from 2021 and is significantly higher than the coastal peer average, which again represents a more efficient operation.

Free Cash Flow Conversion (Earnings Report Q122)

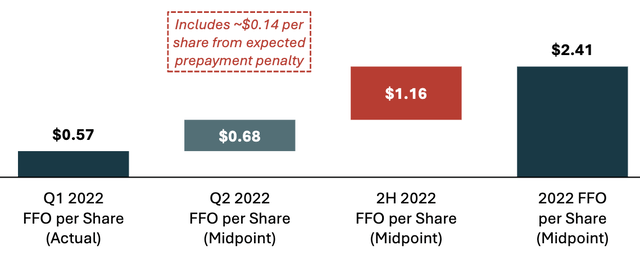

Funds from Operations (“FFO”) per share dipped during the pandemic of 2020 but has now rebounded close to pre-pandemic levels which is great to see. FFO per share was $0.57 in the first quarter of 2022 and is expected to be $2.41 at the midpoint of the company’s guidance.

FFO per share (June 2022 Presentation)

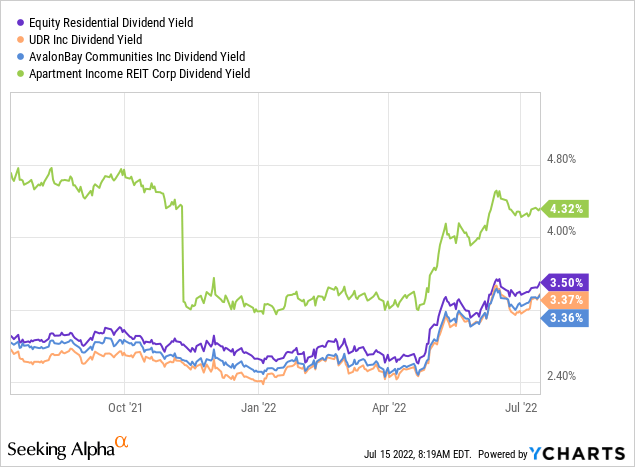

Air Communities has a Dividend Yield of 4.36% with a target payout ratio of 75% Funds from Operations. This is a higher dividend yield than apartment REIT peers such as Equity Residential (EQR), UDR (UDR) and AvalonBay Communities (AVB).

As expected with a REIT, AIRC has fairly high debt of $3.36 billion, with approximately $1.5 billion with variable debt exposure, which is a risk and higher than competitors. However, management has actively paid down or is refinancing $1.1 billion of this debt, which is great to see. The remaining $400 million has been hedged at 3.99%.

Valuation

Funds from operations is forecasted to be $2.41 per share at the midpoint for 2022. If we take this figure and divide it by the share price at the time of writing $41/share, we get a Price to Funds from operations of 17. This is cheaper than other industry peers as you can see from the table below.

| Apartment REIT | Price to FFO (P/FFO) |

| Apartment Income REIT (AIRC) | 17.1 |

| UDR Inc. (UDR) | 19.8 |

| AvalonBay Communities (AVB) | 20.1 |

| Camden Property Trust (CPT) | 20.6 |

| Equity Residential (EQR) | 20.8 |

| Mid-America Apartment Communities (MAA) | 20.9 |

Management also showed confidence on the stocks current value with $72 million of “opportunistic” share repurchases at an average price of $44.2 per share, which is slightly higher than the $41/share price at the time of writing. Thus I believe this could be a good buy point. In addition, $500 million of share repurchases have been authorized by the board.

Risks

Recession/Tenants Not Paying

Luxury apartments are nice, but when the tenants are been squeezed by a higher cost of living from food and utility bill inflation, then cutbacks may start to occur. Analysts are predicting a “shallow but long” recession, which is forecasted to start in the fourth quarter of 2022. If businesses find their input costs squeezed they may have to lay off workers which will mean rent payments may be hard to make.

Final Thoughts

Apartment Income REIT is a tremendous company, which does exactly what it says on the tin. It provides investors with exposure to the growing Apartment rental sector and offers a delicious 4.36% dividend for the pleasure. The recent pullback in stock price means the stock is now undervalued relative to peers. In addition, the Veteran CEO Founder should give investors peace of mind that the ship is being sailed by someone with long term vision.

Be the first to comment